This week, the Federal Reserve (Fed) adjusted its Bond Term Funding Program (BTFP), established in March 2023 post the regional banking crisis, to prevent banks from exploiting an arbitrage opportunity.

This week, the Federal Reserve (Fed) adjusted its Bond Term Funding Program (BTFP), established in March 2023 post the regional banking crisis, to prevent banks from exploiting an arbitrage opportunity. To curb this, the Fed increased the lending rates of the BTFP, thereby eliminating the profit margin on borrowing and reinvesting at higher rates. Additionally, the Fed announced the discontinuation of new loans under the BTFP from March 11 onwards, signaling an end to this crisis-period measure.

Despite the absence of immediate financial distress, as indicated by relatively easy financial conditions, central bankers seem to be taking preemptive measures to strengthen the system against potential future crises. A recent report by the Group of Thirty suggests reforms for enhancing lender-of-last-resort capabilities, emphasizing the need for banks to preposition collateral at central banks to secure future credit lines.

There is an ongoing analysis of the interaction between the Treasury's use of T-bills to potentially counteract the Fed’s quantitative tightening (QT). The Fed is expected to announce a slowdown in QT, which may be influenced by the Treasury's increased issuance of short-term debt.

In the context of central banking actions and reforms, Bitcoin's relevance is highlighted. As an independent currency, Bitcoin offers an alternative to traditional banking systems, which are prone to crises. Bitcoin's decentralized nature and fixed supply contrast with the potential for central banks to create new money during times of financial stress.

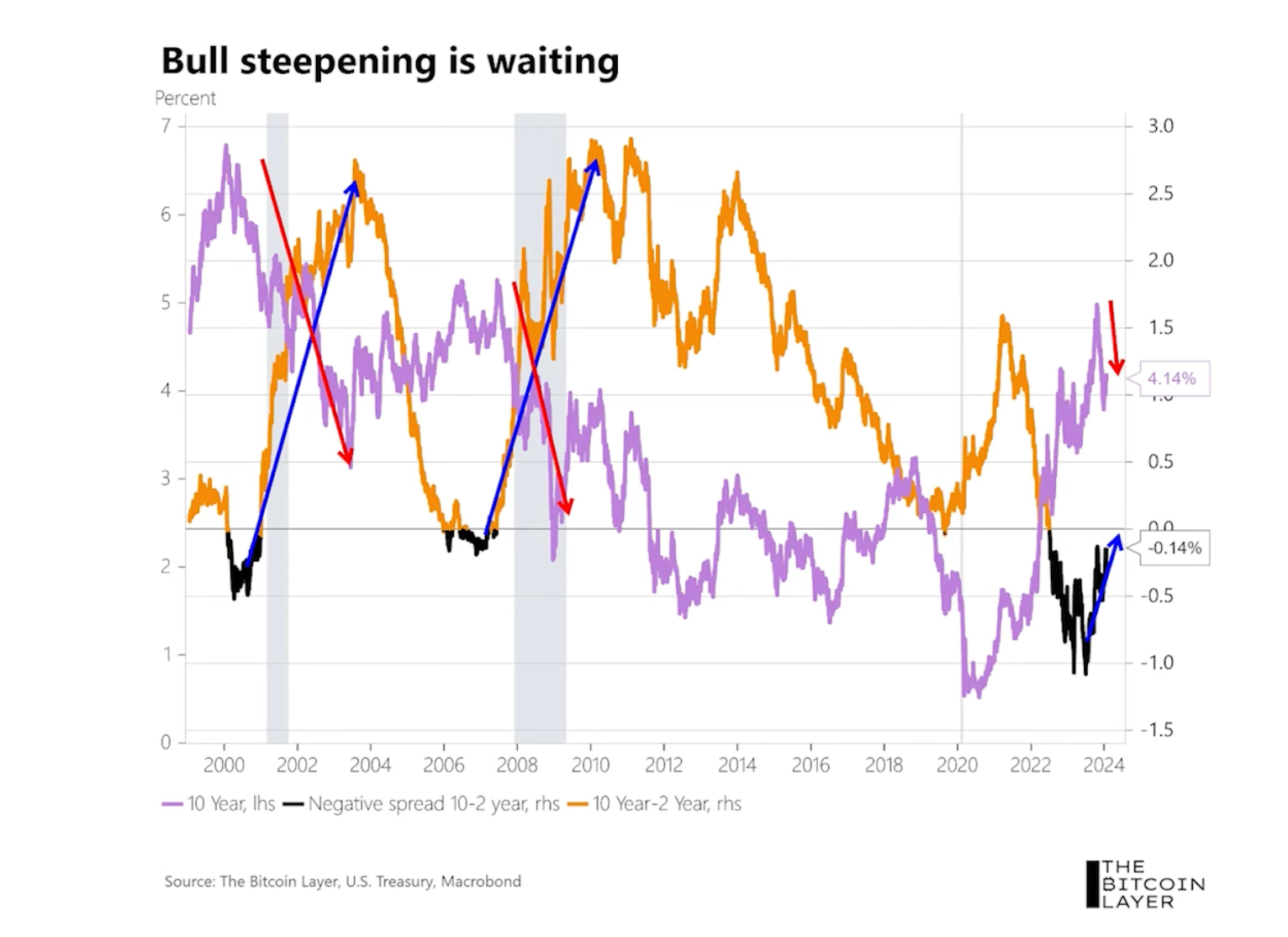

The Treasury yield curve is closely watched, with an uninversion imminent. The Treasury anticipates declaring its quarterly refunding plans, providing insights into its funding strategies and the impact on interest rates. The Fed’s next meeting may hint at a future change in balance sheet policy, potentially setting the stage for rate cuts later in the year.

Looking at market data, the two-year Treasury yield has stabilized despite strong economic indicators, suggesting an anticipation of rate cuts. The ten-year Treasury yield reflects a similar narrative, with expectations of declining rates amidst a potential economic slowdown. The S&P 500's recent rally, while seemingly contradictory to recession expectations, may not be a reliable indicator of economic health in the longer term.

Bitcoin's price stability above key support levels suggests a bullish trend, with current movements scrutinized for signs of continued momentum. The cryptocurrency's volatility is acknowledged, but the overall trend is interpreted as the early stages of a bull market.

The actions and signals from central banks, the Treasury, and financial markets collectively suggest a cautious approach to future economic uncertainties. Bitcoin, with its unique properties, stands out as a potential hedge in a landscape where traditional financial systems are continuously adapting to manage risks. Investors and analysts alike are encouraged to closely monitor these developments as they unfold.