The real estate industry in the U.S. is at a crossroads, with class action lawsuits challenging long-standing practices.

The real estate industry in the United States is currently reeling under the impact of several class action lawsuits that could potentially reshape the landscape of real estate transactions and commission structures.

In October, a landmark verdict was reached in Missouri, where the National Association of Realtors (NAR) and several brokerages were found guilty of conspiring to inflate commission rates artificially for home sales. The federal jury ordered the payment of at least $1.8 billion in damages to affected sellers who sold homes between 2015 and 2022.

The crux of the issue lies in the traditional real estate commission structure in the U.S., where sellers pay an average of 6% commission, typically split equally between the seller's and buyer's agents. This practice has been challenged by companies like Redfin, which have attempted to introduce more competitive rates, often facing resistance from established brokers.

Following the Missouri case, new class action lawsuits have emerged, cumulatively amounting to potential damages of $13 billion. These lawsuits target the same alleged anticompetitive practices and could further strain the NAR and associated brokerages.

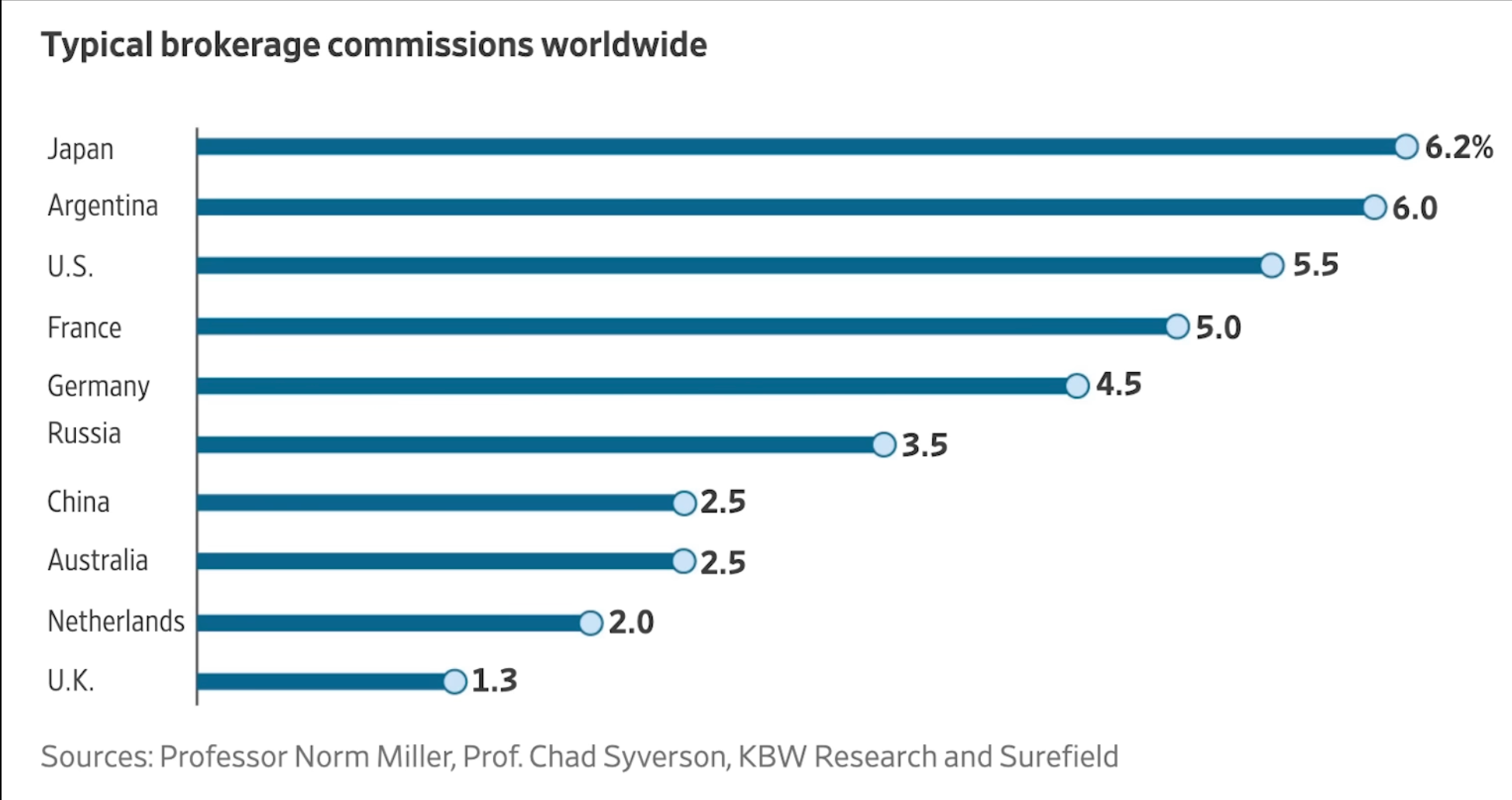

The U.S. real estate commission rate is significantly higher than in many other countries. For example, the UK averages around 1.3% in total brokerage commission, whereas China is at 2.5%. This stark contrast has fueled the argument for revising the commission model in the U.S.

The real estate industry in the U.S. is at a crossroads, with these class action lawsuits challenging long-standing practices. The outcomes of these legal battles could usher in a new era of real estate transactions, marked by increased competition, transparency, and potentially lower costs for consumers. However, the full ramifications of these cases will only be understood as the legal process unfolds and the industry responds to the changing landscape.