Don't look now, but your mining pools are centralized.

Looking at the merkle branches that mining pools send to miners as part of stratum jobs, it's clear that the BTCcom pool, Binance pool, Poolin, EMCD, Rawpool, and possibly Braiins* have exactly the same template and custom transaction prioritization as AntPool. https://t.co/KTjFWtTXEP pic.twitter.com/xhCrdvkOH8

— 0xB10C (@0xB10C) April 17, 2024

I've heard speculation about this all being liked to an FPPS partnership with AntPool/Bitmain.

— 0xB10C (@0xB10C) April 17, 2024

Bitmain insures against bad pool luck but you have to use Bitmains templates/transaction prioritization and pay the mining reward to the insurer for later distribution.

Bitcoin mining pools exist as a way for individual miners to reduce their payout variance so that they can have steadier and more predictable revenue. This makes it easier for miners to run their businesses considering the fact that they have ongoing monthly expenses that need to be paid and unpredictable revenue streams aren't conducive to paying monthly bills on time. Individual miners "pool" their hash together, a miner within the pool produces a hash that enables the pool to add a block of transactions to the ledger, the pool receives the block reward associated with that block, and the reward is divvied up between the miners with each miner receiving a portion of the reward that is commensurate with their share of the overall hashrate pointed at the pool.

Bitcoin mining pools are their own centralized businesses that operate as third party service providers for miners looking for more predictable revenue and, as it stands today, they are arguably the most centralized point in bitcoin. One could argue that ASIC production is more centralized, but it's safe to say that the mining pools are right there with ASIC production in terms of the degree of centralization they introduce to the network. Historically, this degree of centralization has been something that many miners been comfortable dealing with because the ability for an individual miner to move their hash from one pool to another if they deem a pool to be untrustworthy or simply too big is relatively trivial. I have publicly been a big champion of this argument for many years. However, as of two weeks ago, this doesn't seem to be the case at all.

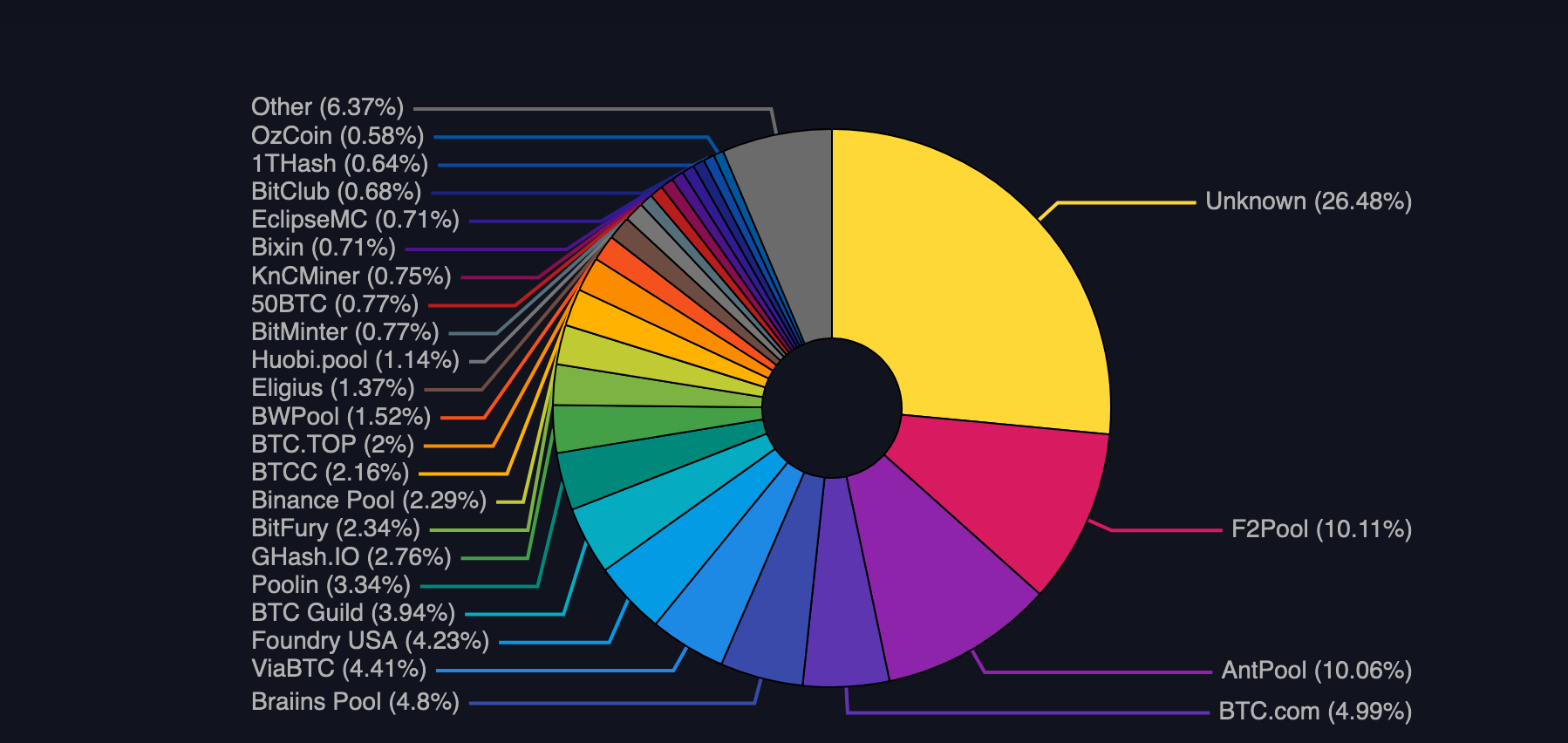

Mononaut, who works at mempool.space, discovered that a single custodian was in control of the coinbase addresses associated with at least 9 mining pools that control 47% of the network hashrate. (A coinbase address is where a block reward is sent to after a block is successfully mined.) Last week, bitcoin chain analysis expert 0xB10C pointed out that many of the pools in question were also being sent block templates and transaction prioritization lists that were identical to Antpool's.

All of this signals that many of the mining pools that miners do business with are proxy'ing in to a parent pool that is creating block templates, sharing transaction prioritization, and divvying out the block rewards. In other words, pools that were previously believed to be separate businesses with competing interests and checks and balances on each other are just one big pool that now controls nearly 50% of network hashrate. This is something that one would label as "not ideal".

There are two popular ways that mining pools dictate how and how much individual miners get paid; FPPS and PPLNS. FPPS is Full Pay Per Share and it allows miners to get paid out consistently (they get paid even on days when a pool doesn't find as many blocks as it's expected to, or any blocks for that matter), but at the cost of potentially leaving some revenue on the table as payouts are dictated by a moving average of the block rewards. PPLNS is Pay Per Last N Shares and it allows miners to reap the most revenue per block found by the pool based on the hashrate they contribute at the time the block is mined, but it adds a bit more variance risk to the equation (the miners only get paid when the pool finds blocks).

Due to the convenience of FPPS more pools have been transitioning their payout schemes to this model. Mainly driven by market demand from a mining industry that has become increasingly capital intensive and involves a lot of companies that are publicly traded and have shareholders who aren't smart enough to understand that variance risk exists and could affect quarterly financial statements.

The problem with FPPS pools is that they are themselves capital intensive. A pool operating with an FPPS payout scheme needs a large bitcoin treasury to be able to handle any variance it may suffer due to the probabilistic nature of block production. Pools can have, and do have, streaks of bad luck. And since the FPPS model dictates that they payout their miners on a consistent schedule they need to be able to pull from a bitcoin treasury to compensate the miners even when the pool isn't finding blocks.

This is probably where the centralization of these large mining pools stems from. The mining pools likely aren't as well capitalized as they need to be to comfortably operate their businesses, so they decided to team up with the Central Bank of Antpool to make sure they are able to pay out their customers. For those who are unaware, Antpool is owned by Bitmain - the largest ASIC manufacturer in the world. Due to the fact that they are a Bitmain company and Bitmain has an extremely robust hardware business that does very well, it is safe to assume that they have a lot of bitcoin. Enough bitcoin to backstop all of the FPPS pools that need to ensure that they can pay out their customers. As a consequence of leveraging Antpool as a backstop for their operations it is possible that the other pools were forced to agree to an arrangement in which they would receive block templates and transaction prioritization lists from Antpool. They have kissed the ring and are currently drinking poison from the chalice.

These pools have put themselves and the bitcoin network at large in a very precarious situation because we now find ourselves in a situation where almost 50% of the network hashrate is controlled by one entity, which significantly increases the risk of transaction censorship at the protocol level.

For context, this has happened before in bitcoin's history. In 2014 GHash.io amassed (I believe) 55% of the network hashrate. Back then, people saw this and took to Twitter to sound the alarm bells. Once the alarm bells were sufficiently loud enough GHash.io announced that they would not be taking on any more customers, a large portion of individual miners pointing their hashrate at GHash.io left the pool for others, and GHash suffered a slow bleed over the next 18-month before closing up shop. So we do have precedent of this problem existing within bitcoin and the market reacting appropriately to ensure sufficient decentralization at the mining layer.

With that being said, the bitcoin mining industry is drastically different than it was a decade ago. The stakes are exponentially higher. The amount of sunk capital in the space would make 2014 miners gasp. And switching costs have increased a bit now that mining is industrialized. Over the last five years, from my perspective, mining businesses have been hyper focused, maybe myopically focused, on locking in low cost power deals and timing ASIC markets to optimize capital allocation so that they can mine as profitably as possible. Over this period it seems that the industry has become extremely complacent in regards to the network side of things. As is evidenced by the current centralized shit show we are watching play out at the mining pool layer.

It is imperative that the industry moves to fix this problem as quickly as humanly possible. Having one entity create the block template for 50% of the blocks that are mined is an existential threat to bitcoin's censorship resistance. Miners should be having conversations with the pools that are connected to the Central Bank of Antpool. Especially if they were unaware of this relationship previously. What is going on here? Why is Antpool creating block templates, transaction prioritization lists, and distributing block rewards on your behalf? Do you plan on fixing this?

If those questions aren't sufficiently answered (particularly the last one) it is time to start shopping around for other mining pools. Furthermore, you should be, at the very least, championing the adoption of Stratum V2, which gives the power of block template production to individuals miners within a pool. There is a world in which Antpool can have the set up it does with the other pools proxy'ing into it and leveraging it to distribute block rewards (still not ideal), but individual miners actually produce the blocks. Decreasing the potential for the censorship of transaction in the process.

I didn't want to write this letter, but it is critical that all of you are aware that this is happening right now, it is existential, and it needs to be fixed.

Final thought...

This was never going to be easy.