Earlier today the Federal Reserve Bank of New York released a report on the state of consumer credit. Dissecting data across student, auto, mortgage credit card, and other similar types of loans that US consumers have taken out and painting a bleak picture of the state of the average American.

Earlier today the Federal Reserve Bank of New York released a report on the state of consumer credit. Dissecting data across student, auto, mortgage credit card, and other similar types of loans that US consumers have taken out and painting a bleak picture of the state of the average American. We'll take a look at some of the most glaring data below, but we'll first state that it seems pretty clear that the average consumer is completely tapped out, struggling to stay afloat, and quickly losing the ability to pay back the debt they've accrued.

Check out the New York Fed's report here.

The report dropped on the same day that consumer credit numbers for December came in with only $1.56B in new debt while expectations were $16B. Put another way, the amount of consumer credit that was created in December was 90% lower than the smartest people on Wall Street were predicting. While I am no fan of credit myself and I think people should avoid it as much as humanly possible, this is a pretty stunning miss that signals the American consumer, who is notoriously ADDICTED to credit, can't take on anymore of the heroin because they have reached their limit. Another limit increase would send them into no man's land.

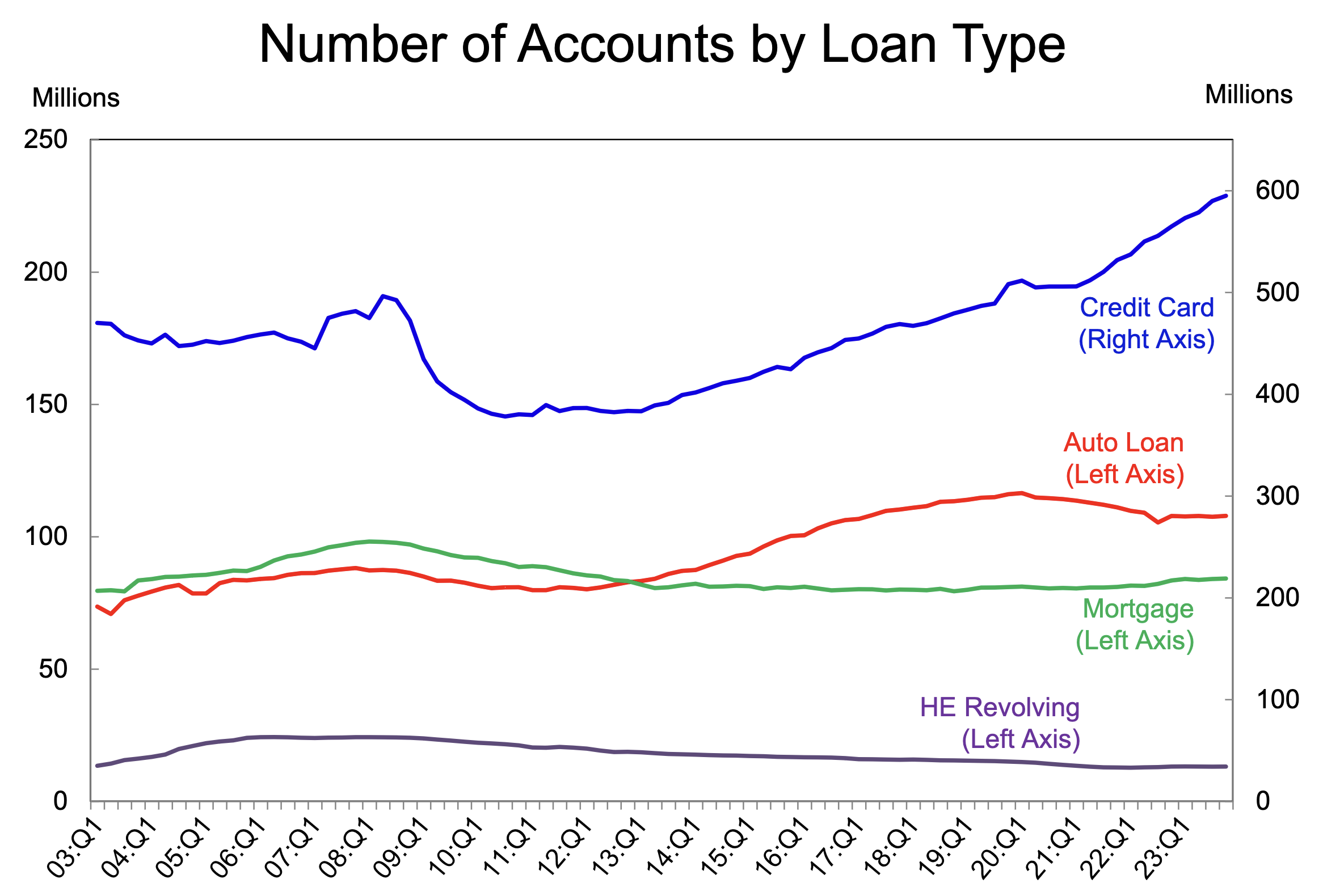

One of the most shocking pieces of data to come out of this report, something that made me rub my eyes to make sure I was reading the right axis correctly, is the number of credit cards held by Americans. Just under 600 MILLION. That is 2.29 credit cards per American over the age of 18. Utterly insane. As you can see from the chart below that number has increased by ~20% since 2020 and far surpasses the number of credit cards held by Americans right before the Great Financial Crisis.

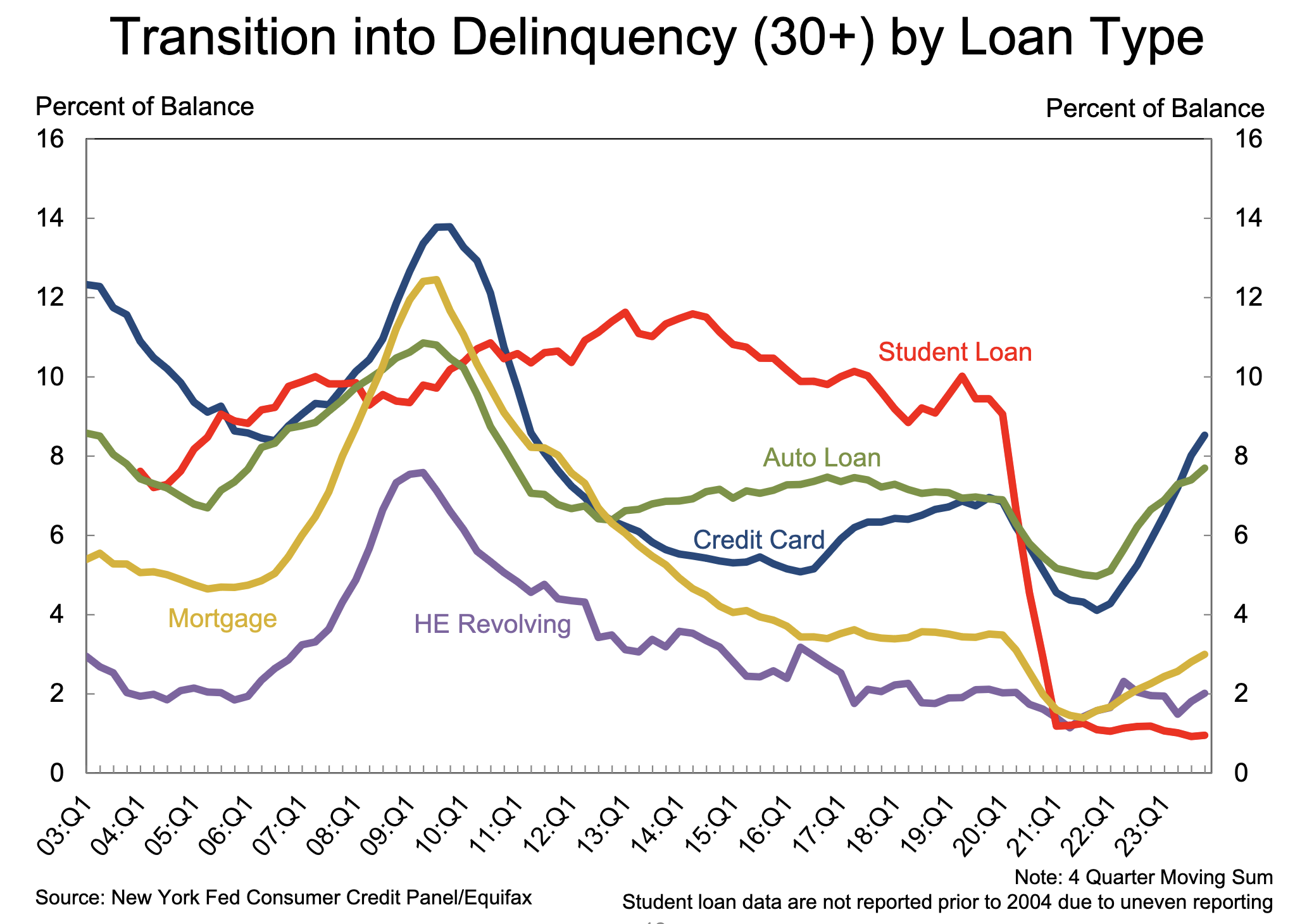

To make matters worse, people are starting to fall behind on their payments for these credit cards at an alarming rate.

Here is the transition into delinquency of more than 30 days:

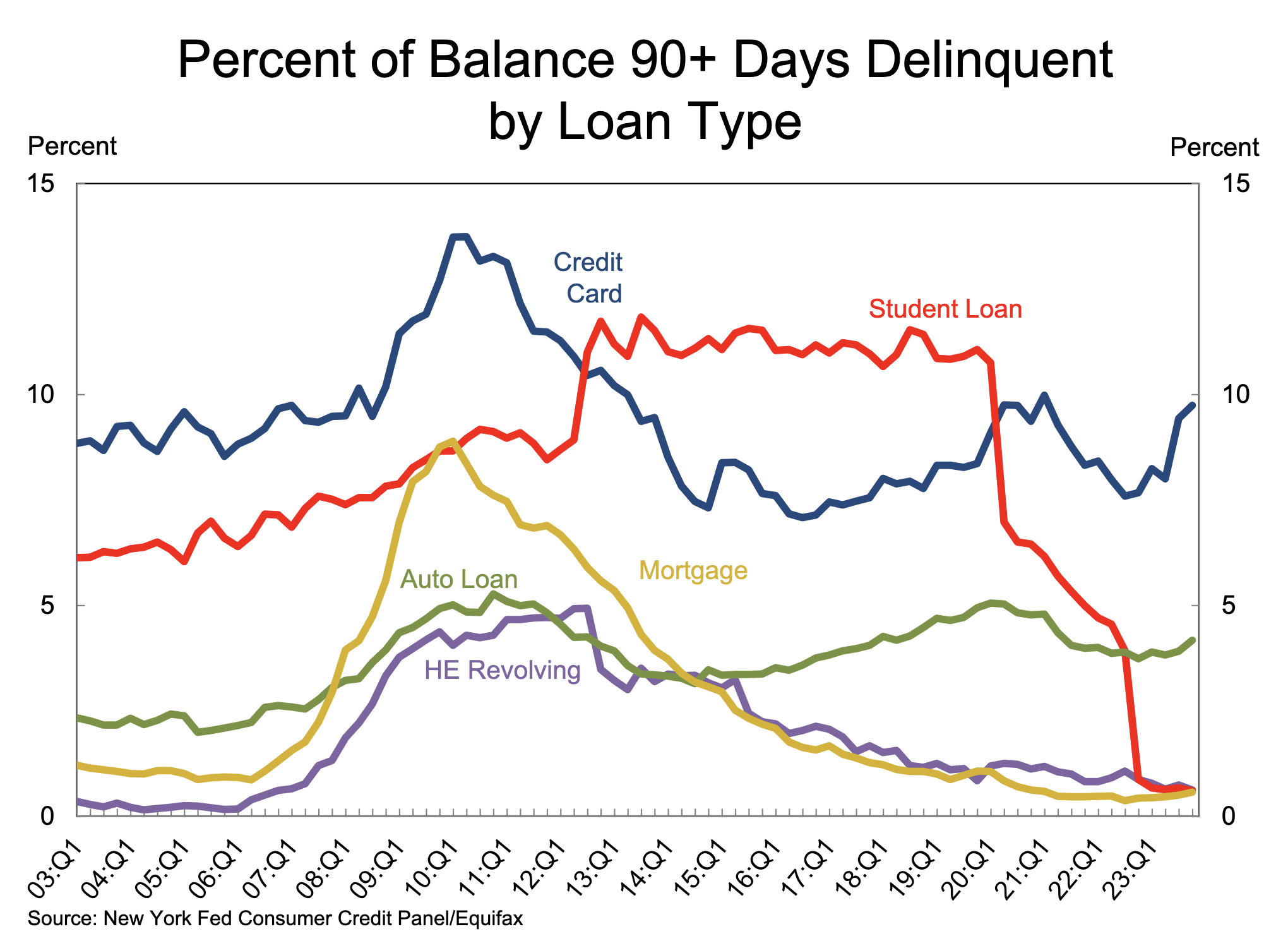

Here is the transition into delinquency of more than 90 days:

Using a squinting eye test it seems that the slope of the increase in 30+ day delinquencies for credit cards is steeper than it was in the lead up to 2008 and the 90+ day delinquency rate seems to be following a similar trajectory. It will take more time for that chart to paint a clearer picture. But I think it is easy to figure out what is happening here when you look at the delinquency rates across the different types of credit.

When it comes to the hierarchy of credit as dictated by Maslow's Hierarchy of Needs, it makes sense that credit card delinquencies are the first to rip higher with auto loans coming in second and mortgages rounding out the top three. People stop paying off their credit cards first and make sure they make their car and mortgage payments as they take priority. People need a way to get to work and drive the family around and they need a house to live in. If forgoing the repayment of credit card debt doesn't prove to be enough, people will stop paying their cars off next and their houses off last.

With interest rates as high as they are and with the amount of consumer debt expansion that happened in 2020-2022, it isn't that surprising that the American consumer is feeling the pain right now. That pain has been exacerbated over the last year with mass layoffs across every sector despite the fact that the Biden administration would lead you to believe that the jobs market and economy are stronger than ever.

"Lowest initial jobless claims in decades" - Even Goldman is mocking the constant political BS spewed by the Biden Dept of Labor propaganda. pic.twitter.com/MKCjQAV4hC

— zerohedge (@zerohedge) January 30, 2024

All is not well in the economy right now and with a banking crisis rumbling on the horizon I find it hard to believe that things could make a rapid turn for the worse in the coming months.

One has to wonder if the average American even cares that they're falling behind on their credit card payments specifically. When you consider that the average American adult holds 2.29 credit cards and the rate of expansion over the last four years, it isn't hard to believe that many have simply thrown their hands up and decided, "If everyone is getting bailed out, I might as well run take advantage of as much credit as is humanly possible and never pay it back. Bail myself out with a trip to bankruptcy court." It's almost as if a nihilistic fervor has taken over the country and most people have decided they might as well get going while the goings good. Ignore the potential consequences and deal with them later. Gary Brode joined us on The Last Trade podcast last week and laid out this exact case.

"If you put yourself in the shoes of the American consumer and they look at everyone else getting bailed out, you can see why people might be willing to run up huge credit card debt and just say we're going to make it somebody else's problem." - @Gary_Brode pic.twitter.com/8v6jcFqVkd

— TFTC (@TFTC21) February 2, 2024

As Gary explains, while many people may be feeling this way and running up their credit because they don't care about the consequences of bankruptcy, someone pays that debt at the end of the day. If enough banks find themselves on the hook for a growing amount of deadbeat credit in the form of credit card, auto and mortgage loans it could lead to a systemic problem that forces the Fed and the Treasury to step in to fill the gap, which means more money printing and price inflation in the future. A vicious cycle currently set on repeat for humanity. Except every subsequent time the song reaches its crescendo it gets louder and more disorienting.

Regardless of whether or not there is a material cohort of American citizens who have adopted a nihilistic view on their relationship with credit, the numbers don't lie. It is becoming increasingly impossible for more and more Americans to cover their debts as they get thrown into the tumbler of inflation eating into their ability to sustain an expected quality of life and a piss poor job market that has turned a worrying amount of people into triple "employed" gig workers.

It doesn't have to be this way. All of these problems stem from a monetary system that is rotten at its core. A monetary system that encourages all of this unnecessary risk. Central planners did this to you and the only way to get out of this problem is to remove the central planners from the equation. This is why we bitcoin, freaks.

Final thought...

I need to take more notes.