Bitcoin is more than a shared hallucination; it's a groundbreaking asset that redefines the essence of money through its digital scarcity, decentralized nature, and growing acceptance.

The concept of money has been a cornerstone of human civilization, enabling trade and economic growth. Its basic functions include serving as a medium of exchange, a store of value, and a unit of account. However, with the advent of Bitcoin, there has emerged a debate about the essence of money and whether Bitcoin can genuinely function as money. This article seeks to dissect the characteristics of money and analyze Bitcoin's role within this framework.

Money facilitates trade by solving the "coincidence of wants" problem inherent in barter systems. If a person grows oranges and desires a wooden table, but the table maker does not want oranges, a medium of exchange – money – allows the transaction to occur efficiently. Rather than trading goods directly, both parties can transact with a universally accepted intermediary – money – which can then be used to purchase desired goods or services.

Money also serves as a unit of account, providing a standard measure of value within an economy. This function simplifies transactions and price comparisons. For instance, the average cost of a new car in the US is approximately $48,000, and the median house price is around $387,000. Using money as a unit, one can quickly assess the value of goods without complex barter negotiations.

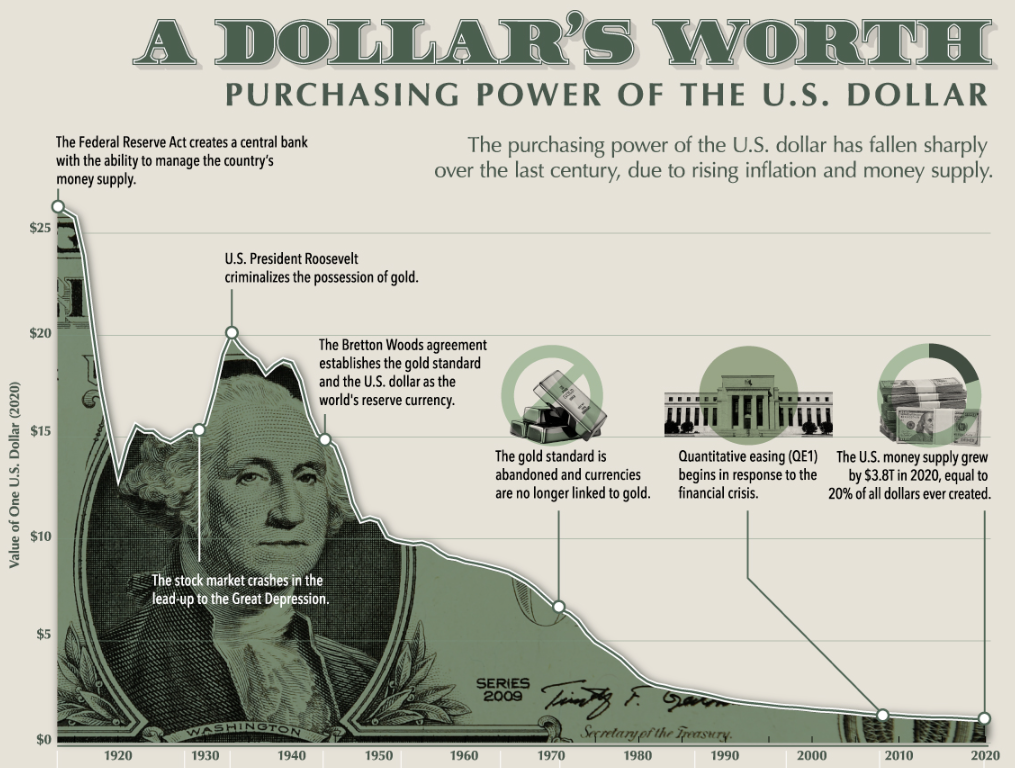

One of the most critical functions of money is its ability to store value over time, essentially allowing an individual to transfer purchasing power into the future. This function is pivotal for long-term financial planning, such as retirement. The stability of money's value is paramount; if it degrades over time, it fails as a reliable store of value. Traditional fiat currencies, while widely used, tend to lose purchasing power due to inflation, as evidenced by the US dollar's significant depreciation since the Federal Reserve was established in 1913.

Conversely, perishable goods, such as fish, are notably poor stores of value due to their limited shelf life and the inability to preserve wealth over time. Even non-perishable commodities like gold have limitations, despite being a historically recognized store of value that is durable, portable, and universally accepted.

Bitcoin's role as money can be characterized as both a shared hallucination and a tangible asset. The term "shared hallucination" refers to the social consensus required for an item to be recognized as money. A currency, digital or otherwise, must be widely accepted to function effectively within an economy. Bitcoin has gradually achieved this consensus, transitioning from a novel concept to a recognized medium of exchange and store of value.

Bitcoin exhibits several attributes that make it a strong candidate for money. It is scarce, with a fixed supply cap of 21 million coins. It is digitally native, making it simple to transfer and verify without the need for physical transportation. It is decentralized and censorship-resistant, affording users a degree of financial autonomy not present with traditional fiat currencies.

Bitcoin's market capitalization has surpassed the trillion-dollar mark, signaling significant adoption and investment. Its value has experienced substantial growth since inception, with notable uptake by nation-states like El Salvador and high-profile investors. While volatile, Bitcoin's long-term trajectory has shown resilience and increasing acceptance as an asset class.

Often likened to digital gold, Bitcoin outperforms gold in several respects, including scarcity, divisibility, and ease of transfer. In a digitized global economy, the ability to transact seamlessly across borders gives Bitcoin an edge over physical commodities.

Despite its strengths, Bitcoin faces regulatory, environmental, and adoption challenges. Its energy-intensive mining process and regulatory uncertainty in various jurisdictions pose hurdles to widespread acceptance. However, its decentralized nature and growing user base suggest a robust future for Bitcoin as a form of money.

Bitcoin can be considered money, fulfilling the core functions of a medium of exchange, a unit of account, and a store of value. While its status may still be evolving, Bitcoin's properties and market performance indicate its potential to reshape the concept of money. As society moves further into the digital age, Bitcoin's role as a financial asset is likely to expand, solidifying its place in the global economy.