Embrace the prolonged bear market. It will be remembered as one of the greatest opportunities to convert your fiat to bitcoin that has ever existed.

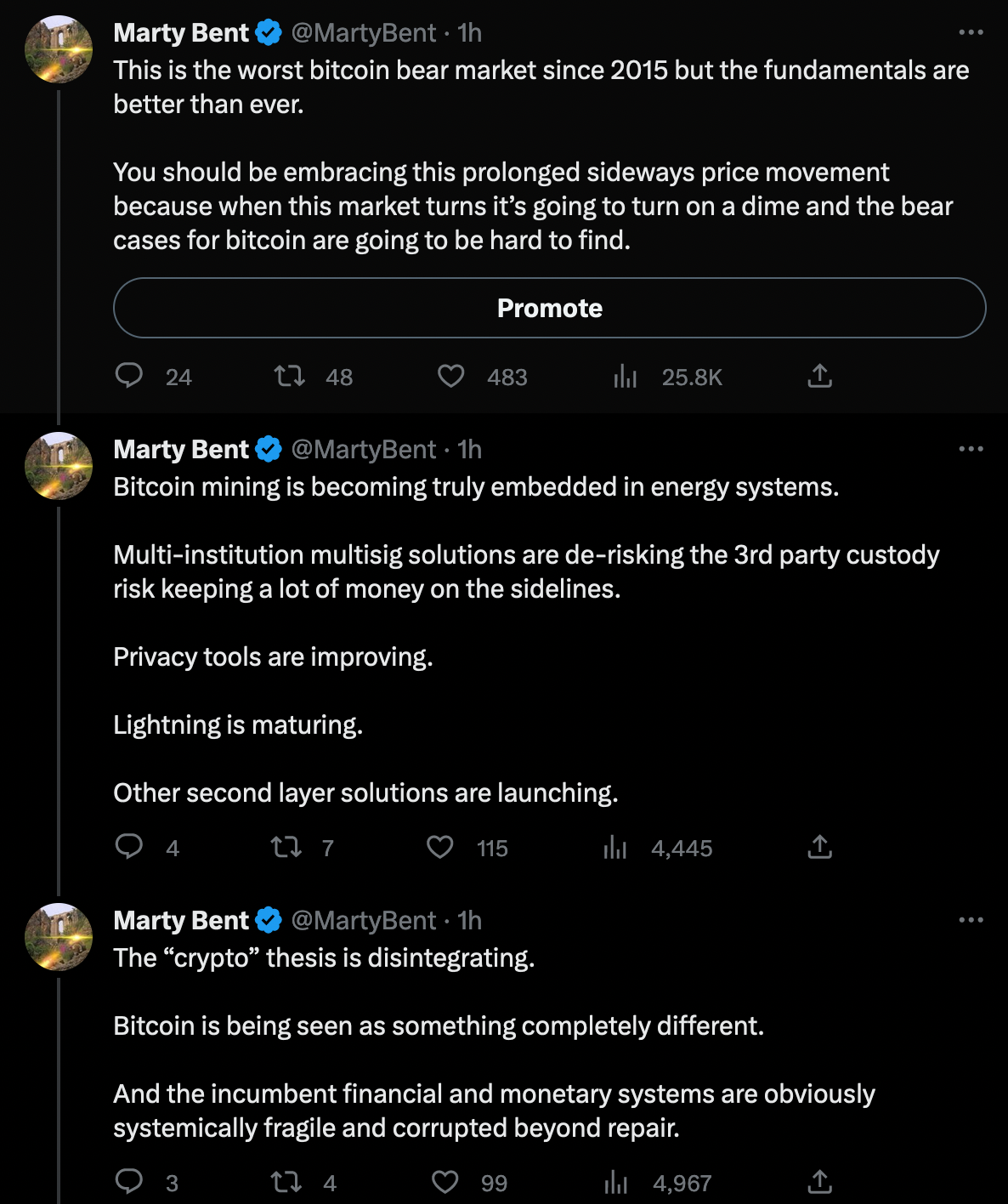

Welcome to the middle of a bear market in bitcoin. From my perspective, this is the worst bear market since 2015 in terms of how drawn out it has been and the overall sentiment around the asset from outsiders. This time should be viewed as a cherished opportunity to stack and build long lasting companies and not a time to panic or worry about the fate of bitcoin. Bitcoin's fundamentals have never been better and when the market wakes up to this I think the next bull run will shock people to the upside.

Whether we like it or not, the chaos of 2021 and 2022 in "crypto" turned most people who were bitcoin curious away from leaning in. The crypto folks have done a good job of making people believe that their affinity scams are in the same class as bitcoin. When those who were on the fence of whether or not to make an allocation to bitcoin saw what happened with Terra/Luna, BlockFi, Celsius, Three Arrows Capital, FTX and many others they associated all of that fraud and capital destruction with bitcoin. It's unfortunate that this is the case, but it is for a large group of people. Though, it should be mentioned that these events also served as a catalyst to push those who were "diversified across crypto" to consolidate their holdings into bitcoin as the events served as a massive lesson in where the signal is within the industry. This particular archetype was further along the learning curve than those who reflexively turned away from the space as a whole.

With all of that being said, there has never been a better time to lean into bitcoin than right now. The fundamentals have never been better and we are witnessing the network begin to enter a territory where it is viewed as systemically important for some key sectors of our economy, particularly the energy sector. The strides the mining industry has made here in the United States and globally in terms of getting key players across the industry for energy clued into how bitcoin mining can be an additive force to their stack cannot be overstated. The energy sector has a massive waste problem and bitcoin miners are proving that they are best suited to solve it. Whether it be flare mitigation, optimal grid utilization, or providing a reliable load for demand response programs bitcoin miners are bringing more revenue and stability to the energy producers who work with bitcoin miners or incorporate it directly into their operational stack. Since the energy sector is arguably the most important sector in any economy (economies don't work well without energy), getting bitcoin integrated throughout the sector is one of the most high leverage things any bitcoiner can do at the moment. And luckily for anyone who cares about bitcoin's long-term success, this bear market will be remembered as the bear market where we orange pilled the energy sector.

One of the things keeping massive amounts of capital on the sidelines is a viable custody solution for high net worth individuals and institutions who aren't comfortable holding their own keys, but also can't stomach concentrated third party risk. BlockFi and FTX, two companies viewed as ironclad brands only two years ago, have highlighted how badly things can go when you trust your bitcoin with a single custodian. This bear market has brought with it the popularization of multi-insitution multisig custody, which enables individuals and institutions to allocate their custody to a quorum of institutions holding different keys. This makes it so no single institution can unilaterally move or lose your funds while providing the added benefit of a dedicated onchain address that can be monitored. Multi-institution multisig custody solutions will be a massive unlock for capital that has been waiting for a custody solution that serves their needs.

The lightning network is maturing and getting integrated into more and more services. Whether it be podcasting, distributed communications protocols, the telecom industry, or AI - it is becoming obvious that the lightning network's ability to achieve instant final settlement of small and large payments is a massive unlock for the digital economy. There are still problems to be solved, particularly around liquidity management and privacy, but there are many solutions being brought to market that solve both of these problems.

Beyond that, we're seeing the emergence of other second layer solutions like FediMints that will provide optionality for users while enhancing the utility of the lightning network. The crypto narrative is disintegrating in real time as projects fail to provide the utility they've promised and draw the ire of regulators. And, probably most importantly, the incumbent financial and monetary systems are proving to be more systemically fragile than was previously though possible. Every repo spasm, banking crisis, debt ceiling debacle, and inflation print is a stark reminder of why bitcoin exists.

When you take all of this together, it is hard not to be bullish on the future of bitcoin. Yes, the price may be in a $10,000 range for what seems to be an eternity, but the fundamentals are stronger than ever and only getting stronger by the day. In fact, I'd wager that the progress that is being made in this bear market will make it very hard for people to find a bear case for bitcoin outside of "the government won't let it happen", which is a very valid concern but one that if acted upon would prove to be a temporary roadblock. Bitcoin is an idea whose time has come and the value it is creating for many sectors of the economy is becoming undeniable. If a government truly exists to serve the people, it would be criminal for that government to prevent the people it's supposed to represent from benefiting from that value.

Embrace the prolonged bear market. It will be remembered as one of the greatest opportunities to convert your fiat to bitcoin that has ever existed.

Final thought...

I didn't take Parker Lewis for a plane sleeper.