Let's take a look at some very interesting charts.

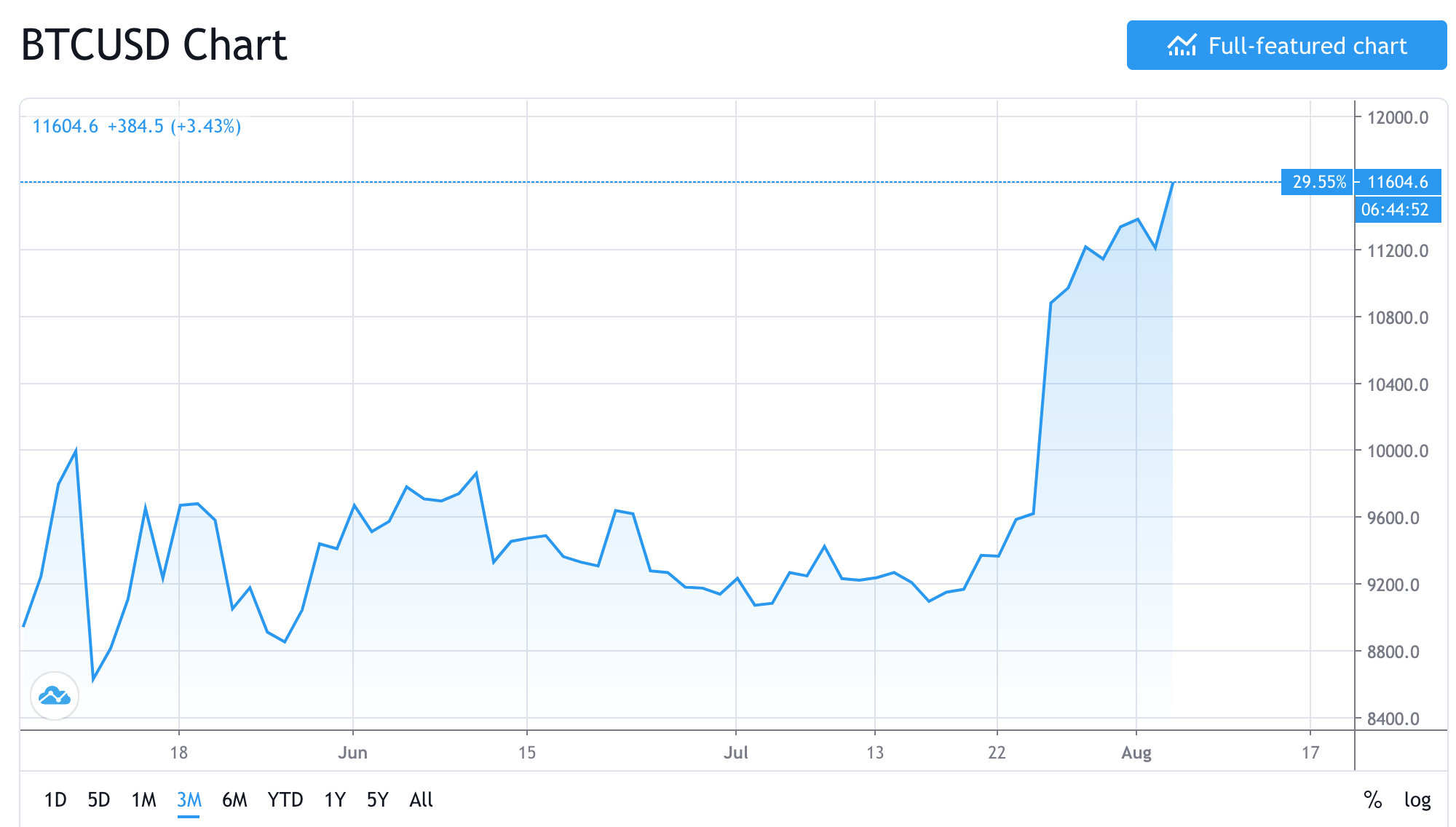

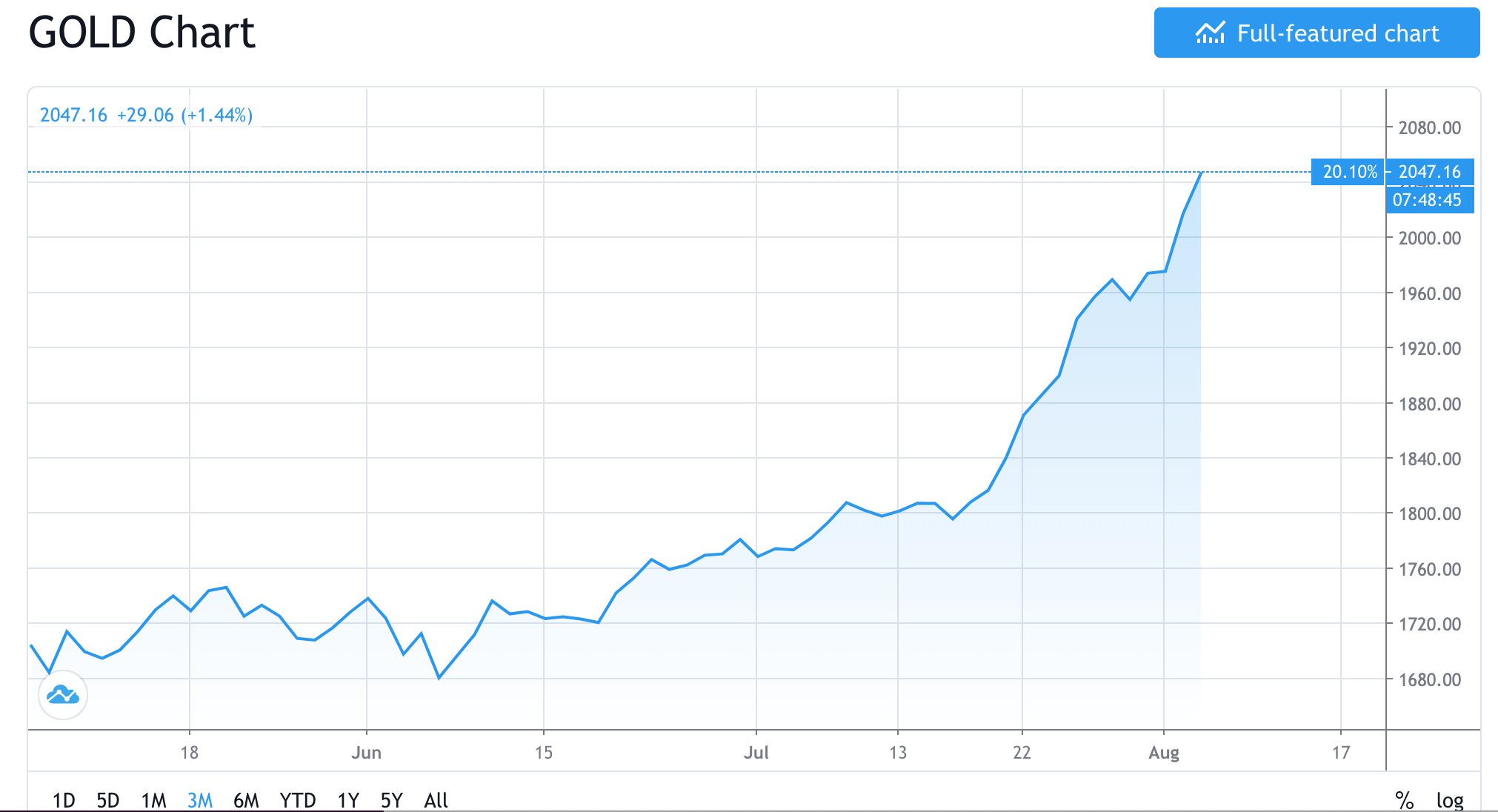

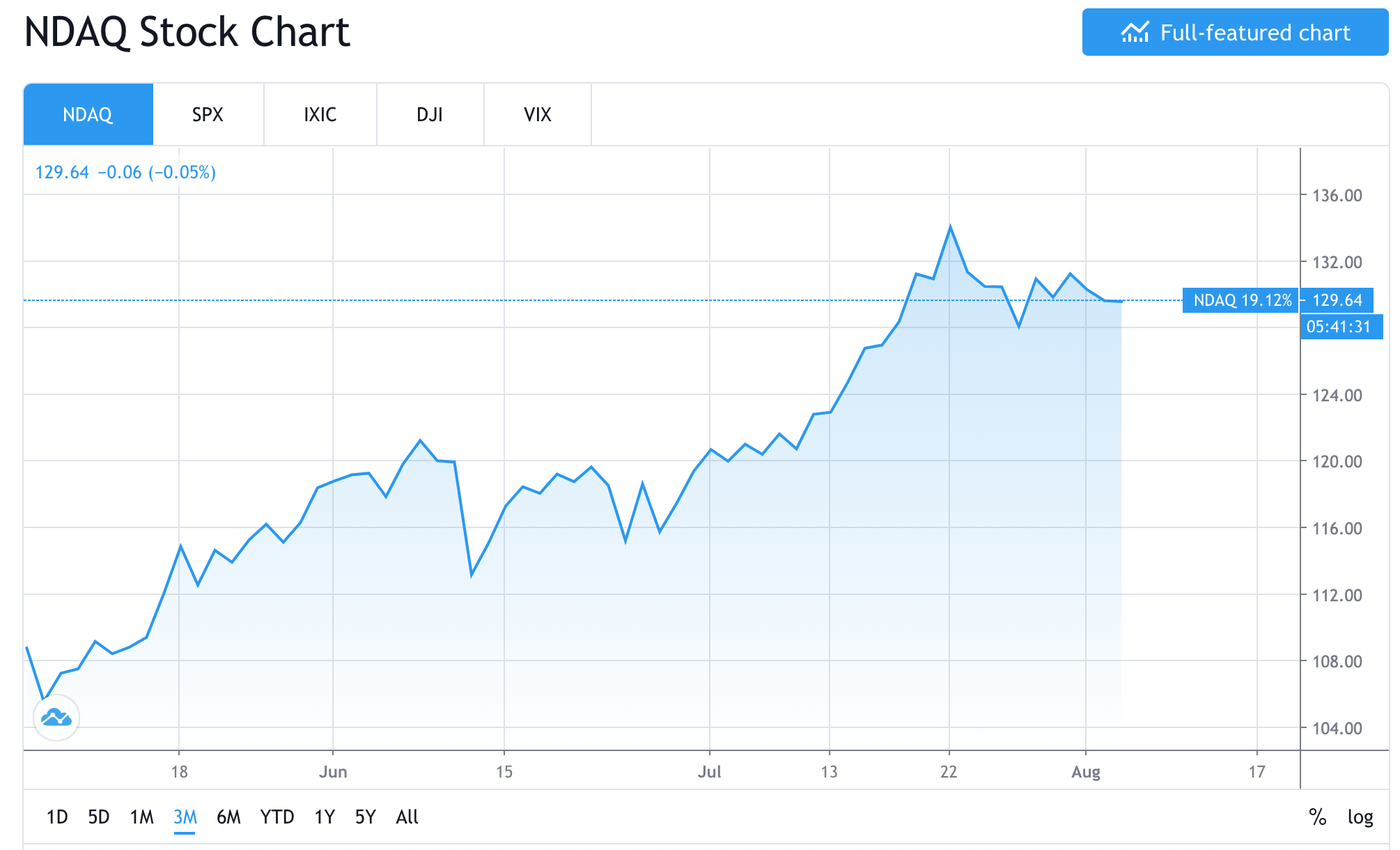

Here's an interesting trend to start following if you haven't already, freaks; the current dislocation between the dollar index (DXY) and other assets like bitcoin, gold, and stocks. The timeframe is a bit short, only being three months, but there has been a material divergence between the dollar and these particular assets throughout the Summer. The DXY is down 7.21% while bitcoin has rallied 29.55%, gold has rallied 20.10%, and the Nasdaq has rallied 19.21%.

Remember last week's rag explaining how the dollar is a pure confidence game? How the dollar's status as the global reserve currency hinges on the ability of the Fed to convince the world that they can maintain its stability? Well, these charts are signaling to your Uncle Marty that confidence is waning pretty quickly. Pay attention to this trend in the coming months as we approach 2021.

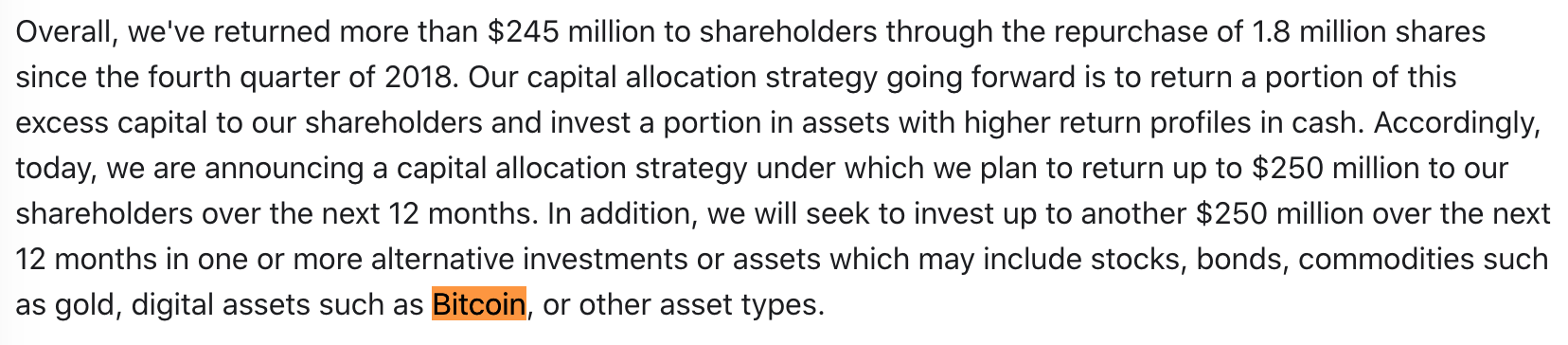

This is not the only sign that confidence is eroding either. MicroStrategy, a publicly traded company that is, admittedly, not a very impressive company when looking at its stock price, announced during their quarterly call last week that they are going to begin diversifying their cash holdings into assets like gold and bitcoin. (Shoutout to Matt Walsh for pointing this out on Twitter this morning.)

"Hence, if we look at assets, gold, silver, bitcoin, and equities have all been accreting as the dollar has been weakening."

Woah. This is a pretty huge step for a publicly traded company to take; diversifying their cash holdings into other types of cash due to the weakening of the dollar. I believe this will be a growing trend as more and more individuals and corporations begin to see the writing on the wall. All is not well at the Fed. All is not well with the dollar. And you can't say your Uncle Marty didn't warn you.

Back in April, I wrote about how the situation the US currently finds itself in is eerily similar to the situation the Weimar Republic found itself in before it experienced a hyper-inflationary event. While we are not in the exact same position, the US has shutdown its economy and turned the money printers and helicopter airdrops on full blast very similarly to how the Weimar Republic shut down their factories and started paying workers with newly printed money when the French began occupying their territory.

This may not be a much talked about theme at the moment, but it seems that many people can feel that something is wrong deep down. This certainly seems to be reflected in asset prices as individuals and corporations begin their exit to hard monies like bitcoin and gold which provide formidable alternatives to the dollar, and stock indices that give them a shot at keeping up with inflation as the Fed keeps their finger on the "Print" button.

I expect more companies of better quality than MicroStrategy to begin allocating cash balances into hard assets like bitcoin as it becomes more evident that confidence in the Fed's ability to back the dollar trends to zero. Once the dominoes begin falling they will be extremely hard to stop. Hyperbitcoinization can happen much faster than anyone is prepared for. It's not at all hard to imagine that MicroStrategy's bitcoin strategy becomes the go-to strategy for corporations focused on ensuring their long-term survival. We may see companies buying back stocks and taking out loans to speculative attack the dollar once it becomes obvious that the Fed cannot put Humpty Dumpty back together again.

Things should get very interesting as we head into the Fall. Hold onto your butts, freaks.

Retail is even seeing the writing on the wall. The herd is coming. Are you prepared?

Weren’t sure whether or not we’re in a bull market? Peep @CashApp’s Q2 bitcoin volume. It moved. pic.twitter.com/MOuhpWW6S6

— Marty Bent (@MartyBent) August 4, 2020

Final thought...

Getting caught on the inside of a hurricane swell is not fun.