Bitcoin is flat on the week. The US government continues to encroach on civil liberties. Bitcoin builders congregate in Austin, Texas.

After months of virtually uninterrupted bullish price action, bitcoin broke its recent streak of weekly green candles this week, settling at roughly flat W/W as of this writing. Bitcoin ETFs continued to take on huge volumes and set another net inflows record of nearly $2.6 billion as investors weighed the unwelcome resurgence of reported price inflation metrics, as well as the upcoming tsunami of incremental federal debt issuance needed to fund the Biden Administration’s proposed budget for next year and the coming decade. Bitcoin closed the week roughly flat after pushing to almost $74,000, but is still hovering right around the prior cycle’s all-time high.

Discouragingly, it was also a bull market for the administrative state this week, with several adversarial headlines hitting the wire. A US court found Roman Sterlingov guilty on various counts related to his alleged operation of the custodial mixer Bitcoin Fog, despite numerous questionable details in the prosecution’s case; just as concerningly, the court ruled that data from Chainalysis used to convict Sterlingov was reliable despite substantial unanswered questions about the efficacy and verifiability of the company’s information, potentially setting a dangerous precedent for future court cases. Also this week, the US House passed a bill seeking to force either a sale or an outright ban of the TikTok app on national security grounds that seem to be merely a pretext for yet more expansion of the executive branch’s power to regulate online speech; meanwhile, the Biden Administration’s new budget contains a revival of the proposed 30% excise tax on US bitcoin miners’ energy consumption, though we expect this provision to be defeated as it was when originally proposed last year.

The Ten31 team, however, found many reasons for optimism this week in Austin, where our team participated in and led presentations at the PlebLab Startup Day and the SXSW Bitcoin Takeover at the Bitcoin Commons. The events were the latest reminder of how vibrant and robust the bitcoin ecosystem is, and it’s increasingly undeniable that the pace of development is accelerating across a variety of verticals from privacy software to payments technology to mining infrastructure. These technologies are all promising from an investment perspective, but more importantly, they will form a key pillar in preserving the liberties that we believe the vast majority of Americans regard as non-negotiable, and the founders behind them are not slowing down. Said another way: we’re going to win.

Fedi is an innovative platform leveraging the Fedimint protocol to provide a custody solution that aims to support mass adoption and low-trust, censorship-resistant use of bitcoin by balancing privacy with usability for less technical users. Fedi's intuitive, user-friendly app uses the Fedimint protocol to offer the privacy of Chaumian eCash alongside a "federation" approach that distributes trust across a variety of parties (who will often be friends and family of end users rather than remote, inaccessible corporations) and eliminates single points of failure while providing a simple UX for users of all technical capabilities. The platform is designed to empower local communities, particularly those in emerging markets, to easily use bitcoin without deep technical understanding or reliance on unaccountable international third parties.

Strike launched Strike Business, a new offering tailored to both small businesses and enterprise users:

Strike also rolled out new payment methods for users in Kenya:

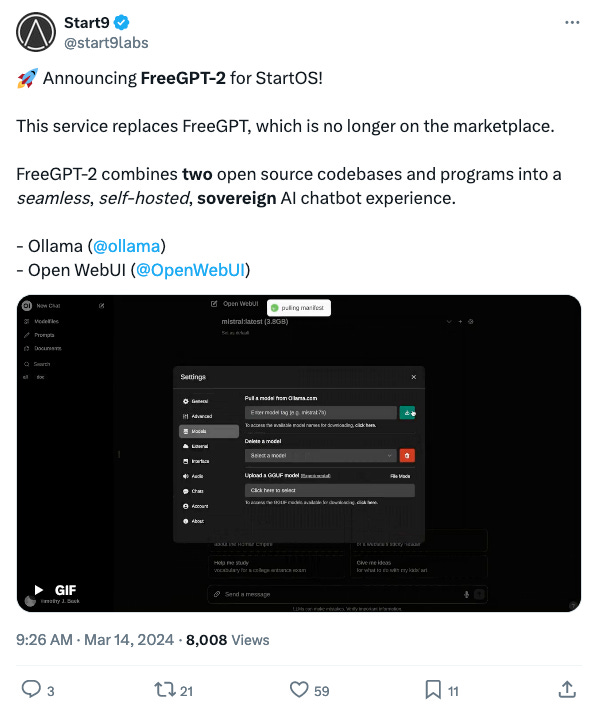

Start9 launched FreeGPT-2 on its officially supported marketplace, enabling users to self-host their own GPT-based chatbot functions:

Coinkite released v1.0 firmware for the Q, its newest hardware wallet:

Unchained Co-Founder and CSO Dhruv Bansal appeared on the What Bitcoin Did podcast to delve into his recent essay on bitcoin’s origins.

Upstream Data Founder and CEO recorded an extensive walkthrough of the Hash Hut, one of Upstream’s flagship products.

In what is becoming a repetitive headline, bitcoin hit another new all-time high this week, pushing close to $74,000 and surpassing silver’s market cap for the first time before paring some gains and closing the week roughly flat around $68,000.

The spot bitcoin ETF complex continued to post strong volumes and inflows on the week, including the vehicles’ first ever day surpassing $1 billion of daily net inflows.

Acolytes of traditional finance continued to capitulate en masse, as the Financial Times – in an article penned by the chairman of Rockefeller International – conceded that bitcoin is “starting to look like more than a passing fad” while BlackRock CEO Larry Fink once again took to mainstream news to extol bitcoin’s virtues.

The Biden Administration released its latest proposed budget, which contemplates expanding total spending 12% Y/Y to $7.3 billion next year and $16 trillion of incremental federal debt over the coming decade (even with optimistic assumptions).

Appropriately, the election year budget was released alongside a more obscure proposal by the International Swaps and Derivatives Association (ISDA) which called for a change to regulatory leverage calculations that would make US commercial banks a source of unlimited demand for US Treasuries right as issuance is set to ramp up on the back of parabolically growing federal debt and interest.

This week’s CPI print was the latest indication that the Keynesians dancing on inflation’s grave might have been celebrating prematurely, as the metric came in +0.4% M/M and +3.2% Y/Y, ahead of expectations and good for the ninth consecutive month with CPI above 3%.

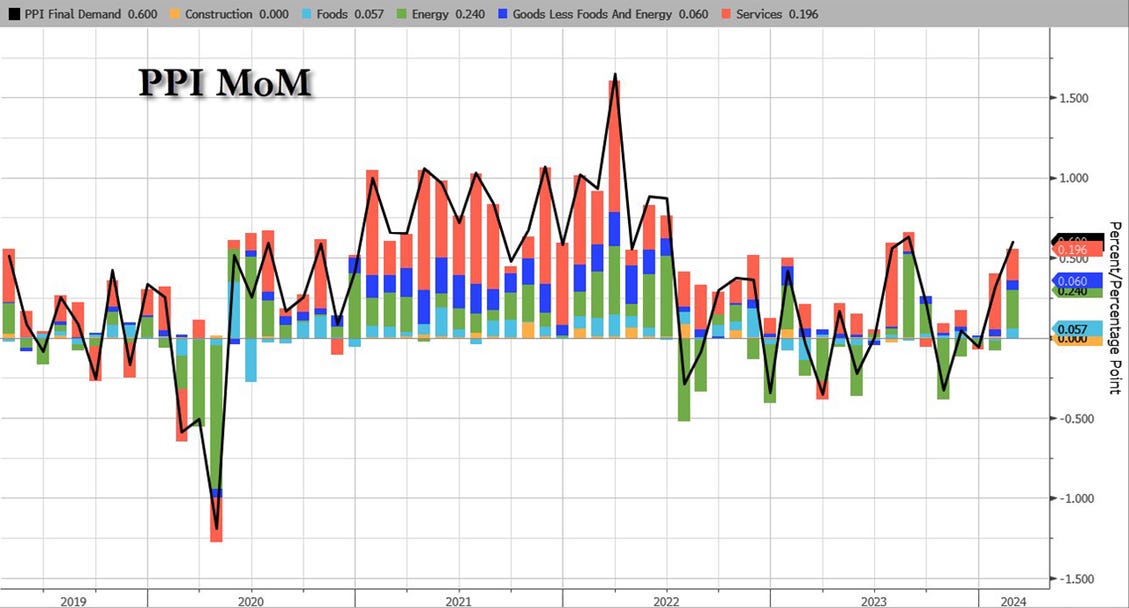

Meanwhile, the Producer Price Index (PPI), which tracks inflation for raw, intermediate, and finished goods, spiked 0.6% M/M, well above consensus and the largest move since September of last year.

Treasury Secretary Janet Yellen responded to the headlines by noting that further progress on inflation “might not be smooth” from here, while traders continued to price in much lower probabilities for Fed rate cuts in the near term.

In response to what increasingly looks like entrenched inflation – even from the perspective of officially reported statistics – yields in the bond complex generally pushed higher on the week, with the US 10-year Treasury pushing past 4.3% in its biggest weekly move since October.

To close out the week, the New York Fed’s regional manufacturing survey showed a huge M/M decline in overall conditions including a miss vs the Street on every key metric.

Roman Sterlingov was convicted on money laundering charges related to his alleged operation of the custodial Bitcoin Fog mixing service. As part of the verdict, the court took the position that the Chainalysis software used to implicate Sterlingov was reliable, apparently ignoring a trove of unanswered questions about that evidence.

The US House of Representatives passed a bill that could potentially lead to the ban of the wildly popular social media app TikTok. Regardless of the merits or dangers of TikTok, the bill contains troubling language potentially laying the groundwork for a significant expansion of executive power to regulate and influence online speech in the US.

The Biden Administration's newly proposed budget for next year would look to institute a 30% excise tax on bitcoin mining energy use, a statute first proposed by the administration last year.

US Republican Presidential candidate Donald Trump spoke positively about bitcoin during an interview this week, softening his stance somewhat relative to his previous public statements.

OpenSats announced a new long-term support program for Nostr developers.

The government of El Salvador revealed its balance of ~5,700 bitcoin this week, which was substantially higher than the ~3,000 estimated by many public trackers. President Nayib Bukele made the announcement by tweeting a screenshot from mempool.space, a Ten31 portfolio company and the default source for blockchain data in the bitcoin ecosystem.

Learn more about Ten31, our investment thesis, portfolio companies, and funds by visiting our website.