Is Tether leading the Treasury toward a soft landing?

These numbers are off the charts.

— Preston Pysh (@PrestonPysh) July 31, 2024

Guess what folks? They make massive profits due to higher yields on short duration paper.

Guess how they are choosing to store their retained earnings? That’s right: #Bitcoin.

If you work at the US Treasury and actually want a market for… https://t.co/3j02thNKI3

Tether reported it's quarterly earnings earlier today and to no one's surprise they are still printing cash as they reap the benefits of the higher yields they accrue from their short-term treasury holdings. In the first half of 2024 they made $5.2B in profits, revealed that they're holding $4.7B worth of bitcoin, and have $97.6B in US treasuries on their balance sheet. I don't know this for certain, but I think they may be the most profitable company in the world from a headcount:profit standpoint. Further details about the attestation were shared by Tether's CEO Paolo Ardoino on X.

Tether's Q2 2024 attestation is out.

— Paolo Ardoino 🤖🍐 (@paoloardoino) July 31, 2024

Another great quarter.

A short summary as of 30 June 2024:

* $1.3 billion in net operating profit.

* $520 million increase in Tether's Group own equity, bringing it to a total of $11.9 billion.

* $5.33 billion in excess reserves

* more than… https://t.co/f0vb4VfmYB

This announcement comes less than a week after Cantor Fitzgerald CEO Howard Lutnick took the stage at the Bitcoin Conference to announce that Cantor Fitzgerald has set aside $2B to issue bitcoin collateralized loans to bitcoin companies looking to grow. He also assured the crowd that the Tether truthers out there are speaking out of their ass when it comes to Tether being fractionally reserved. Lutnick made it clear that Cantor Fitzgerald custodies Tether's treasuries and they are all there.

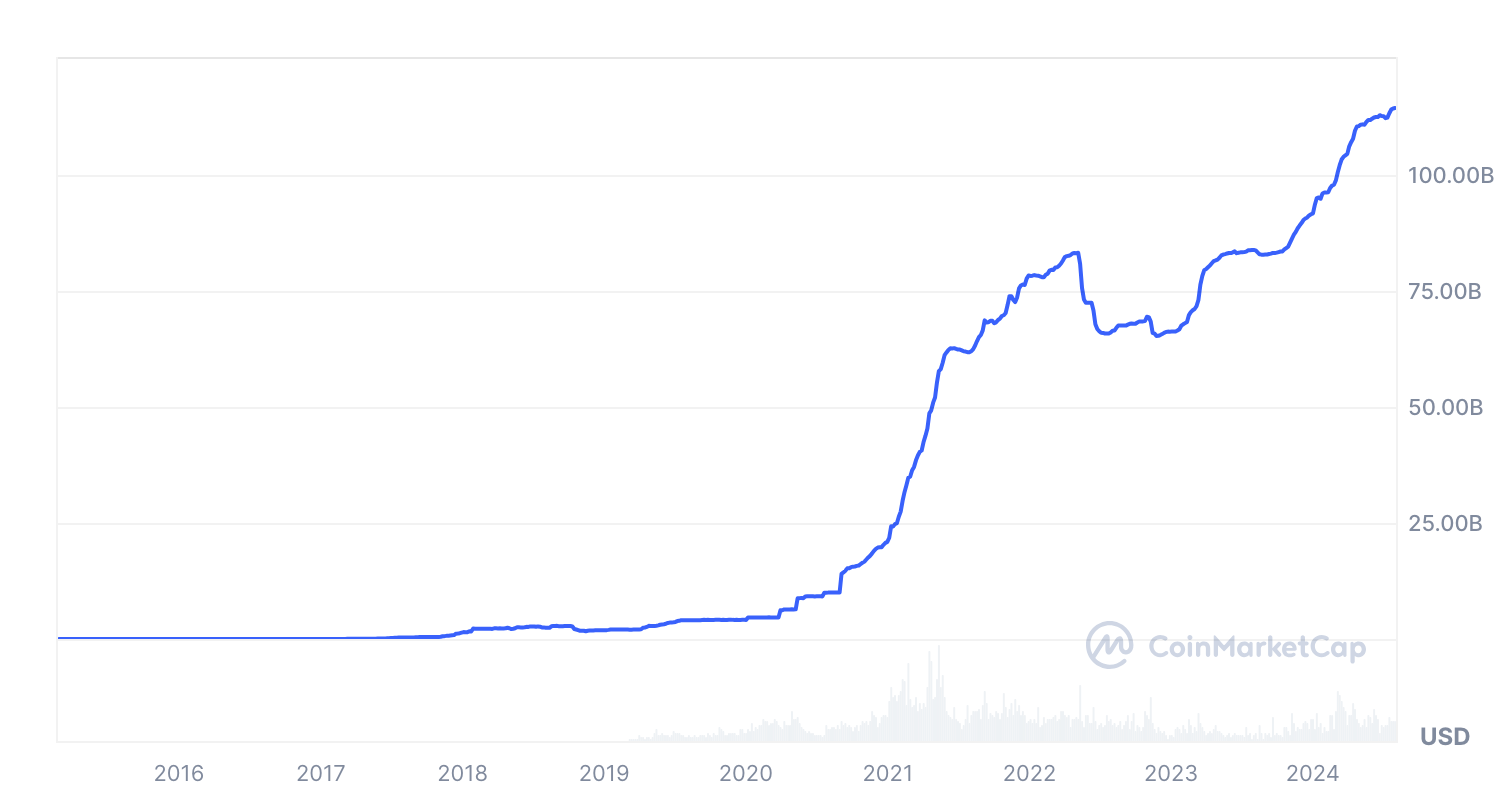

What's becoming abundantly clear is that Tether is becoming a dominant force in Treasury markets. As of the end of June, Tether now holds more US Treasuries than Germany, the UAE and Australia. Mind boggling when you take a step back and realize that a company with less than 50 employees is holding more US government debt than some of the US's largest allies. What you are watching unfold is a company filling a market need (the ability to send dollars instantly and at low cost), practicing prudent risk management (maintaining the dollar-peg of their stablecoin by backing it predominately with US debt), putting their profits into the best monetary asset on Earth (bitcoin), and creating a new offshore dollar market that is much preferable to the Eurodollar market in the eyes of the US. As of today, Tether has a $114B market cap, which has expanded rapidly over the last few years.

If things continue on this trajectory Tether will become a top-5 purchaser of treasuries globally. And as our friend Preston points out, the Treasury - if they care about the stability of their market - should take note of what Tether is doing with the yields they accrue from holding the government's short-term debt, turning them into bitcoin. More importantly, they are favoring the short-end of the yield curve because the yields are attractive and, presumably, holding on to long-term debt is too risky considering the trajectory that US national debt, the monetary base, and unfunded liabilities are on. Why would anyone hold US debt for longer than a few months or even a few years, let alone 20 or 30 years, with a government that is so fiscally irresponsible?

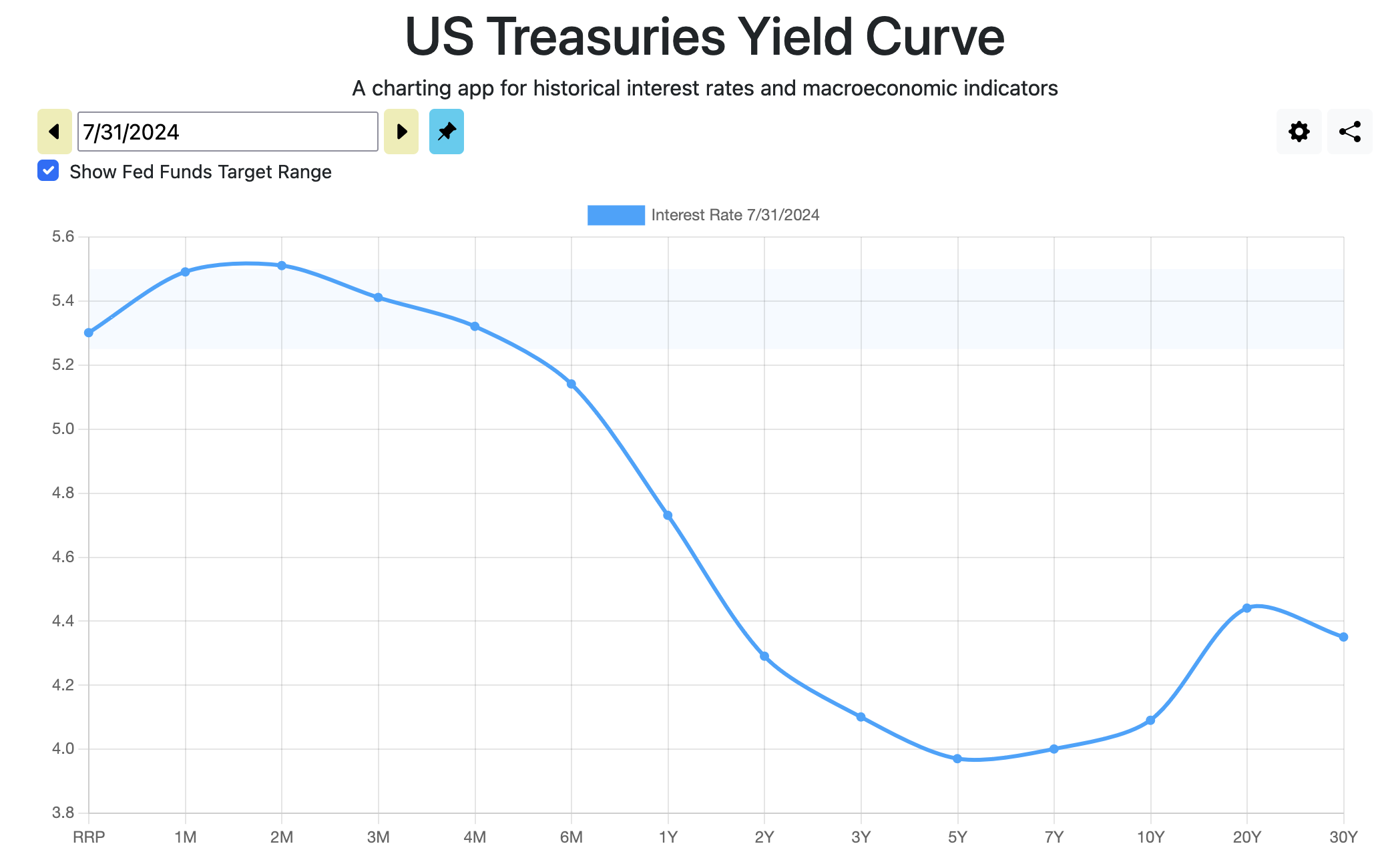

It is obvious that the Treasury needs a way to drive demand to the long-end of the curve, and to do so they're going to need to get creative. Last week at the Bitcoin Conference there were many discussions about how the US should go about acquiring bitcoin if it decides to build a strategic reserve and the one that appealed to me most was the one laid out by Preston above, which we discussed in person at Bitcoin Park. It is obvious that Tether prefers to hold bitcoin over dollars on its balance sheet (they hold 40x more bitcoin than dollars), and is forced to hold treasury bills due to the nature of their business - they need a stable liquid asset that makes them yield. Said clearly, Tether needs dollar-like liquid instruments like bills to facilitate redemptions and they'd like to be able to make some money while doing so. Let's take a look at the Treasury yield curve to help illustrate the "making money" point.

It makes sense that Tether would favor the front-end when you look at the yield curve as it stands today. Over the last two years the Treasury has been issuing an abnormal amount of bills as opposed to longer-dated bonds because they don't want to issue 20 and 30 year bonds when interest rates are as high as they are and/or because they are trying to engage in stealth QE as laid out in a paper by Hudson Bay Capital last week.

With the world fading US Treasury bonds as the US has decided to weaponize the system by freezing the treasury assets of adversaries while pushing its debt burden beyond $35 TRILLION, the Treasury has a growing problem on its hands; no one wants to buy the bonds because of the interest rate and weaponization risk that comes with them. They need to figure out how to solve that problem and Tether, as a very unique large buyer of treasuries, may give them some insight into a potential solution. As we mentioned earlier, Tether clearly prefers to hold bitcoin over dollars and treasury bonds. If the Treasury cares about the long-term stability of the long-end of the curve they may have to think outside the box.

Nothing would be more outside the box then backing long-term bonds with a percentage of bitcoin. I'd say 5-10%. As bitcoin adoption continues to increase and supply and demand dynamics play out, inevitably pushing the price higher over time, bond holders would get some much needed certainty that their bonds will have some value when it's time to roll them over. A buyer like Tether and any nation state worried about the runaway debt situation would be more incentivized to buy the long-end of the curve.

If you pair this strategy alongside a strategic bitcoin reserve as laid out in a bill presented by Cynthia Lummis earlier today you can imagine a scenario in which the federal government is able to bring more certainty to Treasury markets while simultaneously working on a solution to pay down the debt over the long-term via the strategic bitcoin stockpile.

The wait is over. This is our Louisiana Purchase moment.

— Senator Cynthia Lummis (@SenLummis) July 31, 2024

Read the text for my BITCOIN Act below ⬇️⬇️https://t.co/mSYJVwn1wI

I can hear some of you screaming "WTF Uncle Marty, why are you trying to help the Treasury?!" It's because this, to me, seems like a plan that could lead to an actual shrinking of government slowly but surely over time. If the Treasury is shoring up it's debt markets with better bitcoin-backed products while at the same time building a bitcoin reserve that can only be used to pay down the debt over time you can imagine a scenario where the debt problem gets resolved. This would of course happen as individual American citizens and businesses are accumulating bitcoin, making themselves more financially secure and less dependent on government subsidies financed by debt.

In my mind, this is what a slow and steady multi-decade soft landing looks like.

The only question that remains is, will the government dare to be this bold?

Final thought...

A two-day cross country trip after a conference week is exhilarating.