We'll see how long this low-volatility period in Bitcoin's history persists. I have a feeling it won't be persisting for too long.

Bitcoin's annualized volatility over the last 30 days: 14%. That's an all-time low. $BTC.X pic.twitter.com/1QHbMIs2ww

— Charlie Bilello (@charliebilello) November 14, 2018

It's quiet. Too quiet.

Unless you freaks have been living under a rock, or are just normal and not attuned to the everyday happenings of magic Internet money and it's many knockoffs, you may know that Bitcoin Cash is in the midst of a war for its soul that is getting very heated as we approach the hard fork, which is scheduled to happen tomorrow. Now, in my opinion, people are paying way too much attention to this. The market has shown over the course of the last 14 months that Bitcoin Cash is an abject failure as hash rate has less than 10% of the hash power that Bitcoin does at the moment.

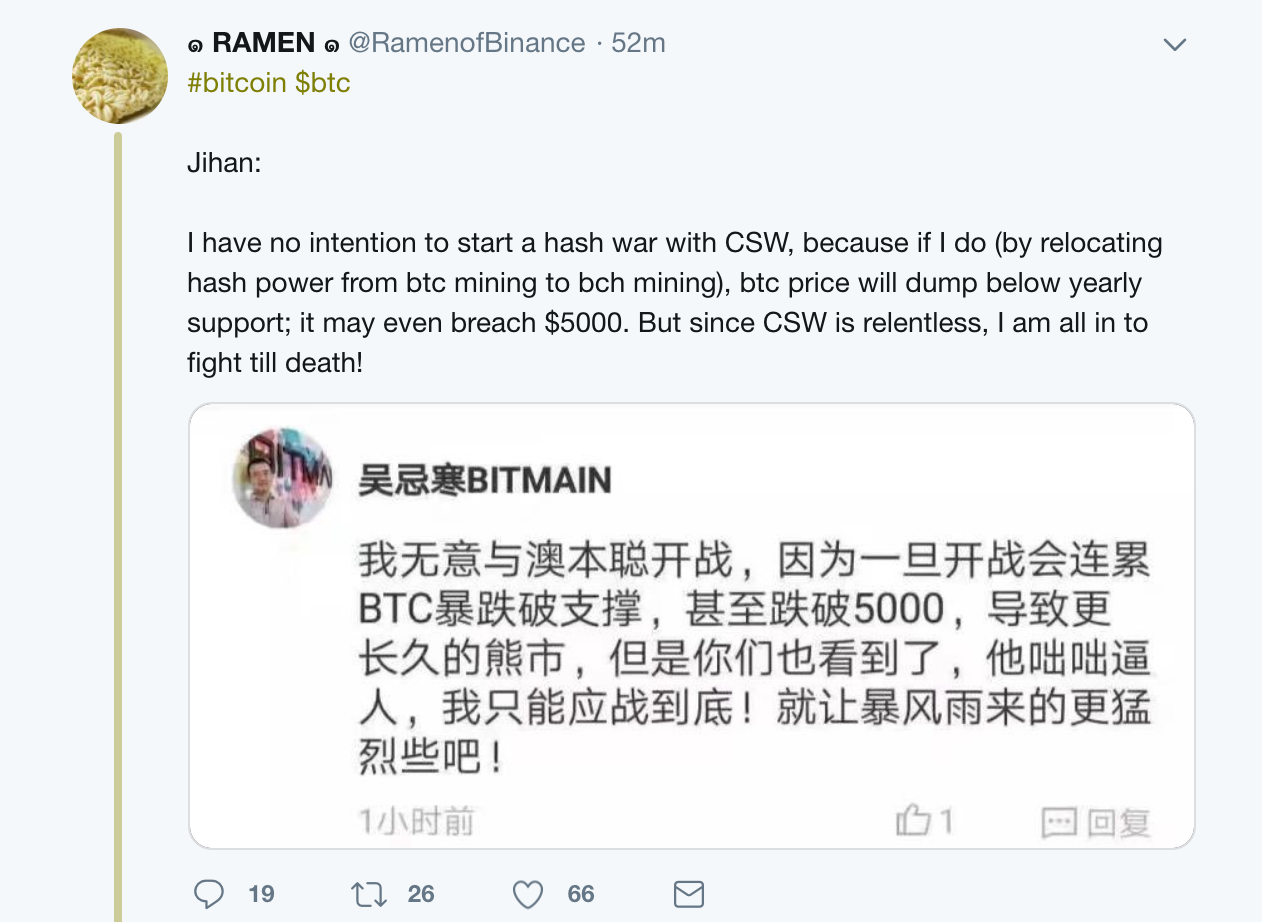

However, it seems as though this war for the soul of Bitcoin Cash will have an effect on Bitcoin as it looks as if Jihan Wu will be allocating some of his mining power currently dedicated to BTC over to the fork of BCH he wishes to see succeed. Again, BCH currently only has very little overall hashing power compared to BTC, but we don't know how much Jihan plans to reallocate towards the fork of his choice. However, I don't think Jihan's logic is solid in this post (if it's even real, not the best capital 'J' journalist here so have not confirmed) as a diversion of the amount of hash rate needed to compete with the competing Bitcoin Cash is not really significant. Yes, it could slow down the chain temporarily, but that's nothing a difficulty adjustment can't help! Though, I can see this play spooking markets and hurting Bitcoin as a result.

At the end of the day, I have no idea how this is going to play out. For all we know, these idiots could be embarking on a journey of mutually assured destruction, which, in turn, could reinforce Bitcoin's long-term scaling path and decision to pursue governance via rough consensus determined by full nodes, making Bitcoin's fundamentals even stronger and causing a price rally. Who the hell knows. All I know is that we'll have much fodder to talk about in the coming week's and a beautiful case study in minority fork economics and the nature of hashing wars.

Maybe all parties involved have admitted defeat to BTC amongst themselves and are actively trying to sabotage Bitcoin Cash while shorting the markets. Both parties will be able to blame the other if Bitcoin Cash doesn't survive this fork, both will be richer from their trades, and both may attempt to fall back into Bitcoin's good grace after "realizing the folly of their ways".

Final thought...

I got Trezors in my mind and can always open my own vault.