Despite acknowledging the Fed's steadfastness throughout the year, Damodaran highlighted that the ten-year Treasury bond rate has returned to its starting point of 3.88%, now standing at 3.95%, after all the fervent discussions about the Fed's actions.

In a recent segment, Aswath Damodaran, a finance professor at New York University's Stern School of Business, offered a contrarian perspective on the role of the Federal Reserve in the recent market rally. Damodaran argued that the Fed is receiving more credit than it deserves for the market's performance, emphasizing that the realignment of market expectations since November has played a more significant role.

Despite acknowledging the Fed's steadfastness throughout the year, Damodaran highlighted that the ten-year Treasury bond rate has returned to its starting point of 3.88%, now standing at 3.95%, after all the fervent discussions about the Fed's actions. This, he implies, indicates a market-driven adjustment rather than a Fed-driven one.

Damodaran pointed out that the shift in market sentiment began in early November, predating the Fed's recent confirmations, and was primarily driven by revised expectations about inflation and future economic conditions. He suggested that the market's relief over a recession not materializing, contrary to experts' predictions, was a key factor in its current trajectory.

Looking to the future, Damodaran expressed concern that the market in the upcoming year would be under more pressure to meet expectations, where good news will need to be genuinely positive to maintain momentum. He forecasted a potential S&P 500 return of 8 to 9% for the year but cautioned that this estimate is based on stable expectations, and actual market performance could vary widely.

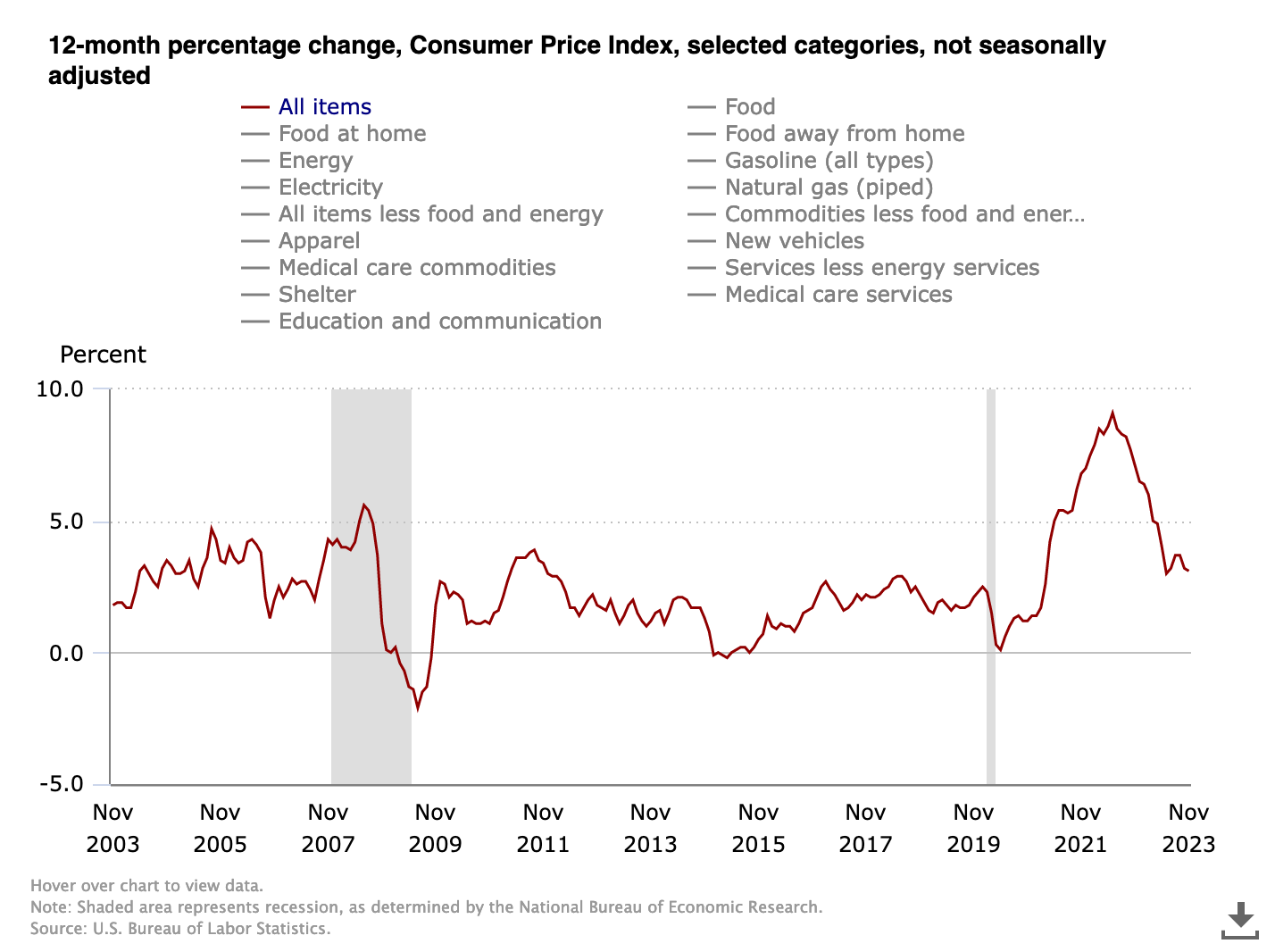

Inflation remains a focal point for Damodaran. He cautioned that the market might be too optimistic about inflation being under control, with the Fed's long-term target closer to 2% rather than the current 3%. The pivotal narrative, according to Damodaran, will be whether inflation will continue to decrease or persist stubbornly around the 3% mark.

The insights provided by Professor Damodaran offer a nuanced view of the financial landscape, challenging the commonly held belief that the Federal Reserve is the primary driver of market movements and highlighting the importance of market expectations in shaping economic trends.