The Finance and Expenditure Committee of the New Zealand government held a meeting with the nation's central bank governors yesterday during which the country's central bankers admitted two things.

The central bankers are getting cocky.

— Marty Bent (@MartyBent) February 13, 2024

“It’s a great business to be in. You can print money and people believe it.”

“We actually fund ourselves.”

Pride cometh before the fall.

Bitcoin is a much more ethical and sensical monetary system.

pic.twitter.com/AeY8xEDKJf

The Finance and Expenditure Committee of the New Zealand government held a meeting with the nation's central bank governors yesterday during which the country's central bankers admitted two things; they are openly stealing from their population via overt monetary debasement and they do not understand how successful bitcoin has been to date.

“It’s a great business to be in, central banking. We print money and people believe it.”

For those who are unfamiliar with the gif above, it is from a scene in The Big Short, which chronicled the lead up to the Great Financial Crisis and a few members of the "select few" within the world of finance who were able to correctly identify and grasp the fact that the US housing market was built on a foundation of sand. In this scene, Steve Carell's character is perplexed after a conversation with a couple of mortgage brokers in South Florida who openly admitted that they were accepting mortgage applications from people who shouldn't have been receiving them because it was highly unlikely that they would ever be able to pay them back. To make matters worse, the brokers were bragging about how much money they made from accepting these applications and were quite frank that they actively try to push riskier subprime loans with adjustable rates because they make more money on those loans.

For anyone who has seen this movie, it is impossible to watch the clip from the New Zealand Reserve Bank Governor and not immediately connect it with this particular scene. The parallels are stark. You have an individual bragging about a moral hazard produced by a perverse incentive system that benefits them unduly at the cost of the Common Man, who is completely unaware of the systemic risk inherent in the system. In the lead up to the Great Financial Crisis the Common Man believed that the US housing market was ironclad and that Wall Street was filled with the smartest people in the world. Little did they know that the smartest people in the world, benefiting from easy money, had blown one of the largest asset bubbles in human history. As bubble that inevitably popped and wrecked havoc throughout the global economy.

What we hear coming out of the New Zealand central bank is exactly the same, just another layer down the stack of finance with, astonishingly, a bit more arrogance. Most of the world is completely unaware that the global monetary system is built on a house of cards, better referred to as a Ponzi scheme. The mass of men believe that the money they hold is good money and that the people who control that money, the central banks, are the smartest people in the room. This class of unwitting men is completely unaware that every central bank around the world engages in moral hazard on a day to day basis because they are operating in a system with completely perverse incentives. And our central banking friend is basically admitting this. He's openly saying it is hilarious that billions of people are falling for the immoral scam that is central banking and then enjoying a good laugh with the committee as they bask in the fact that they are pulling one over on every one.

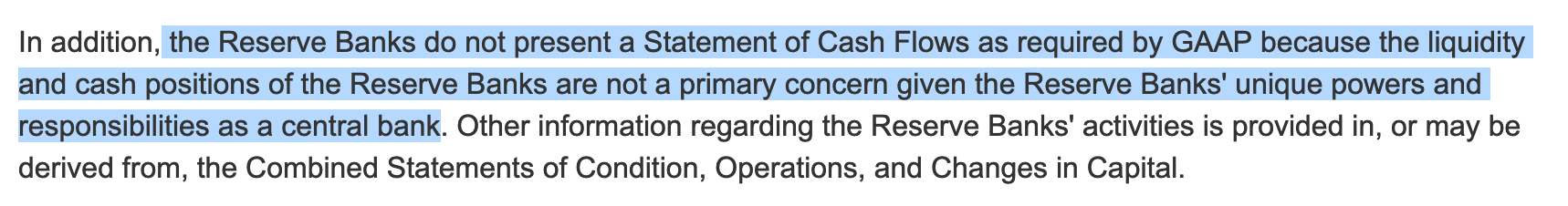

We should give him credit though, this type of forthright honesty is rare in central banking circles. You're supposed to dress up the scam with McKinsey-speak so that it is masqueraded in opaque language that is hard to decipher for the layman. The Federal Reserve here in the United States knows how to do this well as is evidenced by the way they disclose how they do not have to produce a GAAP cash flow statement:

You see pleb, the central banks have "unique powers and responsibilities" that enable them to skirt the proper accounting principles that everyone else is forced to abide by. It's not supposed to be framed as "a great business to be in". That makes the con too obvious. The con most be hidden behind a facade of nonsensical, yet just-official-sounding-enough jargon to make the masses believe that there is some legitimacy backing the Ponzi scheme. The perceived legitimacy is what is backing the fiat currencies of the world. You're not allowed to let everyone know that it's a pure belief with no legitimacy! That may lead to some uncomfortable questions!

They print money and most people believe it. That is all that is backing the global monetary order at the moment. The belief that there is some legitimacy behind it. Well freaks, I hate to burst your bubble, but there isn't. This has been made abundantly clear after every crisis that was created by a central bank reaction that was initiated to solve the crisis that preceded it. If you haven't read Parker Lewis' Enders Game, I highly recommend you do so because he does a masterful job of highlighting that the Federal Reserve had absolutely no idea what it was doing in the lead up to and aftermath of the 2008 crisis.

What's even funnier about the committee meeting in New Zealand is that same central banker attempted to paint bitcoin as an illegitimate competitor to the fiat monetary system.

“Bitcoin is not a means of exchange, it’s not a store of value, and it’s not a unit of account.” New Zealand Reserve Bank Governor

— TFTC (@TFTC21) February 13, 2024

In reality:

- BTC is up 71,001,457% since 2009

- 965,356,378 txs have been confirmed

- More people are selling sats denominated services every day pic.twitter.com/XBP7f4NJlM

This, ladies and gentlemen, is what we in the business of understanding psyops like to call "projection". The rotting, corrupt and incompetent central bankers are trying to project their shitty attributed onto the bitcoin network. This is nice to see. They are scared and they should be. Bitcoin is eating their lunch and humanity will be way better off because of it.

Final thought...

Blaring jazz while being the last one in the office is a nice vibe.