A series of purges among top officials, ongoing efforts to stabilize a volatile stock market, and the struggle to maintain a fragile banking system all point toward a government grappling with significant financial turmoil.

Recent events in China have highlighted the economic challenges facing the country. A series of purges among top officials, ongoing efforts to stabilize a volatile stock market, and the struggle to maintain a fragile banking system all point toward a government grappling with significant financial turmoil. This article examines the available data to understand the depth of China’s economic issues and the impact of the government's responses.

The dismissal of Yi Huiman, head of China's main securities regulator, mirrors the increasing number of purges occurring within China's political landscape. These purges are seen as a response to a plummeting stock market, which has experienced a $5 trillion sell-off. Authorities have been attempting to intervene in the market, urging institutional investors to buy stocks in hopes of halting the decline. However, these measures appear to have had minimal impact, as investor confidence remains low and the stock market continues to exhibit instability.

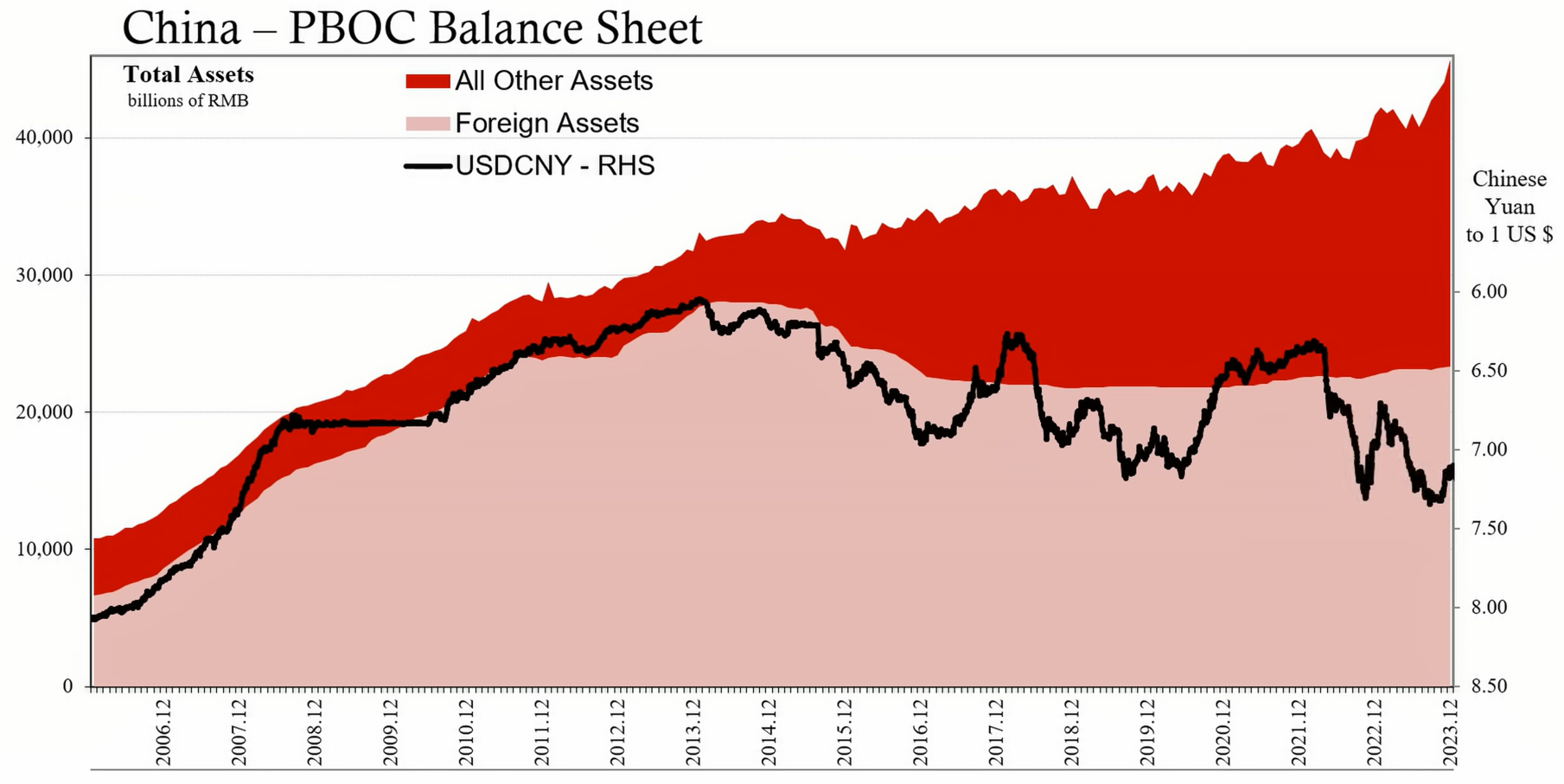

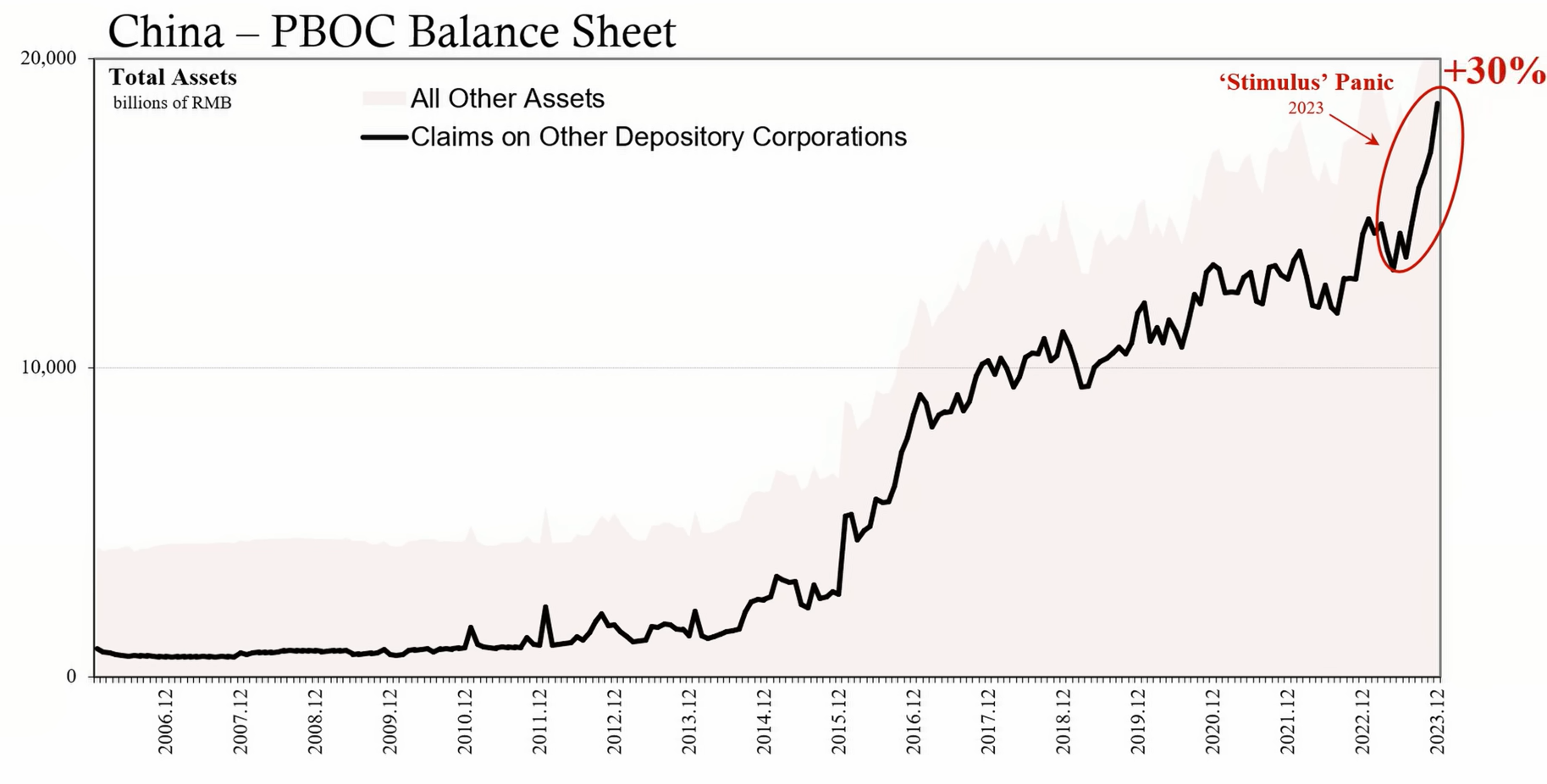

China's banking system is currently under considerable stress. Efforts by the People's Bank of China (PBOC) to provide liquidity have escalated, as evidenced by their balance sheet expansion in the latter months of the previous year. Despite these efforts, the banking system remains fragile, suggesting that the government's interventions are not effectively addressing the underlying issues.

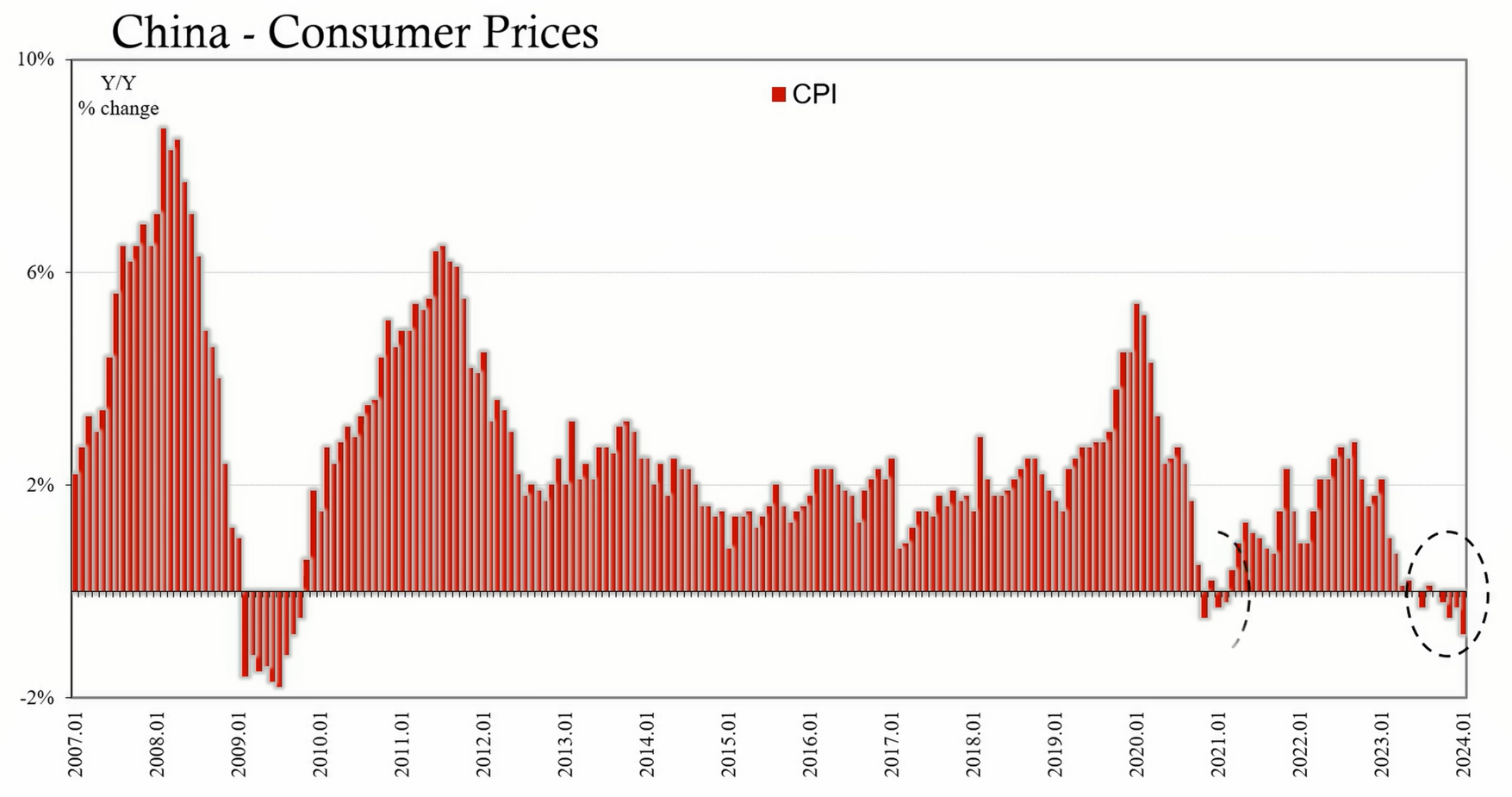

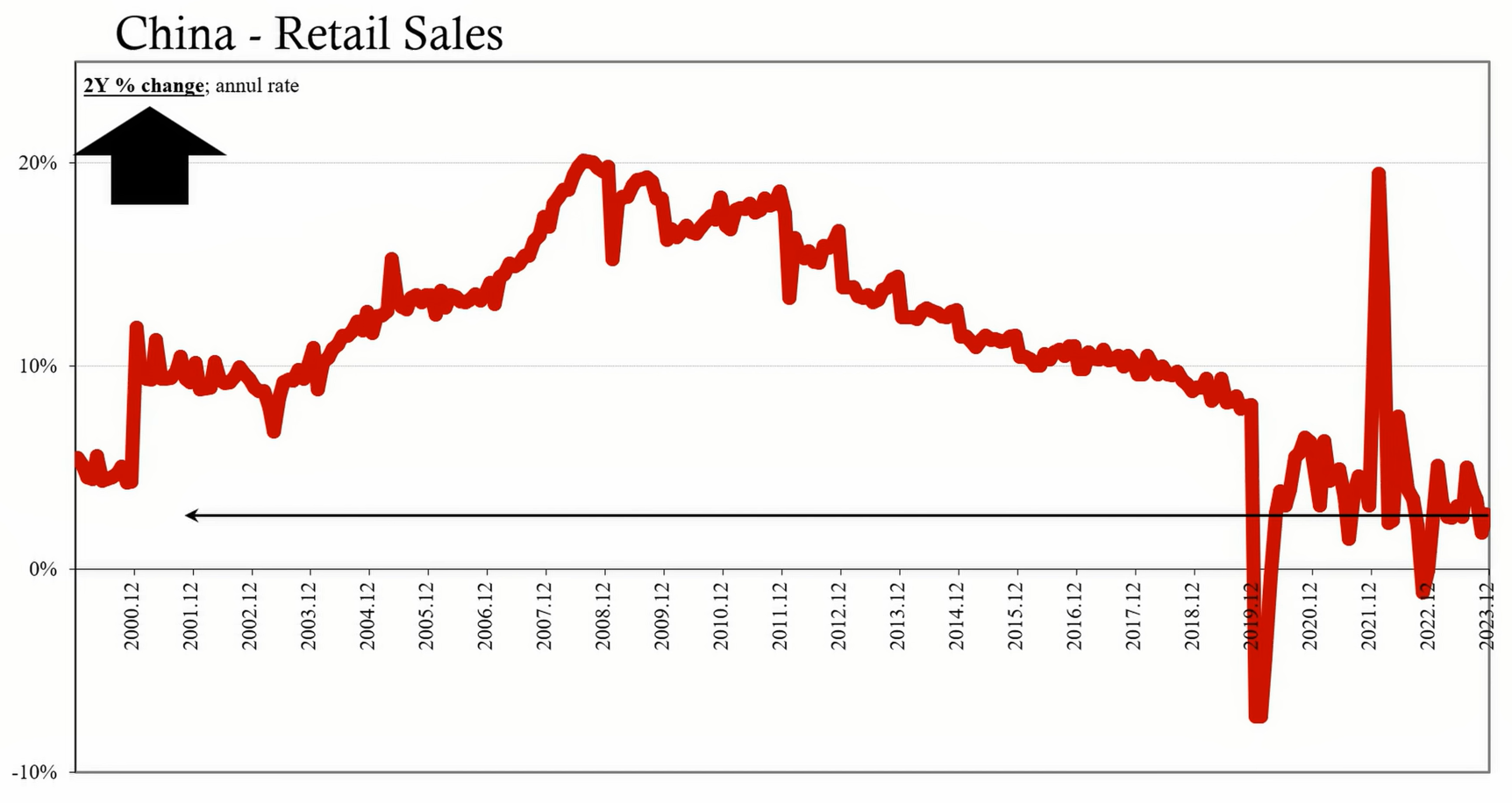

China's macroeconomic statistics are difficult to assess due to the timing of the Golden Week holiday, which affects the reporting schedule for key economic indicators. However, available data on consumer and producer prices for January suggests persistent economic weakness. The consumer price index's year-over-year change marked a 0.8% decrease, and producer prices continued to show deflationary trends, indicating overcapacity and reduced demand.

The PBOC has taken several steps to address the financial challenges. The balance sheet expansion, particularly through claims on other depository corporations and short-term lending facilities, reflects substantial efforts to provide liquidity to banks. Moreover, the unusual cut in the reserve requirement ratio (RRR) in late January aimed to inject further liquidity into the market. Despite these actions, the central bank's initiatives have not translated into increased lending or economic stimulation.

The Shanghai stock index has struggled to recover from its recent lows, despite the RRR cut and other government interventions. Additionally, the consumer price index indicates ongoing deflationary pressures, especially in the retail sales and consumer spending sectors. Producer prices also continue to fall, reflecting the impact of a global trade recession and internal economic challenges.

The Chinese government, particularly the PBOC, has been proactive in its attempts to stabilize the economy. However, the data indicates that these measures have not had the desired effect. The persistence of deflationary pressures, a lack of investor confidence, and a fragile banking system suggest that China's economic troubles are deep-seated and may pose risks beyond its borders. As the government continues to navigate these challenges, the potential for a "hard landing" scenario becomes increasingly plausible. The global implications of China's economic distress will be closely monitored as the situation evolves.