Ten31 Timestamp 820,423

Traditional markets generally maintained gains from the past few weeks even as economic indicators continued to look mixed.

Traditional markets generally maintained gains from the past few weeks even as economic indicators continued to look mixed.

The bitcoin network saw its sixth consecutive upward difficulty adjustment this week to another all-time high, as total network hashrate has now jumped by ~100 EH/s in just under three months.

The US economic picture continues to look precarious, as leading indicators extended their record-long streak of sequential declines and existing home sales cratered to new 13-year lows – but as the Wall Street Journal suggests, you can always consider selling your kidney if times get tight.

Markets decisively reversed course from mid-October woes this week, as the latest CPI reading ignited a short squeeze that sent stock indices back near YTD highs.

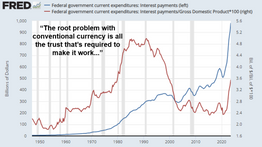

We fully expect the excesses and fragilities of late-stage fiat to compound further over the coming decade.

Meanwhile, bitcoin put up another strong showing, gaining another ~15% after last week’s +10% move (which also coincided with a broad selloff in traditional markets).

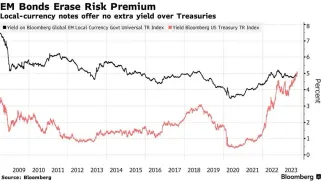

After some temporary relief, yields on sovereign debt spiked again this week, with the 10-year US Treasury rising nearly 40bps W/W to break 5% for the first time since 2007 before retracing slightly on Friday afternoon.

Traditional markets generally maintained gains from the past few weeks even as economic indicators continued to look mixed.

The bitcoin network saw its sixth consecutive upward difficulty adjustment this week to another all-time high, as total network hashrate has now jumped by ~100 EH/s in just under three months.

The US economic picture continues to look precarious, as leading indicators extended their record-long streak of sequential declines and existing home sales cratered to new 13-year lows – but as the Wall Street Journal suggests, you can always consider selling your kidney if times get tight.

Markets decisively reversed course from mid-October woes this week, as the latest CPI reading ignited a short squeeze that sent stock indices back near YTD highs.

We fully expect the excesses and fragilities of late-stage fiat to compound further over the coming decade.

Meanwhile, bitcoin put up another strong showing, gaining another ~15% after last week’s +10% move (which also coincided with a broad selloff in traditional markets).

After some temporary relief, yields on sovereign debt spiked again this week, with the 10-year US Treasury rising nearly 40bps W/W to break 5% for the first time since 2007 before retracing slightly on Friday afternoon.

Jonathan Kirkwood is a cofounder and managing member of Ten31, a venture capital firm that exclusively invests in the bitcoin ecosystem.

Two very different approaches characterize our current moment in monetary evolution: FedNow and bitcoin.

The introduction of the bitcoin computer program by Satoshi Nakamoto was a fundamental advancement in computer science creating a new frontier, digital land i.e. blockspace, for humanity to explore and develop in the digital age.

So many in "crypto" think they are geniuses who have discovered a new paradigm that can make them insanely rich, but the reality of the situation is they have discovered a way to recreate the corruption that exist in the incumbent financial system much cheaper and in a very short amount of time.