The 2024 Bitcoin Halving is set to halve the block reward, initiating pivotal changes for the mining industry.

The Bitcoin mining landscape is poised for a significant transformation as the industry braces for the 2024 Halving, an event set to slash the block reward from 6.25 BTC to 3.125 BTC. This quadrennial occurrence, expected around April 19, 2024, is anticipated to bring critical economic and operational shifts for miners, as detailed in a comprehensive report by Hashrate Index, a leading Bitcoin mining data and analytics platform operated by Luxor Technology.

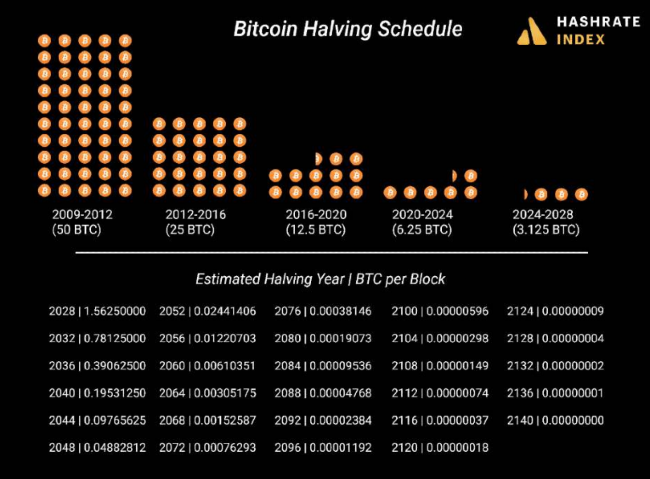

No other major commodity possesses a calculable production schedule with a preordained supply shock quite like Bitcoin. The Halving, baked into Bitcoin's code, is designed to occur every 210,000 blocks, reducing the block subsidy – the new bitcoins awarded to miners for validating transactions – by half. It's a deflationary mechanism that ensures Bitcoin’s supply will never exceed 21 million coins.

The Halving's immediate effect on mining revenue is a certainty: a sharp drop. However, its secondary impacts on Bitcoin's price, network difficulty, and transaction fees remain hotly debated. Some analysts argue that reducing supply issuance could bolster Bitcoin's price, while others contend the Halving should theoretically be "priced in," negating any significant market movement.

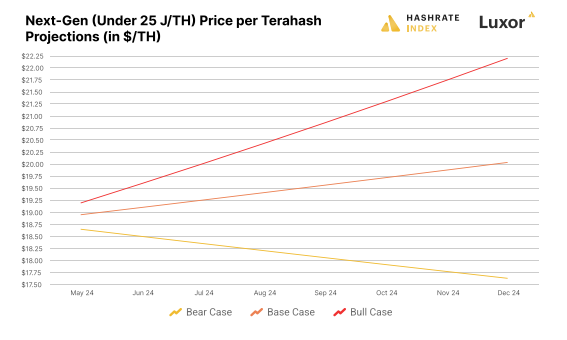

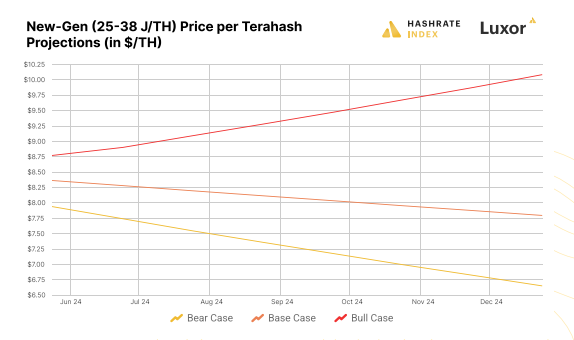

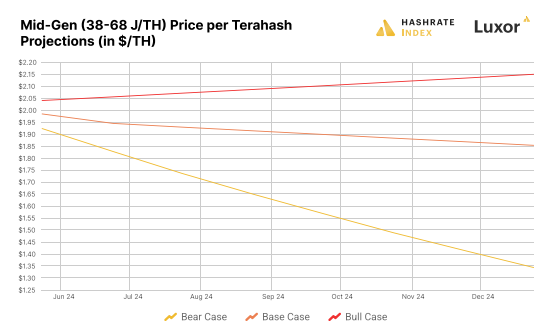

Luxor's Hashrate Index report delves into various scenarios, using quantitative models to project potential outcomes for key mining metrics post-Halving. The projections hinge on several factors, including Bitcoin's price trajectory, transaction fee evolution, and changes in network difficulty.

The report underscores the need for miners to adapt to the post-Halving reality. One critical area is ASIC prices, which are expected to adjust in response to the reduced block subsidy. Miners will need to scrutinize their operational efficiencies, potentially seeking out lower-cost power or upgrading to next-generation mining rigs to maintain profitability.

Public mining companies, known for their efficient operations and aggressive expansion strategies, may experience varying degrees of profitability shifts based on the report's hash price scenarios. The Halving also has implications for hosting contracts, with a possible trend toward profit-sharing arrangements to keep miners operational.

The report predicts a potential migration of mining operations to regions with lower energy costs, such as Africa and South America. Additionally, the adoption of custom firmware to enhance ASIC efficiency could play a pivotal role in extending the lifespan and profitability of mining hardware.

With the Halving poised to introduce revenue volatility, the report anticipates that miners will increasingly turn to financial instruments like hashrate forwards and futures to hedge against uncertainties. These derivatives allow miners to lock in future revenue, providing a buffer against fluctuating Bitcoin prices and mining difficulty.

The upcoming Halving represents both a challenge and an opportunity for the Bitcoin mining industry. While the event could constrain revenue and margins, it also pushes the sector toward greater innovation and efficiency. Miners who navigate these changes successfully may emerge stronger and more resilient in the face of a dynamically evolving market.

The full report