The old dogs haven't proven that they're able to understand the power of bitcoin and the unique properties it possesses.

Correction: This was a knee-jerk reaction to the news as it dropped. As I state in the letter, I am not an expert in trusts or ETF's. BlackRock's Bitcoin Trust is more similar to GLD than GBTC. Main point still stands though, hold your own keys, or at the very least engage with a multi-institution multisig product if you don't want to hold your keys.

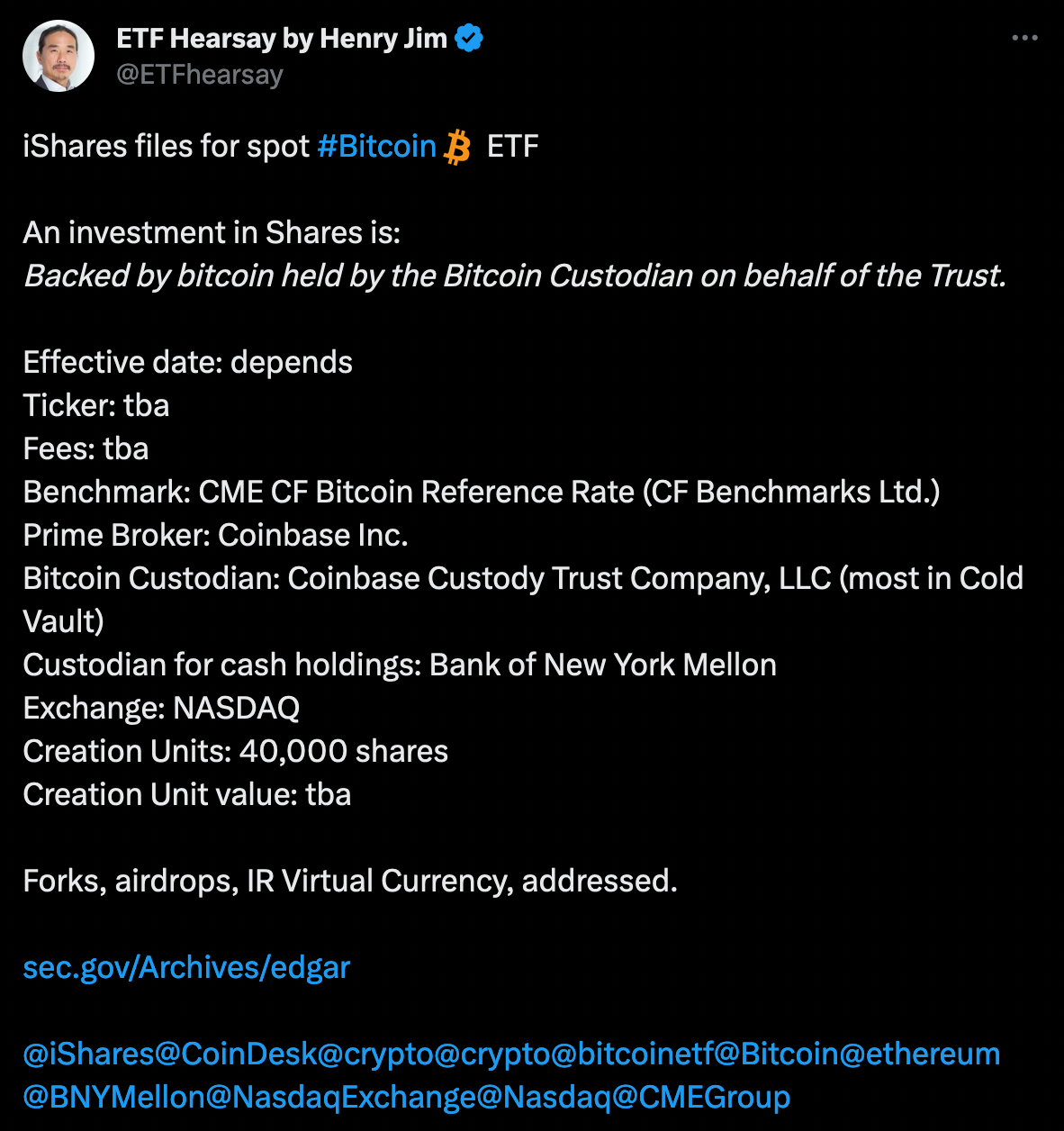

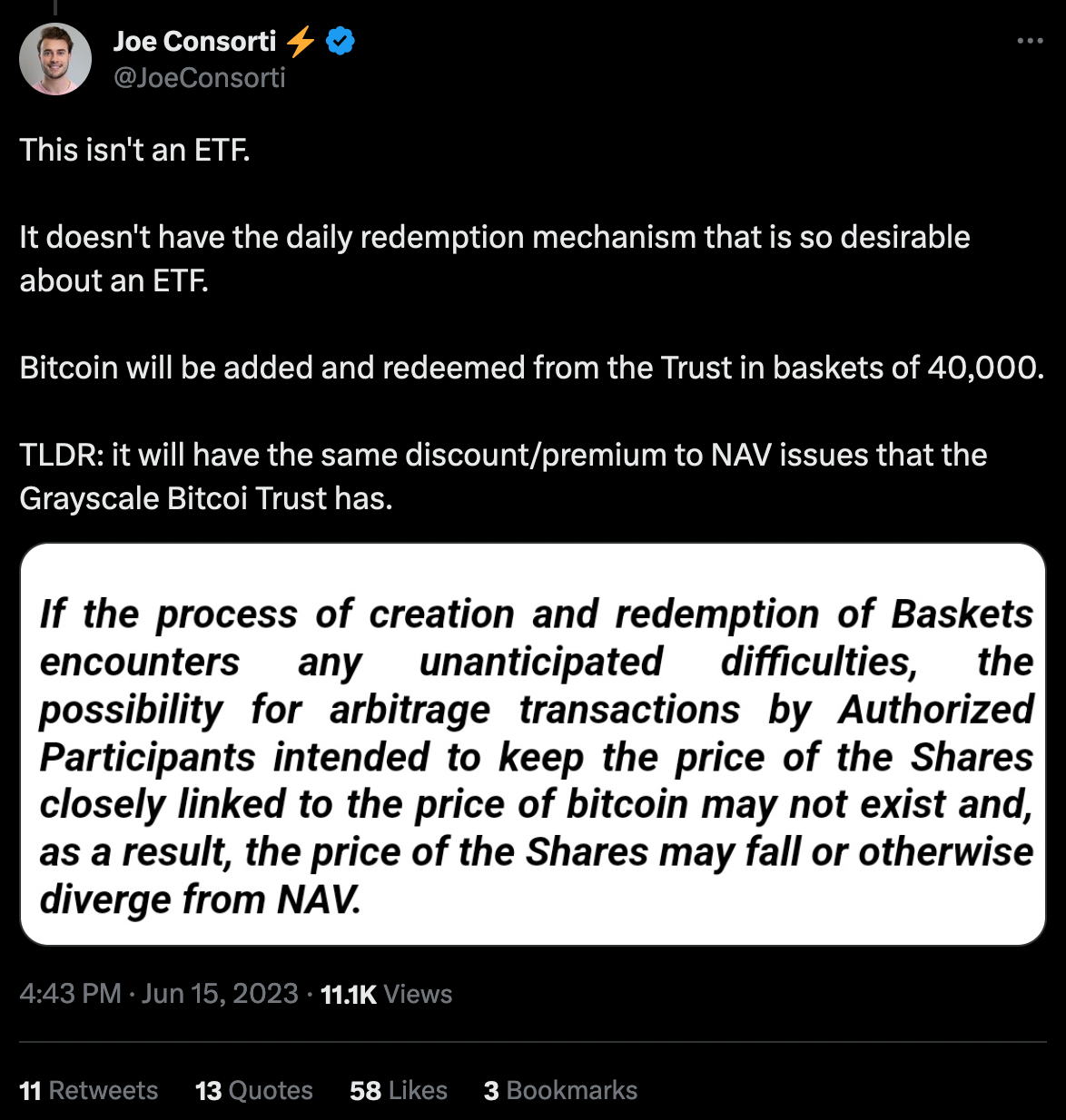

I'm sure you've all heard the news already, but BlackRock has officially filed for a spot bitcoin trust. Many are speculating that, if approved, it will be the first spot bitcoin ETF brought to market. I am not an expert on trusts or ETFs, so I can't speak to whether or not most people are currently running with a bad narrative that this will be an ETF, which is what is happening right now. From what I can tell, it seems that most who have picked up the news are spreading false information. If you dig into the filing it seems that the trust will operate (if approved) very similar to GBTC with the trust selling off blocks of 40,000 share chunks that do not have the daily liquidity profile you get with an ETF.

I would not recommend that anyone touch this product with a ten foot pole. If GBTC has taught us anything it's that this particular trust structure is terrible for the investor. You throw cash into this product and pay fees to underperform bitcoin in the long-run. The only difference with BlackRock's trust seems to be that you can take the bitcoin in-kind if you wish.

Regardless, this is a pretty big signal to the market that bitcoin is legitimate in the eyes of the institutional investor class. Not that bitcoin needed their validation in the first place. It has been operating as advertised for fourteen and a half years and has been a legitimate store of value and payments network for tens of millions of people across the world. With that being said, this is a pretty big endorsement from the largest (and most evil) asset manager on the planet. It seems that their hand has been forced and the demand from their clients has pushed them into the market.

It's funny to see how far behind and out of touch most of the TradFi world is when it comes to bitcoin. Nobody wants or needs GBTC 2.0. Many have stayed away from GBTC because of the discount to spot and the fact that they are heavily dependent on a single custodian, which introduces a massive single point of failure. If institutional investors want to get direct bitcoin spot exposure with a better custody model and the ability to take control of their bitcoin when they are ready then a trust, ETF or custody product that leverages multi-institution multisig custody with the ability to withdraw whenever you'd like.

The old dogs haven't proven that they're able to understand the power of bitcoin and the unique properties it possesses. They'll either learn and adapt or get lapped by people who actually get it.

Final thought...

Great time in Nashville at the Bitcoin Park this week. Hell of a bitcoin third place.