This is definitely something to keep an eye on in the months ahead. Will the acquisition of Credit Suisse prove to be a poison pill?

UBS, the Swiss bank that stepped in to absorb Credit Suisse earlier this year when it proved to be insolvent, is showing signs of weakness this week. On Wednesday, The company's CEO, Sergio Ermotti, assured attendees of a Swiss Risk Association event that UBS is one of the safest large institutions in the world while explaining that he prefers that the bank be subsumed by a private entity if it were to experience insolvency problems in the future. A subject that you never want to see your bank openly discuss in public.

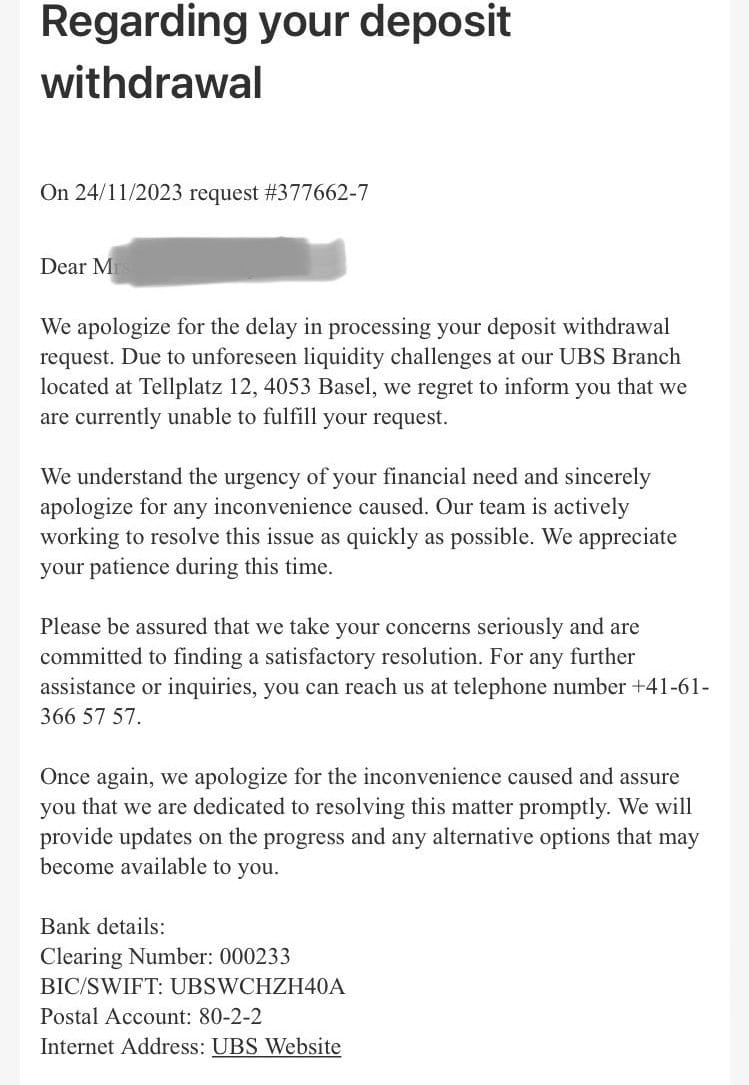

Even though Mr. Ermotti is assuring everyone that his bank is one of the safest institutions in the world, one has to wonder if the weight of the risk that they took on when they acquired the distressed Credit Suisse is beginning to sink their own ship. Something that would signal that UBS is under some amount of stress is withdrawal delays. Lo and behold, earlier this morning this screenshot of UBS apologizing to a client for a delayed withdrawal started to make its way around Twitter.

The apology explicitly cites "unforeseen liquidity challenges" at a particular UBS branch located in Basel, Switzerland. However, it is probably safe to assume that these "unforeseen liquidity challenges" aren't isolated to this single branch.

These two developments are a bit perplexing considering the fact that UBS reported record profits in August of this year, which is being reflected in a stock price that is the highest it's been since 2008.

This is definitely something to keep an eye on in the months ahead. Will the acquisition of Credit Suisse prove to be a poison pill?

Regardless, the apology for not processing a requested withdrawal due to unforeseen liquidity challenges is a stark reminder of the fact that you do not actually own the money in your bank account and the bank may not even have the money to fulfill your IOU. This also highlights why there is nothing better than bitcoin held in self-custody when it comes to actually controlling your money. As long as you properly secure your private keys you will always be able to access your money.

We launched a shop on the website and our first product is a "WTF Happened in 1971?" yard sign that we hope will be used as a tool to signal that you choose not to participate in the partisan politics of Red Team v. Blue Team. Let us know what you think!

Final thought...

Thankful for all of you! Thank you for reading and supporting the cause.