Bitcoin finished a volatile week strong as New York Community Bankcorp gets bailed out by a private consortium.

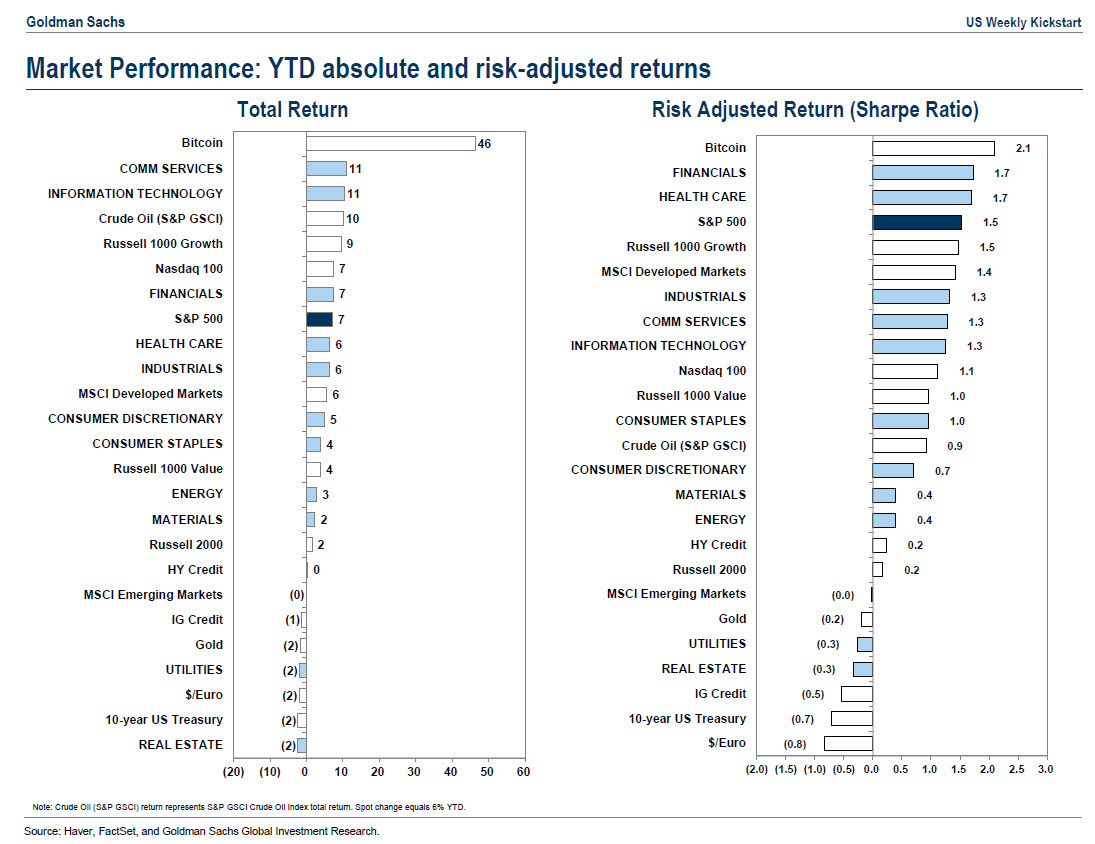

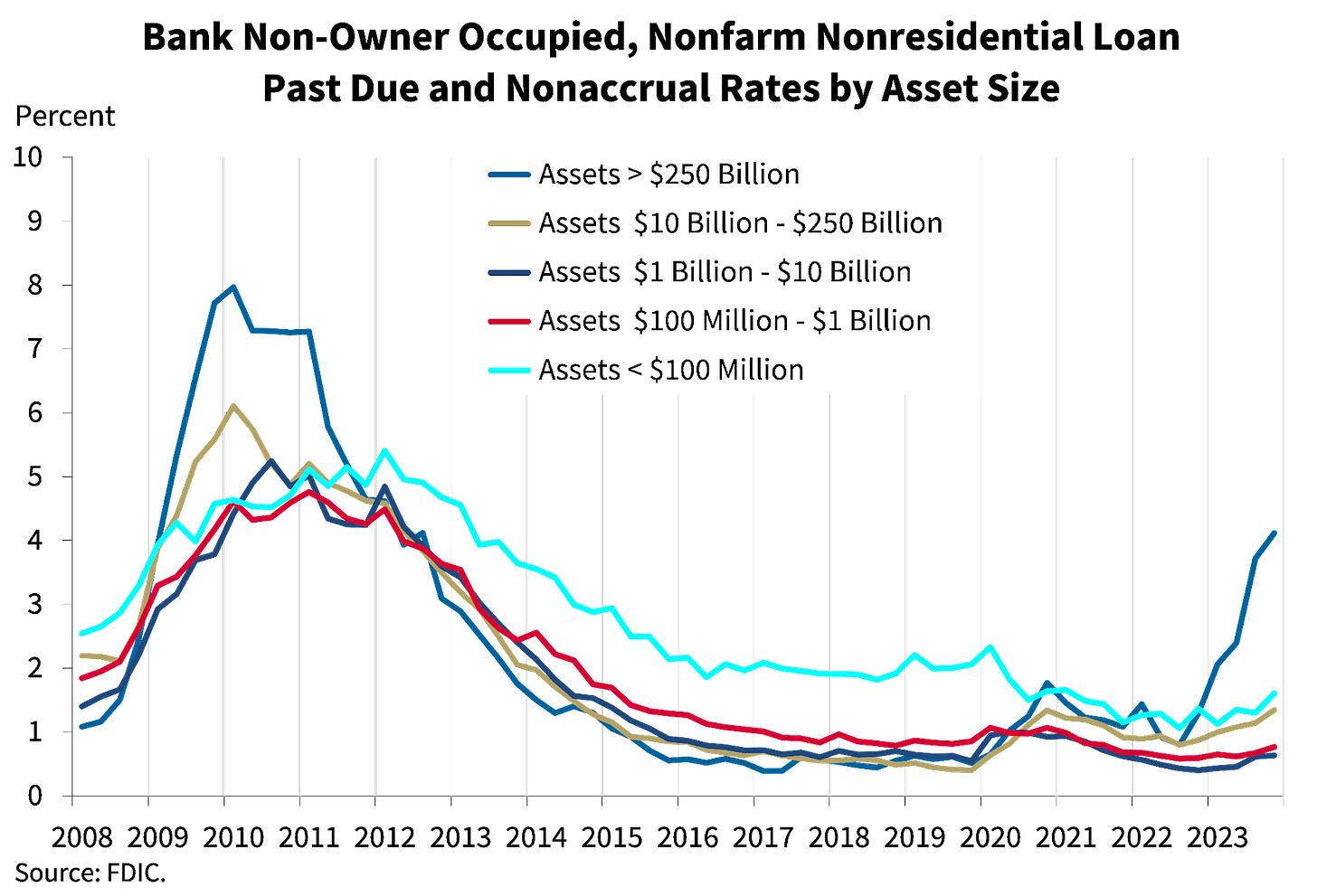

Bitcoin briefly tapped new all-time highs twice this week before retracing to slightly lower levels in price action reminiscent of the last two times the asset was approaching a breakout. In both cases this week, bitcoin quickly erased intraday losses – including a sudden 12% wick down on Tuesday afternoon that was a distant memory less than 24 hours later – on the back of another week of record ETF inflows. On the whole, the ETFs acquired ~8x new daily bitcoin issuance through the week, pushing collective AUM for the new vehicles above GBTC’s total assets for the first time. Bitcoin’s latest +10% weekly candle was coupled with more volatility in the banking sector, as troubled regional bank New York Community Bancorp – the 28th largest bank in the US by assets – saw its stock plunge nearly 50% on Wednesday before the announcement of a $1 billion rescue package by a private consortium. The stock immediately pared losses on the positive news, but is still down substantially on the month and YTD as concerns on loan delinquency and the commercial real estate backdrop persist. Meanwhile, the FDIC’s latest quarterly report pointed to some improvement in unrealized securities losses on bank balance sheets, but also showed overall credit loss provisions and large bank commercial real estate loan delinquencies reaching ~13-year highs:

Portfolio Company Spotlight

Mutiny Wallet is a self-custodial lightning wallet combining privacy best practices built in by default with accessibility for new bitcoiners. Mutiny has just rolled out its native iOS and Android apps on mainstream app stores, but leverages BDK and LDK to also offer a unique web-first design and a progressive web app (PWA) capable of running on virtually any smartphone without the need for a third-party app store. The team – composed of lightning veterans Tony Giorgio, Ben Carman, and Paul Miller – is also working on a variety of new features including forward-thinking integrations with Ecash protocols, a next-generation node implementation tailored to Mutiny Wallet, a dedicated lightning service provider (LSP), various tools leveraging Nostr, and much more.

Mutiny Wallet launched its native app on both iOS and Android app stores:

StatMuse surpassed 4 million daily searches this week, the best search day in company history:

Strike launched the “Switch and Stack” program, which will allow users of other on-ramps to switch to Strike and pay only 69bps in trading fees until the next bitcoin halving:

Cathedra Bitcoin announced a merger with Kungsleden, which will create a combined entity with close to 5 EH/s of hashrate under management:

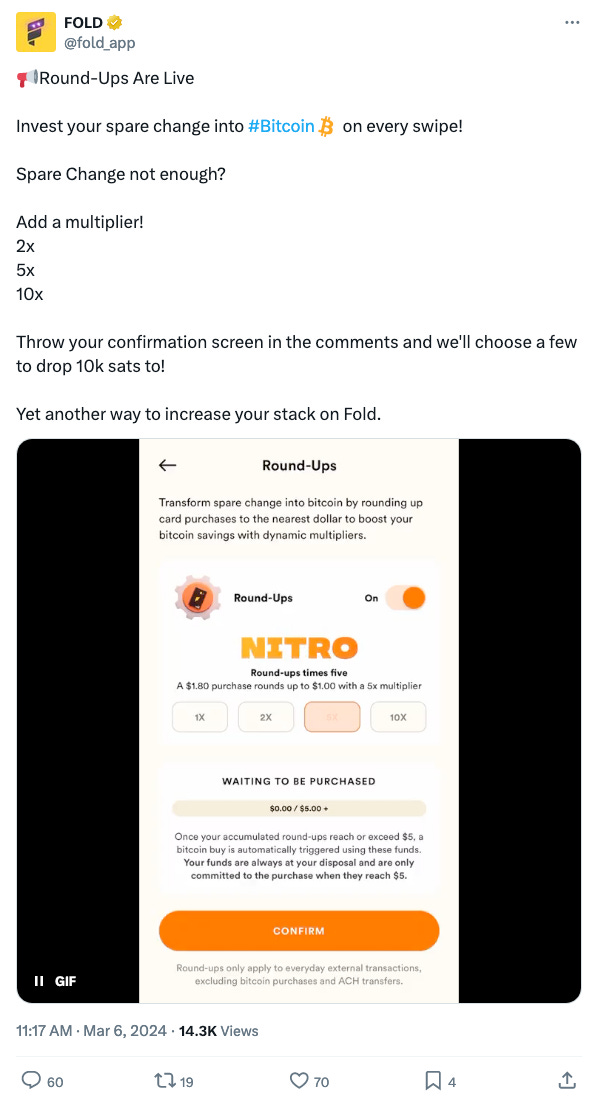

Fold launched a new Round-Ups feature that automatically buys bitcoin to round up card purchases to the nearest dollar:

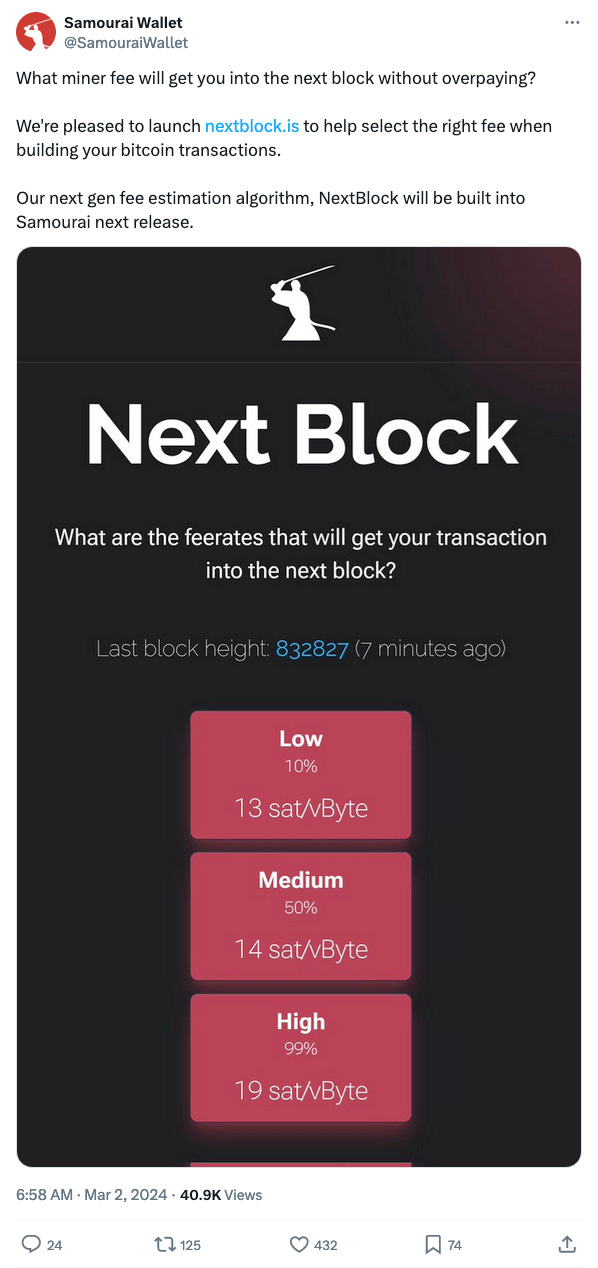

Samourai launched NextBlock, a new transaction fee estimation tool that will be built into upcoming releases:

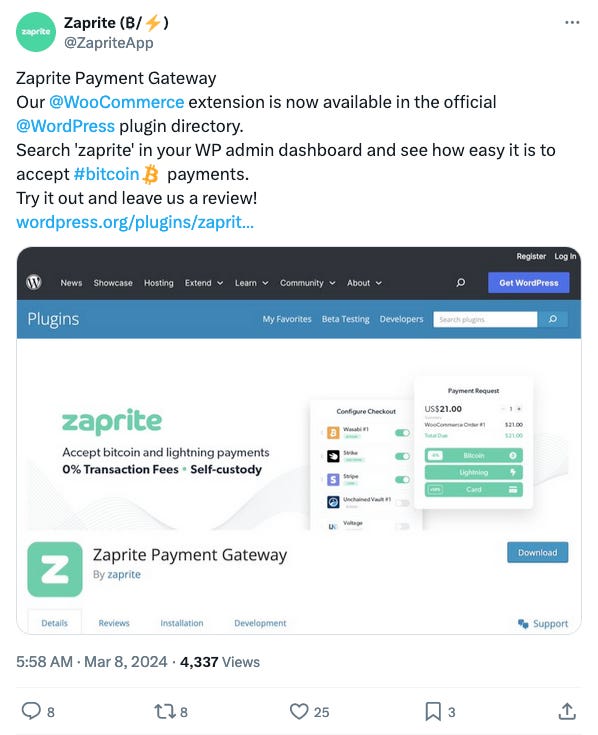

Zaprite’s WooCommerce extension is now available as a WordPress site plugin:

Ten31 Co-Founder and Managing Partner Grant Gilliam appeared on the What Bitcoin Did podcast to discuss his recent piece on the importance of a bitcoin treasury strategy.

Strike Founder and CEO Jack Mallers joined CNBC to discuss bitcoin’s recent price action and growing institutional interest in the asset.

Jack also gave a keynote presentation at the Bitcoin Atlantis conference breaking down some fundamental principles of bitcoin’s design.

Upstream Data CEO Steve Barbour and GRIID CEO Trey Kelly appeared on ARK’s Bitcoin Brainstorm podcast to give an overview of the bitcoin mining landscape.

Ten31 Managing Partner Marty Bent and Cathedra Bitcoin President Drew Armstrong unpacked Cathedra’s merger with Kungsleden on the Blockspace mining podcast.

Bitcoin posted another strong week of 10%+ gains and briefly touched new all-time highs between $69-70,000 twice before retracing both times. The asset reached and sustained new all-time highs in EUR and GBP, as did bitcoin’s USD-denominated market cap.

Spot bitcoin ETFs continued to set new volume records this week, and BlackRock’s IBIT took in nearly $800 million of inflows on Tuesday, far and away a record since launch despite bitcoin’s price wicking down 12% in a matter of minutes that same day. Cumulative net inflows for the vehicles now exceed $9.5 billion, blowing past most analyst expectations for the first quarter.

Amid bitcoin’s record-breaking week, Coinbase underwent two separate outages, the exchange’s second and third such disruptions in less than a week.

Incremental data on the US banking system was mixed this week – while unrealized losses held on bank balance sheets improved Q/Q, small bank credit delinquency rates surged, commercial real estate delinquency in large bank portfolios marched to new post-GFC highs, and the FDIC added 8 new institutions to its list of “problem banks” in the fourth quarter of 2023.

New York Community Bancorp, an embattled regional bank fighting many of the above issues, saw its stock price cut in half on Wednesday on reports of the need for an imminent capital raise, only to erase those intraday losses after the announcement of a $1 billion rescue deal by a private consortium.

Alongside the rescue deal, NYCB announced it had lost 7% of its deposits over the past month and cut its dividend dramatically. Even after the rebound, the stock is still down 30% on the month and 68% YTD.

Those banking headlines formed an interesting backdrop for Fed Chairman Jerome Powell’s suggestion this week that US banks will likely not be subject to new capital requirements tied to the Basel III reforms adopted by many countries over the past decade.

Powell also made various public remarks this week indicating the Fed is still on track to cut rates this year and is “not far” from a sufficient level of confidence for rate cuts.

In a campaign speech Friday night, President Biden seemed to agree with the view of the ostensibly politically independent Fed Chairman.

Elsewhere, Nonfarm Payrolls for February came in ahead of consensus, but the unemployment rate ticked up to 3.9%. NFP figures for December and January were once again revised down sharply, and the gap between the Establishment and Household Surveys continued to widen as the total number of people employed declined for the third consecutive month.

As part of an insider trading case involving former Coinbase employees, a US court ruled this week that various cryptocurrencies involved in the case qualified as securities when traded on secondary markets.

El Salvador announced it would raise the KYC threshold for payments from just $200 to $25,000.

The US Commerce Department, meanwhile, is reportedly seeking to institute new data collection and KYC requirements for a broad array of businesses providing cloud infrastructure services, including those offering compute for AI training processes.

Bitcoin and Ecash developer Calle released some detail on “multinuteral payments,” a scheme to enable large lightning invoices to be paid automatically from aggregated balances across many separate Cashu mints, potentially a substantial UX boost for the Ecash / lightning intersection.

BlackRock filed updated prospectuses for several investment vehicles to enable the institution to add bitcoin ETF exposure to various strategies offered to clients. In the same vein, Arizona’s state government is reportedly considering adding a bitcoin allocation to state pension funds.

Apple reversed its negative stance on progressive web apps (PWAs) in the EU this week, allowing European users to continue installing web apps to home screens in iOS.

Learn more about Ten31, our investment thesis, portfolio companies, and funds by visiting our website.