When you compare the activity happening at bitcoin's base layer to Fedwire you'll notice that bitcoin is scaling just fine.

The topic of bitcoin scaling solutions seems to be bubbling up again. Many people are discussing whether or not certain OP codes should be added to the protocol to enable things like covenants, zero knowledge proofs, and cross-input signature aggregation, among other things. Not only are people discussing them, but many are pushing to have some of these proposals soft forked into bitcoin as soon as possible. While I have my own thoughts about particular proposals and whether or not they'd be advantageous, I don't share the urgency that many currently sparking these conversations seem to have. Particularly those who would like to replicate the "L2 functionality" altcoins have enabled in recent years. In my opinion, I don't think it should be a priority to replicate these use cases on bitcoin. They have provided little utility outside of degenerate gambling to date.

A lot of the conversations around these soft forks seems to be driven by the beliefs that bitcoin isn't scaling sufficiently to meet the coming demands of the market and more "L2s" need to be enabled to stoke a "sufficient fee market" to properly secure the network. I don't think either of these things are a problem and I think everyone who is opining about these perceived problems is doing so out of a misunderstanding of what bitcoin is competing with at the protocol level; Fedwire and similar central bank settlement networks.

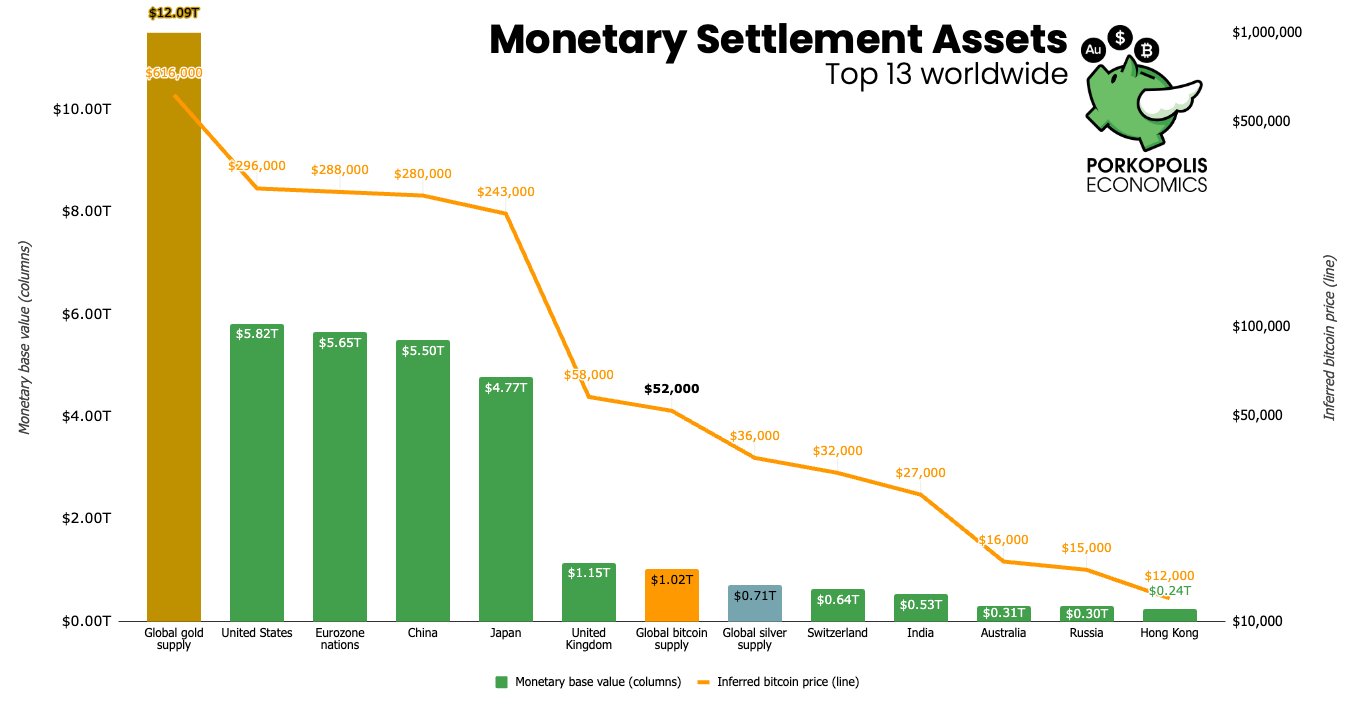

Earlier today I recorded an episode of the TFTC podcast with Matthew Mežinskis to walk through his Q4 2023 monetary base update. As it stands today bitcoin is the 7th largest base money in the world and the 6th largest when you exclude gold.

This is pretty remarkable when you consider that bitcoin has only been competing in the market for base monies since January 2009. It doesn't seem like a perceived scaling deficiencies have prevented bitcoin from competing with currencies that have been around for centuries.

Matthew and I have been recording a podcast every quarter to go over his monetary base updates for the better part of four years now and I always look forward to our discussions because he does the best job of surfacing high signal economic data pertaining to bitcoin out of anyone I have ever met. Today's discussion did not disappoint. We walked through some new data we have never discussed throughout the years; a trailing 12-month comparison of payment volumes and transfer values on bitcoin and Fedwire. These are two of the most bullish charts I have ever seen. They highlight that bitcoin is not merely competing with its base money competition, but it is already out-competing Fedwire. Let's take a look at the charts.

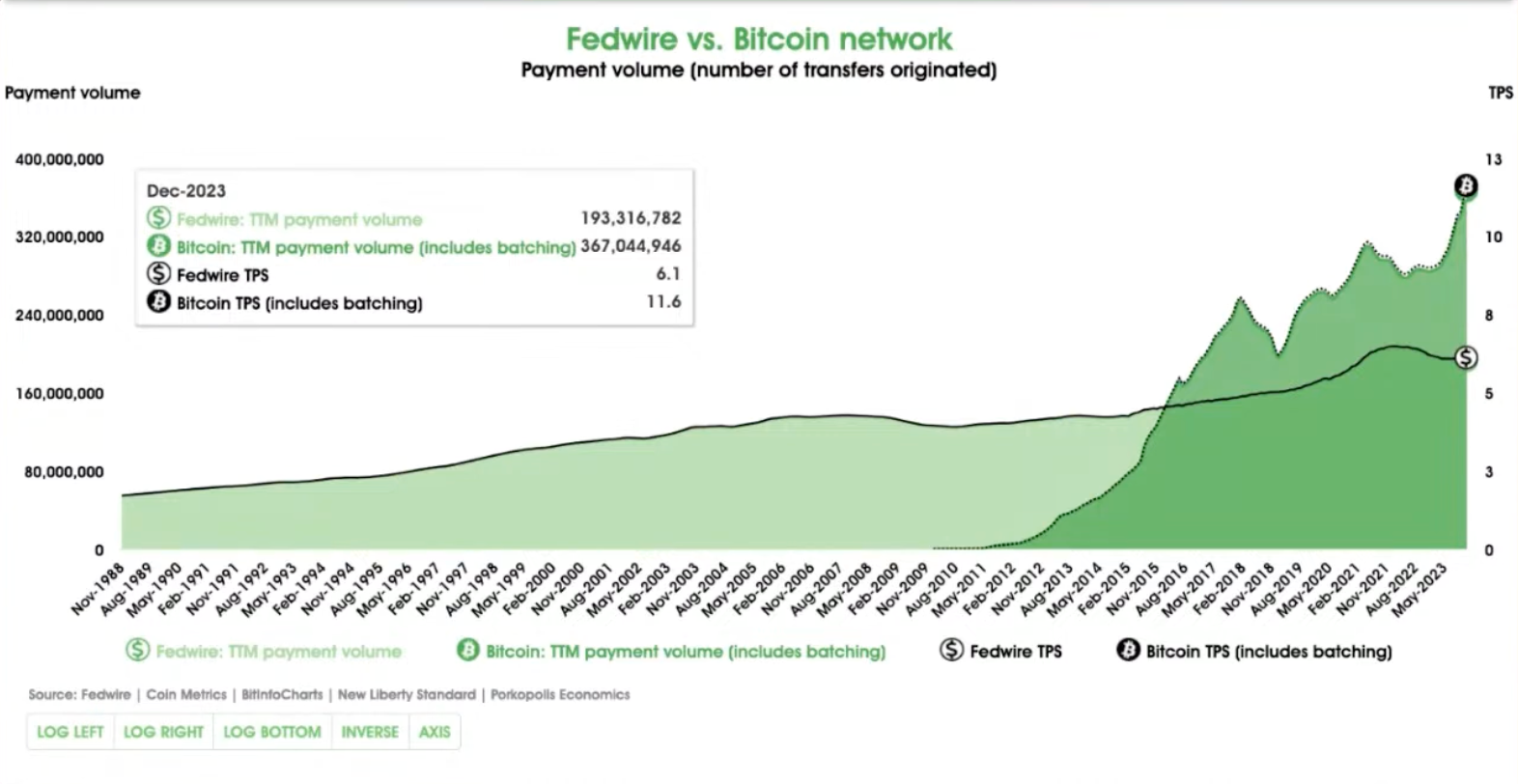

Here we have a chart of the trailing 12-month payment volumes on bitcoin and Fedwire. In 2023, Fedwire averaged ~530,000 payments per day and the trailing 12-month volume was 193,316,782 payments. Bitcoin almost doubled that volume with 367,044,946 payments over 2023. Matthew's calculations take change outputs out of the equation. When you spend bitcoin you make two transactions if you don't spend the full UTXO; one transaction goes to the person you are transacting with and another goes to a change address associated with your wallet. The change address address transaction isn't really an economic transaction, so it is taken out of the dataset. This chart would make bitcoin look more dominant than it already is if those transactions were included.

This calculation also includes batched transactions, which enable users to batch multiple inputs into a single transaction to pay multiple people at once. This is typically done by exchanges who are processing bitcoin withdraws for their users. Instead of sending each user an individual transaction, the exchanges collect dozens or hundreds of withdraws and batches them into a single transaction. This practice has increased the number of transactions per second from 3-4 transactions to ~12. Allowing the bitcoin network to process ~1,000,000 transactions per day.

Again, this is already almost double the amount of transactions that are processed by Fedwire each day and an overwhelming majority of those transactions have better final settlement times compared to Fedwire. If batching becomes more efficient and more widely adopted bitcoin's advantage over Fedwire when it comes to payment volumes can grow even larger.

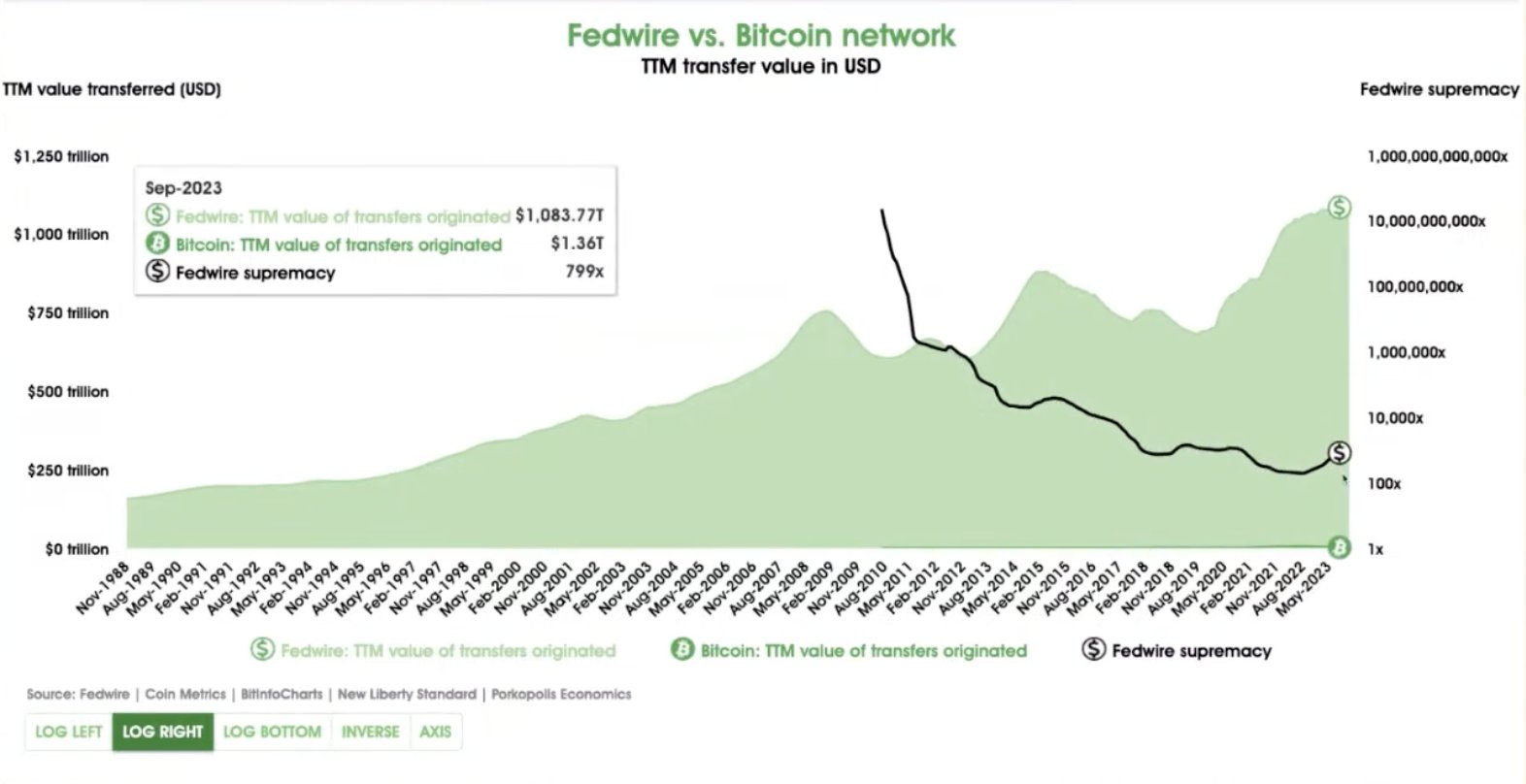

Here's the chart of the 12-month trailing transfer value of Fedwire and bitcoin with the Fedwire supremacy ratio overlaid on a log scale. As you may imagine, at the current moment, the amount of value that Fedwire transfers and settles far exceeds the amount of value settled by the bitcoin network. Last year Fedwire transferred $1.083 quadrillion while bitcoin settled $1.36 trillion. Put another way, Fedwire moved almost 1,000 times more value in 2023. A wide gap to fill!

While that gap is wide at the moment the black line on the chart is showing that bitcoin has been making steady progress to close this gap. In 2010 Fedwire was transferring 22.4 billion times more value than the bitcoin network on a 12-month trailing basis. Today, it is only transferring 799 times more value than bitcoin. And at one point in late 2022 that ratio fell to 190. As the price of bitcoin increases, this ratio will only go lower, at some point it will reach parity, and eventually it will surpass Fedwire in transfer value.

I don't know about you freaks, but bitcoin seems to be scaling just fine at the protocol level to me. Especially when you compare it to its true competitors; other base monies and the rails they settle through.

The questions that remains are, "How do we scale beyond large settlement payments and enable transactions of a smaller value size so that bitcoin can be used efficiently as a transactional currency?" and "How many individuals will be able to hold economically viable UTXOs at the protocol level?"

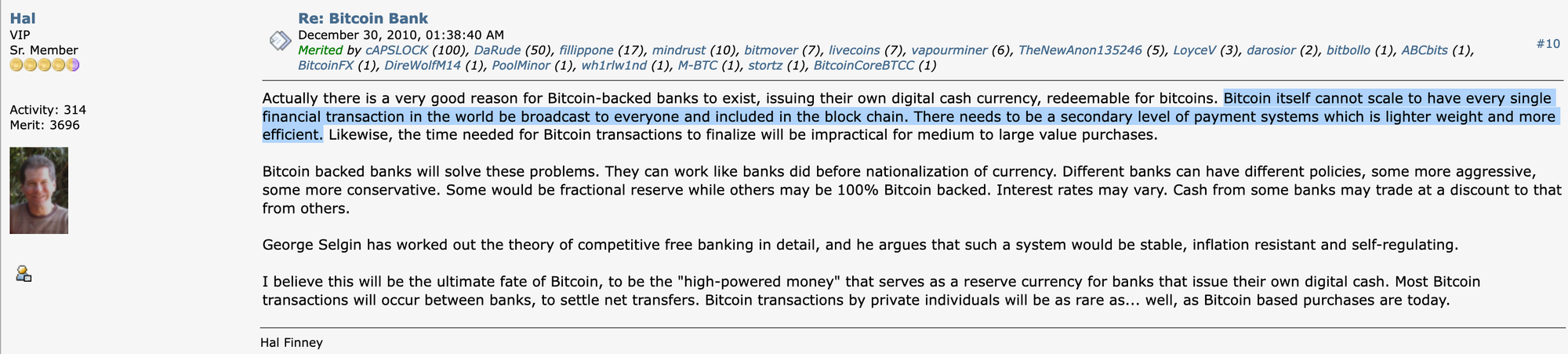

Personally, I think that we should treat the protocol level as a settlement layer for large transactions and push smaller transactions up to higher layers. Hal Finney was incredibly prescient in December of 2010 when he made everyone aware that "[..]bitcoin itself cannot scale to have every financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient."

We are beginning to see Hal's 2010 vision come to life via second layers like Lightning, Chaumian Mints, Liquid, and other solutions like statechains. All of these second layer solutions are still in the early days of their build outs and some are showing a lot of promise.

I do not feel like there should be any urgency to rush through one or many potential scaling solutions for bitcoin right now. There are a ton of low hanging fruit that bitcoiners should be taking advantage of to push the limits of what we have in our hands today. There are efficiencies to be gained with more users adopting best transaction batching practices, leveraging things like Miniscript to create unique scripts that enable desired conditional transactions, connecting lighting with Chaumian mints at scale to bring faster final settlement and more privacy, and experimenting with other second layer solutions that are possible today.

Rushing through a soft fork that could introduce unexpected negative externalities to the network is not a wise decision. One of the main reasons that bitcoin is valuable in the first place is that it is extremely hard to change. Rushing through soft forks so that people who want to engage in altcoin degeneracy can do so seems extremely shortsighted at best and totally reckless at worst.

Bitcoin is already scaling quite magnificently despite what some impatient people would lead you to believe.

On a side note, if you have made it this far, you should subscribe to Matthew's YouTube page. He is putting out very high signal content about bitcoin, economics and markets on a daily basis.

Final thought...

Spring has sprung in Austin, Texas.