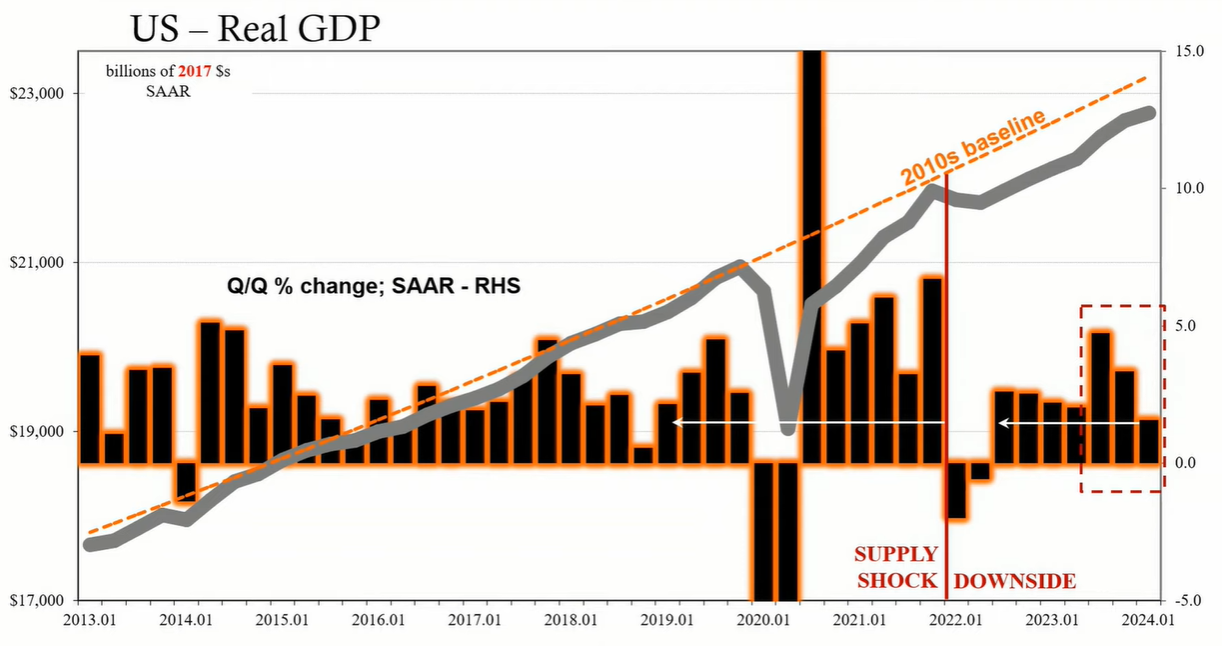

The 2024 Q1 GDP report unveils a troubling economic scenario in the U.S., signaling a return to the "silent depression" conditions of the 2010s with a mere 1.6% growth rate.

The first quarter GDP report for the United States in 2024 indicates a period of stagflation, with the growth rate marking the weakest in two years. At a glance, this may appear to be a resurgence of the 1970s economic climate. However, current data suggests that this situation is more akin to a variation of the economic conditions experienced in 2010, known as the silent depression.

The reported GDP growth for Q1 2024 was a mere 1.6%, a significant decline from 3.4% in the previous quarter and even further from the nearly 5% in the third quarter of the previous year. Expectations had been set at around 2.5%, making the actual figures almost a full percent lower. This shortfall suggests underlying economic weaknesses, exacerbated by rising costs that consumers are struggling to afford.

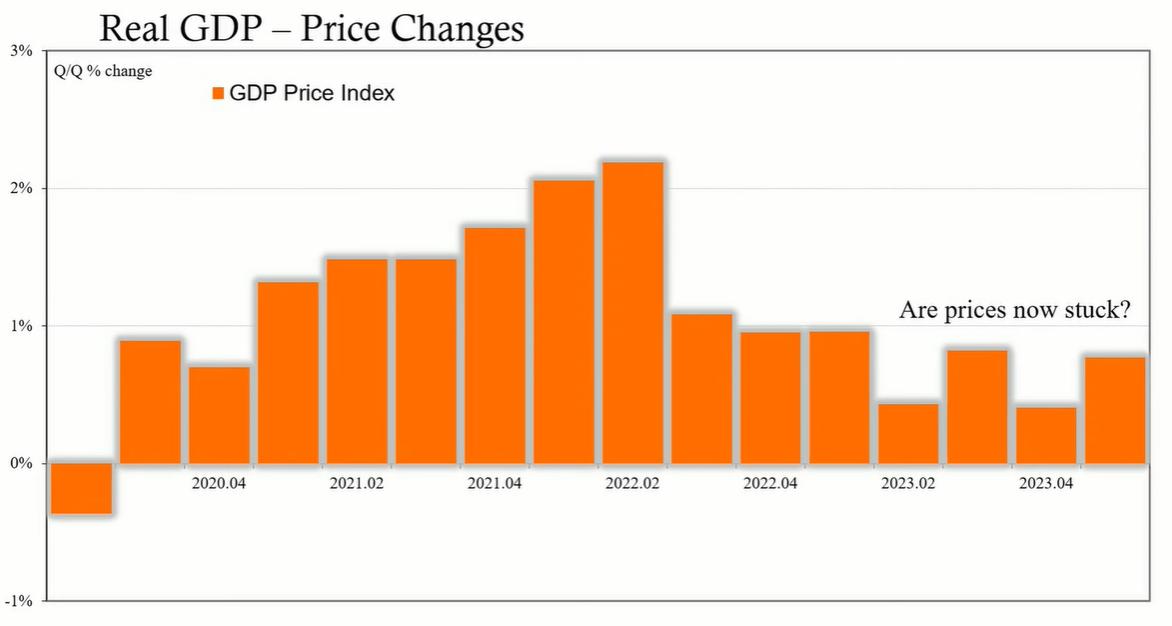

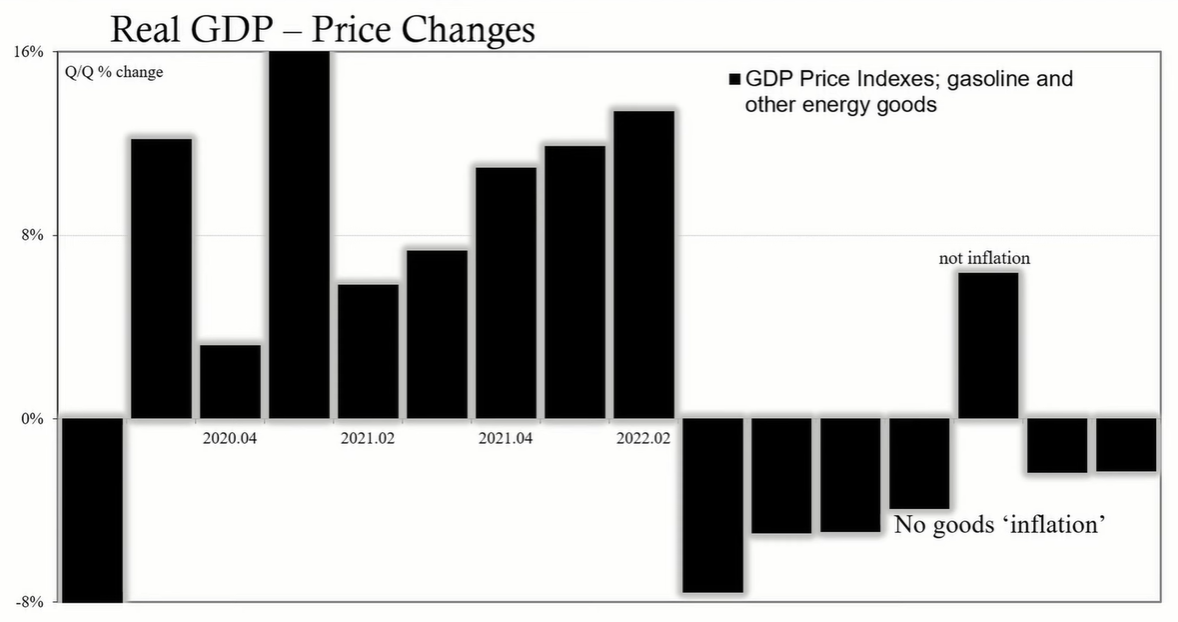

Contrary to initial assumptions, the energy sector did not drive the inflation experienced in Q1. Instead, service-related inflation was the primary culprit. The overall GDP price index increased by 0.8%, twice the rate of the previous quarter but still lower than in 2022. While gasoline and other energy costs are down by 2.3% quarter over quarter, service prices, particularly for financial services and travel, have seen significant increases, with the PCE for services climbing to a 1.3% quarterly rate.

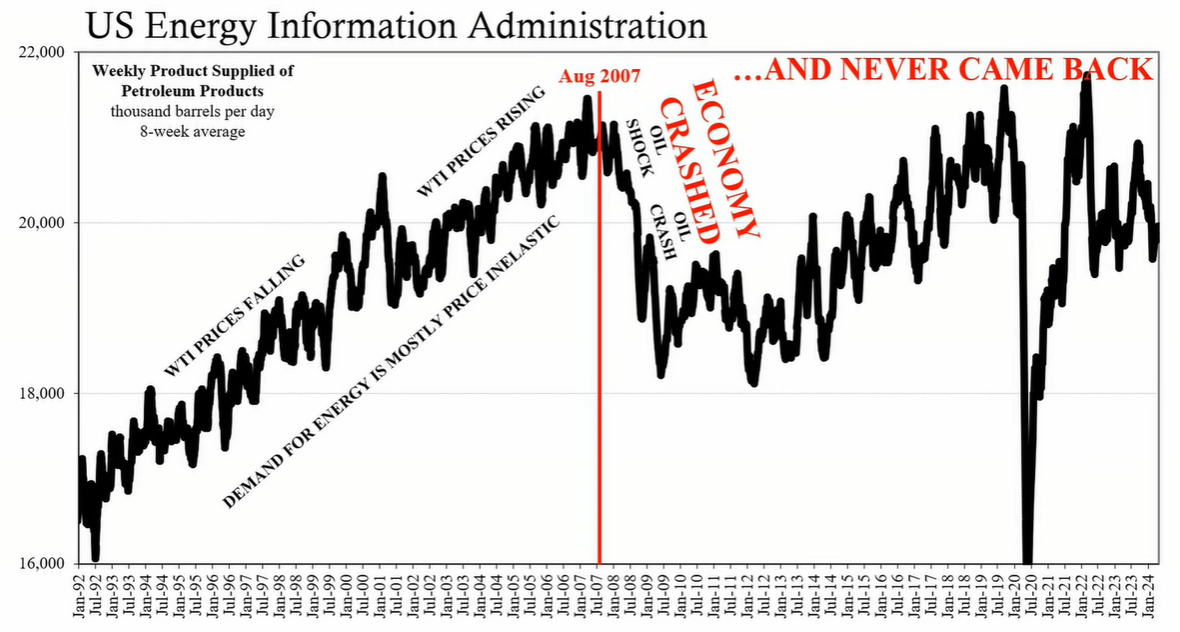

The silent depression, a term used to describe the prolonged economic stagnation since the 2008 financial crisis, is still evident in the energy sector data. Energy usage, particularly of petroleum, serves as a proxy for economic demand. Past trends have shown that following the 2008 crisis, petroleum usage did not recover in line with expectations, hinting at an underlying economic malaise rather than a temporary downturn.

Energy Information Administration data shows that petroleum supplied, which reflects domestic oil usage, has not seen the recovery that would indicate a healthy, growing economy. The lack of growth in utility output, even with the rise of electric vehicles, further supports the notion of an ongoing economic struggle rather than a period of inflationary growth.

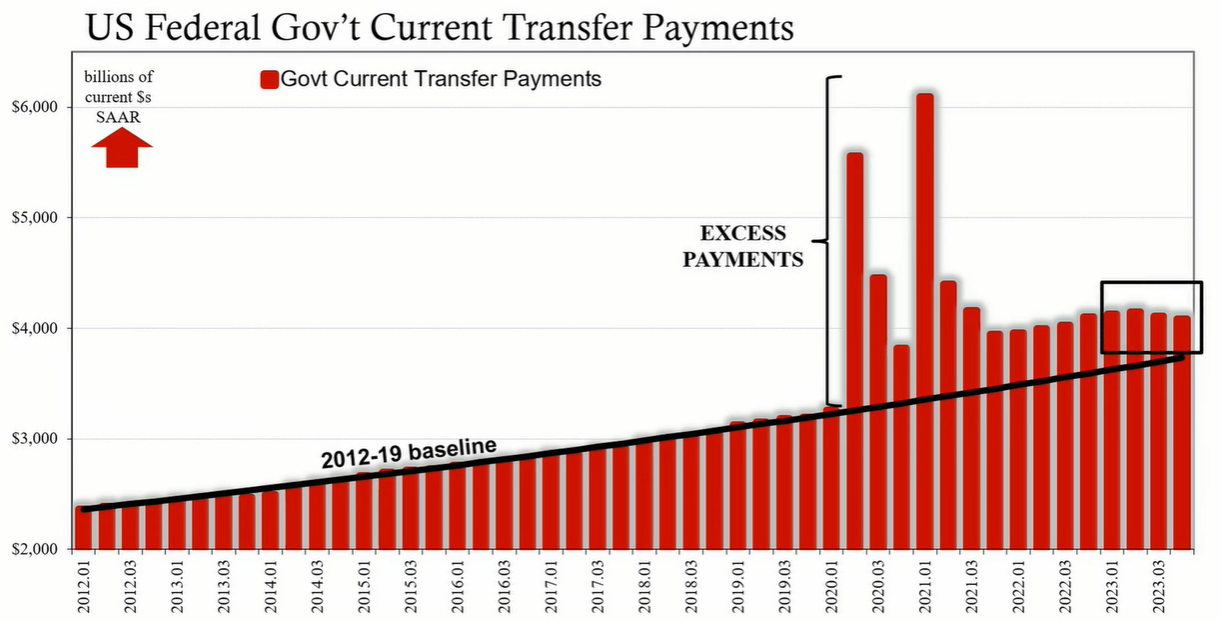

Government transfer payments have played a significant role in shaping the current economic landscape. While these payments have been reduced from their peak, they still exceed pre-pandemic levels. This substantial redistribution has had the effect of propping up prices without stimulating corresponding volume growth. Essentially, these transfers have subsidized cost increases, allowing prices to remain elevated without addressing the fundamental economic weaknesses.

The Q1 2024 GDP report reveals an economy facing stagflation, with low growth rates and rising service costs. However, a closer examination of the data, especially from the energy sector, indicates that the nation is still grappling with the silent depression that took hold in the 2010s. Government interventions, though well-intentioned, have only managed to mask the underlying economic issues without fostering genuine growth.

The energy sector's evidence suggests that the economy is not experiencing a boom but is instead struggling to adjust to post-pandemic and post-2022 supply shock conditions. This period does not herald a return to the inflation-ridden 1970s but rather a continuation and potential worsening of the silent depression. The role of government support, while temporarily mitigating the impact of rising costs, may in fact be prolonging the journey towards a more stable economic state that genuinely reflects the market's fundamentals.