Two very different approaches characterize our current moment in monetary evolution: FedNow and bitcoin.

Introduction

In July of this year, the Federal Reserve will launch its long-awaited FedNow service for instant payments between depository institutions, adding a new wrinkle to the fabric of global payments. Therefore in this paper, we explore the rapidly evolving landscape of settlement networks, specifically focusing on bitcoin and FedNow, two systems often perceived in direct conflict primarily as competitors. By examining their historical context, technological underpinnings, and the importance of the underlying assets’ integrity, we argue that these entities actually cater to distinct purposes and audiences and are likely to co-exist more symbiotically than most expect. While the rise of bitcoin as the world reserve asset may ultimately challenge US settlement networks, in the intervening decades the US dollar will inevitably interact with and leverage the bitcoin network to facilitate the global economic demands of individuals and businesses that want to interact with US dollars (a co-opetition of sorts). Meanwhile, the financial utility of both systems and the innovative solutions offered by companies leveraging the bitcoin network will provide a superior user experience and potentially counterbalance any attempts by foreign governments or conglomerates to displace the US dollar with a more restrictive monetary asset (e.g. BRICS commodity backed currency or a CBDC).

Settlement Networks through History

Throughout history, settlement networks have played a critical role in the development of civilizations. The ability to exchange goods and services for intermediate units of account (stone money, gold, silver, French francs, Dutch guilders, Euros) has enabled trade, financial transactions, and social interactions across vast distances. Systems have evolved from the ancient Greek agora where officials were responsible to verify the weight and quality of coins through to late-20th century systems of fiat central banking and the emergence in recent years of innovative technologies like bitcoin and FedNow. The efficiency, reliability and overall utility of these networks have been instrumental in shaping the economic landscape and providing a foundation for the future. When drilling down into the utility of settlement networks, the integrity of and demand for the underlying asset being transferred is incredibly important. History is littered with examples of settlement networks degrading and societies collapsing because of the gradual and/or sudden manipulation of the underlying monetary asset and consequent decrease in demand for that settlement asset in trade. Separated by more than a millennium, the whole cloths that were the Roman Empire and the Weimar Republic both unraveled as authorities pulled the common thread of monetary debasement. Indeed, history suggests that the destruction of complex societies is often preceded by or accompanied by diminishing confidence in each society’s settlement network.

Considering the crucial role settlement networks play across generations and geographies, we can spring forward from history’s lessons as we think critically about how things have evolved in our recent past with legacy 20th century fiat settlement networks, where things stand today with these old approaches and emergent technologies gaining remarkable adoption and traction, and where the next chapter will be written tomorrow.

Settlement Networks: FedNow and Bitcoin

Two very different approaches characterize our current moment in monetary evolution: FedNow and bitcoin. Both settlement networks can provide near instant transfer of monetary value, but their underlying assets are fundamentally different. FedNow was developed by the U.S. Federal Reserve to enable real-time settlement of US Dollars between banks and their customers 24/7 through a central processing unit—FedNow Service Reserve Bank. Bitcoin is a neutral digital bearer asset that operates through a decentralized peer-to-peer network, was introduced by a pseudonymous individual or group, and is continuously maintained and improved by a consensus-driven global volunteer initiative. Bitcoin transactions are verified by a network of computers via a proof-of-work blockchain rather than any centralized institution. The underlying assets of the two systems, US Dollars and bitcoin, depart at a right angle to each other with the total supply of US dollars skyrocketing upwards over time while bitcoin supply is fixed, its 21 million supply programmed in the code. The contrast is stark: US Dollars are infinite and created in a credit based system; bitcoin is finite, with a fixed supply that is infinitely divisible. When comparing their settlement networks, we see similar divergence. US Dollars payment systems are controlled by the Federal Reserve and other US regulatory bodies who have implemented and likely will continue to implement sanctions and restrictions that prevent market participants–individuals, companies, and other governments–from interacting with its walled-off payment systems. Bitcoin is different: a software program that is open-source, free and permissionless to run, and interacts with anyone globally for storing and transferring value.

Traditional payment systems can take days to process transactions because of intermediaries within correspondent banking. FedNow promises instantaneous transfers, purporting to reduce users’ exposure to chargebacks and fraud while facilitating capital flows. FedNow’s anticipated 24/7 availability will likely prove useful for businesses that operate in multiple time zones or need to process payments outside of local business hours. Notwithstanding these improvements, FedNow is also planned as a closed proprietary system accessible only to banks that are members of the Federal Reserve System. FedNow has not yet operated in an active environment and will begin testing in the coming months. The fees proposed for using FedNow are currently set at nominal rates, but this could change considering that the Federal Reserve does not expect to achieve long run cost recovery for decades. As such, FedNow is reliant on the continued financial support of the Federal Reserve for the foreseeable future. Because of the dependence and direction of the Federal Reserve, FedNow is likely to suffer from the Innovator's Dilemma as development is subsidized by a parent company focused on their needs rather than market demands.

Assets: US Dollar and Bitcoin

While FedNow may offer some UX improvements for interacting with the Federal Reserve’s settlement network, its underlying asset – the US Dollar – will remain unchanged. The US Dollar is backed by the full faith and credit of the United States Government and operates as an ever expanding credit-based system where the value of the dollar is derived by demand of the debt obligations, both public and private. The public debt of the United States is currently $31 trillion dollars, with Congress and the President negotiating to raise the debt ceiling by an additional $1.5 trillion dollars in order for the US to avoid nominal default on obligations such as Social Security, Medicare, military salaries, interest on the national debt, tax refunds, and other payments. The debt ceiling has already been raised 78 times since 1960, and this continued regular cadence of increasing the debt ceiling has so far allowed for an insidious inflationary diffusion that has been hard to perceive in real time.

More recent money expansions in the U.S., like the liquidity injections since March 2020, have had drastic effects similar to those of large money bursts such as that which the French suffered from their monetary expansion and the resulting Mississippi Land Bubble from 1716 through 1720. France witnessed inflation jumps of +20% during the collapse of the Louisiana Venture while John Law, President of Banque Royale, issued ever more credit and expanded the money supply. The United States has beat to a steady inflationary rhythm with secular increases in the money supply over the last 60 years, but in 2020 through 2022, the tempo picked up with a 40% increase in base supply, compounding a goods/service supply and demand imbalance that has resulted in inflation not seen in the US since the 70s.

Bitcoin, meanwhile, is a digital bearer asset and decentralized settlement network that has been self-funded from its beginning in 2009 and has gained popularity as an alternative investment and increasingly as a monetary asset by forward leaning technologists. One of the advantages of bitcoin as a bearer asset is that it operates independently of any global financial institution, which can make it an attractive option for individuals who operate in authoritarian regimes or are prohibited from using the banking system based on personal attributes, such as religion, gender, or ethnicity. As then-Fed Chair Janet Yellen told the Senate Banking Committee in 2014, “Bitcoin is a payment innovation that’s taking place outside the banking industry. To the best of my knowledge there’s no intersection at all, in any way, between bitcoin and banks that the Federal Reserve has the ability to supervise and regulate. So the Fed doesn’t have authority to supervise or regulate bitcoin in any way.”

Bitcoin has a finite supply and has been regulated as a commodity since 2014 in the United States. A fixed total of bitcoin creates an inelastic supply curve that does not change relative to demand, driving significant appreciation in its purchasing power as more users adopt it. Bitcoin has proven extremely dependable, with 100% uptime over the last 10 years. There are also limitations to bitcoin as an asset. For example, with rapidly growing adoption and no centralized control, price discovery has been highly volatile, and its value measured in fiat terms can fluctuate rapidly and unexpectedly. Bitcoin payments are also irreversible, which is an important feature of the network’s security and censorship resistance, but can be a concern for some users who do not trust themselves or others with that power or responsibility. Additionally, bitcoin is not backed by any tangible asset but instead through the network effects of the entire bitcoin system, comprised of miners, node operators, and end users. These attributes have led bitcoin to become a popular and forward looking investment option for individuals, businesses, and governments who are looking for uncorrelated alternatives to both ancient settlement networks (like gold) and twentieth century settlement networks (like fiat currency).

Bitcoin is free and open source software, with new entrants able to join the market and innovate according to their skills, ambition, and capacity for execution. Increasing services, new tools, and a growing user base are together lowering costs and importing more value into the network. Looked at from any vantage, the bitcoin settlement network is orthogonal to the existing system and to proposed updates to that system like FedNow – it is not so much a significant innovation as it is a step-function change onto the Z-axis. From payments to remittances to digital gold to programmable money to cyberwalls to energy management, bitcoin is a fundamentally different type of network with a fundamentally different underlying monetary asset.

Companies Leveraging Bitcoin

The bitcoin settlement network refers to the technology and infrastructure that allows individuals and businesses to send and receive bitcoin transactions either on the blockchain or additional layers like Lightning. Companies like Strike are building novel infrastructure for providing a seamless way for users to interact with lightning and leverage the incumbent liquidity position of the US dollar with global instantaneous settlement (unlike the FedNow system, which is only focused on US banks interacting with the Federal Reserve). Strike’s innovation has provided solutions that free users from the need to manage channels while avoiding the tax events from selling or transferring bitcoin. Innovators like Strike reduce friction, lower barriers to entry, and build on growing momentum to meet individual and global market demands. For example, folks in the US or other countries are able to use Strike’s “Send Globally” feature to link their US bank accounts to Strike and instantly transfer monetary value received in local currency to many countries around the world. Global foreign currencies can become interchangeable with USD on bitcoin rails instantly around the world for anyone on their phone. Send Globally users can transfer money to users through their telephone numbers in countries such as Ghana, Nigeria, Philippines or to a US bank account. People and businesses can then utilize those US Dollars to purchase goods and services needed to facilitate commerce locally and globally creating a more connected and fluid world. This is not the future: it is BitcoinNow, an organic, open, consensus-led, protocol-governed, transparent sound money alternative to FedNow.

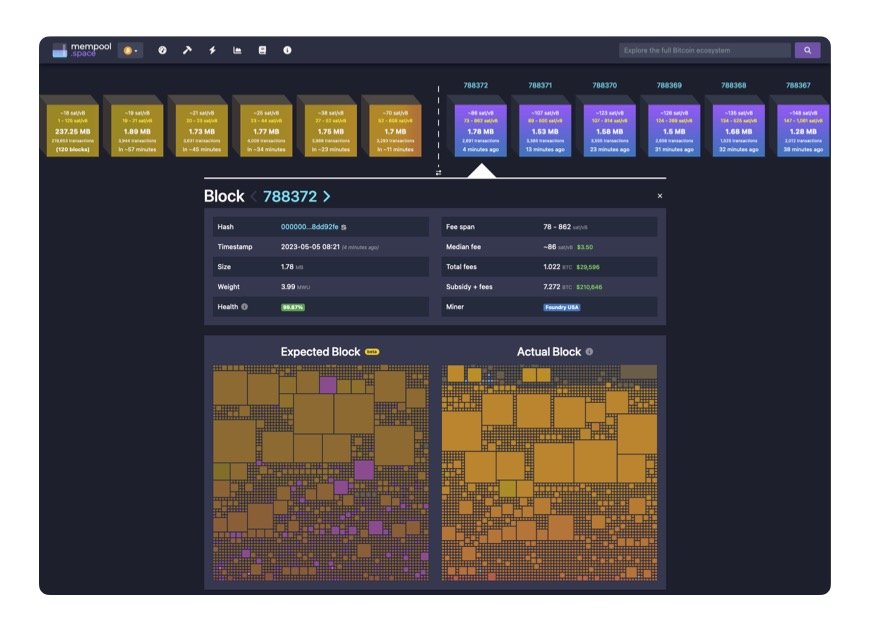

The bitcoin settlement network is decentralized, which means that transactions are processed without a central authority or intermediary. This makes bitcoin payments faster, final, and more cost-effective than traditional payment systems, particularly for cross-border transactions. Bitcoin’s decentralized settlement network will put downward pressure on transaction fees as new entrants move into the market and compete to facilitate transactions. Companies like Mempool.Space are helping to facilitate this competition with easily accessible and intuitive tools to explore and audit the bitcoin blockchain, estimate upcoming fees, and more. Unlike the Federal Reserve, the bitcoin network is auditable by anyone with a computer by downloading the bitcoin software as can be seen below.

Mempool.Space levels the global economic playing field leveraging transparency for all while insights into FedNow will remain a walled garden for the Federal Reserve alone. The bitcoin network’s decentralization, bolstered by companies like Mempool.Space, helps ensure its high level of security, with transactions verified by a global network of independent computers rather than a centralized institution. By contrast, centralized institutions like FedNow have historically been compromised through control, corruption, or vulnerability, as they provide a single vector for malicious actors to exploit in the digital age.

These days, direct interaction with the bitcoin technology stack remains obtuse for less technically sophisticated users, but third party service providers like Unchained are filling the gap to manage onramps into bitcoin and provide solutions that make self-custody more convenient and accessible. Unchained is an example of innovation happening at the edge of an emerging system that could not exist in a top-down permissioned FedNow. There are also limitations to the bitcoin settlement network such as base layer transactions per second, but companies like Fedi are mitigating those limitations with the introduction of chaumian mints to bitcoin. Fedi provides a federated platform where trust is distributed and funds are pooled. Fedi users have their interactions with the base layer and lightning abstracted away through a sleek curated platform. The Fedi platform is also being explored for potential use in mining pools, NGOs, and local banking partners. Unlike the Federal Reserve which is vulnerable to political capture, Fedi offers a federated trust model that reduces the potential for arbitrary political censorship.

Conclusion

FedNow and bitcoin are two different systems that serve different purposes and use different technology. FedNow is a centralized transfer system developed by the Federal Reserve that enables real-time transfers of US Dollars between banks and their customers. It is designed to improve the speed and efficiency of traditional payment systems, particularly for businesses that need to process US dollar payments quickly. Bitcoin, on the other hand, is a neutral digital bearer asset and decentralized settlement network that operates independently of global financial institutions and its underlying asset, bitcoin, is not subject to debasement. Bitcoin payments can be processed instantaneously through a peer-to-peer Lightning network and can be faster and more cost-effective than traditional payment systems, particularly for cross-border transactions. While both FedNow and bitcoin enable faster transactions, they have different target audiences, are not direct competitors, and can and will be used together to meet the needs of individuals and businesses. Furthermore, the combination of a closed currency on top of an open network will help to mitigate foreign competitors or other sovereign conglomerates attempting to replace the US dollar as the world reserve currency with a more restrictive asset in the decades ahead.

FedNow has been primarily designed for businesses that need to process large volumes of US dollar payments quickly within the architecture of late-20th century central banking, while bitcoin is designed for individuals and businesses that want to transfer value without relying on global financial institutions or who prefer to seamlessly convert their goods and services into bitcoin. Bitcoin also offers some features that FedNow does not, such as the potential for pseudo-anonymity and the ability to make cross-border payments without intermediaries and currency exchange.

Overall, FedNow and Bitcoin are different systems, with different objectives and different rules. Speaking pragmatically, they are both likely to coexist in the payments landscape for the foreseeable future. Speaking prophetically, the question is: which system will benefit the most from the other?