Michael Hartnett from Bank of America Securities warns that the next major financial rescue could be for the federal government itself, potentially triggering economic turmoil far surpassing previous crises.

The Next Big Bailout could be the mother of all bailouts: The Federal Government.

So says a new report from Michael Hartnett, Chief investment officer of Bank of America Securities. And it comes on the heels of a seperate warning from Morgan Stanley that the world's governments have "only a couple of years" to fix their debt addiction before it could spiral out of control.

It's worth noting that were this to happen, if major governments are forced to turn to the central bank money printers to fund operations, it would dwarf any bailout we've seen since the creation of the Fed.

After all, there's north of $100 trillion in government debt -- roughly equal to all the money in all the world.

So forget the 1970's inflation, the 2008 bailouts, even the Covid inflation orgy. It could, if it happens, be the big one.

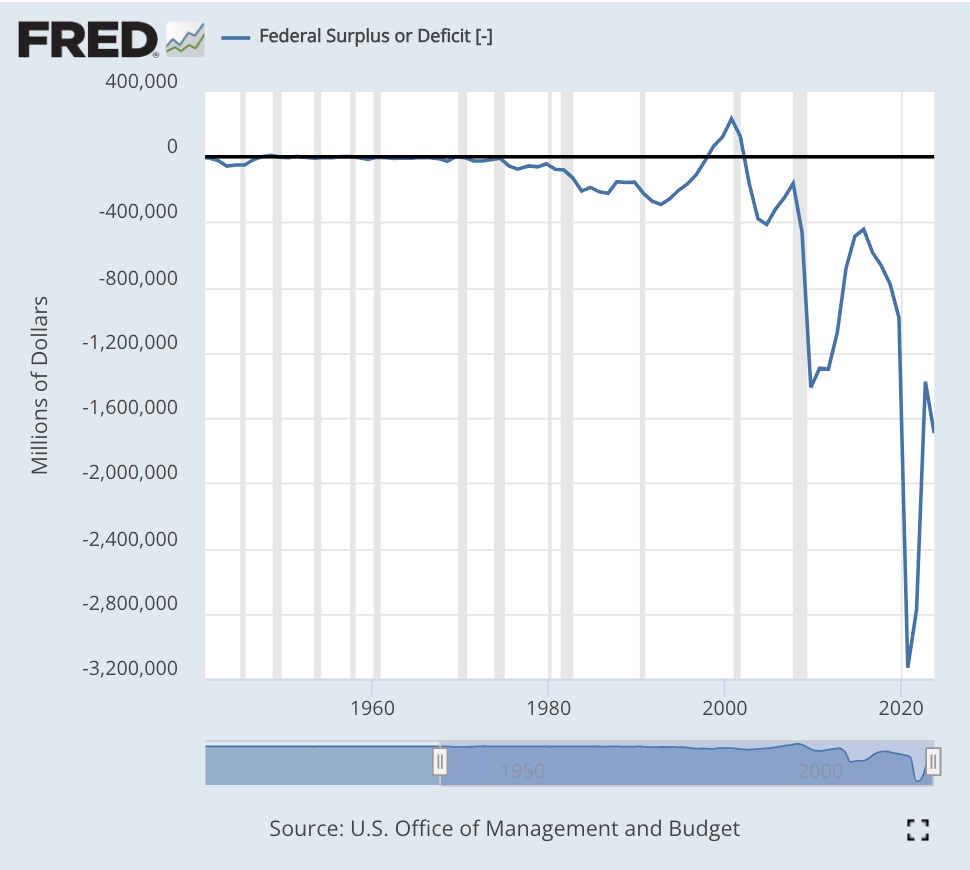

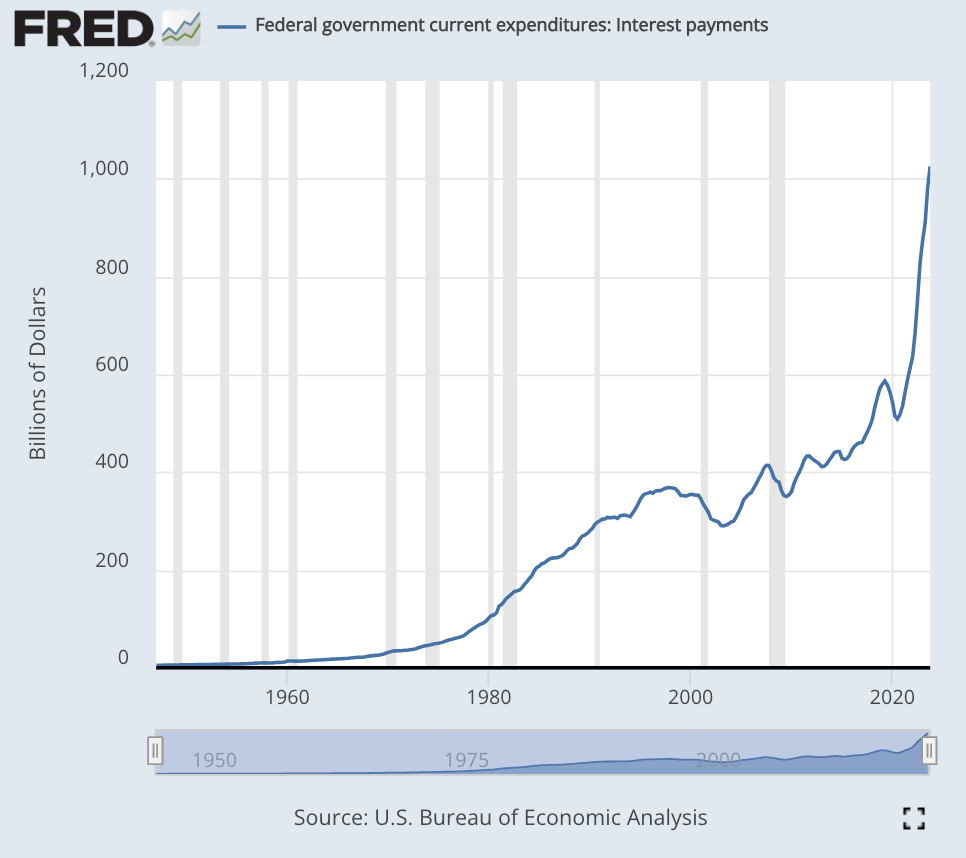

First, Hartnett's argument. He tallies up the rising spending, rising debt, and rising taxes and concludes we're on a runaway spending train with no built-in brakes. Which would lead to higher inflation, runaway debt costs, and higher taxes that progressively strangle the very economy allegedly sustaining it all.

So rising prices and shrinking economy reinforcing each other as there's simultaneously more money yet less stuff being produced for it to chase.

The end result is a runaway process where you need to spend more and more to keep it going, to keep up the illusion, and meaning bigger bailouts every time something breaks. Each swing of the pendulum financed by yet more trillions public debt.

Every intervention or regulation, every tax hike, every trillion-dollar bailout or, indeed, every trillion-dollar spending bill, becomes another brick on the camel's back.

Eventually, it breaks. Meaning eventually the government simply can't suck enough resources out of a starved economy. It gives up an turns to the money printer – the central bank. Who, if Covid taught us anything, will do whatever it takes when its masters in Congress really need the money.

If we are headed to that fiscal Minsky moment when governments take direct control of the money printers, history presents two possibilities.

The least bad is the Japan outcome: since the 1990's, Japan's central bank has built up to where it owns the majority of government debt. Not quite an in-house printer, but half-way there.

What happened? Lending collapsed and the economy -- and wages -- slowed to a crawl. Because the government became trapped by its own debt, locked into near-zero interest rates that rendered lending pointless for banks.

The economy withered on the vine. For 35 nears now. Now young Japanese flee overseas, escaping an economy that was once the envy of the world.

That's the best case. The worst case, as always, is 1920's Germany. Weimar. When the government took full control, printing up every last reichsmark it craved.

That, of course, led to hyperinflation that destroyed life savings, reduced the middle class to prostitution if not starvation, and cleaved German society into warring factions where we know what happened next.

The good news is there's still time to leash the wolf. The bad news is there's zero appetite in Washington, indeed anywhere.

Covid addicted the world's governments to spending. They're not stopping.