In a recent CNBC interview with Howard Lutnick, CEO of Cantor Fitzgerald, Howard provided insights regarding his perspective on the future of the global economy and the potential shifts in policy from major central banks like the Federal Reserve, the Bank of England, and the European Central Bank.

In a recent CNBC interview with Howard Lutnick, CEO of Cantor Fitzgerald, Howard provided insights regarding his perspective on the future of the global economy and the potential shifts in policy from major central banks like the Federal Reserve, the Bank of England, and the European Central Bank. Lutnick offered a candid perspective on the anticipated response of the Federal Reserve to current economic conditions, suggesting that Chair Jerome Powell will eventually have to "bow to reality" and signal the timing of rate cuts.

Lutnick argued that the Federal Reserve is characteristically slow to act and predicted that the central bank would maintain a steady course rather than rush into policy changes. He cast doubt on the likelihood of near-term rate cuts, indicating that such a move would only come when the economy "really needs it." In discussing the health of the economy, Lutnick questioned whether the current state of the S&P 500 suggested an immediate need for rate cuts, implying that the market does not yet feel the pressure for such action.

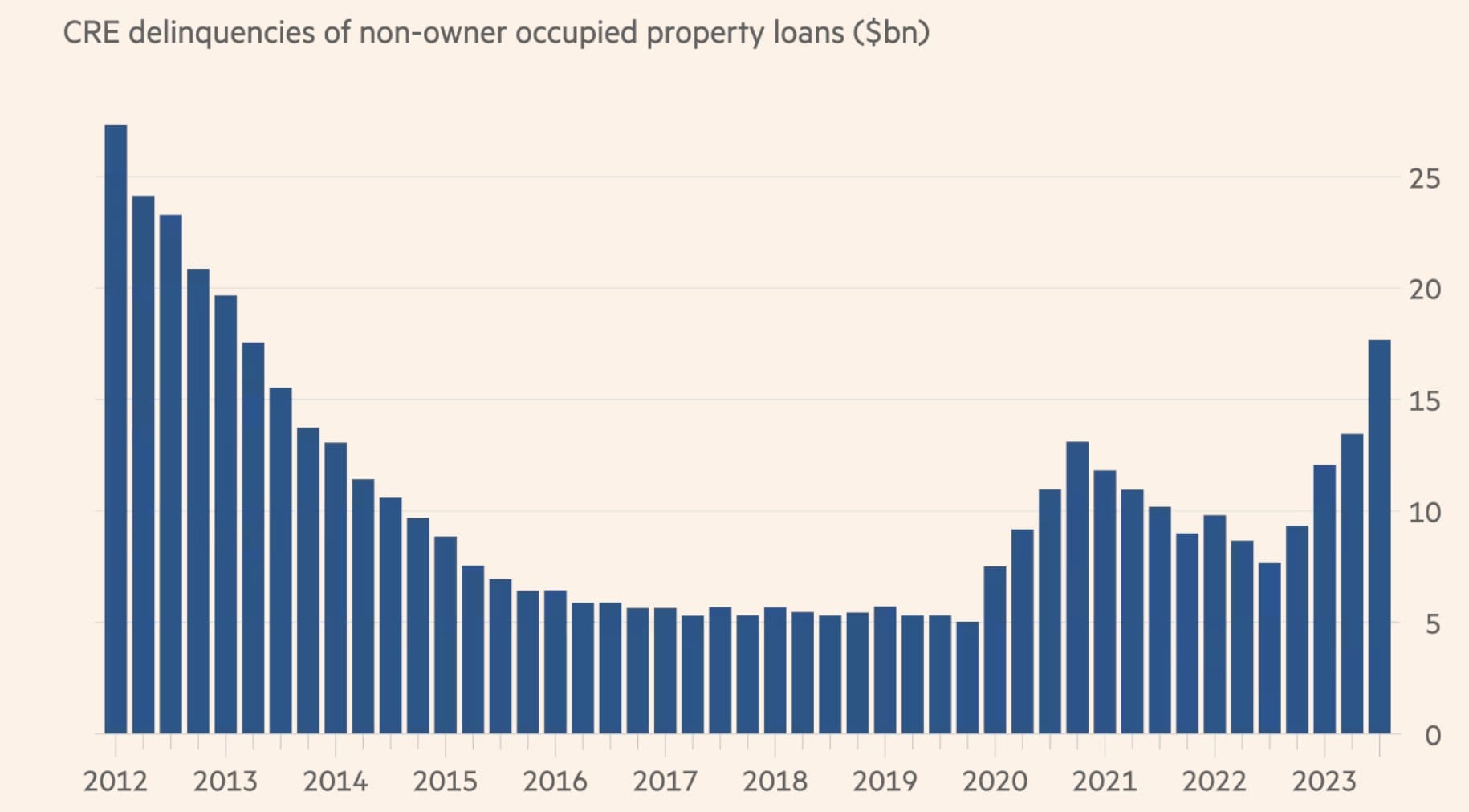

Turning his attention to the real estate sector, Lutnick painted a stark picture for those with equity in real estate. He highlighted the looming challenge faced by property owners needing to refinance buildings that were initially financed a decade ago at very low-interest rates. With refinancing now coming at less favorable terms, Lutnick predicted that defaults on commercial real estate could reach $700 billion over the next two and a half years—though he did not specify the source of this figure.

Lutnick further elaborated on the potential for a "generational win" for his firm, Newmark, in the context of these defaults. He referenced Newmark's recent liquidation of a $60 billion loan portfolio from Signature Bank and forecasted a robust market for real estate services towards the end of 2024 and into 2025. He anticipated a surge in property sales as banks, under Basel III regulations, would be eager to offload defaulted properties rather than hold onto them, breaking the pattern of "kicking the can down the road."

According to Lutnick, this sell-off would enable new buyers to acquire properties at much lower prices and offer leases at more competitive rates, effectively resetting the market. He concluded that while the banks are likely to avoid losses due to prudent underwriting post the 2008 financial crisis, a significant amount of real estate would be entering the market, signaling a fresh start for the sector.