Japan’s potential intervention against the dollar's strength highlights a broader economic narrative, underpinned by the influential eurodollar system.

The strength of the US dollar is causing distress among governments across Asia, with Japan's recent stance on potential intervention to bolster the yen being a prime example. This, however, is not an isolated issue specific to Japan or its currency. The underlying force to be examined is the eurodollar, a global factor that is often overlooked in mainstream discourse.

The eurodollar system, the vast network of US dollar-denominated deposits and loans outside the United States, is a pivotal component of the international financial system. It is a critical barometer for global liquidity and economic health. The current situation reflects a historical pattern where the movements of currencies are not solely directed by central banks, but rather by a complex interplay of traders, investors, and international financial markets. This was succinctly captured in a 1992 New York Times article during the British pound crisis, asserting that currency markets are governed not just by central banks but by global market forces.

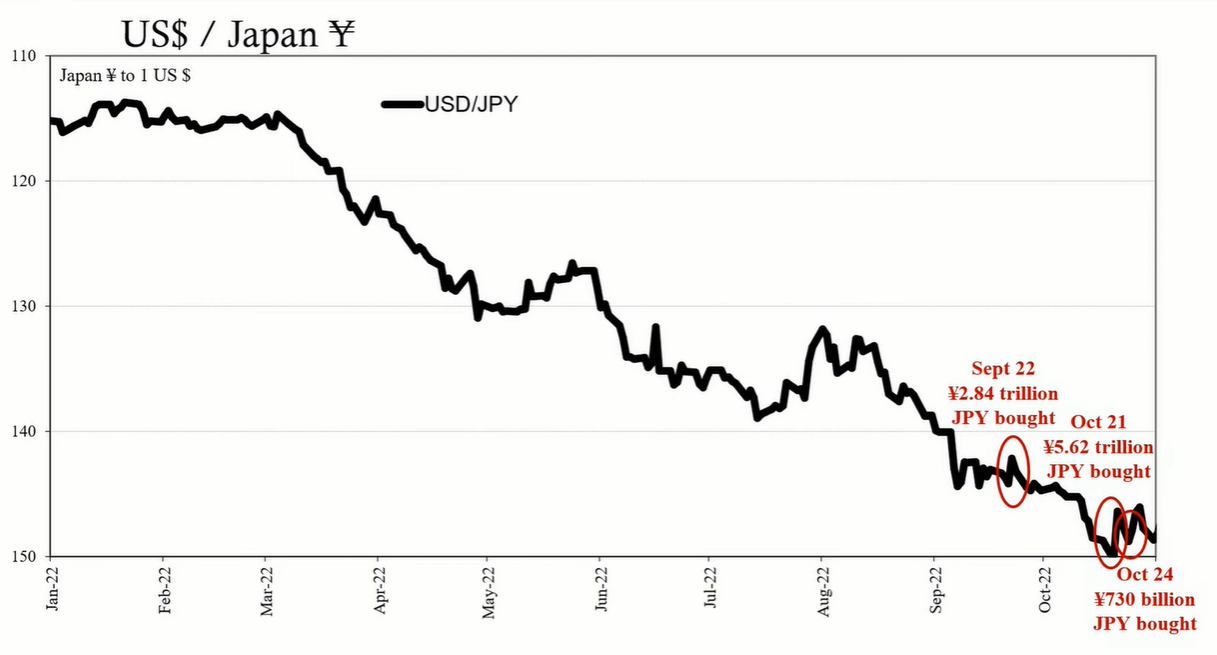

Looking at Japan's interventions in the foreign exchange market, we see a consistent pattern. In 2022, Japan intervened by selling US dollars to purchase trillions of yen. Despite these massive interventions, the impact on the yen's exchange value was fleeting, with the currency resuming its decline shortly after.

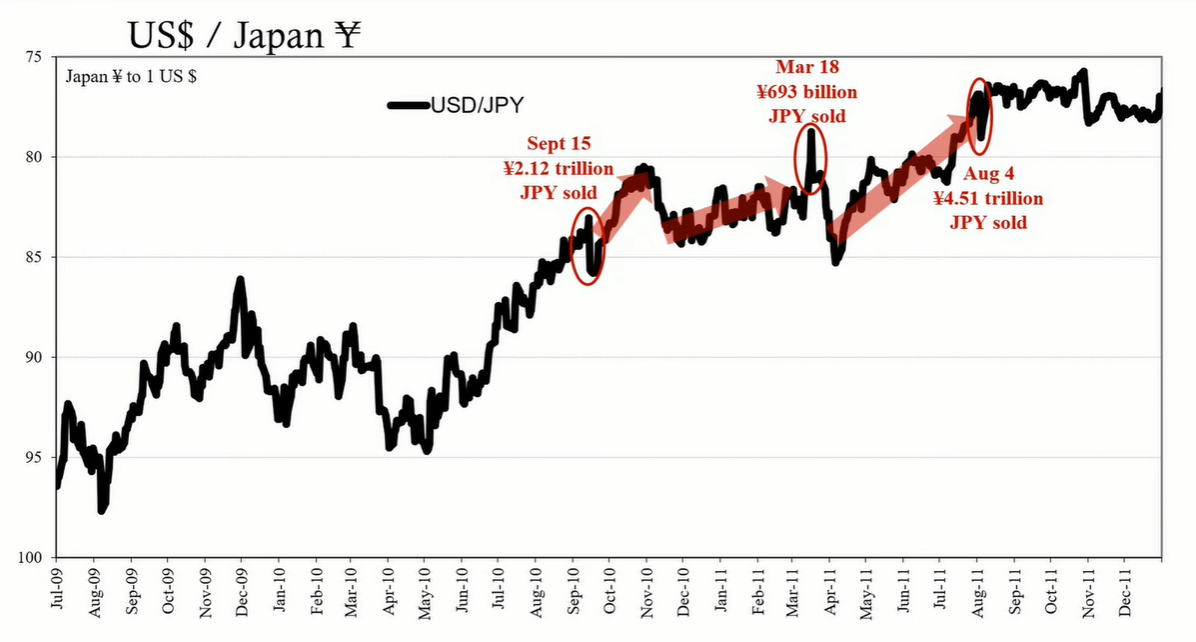

Going back further to 2010 and 2011, Japan faced the inverse problem with a strengthening yen, prompting interventions to protect their exporters. Even then, the effect of interventions was short-lived, with the yen's value reverting to its previous trajectory.

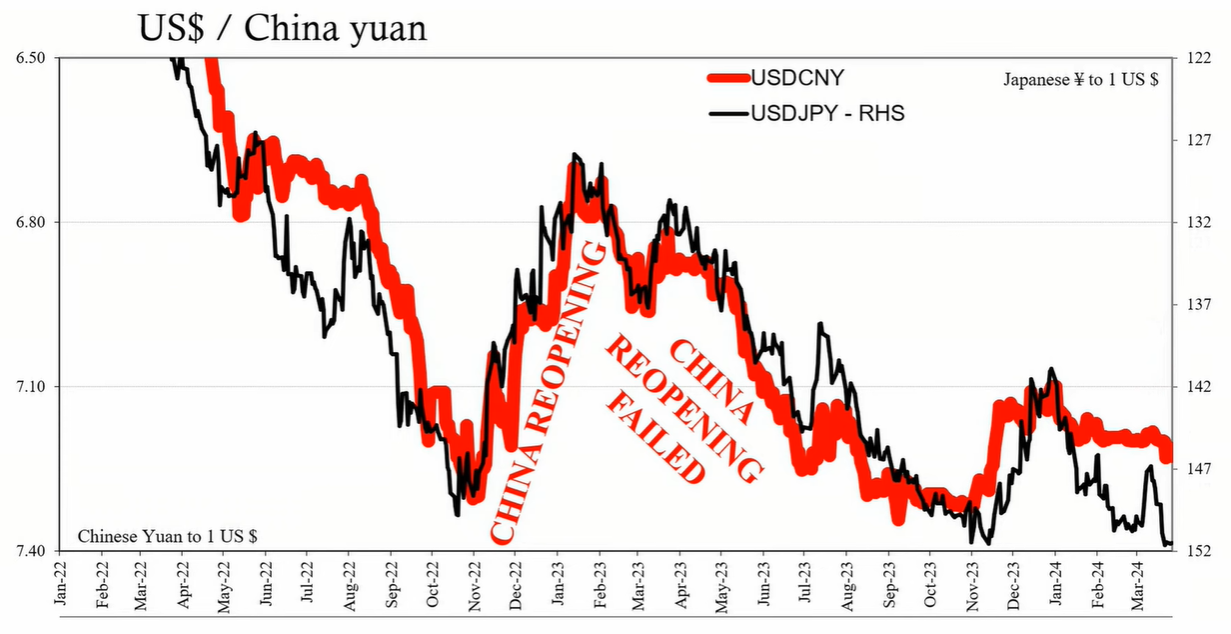

The key takeaway from these historical interventions is that the direct impact of central bank actions on currency markets is often limited and temporary. Instead, deeper economic and financial factors, particularly those associated with the eurodollar system, play a more significant role in determining currency values. For instance, the yen's movement in late 2022 correlated with China's yuan due to speculation about the end of China's zero-COVID policies, not because of Japan's interventions.

The recent weakness in the Japanese yen, the Chinese yuan, and other currencies against the US dollar signals broader economic and financial challenges. This dollar strength, contrary to what the term might suggest, is a harbinger of heightened risk in the eurodollar system and a potential indicator of global economic strain.

The focus on Japan's potential interventions in the yen misses the larger picture. It is the dynamics of the eurodollar system that provide a more comprehensive understanding of the global financial landscape. Central banks, including the Bank of Japan, are not the sole arbiters of currency values—global economic forces play a pivotal role. The ongoing strength of the dollar and its implications on other currencies underscore the interconnectedness of global markets and the influence of the eurodollar system on economic trends. Recognizing these underlying forces is essential for grasping the current state of the global economy and anticipating future developments.