The Shanghai index, China’s benchmark index, plummeted by 5% last week, leading to a staggering loss of $500 billion in Chinese corporate equity.

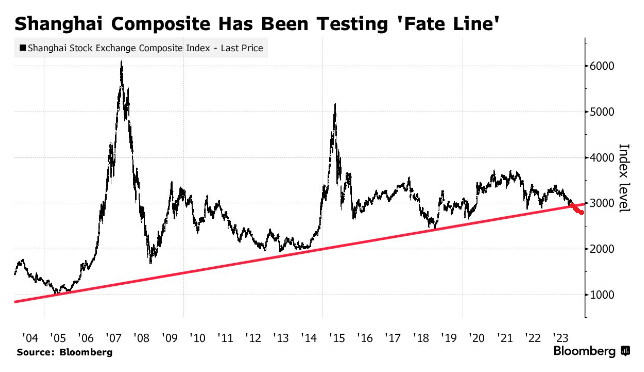

In an alarming financial downturn, China's stock market is experiencing a significant collapse, causing widespread concern within Beijing's political echelons. The Shanghai index, China’s benchmark index, plummeted by 5% last week, leading to a staggering loss of $500 billion in Chinese corporate equity. This precipitous fall has contributed to a 25% drop over the past two years, starkly contrasting with the global financial landscape where U.S. stocks rose by 10%, British stocks remained stable, and Japanese stocks saw an increase of nearly a third.

The performance of Chinese stocks is a troubling outlier on the world stage. Since 2007, Chinese stocks have failed to show any growth, marking 17 years of stagnation—a period that coincides with President Xi Jinping's tenure and his government's handling of the economy. Under Xi's leadership, the Chinese economy has suffered from government mismanagement, politicized subsidies, and authoritarian interventions, casting doubt on the nation's economic stability.

The recent nosedive has sent shockwaves through Beijing, with officials acutely aware of the potentially catastrophic impact on Chinese households and the country's deeply indebted financial system. China's debt crisis looms large, with debts surpassing 300% of its GDP—an equivalent of nearly $80 trillion by U.S. standards. A deflationary spiral, driven by overcapacity in sectors like manufacturing and housing, exacerbates the problem by effectively increasing the real burden of debt.

In response to the crisis, China's State Council has initiated an all-hands-on-deck approach to stave off further market collapse. Measures have included tax tweaks, bans on short sales, and infusions of capital into state-linked firms. Reports suggest a potential 2 trillion yuan ($300 billion) rescue package, reminiscent of the 2015 bailout. However, skepticism abounds regarding the effectiveness of these interventions due to the underlying weaknesses in China's growth model, which has been propped up by government spending, state-supported exporters, and a faltering housing market.

This economic turmoil has prompted a shift toward a nationalized stock market, mirroring the broader trend of an increasingly state-controlled economy. As growth stagnates and President Xi's authoritarian policies deter investors, capital is flowing out of China to emerging markets like Indonesia, Vietnam, and even Mexico, while the U.S. struggles to attract foreign investment due to its own domestic challenges.

The unfolding situation in China could present an opportunity for the United States, particularly if there is a shift in domestic policy following the 2024 presidential election. With potential changes in the political landscape, America could capitalize on China's economic distress—if it manages to address its internal manufacturing and policy constraints.