Following its worst year in generations and a bloodbath earlier this fall, the traditional “60/40 portfolio” put up its best November + December performance in nearly 30 years.

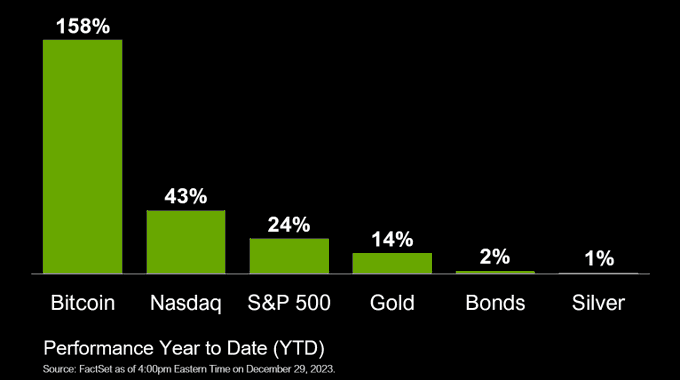

This year ended on a high note for traditional markets, with the S&P closing just below all-time highs and the classic 60/40 portfolio rebounding aggressively over the past two months as the market continued to price in more rate cuts for 2024 (as always, though, there is no second best).

Meanwhile, the many legacy finance players chasing a spot bitcoin ETF issued new updates to their filings that suggest final approval of the vehicles could be close at hand. At the same time, new headlines from the week pointed to ongoing shifts away from the US dollar on the margin, continuing a trend we expect will have substantial implications for both the legacy financial system and bitcoin over the long term.

Most importantly, as we close out the Timestamp for 2023, it’s only appropriate that we have several exciting developments to share from portfolio companies as varied as GRIID (a leader in bitcoin mining), StatMuse (a huge and fast-growing content platform), and Mutiny (a young, innovative lightning company). These updates point to the overall momentum we’re seeing across the portfolio going into 2024, and their diversity speaks to the growing breadth of bitcoin-related opportunities we expect to see across many different verticals in both the coming year and coming decade. With a huge amount of tailwinds propelling our companies – from ETFs to the halving and beyond – we look forward to a banner year ahead.

GRIID is a bitcoin mining company pursuing a differentiated strategy of vertical integration to secure low-cost power and enhanced control over its operations. Founded in 2018, GRIID currently operates across four active sites in the US, with a substantial pipeline of additional buildouts to take place in the near term. GRIID seeks to directly negotiate power contracts as close as possible to the source of generation, with a primary focus on nuclear and hydroelectric power assets. GRIID’s strategy drives both highly competitive power costs and greater control over site build outs and daily operations, all of which are critical to long-term success in bitcoin mining.

GRIID announced completion of its combination with ADEX, paving the way for its public listing early next year:

StatMuse published its latest Muse Letter, which highlighted the company’s fantastic growth this year (including total searches up 2.5x Y/Y):

StatMuse also announced it will add search data for the hugely popular English Premier League:

Mutiny launched experimental support for its Fedimint integration, allowing for early testing of a feature that could substantially improve lightning UX while offering better privacy and security than standard custodial experiences:

Primal Founder and CEO Miljan Braticevic joined The Investor’s Podcast to discuss the potential of the Nostr protocol and Primal’s approach to building tools for the Nostr ecosystem.

The S&P 500 continued its blistering year-end rally to close 2023 just below its all-time high, as the market is now pricing in a growing number of rate cuts in 2024.

Following its worst year in generations and a bloodbath earlier this fall, the traditional “60/40 portfolio” put up its best November + December performance in nearly 30 years.

However, the week showed persistent signs of growing strain in the credit complex as well, with outstanding credit card balances increasing substantially this past quarter as banking deposits continue to fall. Meanwhile, a new Wall Street Journal profile highlighted ongoing stress at regional and community banks on the back of sharp rate hikes over the past two years.

The US is reportedly weighing a plan to seize $300 billion in Russian central bank assets frozen at the outset of the Russia–Ukraine war, an escalation from the US’s already unprecedented unilateral freezing of the assets in February 2022.

Apparently not realizing the damage already done to the dollar’s international credibility when the US froze the assets in the first place, famed economist Robert Shiller warned of a “cataclysm” if the US were to proceed with the asset seizure plan.

To that point, a new report this week indicated that 20% of oil volume this year was traded in non-USD currencies. The report also notes an increase in new non-USD contracts for major commodities (up to 12 this year off 7 last year and just 2 in 2015).

The end of the week saw a flurry of updates on the spot bitcoin ETF race, as BlackRock submitted an updated S-1 filing which listed Jane Street and JPMorgan (whose CEO is famously a big fan of bitcoin) as its authorized participants, pointing to increased likelihood the vehicles get approved in early January.

Shortly thereafter, Fidelity, Bitwise, WisdomTree, and Invesco filed their own updated S-1s, many of which also name JP Morgan and Jane Street as authorized participants.

The Central Bank of Nigeria lifted its ban on cryptocurrency transactions after first barring banks and financial institutions from such transactions in February 2021. However, the central bank is falling in line with a variety of other global regulators in seeking to impose virtual asset service provider (VASP) licensure obligations on any participating institutions.

New research out this week showed that attackers were able to exploit a hardware vulnerability in iPhones to allow for an “unprecedented level of access” to devices of affected users potentially for the last several years, the latest incident emphasizing the need for highly secure bitcoin custody solutions.