Markets decisively reversed course from mid-October woes this week, as the latest CPI reading ignited a short squeeze that sent stock indices back near YTD highs.

Markets decisively reversed course from mid-October woes this week, as the latest CPI reading, which came in slightly below consensus expectations, ignited a short squeeze that sent stock indices back near YTD highs while dampening bond yields on the expectation that macro data now support an end to Fed rate hikes. Worsening retail sales data, consistent growth in continuing jobless claims, and ongoing declines in federal tax receipts also seemed to support this thesis, and investors are now pricing in Fed rate cuts as early as the first half of next year. It remains to be seen how long the perverse “bad news is good news” trade can last given substantial and growing underlying market stressors including the tenuous commercial real estate backdrop (highlighted in increasingly frequent data points like the chart below).

The S&P wasn’t the only metric that saw a large upward impulse this week. Bitcoin network mempools were as busy as they’ve been since this spring’s BRC-20 craze, with fees for high priority transactions pushing above 300 sats per virtual byte (roughly $16 for an average-size transaction) for the first time since May, pushing total transaction fees per block to over 3 bitcoin (~half the block subsidy) while backlogged unconfirmed transactions spiked above 300,000 (off of ~20,000 a few weeks ago). As we highlighted during this spring’s parabolic move in transaction fees, this activity represents bitcoin working exactly as designed, and should offer consolation to any observers worried about bitcoin’s long-term “security budget” – if the bitcoin network can command transaction fees of this magnitude on the basis of relatively trivial price increases and NFT gambling, we struggle to see how it will not sustain much higher fees as bitcoin becomes the global reserve asset and a neutral means of settlement for trillions of dollars of highly sensitive institutional and sovereign transactions worldwide. That same dynamic also highlights the importance and long-term economic value of the many companies in the Ten31 portfolio that are building tools and applications to navigate, manage, and benefit from this upward fee pressure.

Strike is an emerging fintech and payments innovator leveraging the lightning network to allow consumers and merchants to send and receive payments instantly and cheaply in a wide variety of settings. Strike's offerings include a consumer app – now available in 65+ countries – for P2P payments, bitcoin purchases, global remittances, and more. Strike also offers a merchant API allowing vendors to easily benefit from lightning’s low cost, near-instant settlement. The company has announced a variety of exciting new features over the last few months and continues to have one of the most robust pipelines of upcoming launches in the bitcoin ecosystem.

Strike launched bitcoin buying capabilities for global wallet users in 36 countries, with the rest of its 65+ markets in progress:

Announcing Buy Bitcoin Globally

— Jack Mallers (@jackmallers) November 16, 2023

Today, @Strike marches forward on its mission to democratize financial freedom around the world

Our global users can now buy #bitcoin, cash out, shop, and more

This is more than just an update; it’s a milestone!

🌎🌍🌏https://t.co/3IaYrWzkfY

Unchained added selling functionality, which will enable users to sell directly from their Unchained Vaults (rather than first sending out to an exchange):

Today we’re announcing a major enhancement to the Unchained trading desk: Our smoother, faster selling experience is now available, allowing you to sell #bitcoin directly from your vault! pic.twitter.com/KD6JYVjxrc

— Unchained (@unchainedcom) November 16, 2023

Unchained also announced that Bakkt will join is network of collaborative custody key partners:

Today we're announcing that @Bakkt has agreed to join our network of collaborative custody partners!

— Unchained (@unchainedcom) November 15, 2023

No single custodian can be better than a custody solution that distributes your #bitcoin keys among several key agents.

Read more: https://t.co/WMyJaOdNgU pic.twitter.com/48lENtetgl

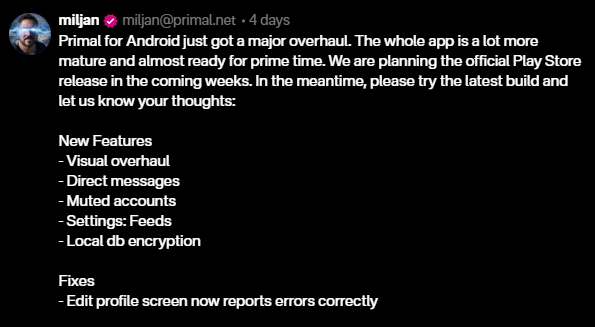

Primal released its latest beta build for Android, as well as a new version for iOS in TestFlight:

Fold announced a variety of updates to its rewards program, including many new merchant offers:

📣 Rewards Update

— Fold⚡️ (@fold_app) November 13, 2023

🚀 Big Merchant Boosts - Up to 5% at Target ⭕

🥧 Simplified Rewards - All signature transactions earn rewards up to 1.5% (no more blackout categories)

🧢 Pay Bills - Get rewards

More detalis 👇 👇 https://t.co/nOe3IpCux2

Parker Lewis, Ten31 Advisor and Head of Business Development at Zaprite, joined The Investor’s Podcast to discuss his view of bitcoin as a store of value, his upcoming book, and more.

This week’s highly anticipated October CPI reading came in at +3.2% Y/Y, slightly slower than expected. Many of the usual caveats apply to this month’s print, but stock and bond markets reacted very favorably as investors read the results as an indicator the Federal Reserve’s rate-hiking cycle is likely complete.

Despite some Fed officials publicly pumping the brakes on this narrative, the market is again pricing in no more hikes and even rate cuts for early next year, and the Wall Street Journal’s Nick Timiraos, often thought to be a favored spokesperson for the central bank, suggested the same.

Retail sales data for October also flashed signs of contraction, as US consumers reduced retail spending 0.1% M/M for the first time since March. In the same vein, continuing jobless claims maintained a monthslong upward trend, rising to their highest level in two years.

US federal tax receipts declined for the seventh consecutive month, with receipts in October coming in -8% Y/Y, a pattern consistent with prior recessions.

The Wall Street Journal ran a feature article this week highlighting softening demand for US Treasuries among foreign central banks and investors. Net monthly foreign buying has eased to ~$300 billion over the last twelve months (vs $400 billion+ during 2022) in the face of much larger new debt issuances.

The Journal also reported a spike in foreclosures of higher-risk mezzanine loans linked to commercial real estate projects, with the tally through October already the highest on record and double last year’s total.

Bitcoin network mempools were again very busy this week, as high-priority transaction fees shot back up to more than 300 sats/vB for much of the week, in line with bitcoin’s incentive design. Bitcoin’s backlog of unconfirmed transactions once again eclipsed 300,000 after falling to only ~20,000 a few weeks ago.

Coin Center published a paper highlighting the likely unconstitutionality of the Bank Secrecy Act (BSA), the legal foundation of much of the US’s “anti-money laundering” regulation.

US Presidential candidate Nikki Haley called for all US citizens to fully verify their identities in order to use social media platforms. She later slightly walked back those comments, but the sentiment is far from uncommon among regulators, again highlighting the importance of censorship-resistant communications protocols like nostr.

Joana Cotar, a member of Germany’s parliament expressed support for recognizing bitcoin as legal tender. Notably, Cotar’s focus is entirely on bitcoin rather than “crypto” more broadly.

The Human Rights Foundation launched a new CBDC tracker, which seeks to highlight the progress of potential CBDC initiatives around the world and their likely impacts to civil liberties.

Cboe, the largest options exchange in the US by volume, announced it would enable margined bitcoin futures contracts early next year.

As expected, the SEC delayed its decision on Franklin Templeton’s spot ETF filing.

Originally published on Ten31 Timestamp