2023 has been the year of the Great Bitcoin Decoupling and it may be driven by the fact that more and more individuals are beginning to understand how much counterparty risk they are exposed to in the banking system.

The price of bitcoin has more than doubled since January 1st of this year on the road to recovery from cycle lows of ~$15,800 reached in late November of 2022 to ~$34,400 today. The simple explanation for bitcoin's performance this year is that there have been more buyers than sellers in the market and that is what the price appreciation is reflecting. Whether or not the price pump is being driven by the fact that a spot bitcoin ETF approval seems to be more imminent than ever, an exodus of capital out of China, instability in the banking system, or a combination of the three plus other factors is anyone's guess. The price is what it is because demand for bitcoin has outpaced the supply of bitcoin for sale to the market this year.

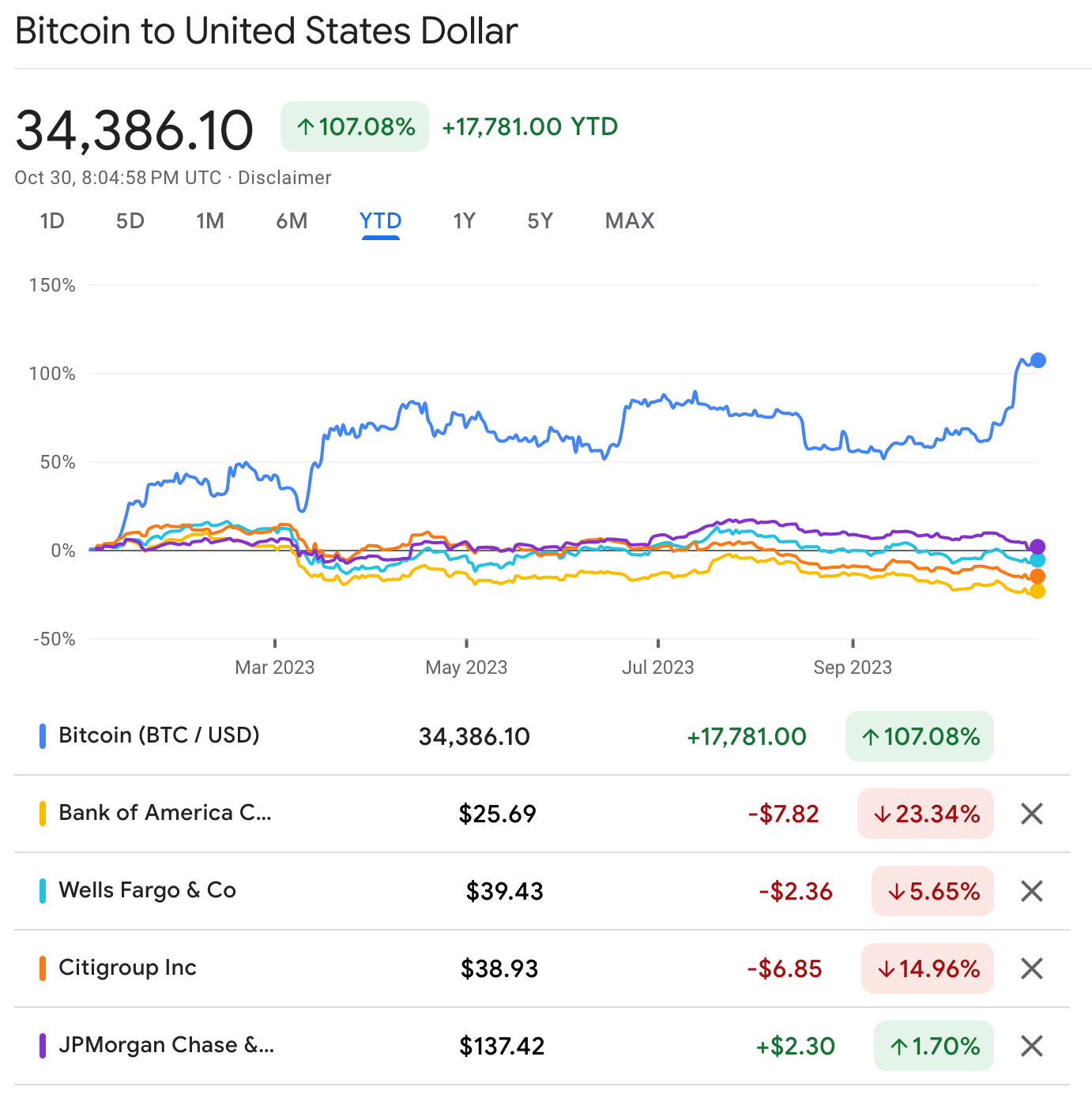

With that being said, I do think it is interesting to hone in on bitcoin's relative outperformance when compared to the banking sector. This year hasn't only been a year of relative outperformance, it's been a year of overt decoupling from the banking sector in terms of returns for investors. Above is a comparison chart of bitcoin's performance versus the big four banks in the US. The only bank with a stock price that is higher than it was at the start of the year is JP Morgan Chase, which was the main benefactor of the consolidation of the smaller banks that failed in Q1. Not only that, it is pretty safe to say that JP Morgan Chase is the preferred bank of the Federal Reserve and the Treasury. It is the bank that will be protected at all costs when the systemic banking crisis begins in earnest. Every depositor will fall back to the biggest bank either by free will or forced consolidation and this fact is reflected in the stock price.

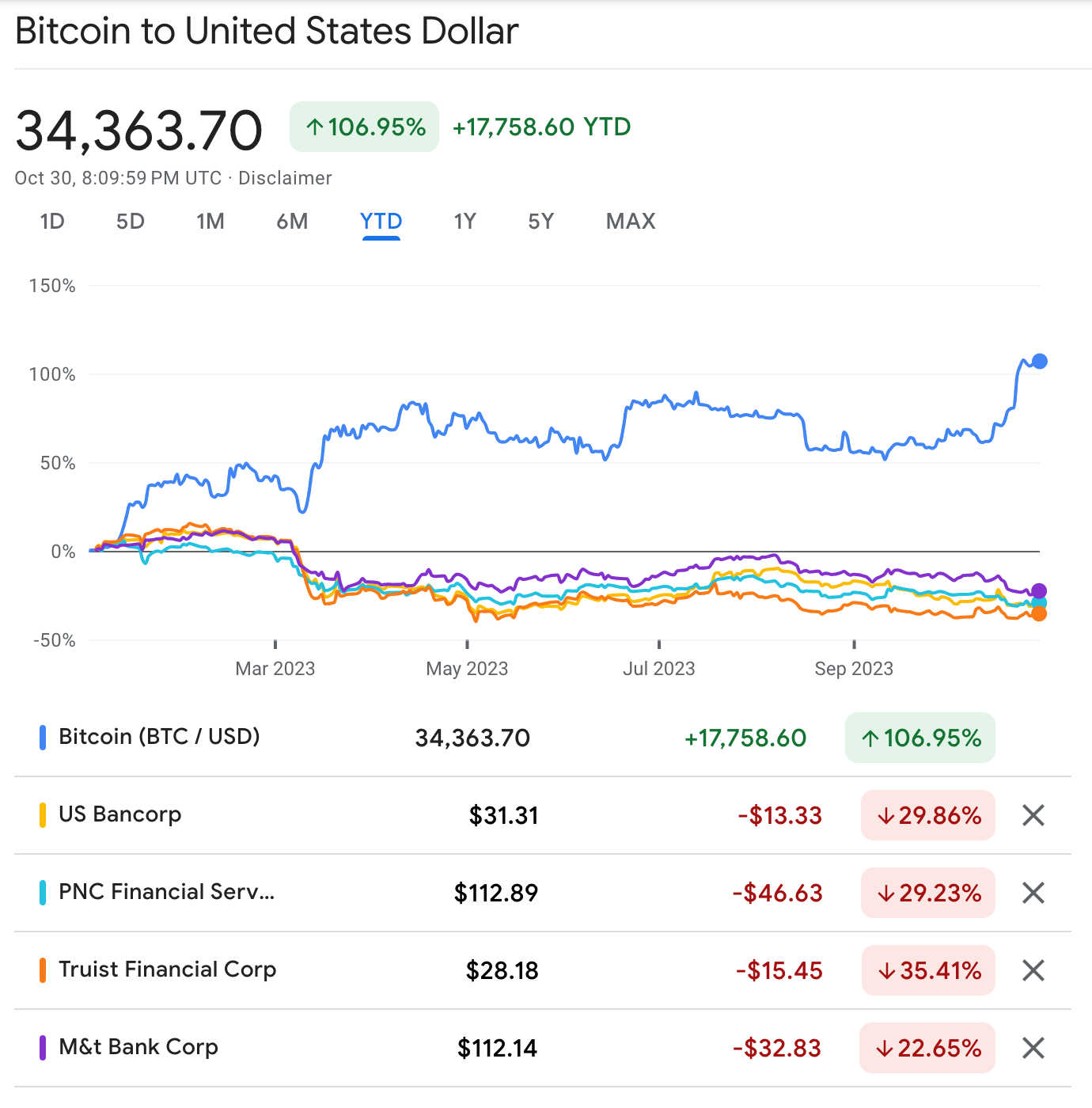

Despite this, $JPM is only up 1.7% year-to-date. Its competitors at the top of the US banking industry have not fared as well. Wells Fargo is down 5.65%. Citibank is down 14.96%. Bank of America is down 23.34%. To put this into perspective, the S&P 500 and NASDAQ indices are up 8.96% and 23.13% respectively. The banks are underperfoming massively this year. The situation is even more dire for the "regional banks", whose stock prices are down more than 20% across the board.

This shouldn't be surprising. The banking crisis that unfolded earlier this year proved that banks are using toxic assets, more commonly known as US Treasury bonds, as reserves and when these banks are forced to mark those toxic assets to market when depositors demand their cash they are worth considerably less than what they are allowed to present via their financial statements. Their balance sheets have been shown to be extremely risky.

I don't think we'll ever be able to know for sure whether or not bitcoin's price rise has been driven by a collective recognition of the gravity of the systemic risk that exists throughout the banking sector. However, we can point out that bitcoin's decoupling from the banking system is what should be happening as more people come to the realization that the banks are effectively insolvent.

The banking system is a cascading fractal of counterparty risk that cannot be unwound without collapsing in on itself. Banks lend money out to individuals and companies using a combination of user deposits and free money they manifest out of the ether via credit creation. With credit creation doing the lion's share of the work in that relationship. They then hope that the money lent out is returned plus interest so that they can service their liabilities and make a profit. A lot of the reserves that are brought in are immediately converted into "low risk" credit instruments like treasuries that are viewed as liquid and relatively stable. The banks are depending on the governments to pay back their obligations plus interest to ensure the stability of those reserve assets. But as we've come to find, the governments have become so addicted to issuing new debt in the form of treasury bonds that it is becoming clear that it is unlikely that they will ever be able to pay back their creditors without completely debasing the US dollar.

As the market becomes more aware of this reality, treasury yields are soaring as risk begins to be more accurately reflected by the market. Soaring treasury yields means falling treasury prices, which means less liquid reserves for the banks who may need to service deposit outflows at any given moment. If depositors begin to withdraw their money from the banks en masse, the banks will be forced to sell their treasuries at cost, locking in losses while exacerbating the treasury yield rate rises even more.

If the banks aren't bailed out in time there will be a large number of depositors who will learn the hard lesson of the counterparty risk they are exposed to in real time when they cannot deposit their funds.

With all of that in mind, it makes sense that a distributed peer-to-peer digital cash system that doubles as a personal bank for anyone with access to it who has the ability to manage their own private-public key pairs - bitcoin - would more than double in price over the course of the year. Bitcoin provides individuals and institutions alike with a mechanism to store their value without having to worry about the layered counterparty risk that exists throughout the banking system and the government debt system it heavily relies on.

Bitcoiners who control their own private keys can sleep tight in the middle of a systemic banking crisis because they don't have to worry about whether or not they'll be able to access their bitcoin when they wake up. They can simply audit the chain before hitting the pillow to make sure their bitcoin is where they think it is and know that it will be there when they wake up because only they can move money out of the addresses that they control.

2023 has been the year of the Great Bitcoin Decoupling and it may be driven by the fact that more and more individuals are beginning to understand how much counterparty risk they are exposed to in the banking system.

Final thought...

The joy of a child who is excited to rock his Halloween costume is infectious.