Chinese stock markets are collapsing- is their entire stock market a potential fraud?

Stock markets are plummeting in China, indicative of a vicious deleveraging cycle as the real estate woes worsen. What will they do to stem the bleeding?

In spite of Beijing's recent efforts to boost confidence in the economy and halt a prolonged decline in the stock market, which has resulted in a loss of $7 trillion in value over three years, investors continue to sprint for the exits.

Last week, the Shanghai Composite index experienced its most significant weekly decline since October 2018, dropping by 6.2%, while the Shenzhen Component index recorded its most substantial decrease in three years with an 8.1% loss. Both indexes had witnessed losses of more than 8% and 15% each since the beginning of the year.

On January 29th, a Hong Kong court announced the liquidation of Evergrande, the globe's most indebted property developer and a symbol of the Chinese real estate crisis. Instead of offering closure, this order spread new fears about the fate of the real estate business and other financially troubled developers.

I wrote extensively about the Chinese real estate crisis in December in a paid research piece, especially targeting the risks to the financial sector:

“The major concern revolves around the ripple effect on China's "shadow banking sector," an enigmatic term to describe institutions that act as banks and make up a significant part of its financial realm. This industry, valued around $3 trillion at its most conservative estimate and potentially reaching $12 trillion when factoring in asset management products and consumer loans, has garnered attention lately due to the default of two major entities.

These players, heavily involved in the property market, have struggled to fulfill their obligations to investors.

Last month, Zhongzhi Enterprise Group, a prominent financial conglomerate in the country (one of the shadow banks), declared insolvency following defaults on numerous investment products. This move has prompted a criminal investigation by the police targeting the company. In other news, two weeks after Zhongzhi's financial turmoil, China's state media disclosed that another shadow bank, Wanxiang Trust, an investment and asset management firm based in Hangzhou, postponed payments amounting to several hundred million dollars across various investment products.”

The deleveraging that was occurring in the real estate markets and the shadow banking system appears to be spreading to the traditional equities markets. The CSI 1000 index in China has experienced an 8% decline today and a staggering 30% decrease in the first month of 2024. In the past 10 days alone, the index has plummeted by a substantial 21%. The CSI 300 benchmark dropped by as much as 1.4%, marking its most significant weekly loss since 2022.

The crisis has continued despite new restrictions on lending and short stocks, which were implemented in hopes of slowing the rapid decline in the equities markets. 13 hours ago, 30% of all stocks in the CSI 1000 index were halted as the market rout deepened.

On Sunday, the China Securities Regulatory Commission pledged to curb volatility by directing additional medium- and long-term funds into the market. Additionally, the commission stated its intention to clamp down on illegal practices such as malicious short selling and insider trading. However, this appeared to do little to slow the spreading panic.

More drastic measures may even be at hand- one academic at a government policy center stated that the country should set up a stock market stabilization fund to buy up distressed equities, filling the fund with 10T yuan ($1.4T) or more!

All of this comes on the back of another negative CPI print for the Chinese in December, where the index fell 0.3% YoY. The Producer Price Index (PPI) experienced a 2.7% decrease following a 3% decline in November, marking the 15th consecutive month of declines.

The slowing Chinese economy may be a canary in the coal mine to other financial markets that the effects of the fastest rate hiking cycle in recent memory (with record global debt levels) have not been fully felt yet.

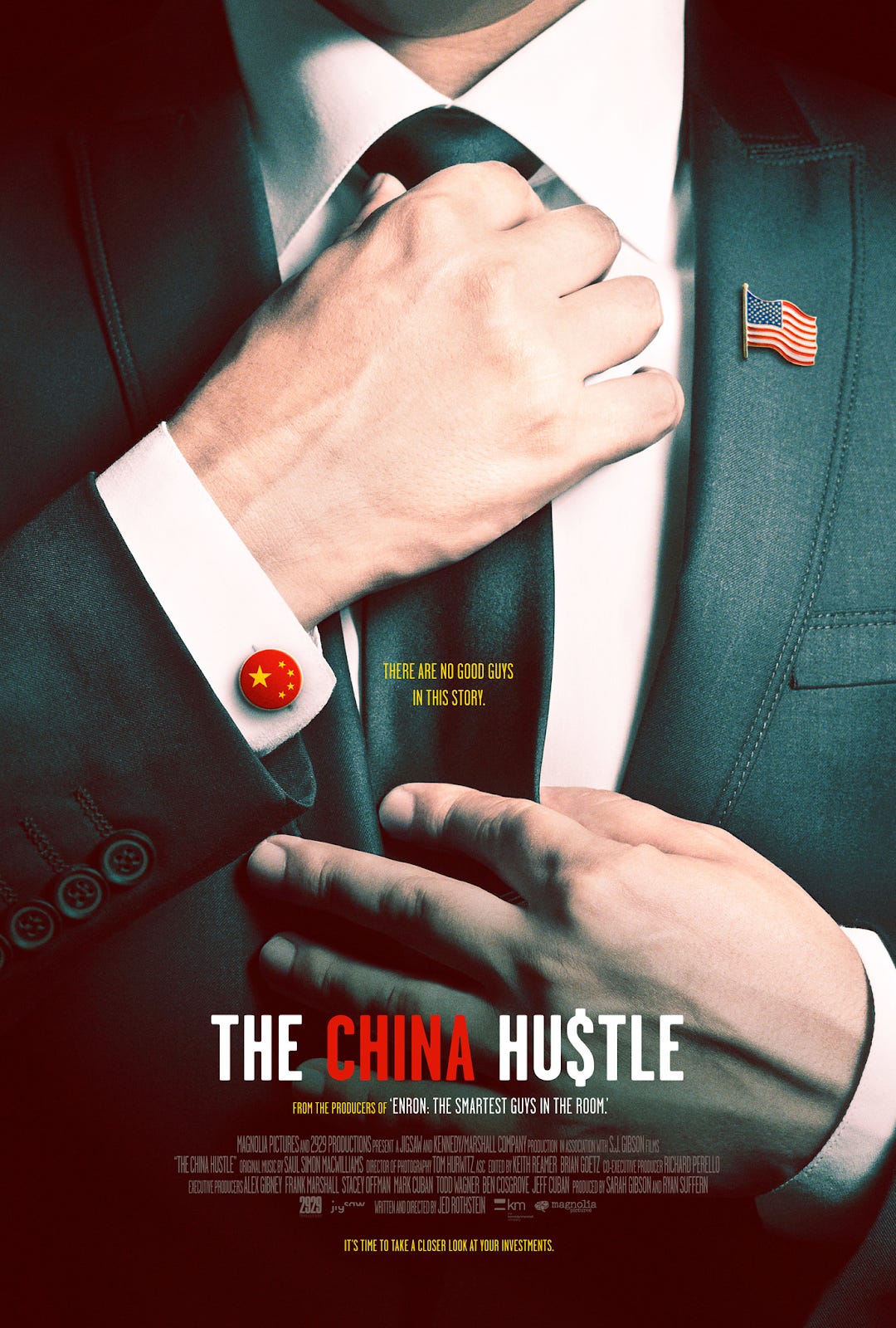

The speed of this downturn may be shocking to some, but I am relatively unsurprised. The Chinese stock market is littered with frauds, scams, pump and dumps, and blatant corruption. Officials are paid to look the other way, auditors don’t care about the accuracy of reports, and due diligence is essentially a non-starter. I was awakened to the depth of the problems in China in 2018 when watching The China Hustle, a documentary on the fraudulent listing of Chinese equities on U.S. exchanges and how retail investors were exploited.

In contrast to many documentaries on finance, economics, and fraud, "The China Hustle" is accessible to mainstream viewers with limited knowledge of stock markets and investments. The film effectively breaks down complex concepts, straightforwardly presenting each step with clear explanations and demonstrations of the processes and outcomes.

Most importantly, it features real individuals who experienced the fraud, some who suffered losses, others who profited, and some who, despite having benefited, are now actively working to expose and end such practices, even if it means putting an end to their own profits.

I haven’t watched the film in years, but from what I remember, it tells the story of a fund manager who begins to investigate several different Chinese equities that got listed on NYSE. He begins to realize that the companies are complete frauds, and are used to extract wealth from U.S. investors including retired seniors. It was a fascinating watch, and one I highly recommend- but the main gist of the story was that nobody was prosecuted for these crimes.

In China, there is a categorical difference between domestic investors and foreigners. If a board of a company is caught manipulating financials and lying to other (wealthy) Chinese, the regulators, if properly incentivized by the victims, will come after the perpetrators. Typically, they will ask for tit-for-tat; meaning if they prosecute the board members the regulators themselves ask for something in return, like the placement of their son or daughter in a prominent school. However, if the investors are poor, and even more so if they are foreign- then nothing will be done.

No arrests. No interrogation. No investigation to speak of at all.

This led me to believe that the Chinese stock market could be a wholesale fraud- if regulators were this blind in these cases that were connected to the foreign markets, where an argument could be made for cracking down in order to appease influential American investors, then how much worse was the auditing for blue-chip Chinese stocks listed on their own exchanges?

The answer seems to be much worse. Given the absolutely abysmal performance of the main indexes such as the SSE Composite, almost no new money is flowing into Chinese equities, either from the mainland or elsewhere.

If you look closely on the graph, Chinese equities are trading at the same place they were in November 2014, 10 years ago. If you compare this to the SPY index in the U.S., this means that U.S. markets would have to fall 60% relative to China to get back down to the level seen that month a decade ago.

Now, is this indicative of an overbought U.S. market? Partly perhaps- but the absence of fundamental growth is a worrying sign that the Chinese themselves know that their equities are nowhere near a fundamental representation of the growth in their own economy.

This article was originally written on The Dollar End Game.