Let's check in on the Bitcoin mining industry.

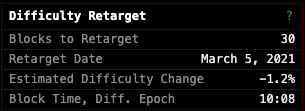

At the time of writing the Bitcoin network is 30 blocks away from its 335th difficulty adjustment. Throughout the last couple of weeks, it seems that more computing power has left the network than joined the network as is evidenced by the fact that difficulty is going to adjust downward by 1.2%, making it easier for miners to find blocks.

This is nothing unusual, the network is acting exactly as designed, and it is designed beautifully. However, a downward difficulty adjustment as the price of bitcoin hovers around an all time high is a bit perplexing. The price of bitcoin has appreciated by about 500% since the beginning of October. Running from ~$10k to ~$50k. Over that same period, hashrate has risen from ~145 exahash per second to ~165 eh/s; only a ~14% increase. This is not the type of growth one would expect in hashrate considering the pace at which the price has appreciated.

Historically, this type of price jump would incite a production and execution rate that would lead to a considerable amount of hashrate being added to the network. That has not materialized. Why?

The answer is multifaceted. There is currently a shortage of supply of the ASIC chips that dominate the bitcoin mining industry today. And producers are currently unable to add a considerable amount of supply to the market because there is not enough room at the foundry floor level to produce the chips. This is an issue that is affecting more than just the bitcoin mining industry. Car manufactures and military tech companies are also having trouble sourcing the chips necessary to build and get their products to market. On top of this, a few provinces in China have banned bitcoin mining and those miners have had to unplug and move their equipment in recent weeks. This is probably the reason hashrate has fallen since the last difficulty adjustment instead of remaining static.

Adding to this, there are a number of large publicly traded bitcoin mining companies that made large purchases of ASICs towards the middle and end of last year. They have received tens of thousands of miners recently, which should be pushing hashrate higher. The lack of growth in hashrate is leading me to believe that some of these large "mining companies" don't really know how to mine bitcoin too well and are keeping a bunch of machines unplugged on the sidelines. Providing a windfall of sats for miners that are currently up and hashing.

It will be interesting to follow along with the mining industry this year as the many factors described above continue to play out. Will we fix the issues at the base of the supply chain? Will China continue to get stricter with miners? Will bigger players learn how to execute or wind up selling their equipment (at a handsome profit)? We shall see and we will keep you freaks abreast of the situation in this rag.

Final thought...

I feel bad for my son. He has a butt rash. Butt rashes don't seem fun.

Enjoy your weekend, freaks.