The US is printing debt at a nauseating pace as ETFs accumulate thousands of bitcoin per day.

The broader market got a small taste of what accelerating demand meeting perfectly inelastic supply looks like this week, as bitcoin blew past the $60,000 level for the first time in more than two years and ended February up ~$20,000, its largest monthly move in history. The post-ETF sell the news event was short-lived as volume and inflows into the new vehicles exploded and the ETF complex saw more activity in just a few days than in its entire first month of trading and net new money blew away prior records even while absorbing substantial outflows from GBTC. During several days this week, the ETFs by themselves took in north of 12x bitcoin’s daily new issuance, and it bears remembering that this available new issuance will programmatically shrink by 50% in less than two months. This price action meant bitcoin carved out even more free real estate in the mainstream financial press this week, including a beleaguered Jim Cramer glumly pondering what bitcoin has ever done for the world.

This was, ironically, a question well worth asking during a week in which the banking system once again showed signs of fragility; President Biden looked to advance a plan to spend hundreds of billions of unilaterally frozen assets of a major sovereign nation; the New York Fed acknowledged long-term deterioration in US Treasury market liquidity; key inflation readings surged M/M; and the US national debt expanded at a pace that puts it on track to grow by $1 trillion every 100 days. If we ignore bitcoin’s unique and unprecedented elimination of counterparty risk in holding a globally saleable money; its resistance to adversarial actors bent on unilaterally enforcing preferred policy agendas through theft and censorship; its global 24/7 liquidity, 99.9% uptime, and trillions of dollars of permissionless annual settlement; its dramatic outperformance of every other asset class as a tool for savings and inflation protection; and its incorruptible scarcity in the face of parabolically growing and unserviceable sovereign debt levels…then we suppose we might have to agree with Cramer that bitcoin has never really done anything for humanity.

Portfolio Company Spotlight

Strike is an emerging fintech and payments innovator leveraging the lightning network to allow consumers and merchants to send and receive payments instantly and cheaply in a wide variety of settings. Strike's offerings include a consumer app – now available in 70+ countries – for P2P payments, bitcoin purchases, global remittances, and more. Strike also offers a suite of APIs for merchants and enterprises to easily benefit from lightning’s low cost, near-instant settlement. The company has announced a variety of exciting new features over the last few months and continues to have one of the most robust pipelines of upcoming launches in the bitcoin ecosystem.

Strike announced the launch of Strike Africa, which opens up Strike’s suite of services into seven African markets, with more still to come:

Debifi launched the open beta for its non-custodial bitcoin-backed lending platform:

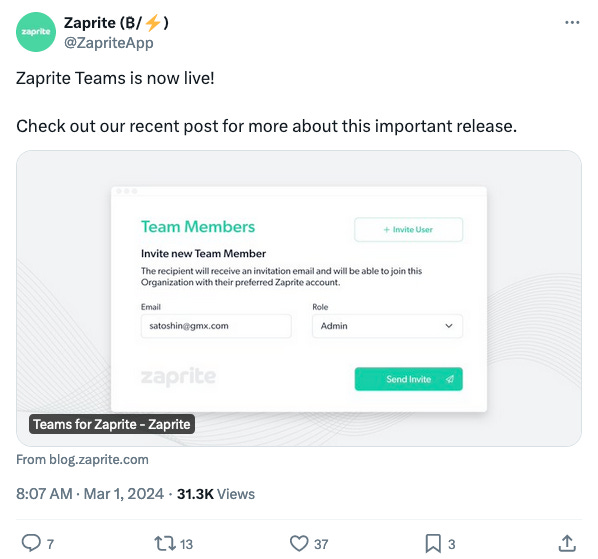

Zaprite rolled out its new Teams feature, which will substantially improve the UX for multiple users collaborating on the same account:

Unchained launched a new and improved version of Caravan, its open source multisignature coordinator software:

Ten31 Principal John Arnold joined the What Bitcoin Did podcast to discuss Ten31’s strategy and his essay Bitcoin Is Eating the World.

Strike Founder Jack Mallers and Debifi Founder Max Keidun led a panel discussing the market for bitcoin exchanges at the Bitcoin Atlantis conference.

Primal Founder and CEO Miljan Braticevic gave a talk at the Bitcoin Atlantis conference on the power of Nostr and Primal’s approach to the ecosystem.

Unchained’s Senior Software Engineer Buck Perley published a deep dive on the company’s approach to building secure collaborative custody infrastructure.

Ten31 Advisor and Zaprite Head of Business Development Parker Lewis appeared on the Bitcoin Boomer Show to discuss Zaprite and more.

Bitcoin stole the show this week, breaking the $60,000 level for the first time in over two years, closing the week up over 20% and ending February with its biggest monthly candle (+$20,000) in the asset’s history.

Notably, bitcoin has now breached the $60,000 level against both a ZIRP backdrop as well as with rates at 20+ year highs. Moreover, bitcoin is now just ~10% off its all-time high, an historically unprecedented move relative to prior cycles in which bitcoin’s price has hovered 40-50% below previous highs heading into halvings.

Newly approved spot bitcoin ETFs posted their best week on record with nearly $2 billion of net inflows pouring into the vehicles over the past five trading days. BlackRock’s IBIT by itself posted several days of greater than $1 billion in total volume, while the complex as a whole had multiple record-breaking days and traded more this week than in the entire first month post-approval.

Meanwhile, new reports indicated that the wealth management platforms at Merrill Lynch and Wells Fargo will begin offering clients access to spot bitcoin ETFs.

Bitcoin closed the week as the fifth largest base money in the world, surpassing the British Pound, the world’s oldest fiat currency. While bitcoin has not yet broken all-time highs in USD terms, it has continued to make new lifetime highs around the world, including in Chinese Yuan and Indian Rupees.

As is tradition amid a major bitcoin pump, Coinbase suffered widespread outages and malfunctions, including many users seeing erroneous $0 balances in their accounts. Trading desks at Strike, Unchained, and River remained operational all week.

While bitcoin continued to befuddle the journalists that have spent the past few years prematurely celebrating its demise, the latest reading for core PCE – the Fed’s preferred measure for inflation – printed at +0.4% M/M in January, in line with consensus.

Equity indices rallied on this news and popped to yet another all-time high, though “supercore” PCE – which adds in services inflation and subtracts energy and housing – ripped to two-year highs on persistently elevated services spending. On a related note, Kansas City Fed President Jeffrey Schmid called for “patience” on rate cuts, noting concerns about ongoing inflation.

This week also surfaced the latest evidence that the structural fragilities that precipitated last spring’s banking crisis have continued to bubble under the surface, as the stock of the embattled New York Community Bancrop – already down over 50% on the year over concerns about its commercial real estate loan book – was once again hammered by 26% after disclosure of “material weaknesses in internal controls” and the resignation of its CEO.

The bank also reported a new $2.4 billion non-cash impairment charge related to historical transactions, and ratings agencies Fitch and Moody’s downgraded the bank’s debt once again.

Elsewhere, a cash infusion deal for the much smaller Republic First Bank (not to be confused with much larger and now defunct First Republic) fell through this week on similar reports of internal control deficiencies.

Following substantial mining industry pushback and criticism from lawmakers, the US Department of Energy canceled an “emergency” order from several weeks ago that sought to compel bitcoin miners to provide extensive operations information to the federal government. The agency will re-initiate the process with a conventional 60-day public comment period.

The Biden Administration is once again seeking to “tap” the nearly $300 billion of Russian assets frozen by the US Treasury following Russia’s invasion of Ukraine, a move unlikely to bolster already flagging global confidence in US government debt.

The director of financial stability policy research at the New York Fed gave public remarks this week acknowledging ongoing strains in US Treasury market liquidity and noting the longer-term outlook for this trend is worsening.

OpenSats announced its latest wave of grants for nine additional open-source bitcoin projects.

Learn more about Ten31, our investment thesis, portfolio companies, and funds by visiting our website.