Bitcoin is not going away anytime soon.

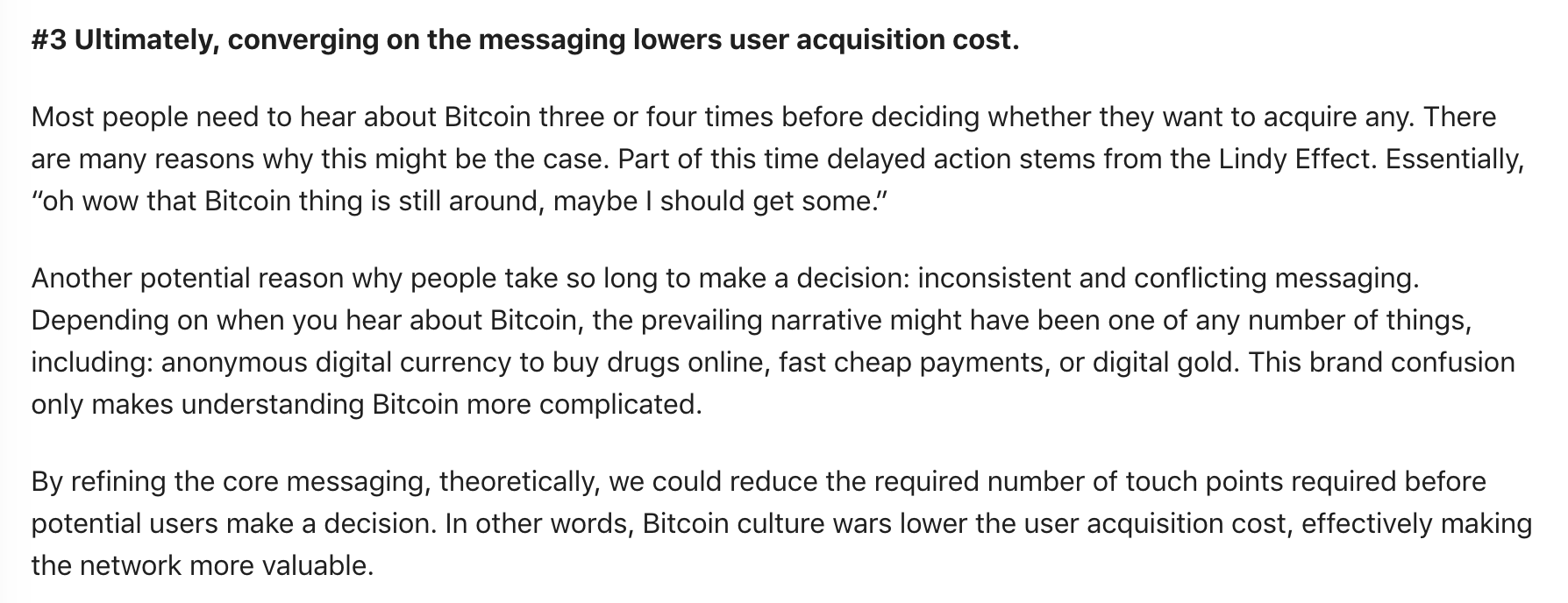

The below screenshot was taken from this very good essay on "Bitcoin Culture Wars" from our boy Brandon Quittem. Go read the piece in its entirety if you have the chance at some point today because Brandon does a great job of describing Bitcoin's rough governance, how disputes have been settled in the past, and how the resolution of these public disputes that result in protocol change or stasis sharpens the narrative around Bitcoin.

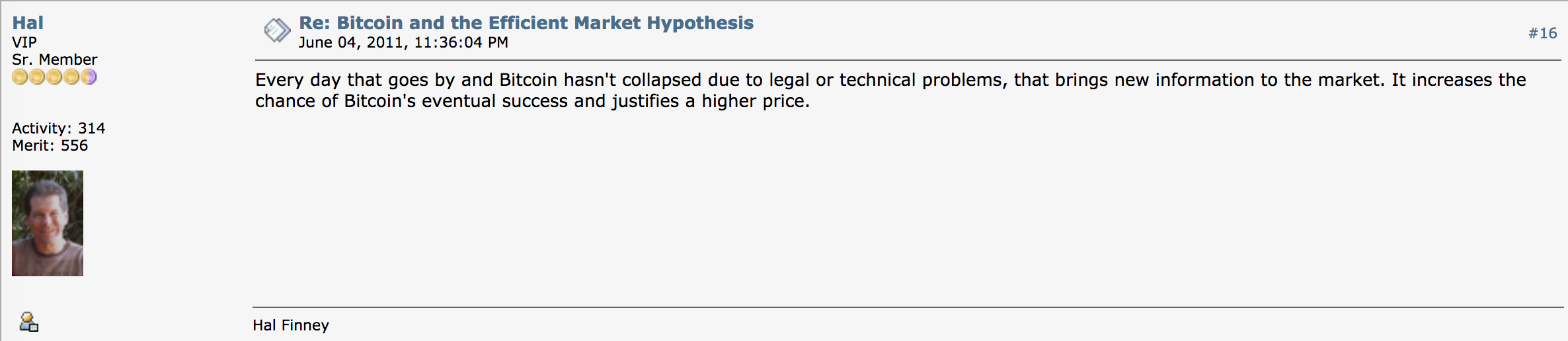

Today, I'd like to focus on the last part of what this essay touches on because I think it's a fascinating observation that reminds me a lot of this quote from Hal Finney.

I believe these two lines of thinking directly benefit each other. As time goes on and Bitcoin hasn't collapsed due to legal or technical problems it increases the chance of Bitcoin's eventual success and as we fight and resolve these protocol battles in parallel the narrative becomes more refined, allowing new users to "get" Bitcoin quicker, precipitating a new wave of adoption, usually an order of magnitude larger than the wave that preceded it. What I'm curious to see is how this gets compounded as we move further into the future. Right now, it seems as though it will take forever to reattain the price levels we witnessed in December of 2017. However, the fundamentals surrounding Bitcoin have never been better IMO. The narrative has never been this sharp, especially with the recent proliferation of the "Bitcoin is free speech money" (which can even be reduced further to simply "Bitcoin is Free money"), the number of onramps continues to increase, and the number of things being built on top of Bitcoin is growing at an exponential pace.

All of this combined has me wondering how big the next bubble will be. Bitcoin just passed the decade mile marker, a huge psychological checkpoint in people's minds. At what point do people point at Bitcoin and say, "Well, it looks like this thing isn't going away anytime soon, or even ever"? When will the world expect Bitcoin blocks being produced roughly every ten minutes to be as expected as the sun rising every morning? I don't know exactly when that will be, but we're definitely getting closer. It is at this point that I believe we won't be able to depend on historic boom and bust trends in Bitcoin to attempt to predict future price movements. The real pricing-in of Bitcoin will begin in earnest at this hypothetical future juncture. It might make sense to grab some in case it catches on even more.

(Remember, freaks. You're reading the ramblings of a dunce.)

Final thought...

The Eagles just double doinked my heart.