this is for the real bitcoin mining nerds.

Let's start the week off with some mining talk, freaks. Mining is one of the most important, overlooked, and least understood aspects of Bitcoin, in Uncle Marty's opinion. Many of the affinity scams created in Bitcoin's wake tend to focus on things like "governance", "dev incentives", "DeFi", and a bunch of other buzzwords that grab the attention of unwitting noobs.

These affinity scams are severely underestimating the grave importance of the physical infrastructure that will need to be built out alongside the software that dictates how these protocols work to ensure security and long-term viability. Those focused on the number of developers working on a protocol, the amount of assets locked in "DeFi", and security via Proof of Stake consensus have completely missed the mark. Bitcoin's greatest innovation is introducing the world to a Proof of Work mechanism with a difficulty adjustment.

This innovation ensures that the production of blocks is costly. Therefore creating a very large incentive for those who are spending money to produce blocks to act in ways that are conducive for the continued operation of the network within the rules set forth by the consensus dictated by full nodes. If block production isn't costly or can be easily gamed by dumping a bunch of capital into the system, which Proof of Stake enables, the cost to attack one of these networks is considerably reduced. This revolution is just as much contingent on hardware/infrastructure as it is on the software. Remember freaks, there may be an order of operations to all of this.

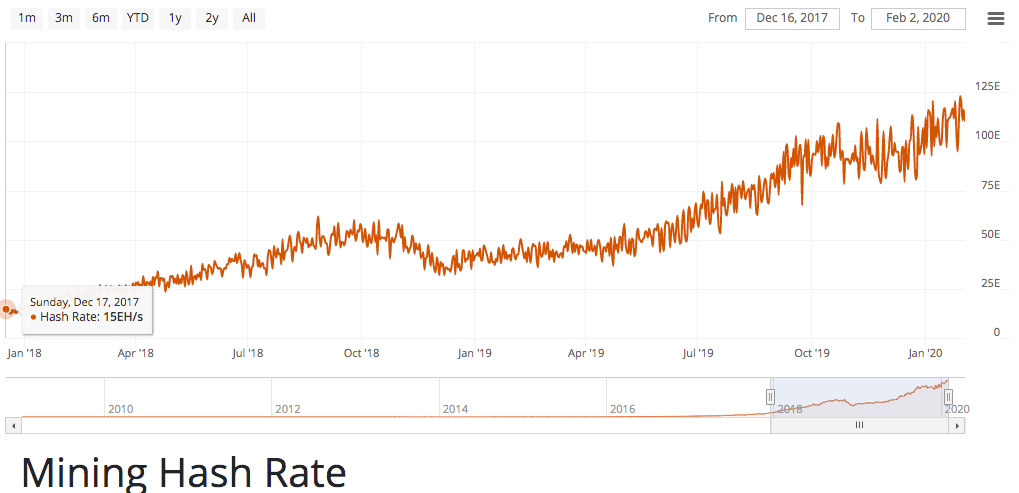

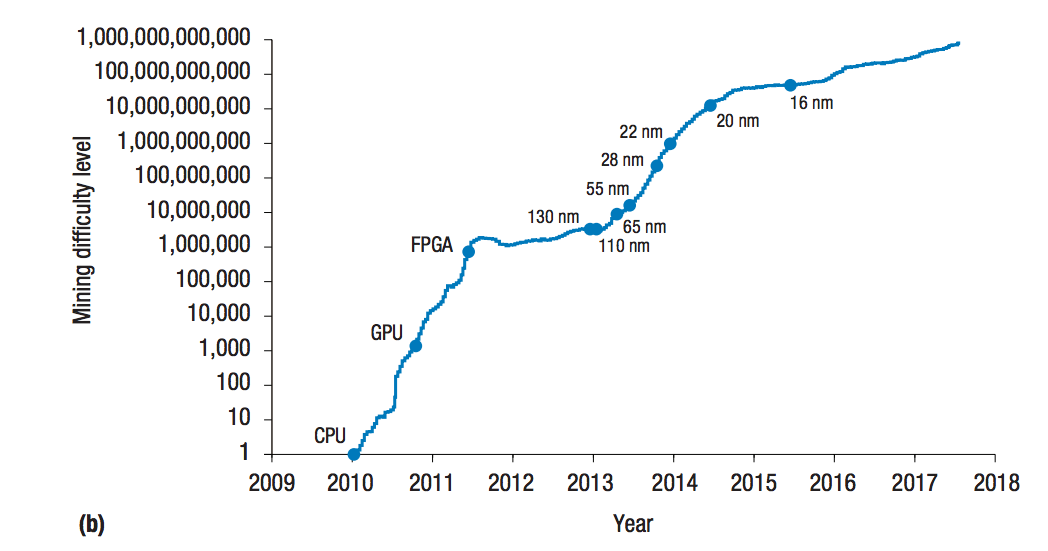

With all of that being said, it is glaringly clear to your Uncle Marty that Bitcoin is the most robust protocol by miles when it comes to the needed infrastructure build out. This is evidenced by the chart above and the chart below.

The chart at the top of today's rag highlights the insane amount of hash rate that has joined the market since the last price peak was reached in late December, 2017. Hash rate has increased by ~8x since then, surging from ~15 ExaHash/second to ~120 EH/s over the course of two years. The chart immediately above this paragraph highlights the advances in specialized hardware that has been produced to make bitcoin mining as efficient as possible.

The chart was created in 2017, since then we have seen even more improvements to the ASICs used to mine bitcoin. Today 8 nanometer and 7 nm ASICs are the most efficient on the market. With rumblings of 5 nm being a possibility within the next two to five years.

With this is mind, it will be very interesting to see how hash rate and difficulty react to the imminent block subsidy halving scheduled to happen in late April or early May.

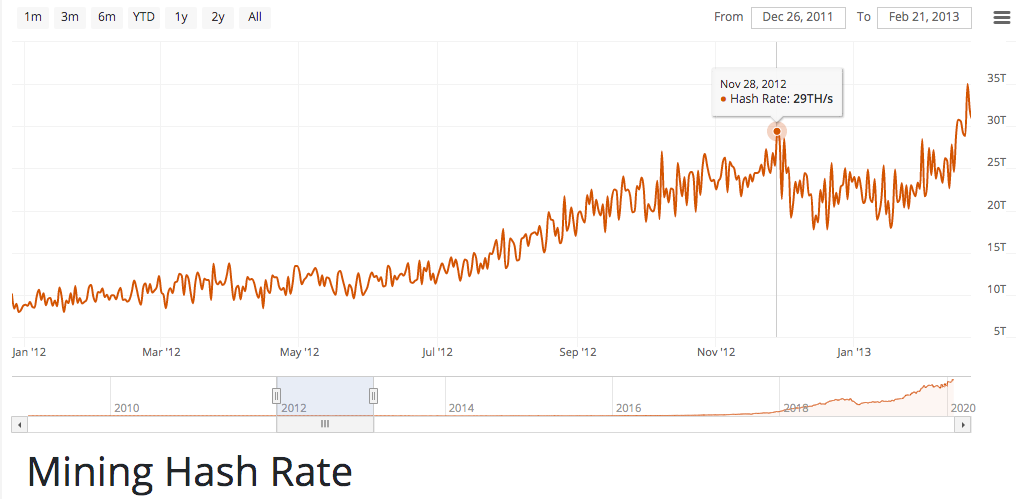

Here's what happened to hash rate after the first halving in late November, 2012:

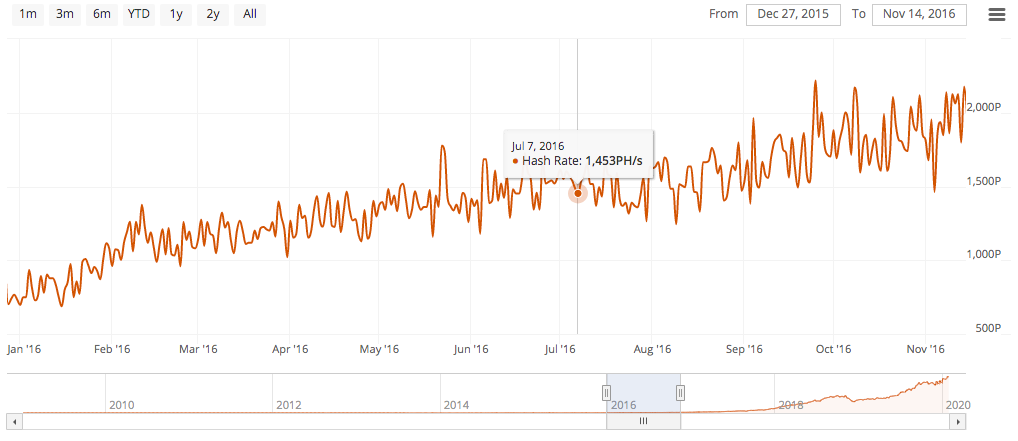

And here's what happened after the most recent halving in July, 2016:

The 2012 halving was followed by a ~33% decrease in hash rate, a plateau for a few months, and then a surge that began in early February, 2013. If you look at the chart with the blue line above, this decrease was probably caused because there hadn't been any significant (public) mining tech advances since mid-2011. The surge in hash rate that began in February 2013 was probably a combination of bitcoin's price run towards a local peak of ~$230 in April of that year and the fact that new, more efficient ASICs were brought to market around the same time. This signals to me that, due to the lack of mining innovation at the time of the halving in 2012, many miners turned off their machines because they were inefficient and unprofitable.

Compare this to the reaction of hash rate after the 2016 halving, which saw a slight decrease and temporary plateau before continuing its march up and to the right. Interestingly enough, the price of bitcoin fell for a few months after the last halving. If I had to guess, the advancement of ASICs to 16 nm at this point allowed miners to remain operational despite a lower to flat price in the months following the last halving.

What does this mean for the upcoming halving? I'm not exactly sure, but we do know a few things. Mining has become A LOT more efficient since the last halving. Bitmain S9s came on the market in mid-2016 and are still operational today. Though, they aren't very profitable unless you have free energy. In the last 5-months, we have seen the emergence of Whatsminer's M20 series of miners and the latest from Bitmain's S17 series, which are the most efficient bitcoin miners on the market at the moment.

It will be interesting to see how much slack these miners make up for the inevitable moonlighting of the S9s that are still mining today after the reward subsidy gets cut it half. Are the more efficient miners getting to market quick enough? We'll see.

Thank you for following along with this random rant that evolved as I got further in the weeds writing today.

Final thought...

Buzzfeed sucks.