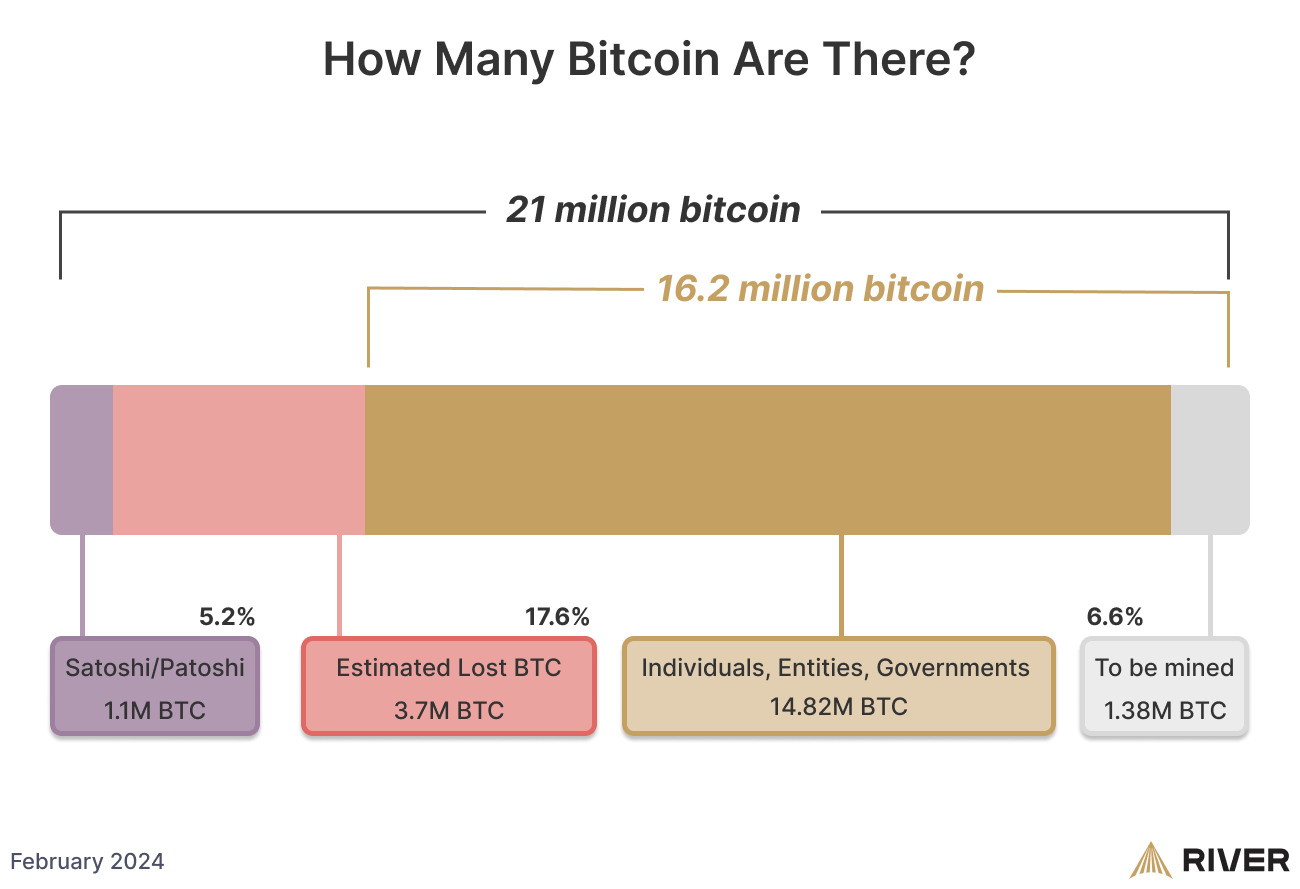

The estimated number of lost Bitcoin amounts to around 5 million, unrecoverable due to forgotten or misplaced keys, inadvertently contribute to the scarcity and redistribution of value within the Bitcoin ecosystem.

An intriguing aspect of Bitcoin is the phenomenon of lost coins – those that are no longer accessible due to misplaced or forgotten private keys. This article delves into the implications of lost Bitcoin on the total money supply and the sustainability of the Bitcoin network.

The concept of lost Bitcoin refers to coins that are inaccessible due to the loss of private keys required for transactions. Estimates suggest that around 5 million Bitcoins, including roughly 1 million owned by Bitcoin's creator, Satoshi Nakamoto, are potentially lost. This reduces the effective maximum supply from the hard cap of 21 million Bitcoins to approximately 16 million.

Determining whether Bitcoin has been lost is a complex matter. There is no definitive method to prove the loss of spending keys, and inactivity of an address does not confirm the loss of its associated keys. Nonetheless, some Bitcoin is provably lost, such as coins sent to so-called "burn addresses," where the private keys are unknown or unobtainable.

Presently, there is no existing protocol or program that reclaims lost Bitcoin into the circulating supply. Any attempt to do so would be tantamount to theft, as it would involve altering the protocol to seize assets that may belong to individuals who have chosen not to move their coins or are saving them for future generations.

The loss of Bitcoin effectively acts as a proportional redistribution of value to other Bitcoin holders. Rather than being a system that penalizes responsible management of assets, Bitcoin rewards careful individuals by increasing the scarcity and potential value of their holdings.

The finite supply of Bitcoin is often criticized based on Keynesian economics, which advocates for a growing money supply to support a growing economy. However, Bitcoin's design allows for the free market to adjust the value of each unit of currency. As Bitcoin's price increases, the market capitalization, and consequently the money supply in terms of purchasing power, also increase without the need to produce additional units.

Contrary to some economic theories, deflation in the Bitcoin ecosystem, driven by technological progress and increased efficiency, is not inherently destructive. Historically, periods of deflation have coincided with innovation and improved standards of living when not accompanied by excessive debt.

The loss of Bitcoin does not pose an existential threat to the network or the currency's sustainability. Bitcoin's fixed supply and the potential for deflationary growth encourage responsible financial management and can foster an economy that thrives on technological advancement and efficiency. As a decentralized digital currency, Bitcoin presents a model for a sound money system free from the inflationary practices of traditional banking and monetary policy.