A vision for the ideal zero-dollar bank. #GetOnZero

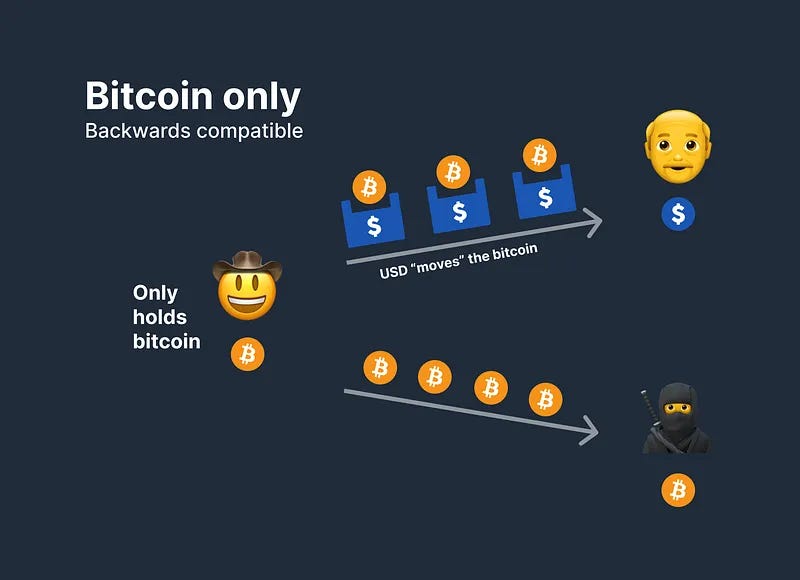

In The Zero Dollar Manifesto: Part One, we talked about why you’d want to hold zero dollars. With GetOnZero, you use bitcoin as the money in your checking account, while using the dollar as a legacy payment rail to remain interoperable with the fiat system. The benefits are clear to anyone who’s been down the bitcoin rabbithole: you are upgrading your money from one that is being actively devalued, to one that can’t. Touching dollars for no longer than a millisecond (only at the time of transaction) allows us to completely sidestep financial debasement by unelected bureaucrats in government.

In The Zero Dollar Manifesto: Part Two, we walk through how to achieve this goal with the tools we have available to us today. Much of the process involved disparate tools, manual processes, and periods where we may be exposed to the dollar more than we’d ideally like to be.

For example: you receive your paycheck via your “ACH Node” (discussed in Part Two here) via dollars. Instead of being instantly, automatically converted from Weak Money (dollars) to Strong Money (bitcoin), today you manually “buy” bitcoin with those dollars. Next, when it comes time to pay a bill through dollars via your ACH node, you manually “sell” the exact amount for the conversion & payment to go through. Unfortunately, chances are that your bills are not all due on the same day. This complication implies one of two strategies—either:

Filing taxes at the end of the year is much easier than you may think, but still may involve a little bit of manual effort:

I get it. Between work, family, and rising cost of living, we all have enough to deal with on a day-to-day basis. No one is looking for additional friction in their financial tools; none of this is the ideal GetOnZero experience. With that said, we’ve come a long way in the last few years. Developers and companies like Fold and Strike working on GetOnZero tools are actively looking for help—we owe it to ourselves to give them feedback and steer them in the right direction! I would argue that these compromises are minor, and are absolutely worth it in order to avoid financial debasement and fully participate in the upside of bitcoin’s purchasing power.

Originally, internet connectivity relied on dial-up connections through traditional, legacy phone lines, necessitating a switch between phone and internet usage. However, with technological advancements, the landscape shifted towards broadband internet access and Voice over Internet Protocol (VoIP) for voice communication. This transition streamlined communication processes, offering faster internet speeds and enabling seamless integration of voice and data services over a single, interoperable network. Fast-forward past the transitionary period to today, and modern phone calls now primarily utilize digital upgraded networks, providing enhanced reliability, clarity, and efficiency compared to the legacy network.

In much the same way, I see interoperability with legacy payment rails as a transitionary phase as we evolve into a fully hyperbitcoinized world with bitcoin as store of value, direct medium of exchange, and unit of account. Until then, it helps to have a foot in both worlds so we can focus on our craft, providing value, and enjoying life - rather than worrying about having a second job as an investor.

Let’s be very clear about the ultimate vision of what a GetOnZero bank looks like: with your upgraded bank account, you will be able to send and receive money - anytime, anywhere, using any payment rail, without holding any fiat currency. You hold Strong Money (bitcoin) while being interoperable with anyone, regardless of what the medium of exchange or payment rail is. Conversions will happen instantaneously and automatically, without having to think about the underlying mechanics.

Whether it’s dollar bills, lightning network, ACH, ecash, or PayPal, you are fully interoperable with any payment rail while only holding bitcoin—upgraded money.

Here are the missing pieces, and the path to get to GetOnZero bank vision:

Conversions between Strong Money (bitcoin) and Weak Money (dollars) must be instant. When receiving via the dollar network, it’s important to instantly convert to bitcoin to completely sidestep fiat financial debasement. When sending money, conversions from bitcoin to dollars must be instant, to be able to make payments at any time without running into liquidity constraints (eg. waiting 2-5 business days for a transfer to settle).

Today, some products have instant conversions (milliseconds), while others have near-instant conversions (1-5 minutes). As conversion time decreases, we’ll be exposed to weak money for little time.

While not a strict requirement for those of us that are willing to jump through a few hoops (like manually buying and selling), automated conversions between Strong Money (bitcoin) and Weak Money (dollars) are critical to providing a smooth user experience that abstracts away underlying complexities–the optimal user experience.

When dollars touch your bank account (via ACH, account/routing number, or wire) a bitcoin-buy order is placed, instantly converting the fiat currency into bitcoin.

On the other side (say you need to pay off your credit card bill, denominated in fiat currency): When an ACH-pull is triggered by your credit card company, a bitcoin-sell order is placed, converting the exact amount of bitcoin you need to fiat currency to pay off the bill.

This way, you are only exposed to fiat currency debasement at the time of transaction, and for no longer.

There is no denying that it’s important for a financial services company to be able to earn revenue to be a sustainable business. That said, charging a fee (or spread) on conversions negatively incentivizes the conversion process.

It’s not a big deal if a is occasionally buying bitcoin or sets up a recurring DCA. It’s much more painful when they are frequently converting between Weak and Strong money. Conversions should not be penalized! Fees cause huge psychological friction.

Instead of charging a conversion fee, the ideal Strong Money bank would charge a recurring subscription fee, better aligning incentives for providing a valuable financial service. This bank could have two tiers of service: one for occasional buyers (fee-based) and another for those who live on bitcoin (subscription).

Interoperability with legacy rails is critical for this transitionary period we’re living through. With that said, being able to make payments via superior, upgraded rails (bitcoin-native rails) is even better whenever possible. If you’re able to spend your money (bitcoin) with both payment rails, you and your counterparty have a choice of which rail to use—and there are clear benefits of using upgraded rails.

The lightning network is a second-layer scaling solution for near instant, inexpensive bitcoin payments. You can think of lightning as a clearing mechanism between different self-custodial wallets, fedimints, and banks. Imagine a world where you can spend bitcoin to pay rent via ACH, and pay for coffee via lightning—using the same Strong Money bank. A single bitcoin balance, available to pay anyone, regardless of rails.

Most bitcoin banks will likely be custodial (third-party custody), at least during this transitionary period of using the dollar as a legacy payment rail. While there is certainly a downside risk of custodial bitcoin, the benefit is ease of use and user experience. By storing some money in a Strong Money Bank, you can seamlessly spend that money via bitcoin-native rails, or legacy (dollar) rails without having to manually transfer funds.

On-chain withdrawals of your bitcoin will be critical to allowing for a “run on the bank”, and will help to keep these Strong Money banks honest. In your bitcoin bank, store only what you need for your “checking account” amounts, and withdraw the rest to cold storage. Not your keys, not your bitcoin.

However, some people that have a fixed number of bills in the month (say, a couple credit card bills, mortgage, car payment) may be comfortable with the tradeoff of manually depositing bitcoin into their Strong Money bank right before a payment is due, in order to minimize custodial risk. A good Strong Money bank should allow you to deposit and withdraw your money to your own self-custody wallet via bitcoin-native payment rails (on-chain, lightning).

As bitcoin evolves as a medium of exchange, many customers will want to accept bitcoin directly for goods and services. As Parker Lewis talks about in his Pay Me In Bitcoin Theory, this behavior is rational. Accepting bitcoin directly bypasses added friction in acquire Strong Money: namely cost in conversion between Weak and Strong Money, and using more privacy preserving payment rails (bitcoin-native rails). Allowing for bitcoin deposits will make your bitcoin bank a one-stop shop for all bitcoin transactions, including using legacy payment rails via the dollar.

Allowing for deposits will also let customers spend bitcoin savings without having to keep a large custodial balance. By withdrawing your balance after exceeding a certain amount (based on your custodial risk appetite), you can withdraw to self custody. Then, if you need to spend your bitcoin via the dollar as a payment rail, deposit the bitcoin and spend via your bitcoin bank.

Today, your bitcoin exchange or Strong Money bank provides a simple spreadsheet of buy and sell transactions. This data needs to be manually formatted, and then uploaded to your tax tracking tool of choice (eg. Cointracker). Getting this transaction information into the tool is important to be able to minimize your tax liability, since we are converting between Strong and Weak money often. As we discussed in detail in The Zero Dollar Manifesto: Part Two, capital gains tax should not be an impediment to upgrading your money. If you owe tax, it’s because you are coming out ahead compared to holding Weak Money. All of this is fairly straightforward, and takes me around 30-60 minutes every year.

That said, it is additional friction that could be abstracted away. In the future, Strong Money banks could export spreadsheets already pre-formatted for the most popular tax tracking software. Even better—they could have one-click integrations with tax tools like Cointracker or TurboTax.

As we discussed in The Zero Dollar Manifesto: Part Two, spending on credit is not critical, but helps streamline some of the experience around transactions. If you could minimize spending your bitcoin to zero (and spend on credit), would you?

In this hypothetical example, your checking account balance (held in Strong Money: bitcoin) would be used as collateral for a revolving line of credit (similar to a HELOC) that you could draw on at any time. This bank would have both ACH and lightning network interoperability, so that you could “unleash” your collateral (checking account balance) without spending it directly, to pay for rent, coffee, and more.

The obvious risk here would be exchange rate fluctuations, but it could be mitigated by having enough of a balance to be able to withstand harsh drawdowns.

Relax—I’m not talking about altcoins!

GetOnZero doesn’t mean hold only bitcoin. It just means holding fiat currencies that are actively debased by governments.

What if you could hold Apple shares, stock market index funds, or even gold ETFs in your Strong Money bank, and be interoperable with all payment rails? Imagine a basket of these non-dollar assets as your money that you can send, receive, and save in. It’s not something I’m personally interested in (bitcoin-only for me!) but I could see this being a useful bridge service, especially for those who are more concerned about bitcoin’s near-term exchange rate volatility measured in dollars. Additionally, this would likely increase the total-addressable-market for a GetOnZero product by going beyond just bitcoiners.

Debit cards are important for both spending money, and being able to withdraw dollar bills from ATMs. “Spend your bitcoin” using dollar bills as a payment rail: a great privacy win! Some transactions require the use of personal checks, so being interoperable with that payment rail is important as well.

In my opinion, Know Your Customer and Anti Money Laundering laws harm honest citizens more than they do stop criminals, and should be abolished. That said, there is no denying the fact that Strong Money bank will be required to comply with KYC/AML regulations. I don’t like it or agree with it, but that’s one of the tradeoffs of using a convenient Strong Money bank.

If noKYC is a strict requirement for you, I still think the Strong Money mental model can be a valuable one to internalize. Holding as few dollars as possible should be the goal, and the specific mechanics can be adjusted depending on your acceptance of KYC vs UX tradeoffs.

Some examples of privacy-friendly ways of spending Strong Money are: The Bitcoin Company VISA gift cards, Fold gift cards, and noKYC physical cash ATMs.

You may still want to track the cost basis of your noKYC coins. Privacy is the ability to selectively reveal information about yourself, so being able to choose to reveal cost basis information if you need to spend large amounts of bitcoin via a KYC exchange (eg. buying a house) can be a useful preparatory tool.

Looking ahead: imagine a future where all Square terminals accept bitcoin directly, and your landlord accepts bitcoin as payment. I’m optimistic that this future is coming soon. I am hopeful that legacy payment rails are a transitionary phase until bitcoin-native rails are more commonplace, and we can spend bitcoin directly in a more privacy-preserving way.

Note: I am by no means a bitcoin privacy expert. Follow my friends Matt Odell and Tony Giorgio for more information on how to transact privately with bitcoin.

Bitcoin has superior monetary properties to dollars in almost every way. Those of us who already have a large potion of their savings in bitcoin already understand this. As far as I can tell, the primary benefit of the dollar is its salability—that is, it’s much more widely accepted around the world.

When we GetOnZero and use the dollar as a payment rail rather than an asset, we get the best of both worlds: the salability of dollars with the store of value properties of bitcoin.

After Parts 1, 2, and 3, we now understand why we should hold zero dollars, know how to functionally implement the framework today, and are aware of the tradeoffs. If you believe in this vision and are a builder yourself, now is the time to implement this vision. If you work at a bitcoin company, consider adding these features to your roadmap. If you’re a client of a bitcoin company, ask your favorite product when they are going to help you GetOnZero.

Now is the time. There is no need to wait for “hyperbitcoinzation”. We’re living through it.

Have specific questions? Find me on Twitter @SahilC0 and join the GetOnZero Telegram group here.

Read Part One and Part Two on TFTC.

Originally published on Sahil's Substack