In a striking revelation that has economic experts and policymakers alike concerned, the Federal Reserve has reported a staggering operating loss of $114 billion for the year—an unprecedented event that marks the largest loss in the institution's history.

In a striking revelation that has economic experts and policymakers alike concerned, the Federal Reserve has reported a staggering operating loss of $114 billion for the year—an unprecedented event that marks the largest loss in the institution's history. The preliminary financial statements for 2023, while not yet audited, have been released by the Fed, raising eyebrows and concerns over the central bank's financial health and its broader implications for the American economy.

The Federal Reserve, often scrutinized for its opaque operations and lack of comprehensive oversight—a point famously emphasized by critics like Ron Paul and Murray Rothbard—has never before recorded an annual loss. This alarming development places it hypothetically third in the ranks of the largest bankruptcies in American history, trailing only behind the collapses of Lehman Brothers and Washington Mutual in 2008, both of which ironically resulted from monetary policies enacted by the Fed itself.

The bulk of the Federal Reserve's losses stems from its response to the COVID-19 pandemic, during which it printed trillions of dollars to fund lockdown measures and used this capital to purchase government bonds. However, in a panicked response to soaring inflation rates, the Fed aggressively raised interest rates, causing bond prices to plummet and the value of its $9 trillion bond portfolio to sharply decline.

Estimates suggest that unrealized losses—losses not yet acknowledged due to bonds that haven't been sold or have yet to reach maturity—could exceed over a trillion dollars. These losses are a direct consequence of the Fed's maneuvers, known as quantitative tightening, aimed at curbing inflation by selling bonds or allowing them to mature.

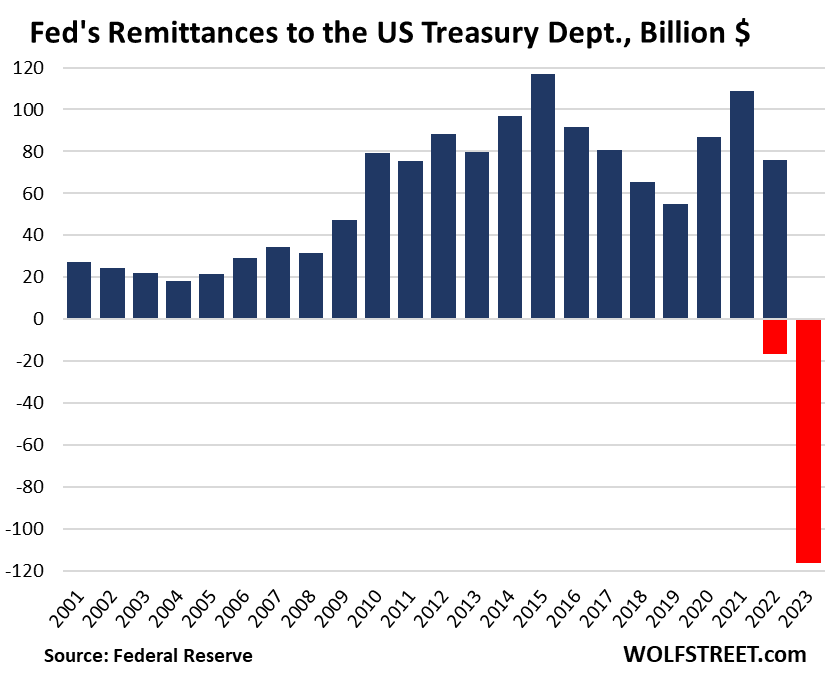

What does this mean for the American taxpayer? In the short term, the Fed's capability to simply print more money might mask the immediate impact, transferring the burden through inflation. However, the long-term outlook is grim. Federal Reserve remittances, which are essentially the profits from its operations paid to the Treasury, are expected to fall short for decades. These remittances, which previously averaged around $80 billion annually, are now predicted to be in the negative, adding to the federal debt that already amounts to $275,000 per American household—with an alarming growth rate of nearly $30,000 per household each year.

As the Federal Reserve embarks on this uncharted financial path, with a loss of $114 billion and potentially over a trillion more to account for, the only certainty is uncertainty. Interest rates will need to come down significantly to stave off these losses, but such a move is likely to trigger a severe recession, further exacerbating the nation's debt crisis. The economic horizon is clouded with challenges, and the world will be watching closely as the Federal Reserve navigates through these turbulent financial waters.

SEO URL Slug: unprecedented-federal-reserve-losses-economic-turbulence-ahead

Google Metadata Description: The Federal Reserve reports historic $114 billion loss, signaling potential economic instability and long-term implications for the U.S. taxpayer. As unrealized losses loom, the Fed's financial trajectory raises critical concerns for America's economic future.