The ECB research is purely a simulation.

It has long been my contention that we are in the midst of an extremely slow process of detachment from reality in our society, especially in the financial world. Hate to lead the week off with a negative vibe, but this particular "research" that was highlighted by Ben Hunt over the weekend irked me so much that I had to bring it up this morning. As some of you freaks may know, my departure from the world of finance was heavily driven by the fact that I was simply fed up of the bullshit being fed to the world by the Fed, other central banks, and policymakers the world over.

This ECB "research" is purely a simulation, based on a model assuming a channel for asset purchases to reduce unemployment. Amazingly enough, the simulation works! No actual data was collected or analyzed here, but the "results" are presented as a historical fact. #MiniTrue https://t.co/MJcX8vrzGW

— Ben Hunt (@EpsilonTheory) February 10, 2019

The world of centrally planned monetary policy is wrought with tactics that are used to portray the world as being a certain way instead of describing how it actually is. We've described some of these tactics in this rag before; things like hedonic adjustments to the CPI, signaling to the market via Fed speak during FOMC meetings, and using models to "predict" how certain policies will affect the economy. What Ben has highlighted above falls into the last category.

It's as if these economists are openly taunting the world with their hubris, attempting to see how far they can divert from reality before anyone notices. Running data through these simulations and presenting them as fact is patently absurd. Yet, this "research" will certainly be used in attempts to justify the continued expansion of the ECB's balance sheet and overall debt levels, exacerbating the already dire wealth inequality issue that we face today.

It's a real shame that most of the world (and especially the US) has misdiagnosed the cause of this increasing inequality and blamed it on inadequate fiscal policy when the real issue, I would argue, is irresponsible and unproven globally coordinated monetary policy. This misunderstanding fuels the fires of partisan politics that are becoming increasingly more aggressive as we round out the second decade of the 21st century. Ping-ponging back and forth between Republican and Democrat majority regimes that rarely produce the change they promise while campaigning. Each side growing angrier at the other as the honest belief that the other is the one thing holding back society grows stronger as the economic situation of the average citizen continues to deteriorate. All the while, the true enablers of the destruction of the common man watch from their perches, relatively unscathed as their grand experiments go largely unquestioned by the mainstream.

It's imperative that we call bullshit on "research" like this when it arises.

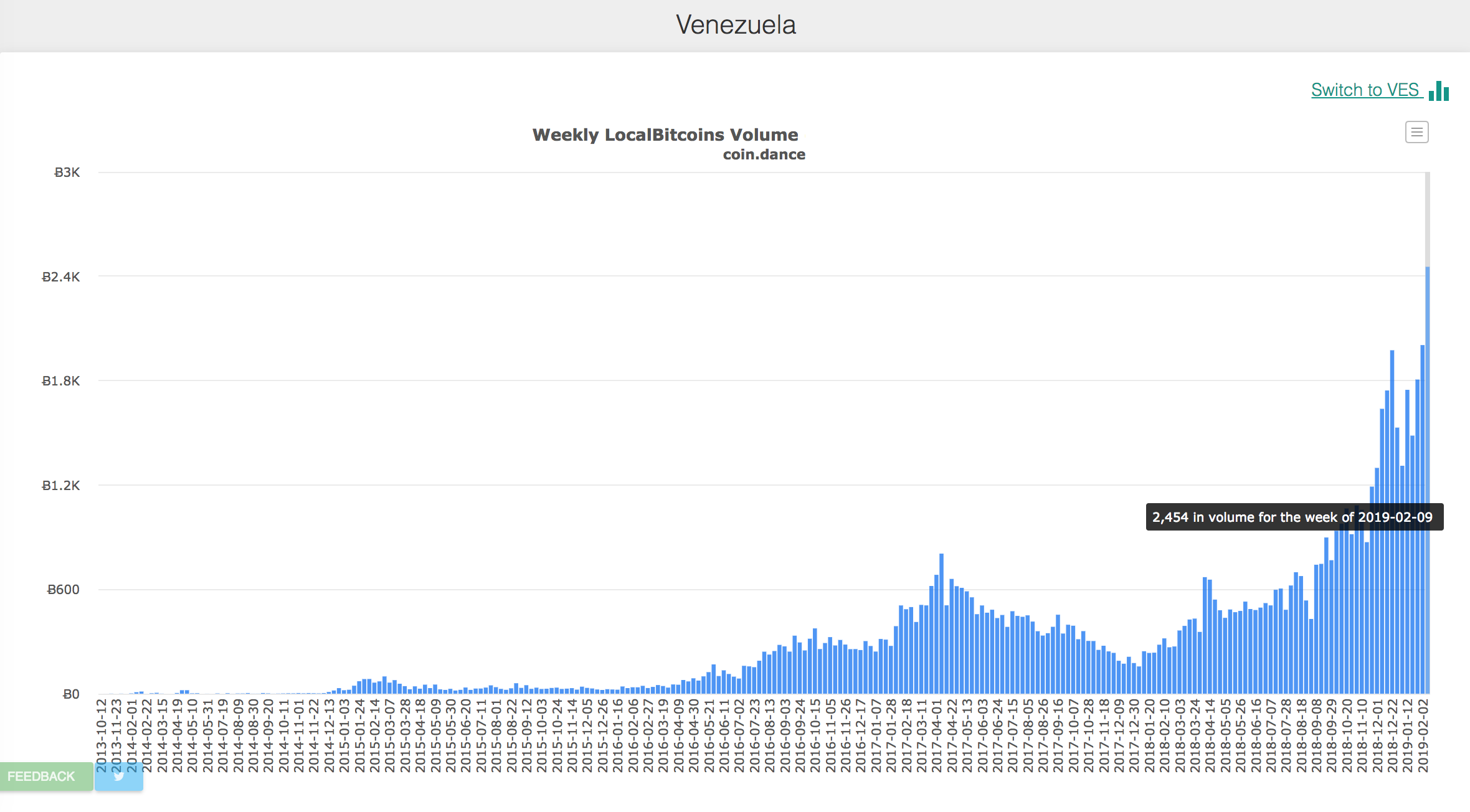

Here's a great follow up stat for Friday's issue, Venezuela just posted it's best week ever in terms of BTC bought on LocalBitcoins. Hitting 2,454BTC in volume for the week, a 22% increase from the previous all-time high set last week.

As our boy Matt points out, Venezuelans are providing considerable buy support for BTC at the moment and it only seems to be increasing.

USD chart courtesy of @TheBlock__ : https://t.co/Ph0jJIs8DO

— Matt Odell (@matt_odell) February 12, 2019

Also an all time high... pic.twitter.com/JikBBwJbBq

If the people of Venezuela are able to maintain this buying pressure, they will be able to account for ~18% of the needed $3B of inflows between now and the next halving to maintain the current price level. And this is only Venezuelans transacting LocalBitcoins. Actually won't be surprised if they account for more than that as it doesn't seem like this trend is slowing down.

sry not sry for spamming you freaks with the Venezuelan story so much over the last few weeks. I'm genuinely happy to see Bitcoin thriving where it is needed most and will pump it as hard as possible.

Final thought...

The Abducted in Plain Sight movie creeped me tf out.