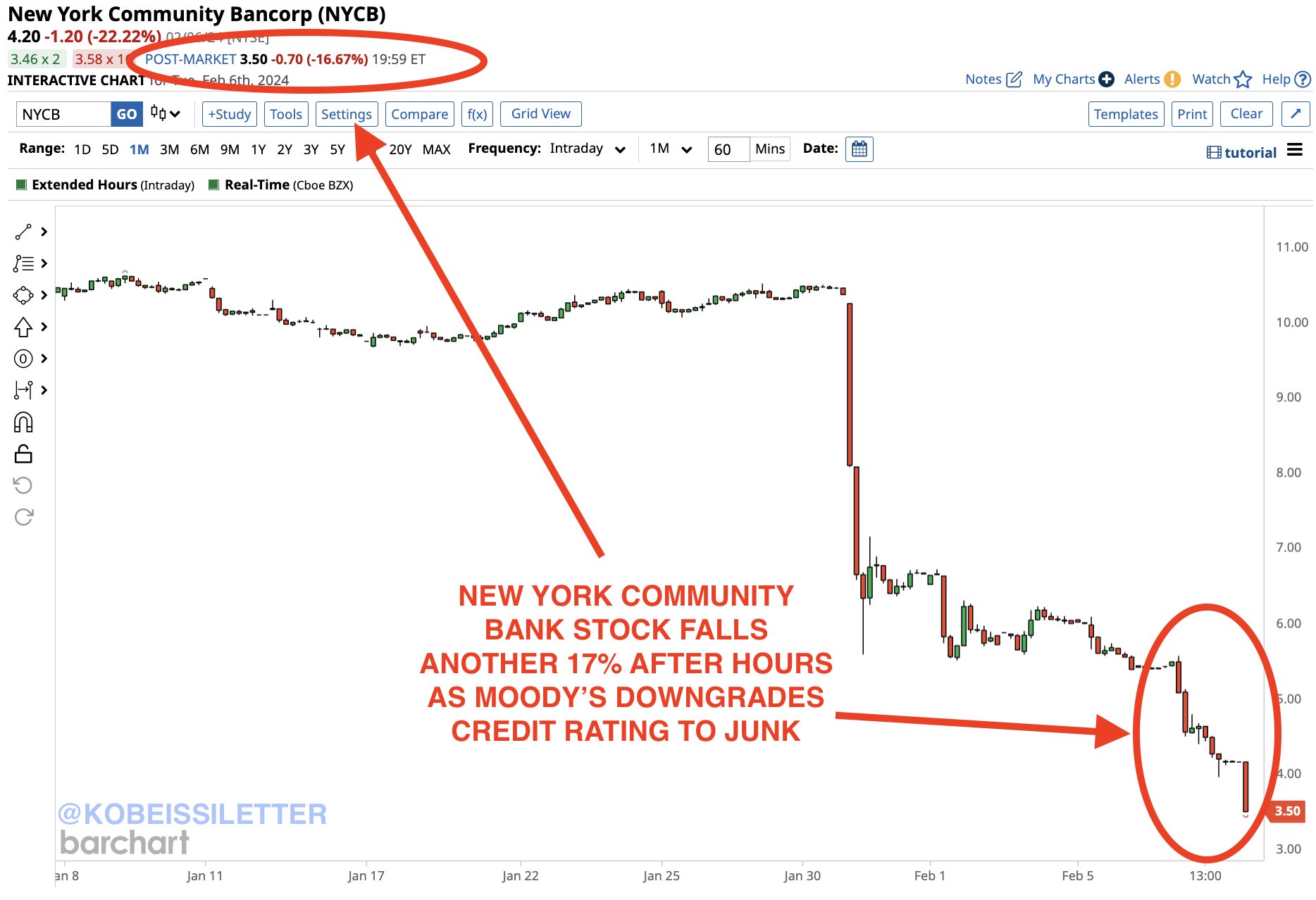

New York Community Bank faces credit quality concerns due to new rent regulations and higher interest rates, leading to a significant fourth-quarter loss. The bank's struggles raise questions about the resilience of the regional banking sector amid these challenges.

New York Community Bank (NYCB), a prominent apartment lender in the New York City area, has come under scrutiny due to a confluence of regulatory changes and market pressures. The bank, known for its focus on rent-controlled and stabilized apartments, has been adversely affected by the latest rent regulations in New York, which limit the potential rent increases landlords can impose on tenants. This, coupled with rising interest rates, has placed a significant strain on landlords and introduced substantial refinancing risks. In the fourth quarter, NYCB reported a substantial loss, raising questions about its future stability.

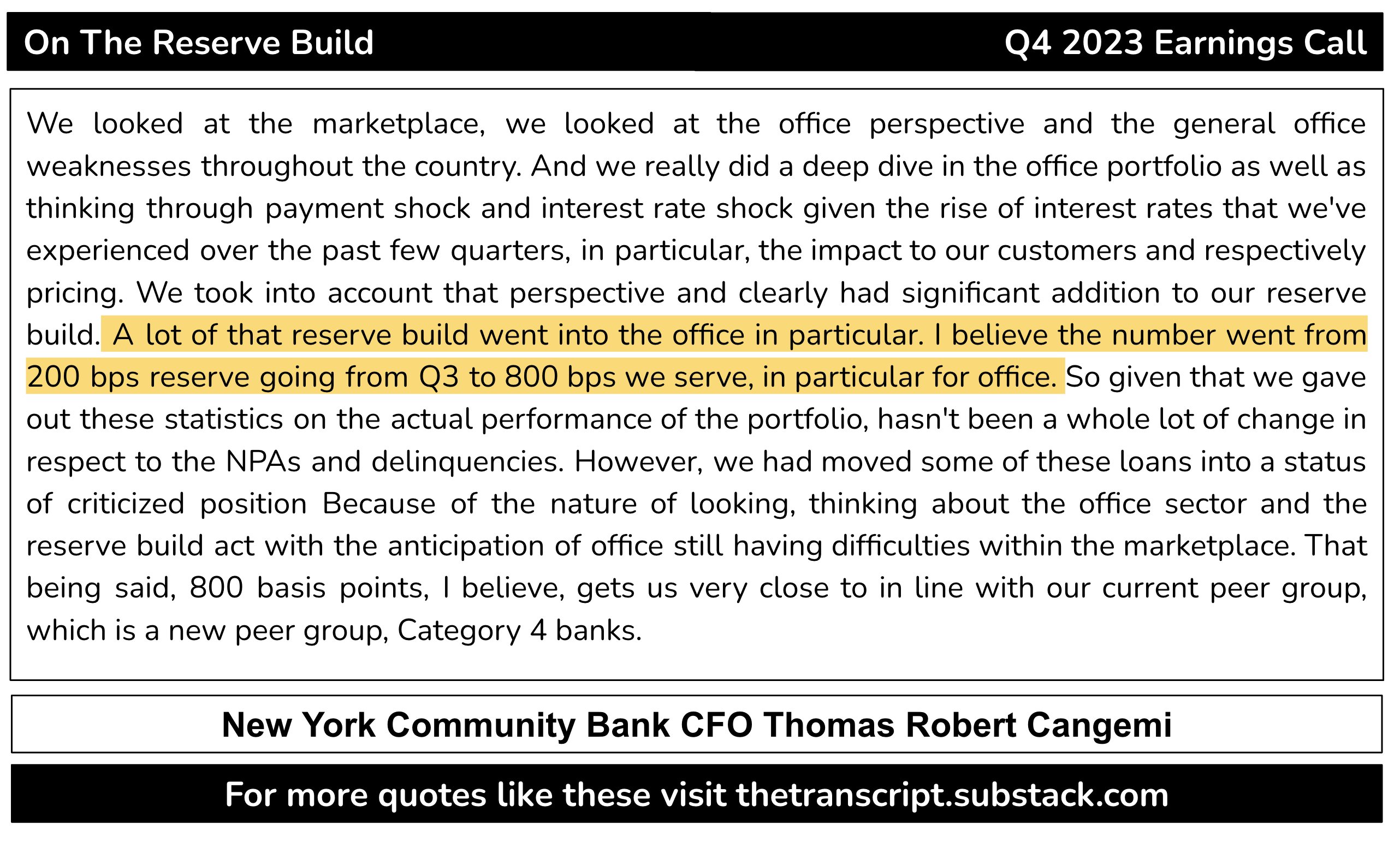

Moreover, NYCB has approximately 4% of its loans tied to office space exposure, slightly above the median for similar institutions, intensifying concerns over the bank's credit quality. In response to these challenges, NYCB has bolstered its reserves, aligning with the actions of its peers.

The broader implications of NYCB's financial woes were felt in the marketplace, as evidenced by the 3.45% dip in the SPDR S&P Regional Banking ETF (KRE), of which NYCB's performance is a contributing factor. This downturn has led to speculation on whether NYCB's struggles are isolated or indicative of a regional banking sector issue.

The bank's issues come as the last of the larger regional banks to report their fourth-quarter earnings, with its counterparts generally expressing optimism about credit quality for 2024. This suggests that NYCB's situation may be more of an idiosyncratic challenge, necessitating a reinforcement of its balance sheet and the need to instill greater market confidence.

With Jerome Powell, the Federal Reserve Chairman, scheduled to speak, it is speculated that he might address NYCB's predicament. Powell is expected to reinforce the message of resilience within the banking industry, emphasizing the sector's stability, particularly in credit quality and deposit strength, following the initial pandemic-related economic turmoil.

Since the unsettling market events of March and April, banks have adopted a defensive posture, retreating from lending, exiting non-profitable loan portfolios, and adopting a conservative operational approach. This prudence has allowed banks to build their reserves over three quarters, thus proactively addressing potential issues.

The conversation also touches upon the anticipated recovery of the banks' earnings capabilities. The pause in rate hikes from last year has eased the pace of deposit repricing, and net interest margins are beginning to stabilize. The industry is hopeful for a resurgence in lending and an improvement in top-line performance and earnings, contingent on forthcoming rate cuts and a 'soft landing' economic scenario.

Lastly, the video discusses the dividend cut made by NYCB, which lowers the payout to shareholders to an expected seventeen cents. NYCB, traditionally boasting a strong dividend and significant insider ownership, has made this decision to conserve capital in anticipation of stricter regulations. The bank aims to enhance its CET1 ratio from 9.2% to a target of 10%, with earnings generation and the reduced dividend as possible means to achieve this goal by the year's end.

In conclusion, while NYCB faces specific challenges partly resulting from local regulatory changes and broader economic conditions, the regional banking sector, in general, appears to be on a more stable footing, with NYCB's situation being an exception rather than a rule.