This is getting crazy...

It's chaos out there! With inflation running rampant, supply chain problems becoming more exacerbated by the day and interest rates remaining relatively elevated as Jerome Powell and crew attempt to reel inflation in things are starting to... break. A rise in the Federal Funds rate (the rate at which banks and similar financial institutions trade their overnight reserves) has an effect on every other interest rate throughout the market. If it gets more expensive for banks to borrow funds overnight to ensure they have sufficient reserves, they have to cover those increased costs by passing them along to their customers.

Stocks, startup equity, crypto, real estate — via leverage they are joined at the hip pic.twitter.com/rerBPFEu3c

— Tuur Demeester (@TuurDemeester) May 10, 2022

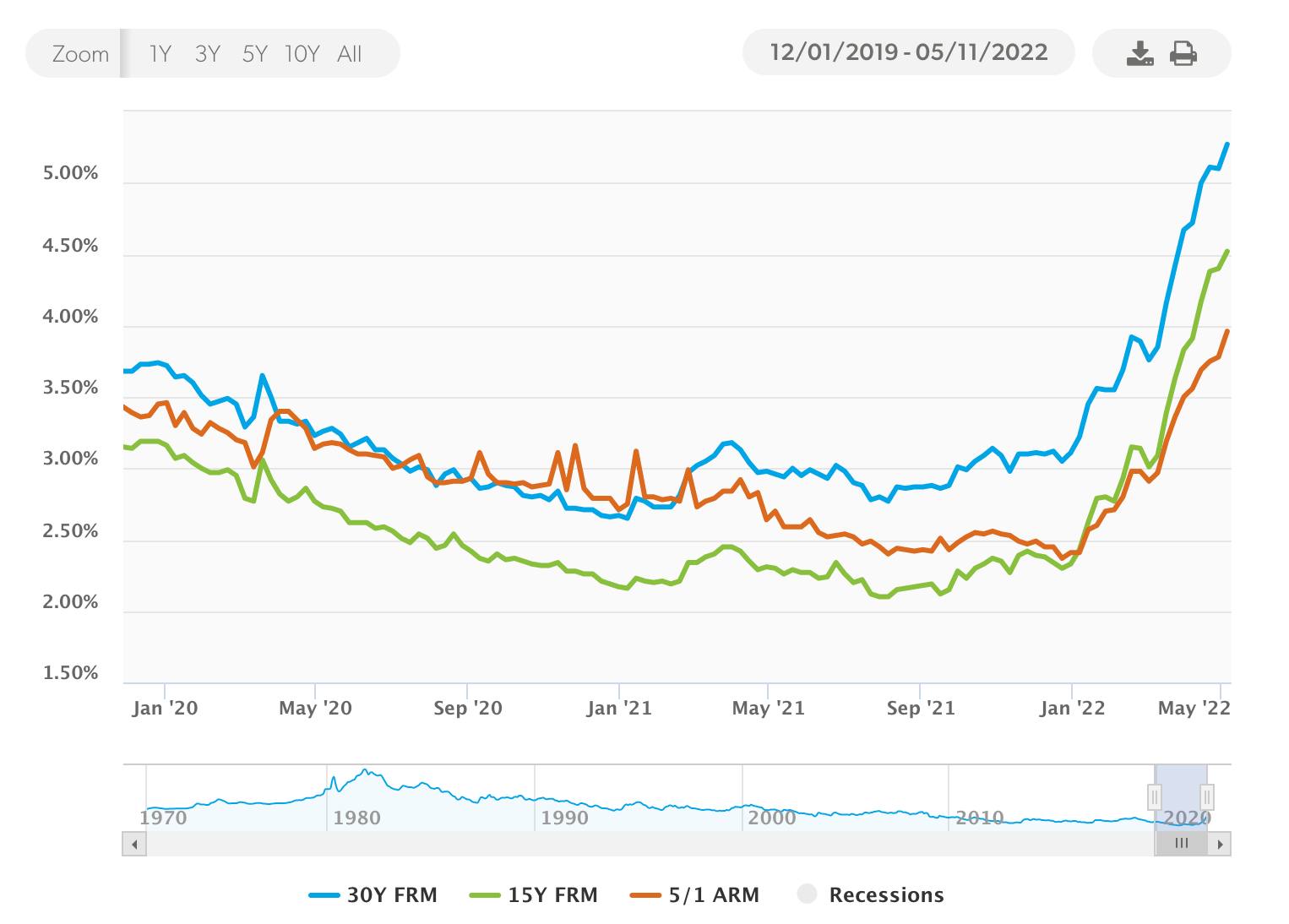

One place this cost passing materializes is in the real estate markets. As you may have noticed mortgage rates have begun steadily increasing since the Fed started its rate hikes earlier this year.

I picked January 2020 to today as the time series for this chart because it captures the immediate lead up to the forced lockdown of the global economy and everything that has ensued since that point. If you recall, the lockdowns forced a lot of individuals to question whether or not they wanted to live in cities anymore and many across the US decided that they, in fact, did not. So they went out, took advantage of an extremely low interest rate environment and purchased houses using mortgages with historically low interest rates attached to them.

Concurrently, the Fed and the Treasury were pumping the US economy with as much cash as humanly possible to prop up the economy as the entire workforce of the country was forced to adjust to the lockdowns on the fly. Many were able to work from home. Many others were not. Artificially forcing a material amount of the workforce out of... the workforce created massive disruptions in our supply chains. As the Fed was pumping money into the economy, many of those who were lucky enough to keep their jobs and work remotely were taking the excess income they had from not being able to operate throughout the economy as they normally would and dumping it into the stock markets, "crypto", more real estate, and a number of other investments to "put their money to work". Many of these individuals were using leverage.

This created a ticking time bomb with a very short timer. That money was going to "work" in completely artificial markets that were being driven by pure central planning insanity instead of actual fundamentals. As everyone and their mother who had excess cash was shoveling it into financial and real estate assets, global supply chains were quickly breaking down. The halting of these supply chains in early 2020 sowed the seeds for the barrage of massive inflation prints that we have experienced over the course of the last six months. Breaking the supply chains has led to massive supply shortages for things that actually matter - food, fuel and raw materials - and is pushing their prices to astronomical levels.

(This is where we return to the beginning of this rag.)

Noticing this and getting weary of inflation running so hot that it creeps into hyperinflationary territory, the Fed is being forced to raise rates to try to curb that inflation. That is having an effect on the financial and real estate markets that were being artificially propped up for the last two years. The rise in rates and shutting off of the money spigot, in conjunction with a negative GDP print in Q1 2022, is causing markets to puke their brains out. There is no one there to artificially prop up prices and people are beginning to have to weigh the decision of keeping their money in the stock and real estate markets or selling those assets so they can afford to survive.

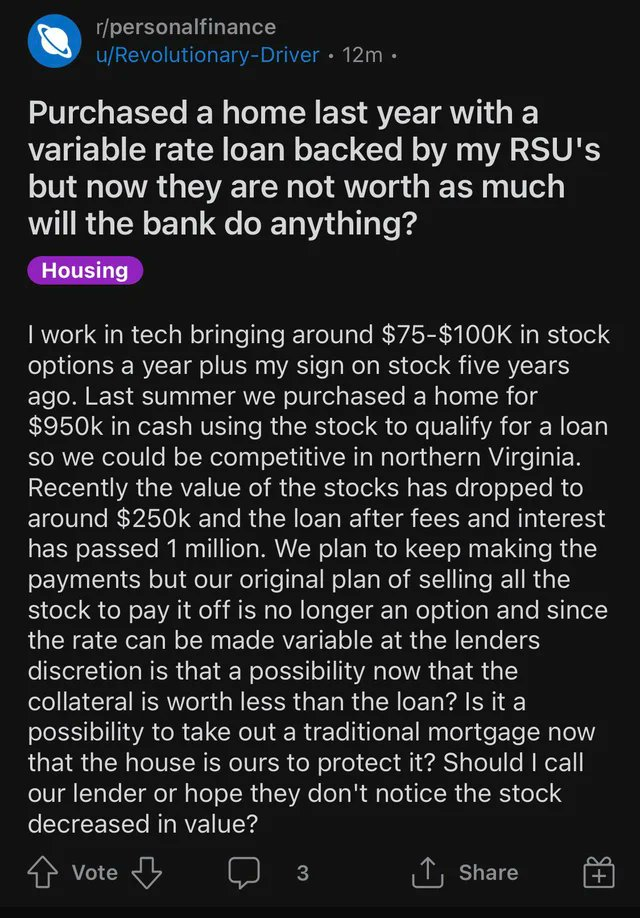

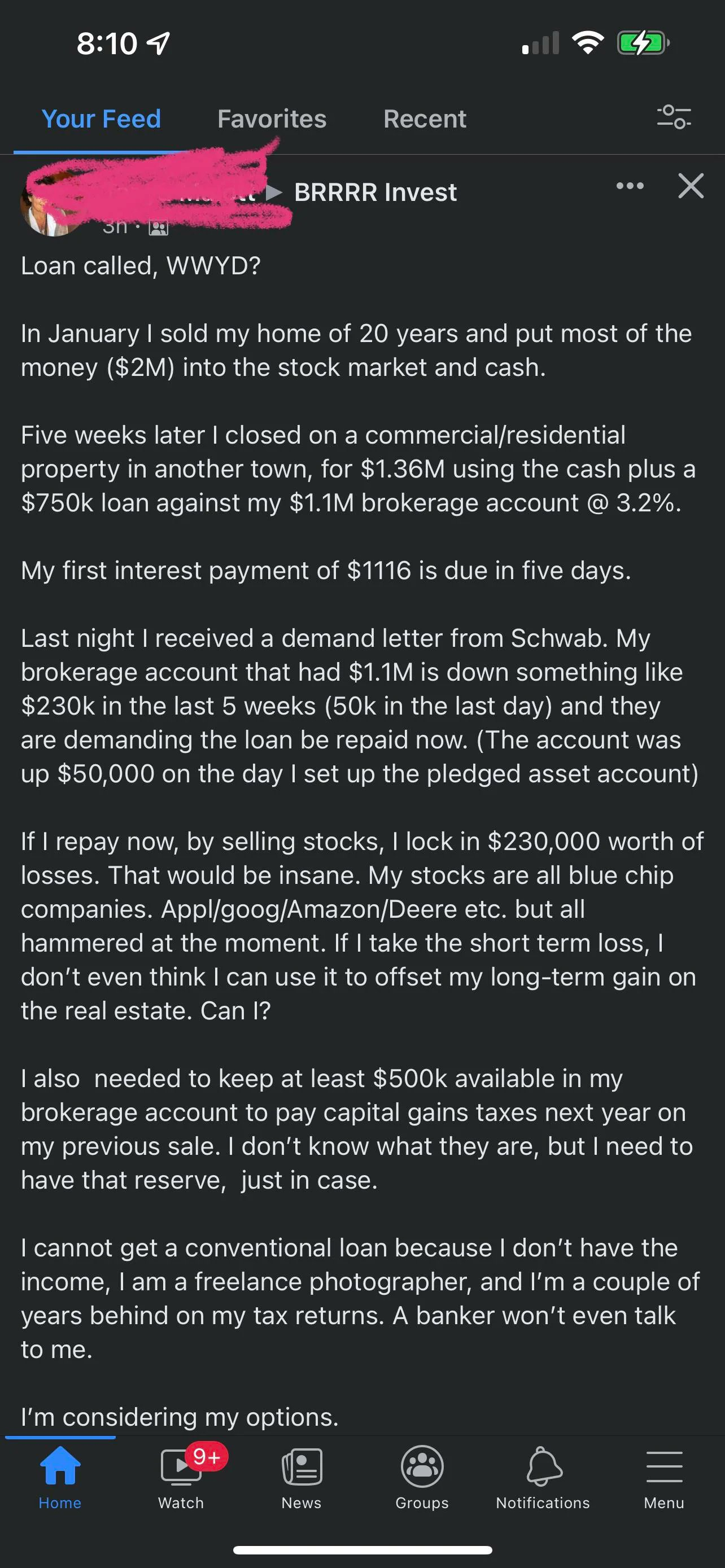

This is creating a doom loop because, like we said earlier, many individuals were using leverage to get exposure to these assets over the last two years. Tuur came across two examples of this on Reddit and Facebook.

There are many out there who have very similar stories to the two above. There are a number of individuals throughout the country who took advantage of elevated stock prices to use their portfolios as collateral for the real estate they purchased. "The Fed isn't going to stop printing so stocks will keep pumping and mortgage rates will remain glued to the floor." Seemed like an iron clad strategy. A risk-free bet to many. How could it go wrong?

Well, reality stepped into the picture. That's what went wrong. At the end of the day essential goods need to be produced and delivered to market. That has not been happening for the last couple of years. The proverbial pot was slowly (quickly, really) boiling over the course of 2020 and 2021 and the whole god damn world was sitting in it as if it was some desert oasis. The paper gains in stocks, real estate, and "crypto" (bitcoin included) felt really nice to look at and periodically tap into.

While many were looking at their Robinhood accounts and refreshing Zillow to see how much their houses had appreciated in value, inventories for the things we desperately need - food, fuel, and the raw materials necessary for building the things that get them and other essential goods to market - were quickly being depleted. And now, the whole world is learning the Day 1 Economics 101 lesson of supply and demand. If demand for certain goods stays static or increases while the supply of those goods dwindles, prices are going to rise.

Price increases are forcing the Fed to act and their action is leading to a cascading effect driven by interconnected risk that has been pushed to the heavens in financial markets via artificial money printing. Stocks are going down and people who used those stocks as leverage to buy homes are beginning to realize they are not as secure as they thought they were when they signed their mortgages. That problem is being exacerbated by adjustable rate mortgages which are simultaneously increasing monthly payments as the underlying collateral is evaporating. That scenario is being exacerbated by the fact that others, who don't find themselves in that situation, are finding themselves in a forced selling position because they need to afford to put gas in their cars and food on their tables. What is really scary to think about is that this could be further exacerbated by the Baby Boomers who previously thought they were comfortable in retirement adding to the cascading effect by selling their financial and real estate assets in an attempt to lock in a somewhat material nest egg in cash so that they can live lives of sufficient comfort.

This is what happens when you build an economy on fiat. It produces a mirage of security that can be wiped out in a very short period of time. That is what is happening at the moment. People are losing security at a rapid pace.

And yes, bitcoin seems to be getting swept up into this cascading doom loop. I'd argue that this is due to the fact that it is a nascent monetary asset with a relatively small network effect. However, this does not mean bitcoin isn't working. Bitcoin works beautifully. As of the time of writing, we are sitting at block height 736,015 and while the price associated to the network's native token may be taking a hit with the rest of the markets, it is still working as advertised. Producing blocks roughly every ten minutes and adjusting the difficulty target as necessary (+4.9% yesterday).

If anything, despite the short-term price hit, the first five months of 2022 could not be a better advertisement for bitcoin if you asked for one. The policy moves made by the Fed over the last two years coupled with overarching totalitarianism from the federal government are acutely highlighting the systemic problems with fiat money and centralized control that can only be solved by adopting a hard money standard. Under a Bitcoin Standard the Federal Reserve won't be able to print money ex-nihilo, propping up markets, misallocating capital on a global scale, and giving people a false sense of security. Likewise, the federal government won't be able to attempt to centrally plan the economy because they won't have the Fed's money printer to lean on and any attempts to do so will be too costly.

Things may seem dire at the moment, but this experience should be seen as a cleansing that (hopefully) leads to a wake up call that helps people realize that this type of micromanagement isn't sustainable. Many are starting to realize that we have a massive problem on our hands. That's the first step in fixing the problem; recognition. Next, it is imperative that competent individuals who understand what is going on to work as hard as possible to educate those who are beginning to recognize that there is a massive problem about the core of that problem; easy money. From there, solutions can be presented. And the best solution we have is bitcoin.

Fix the money, fix the world.

Final thought...

The fasting clarity is starting to kick in.