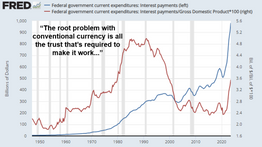

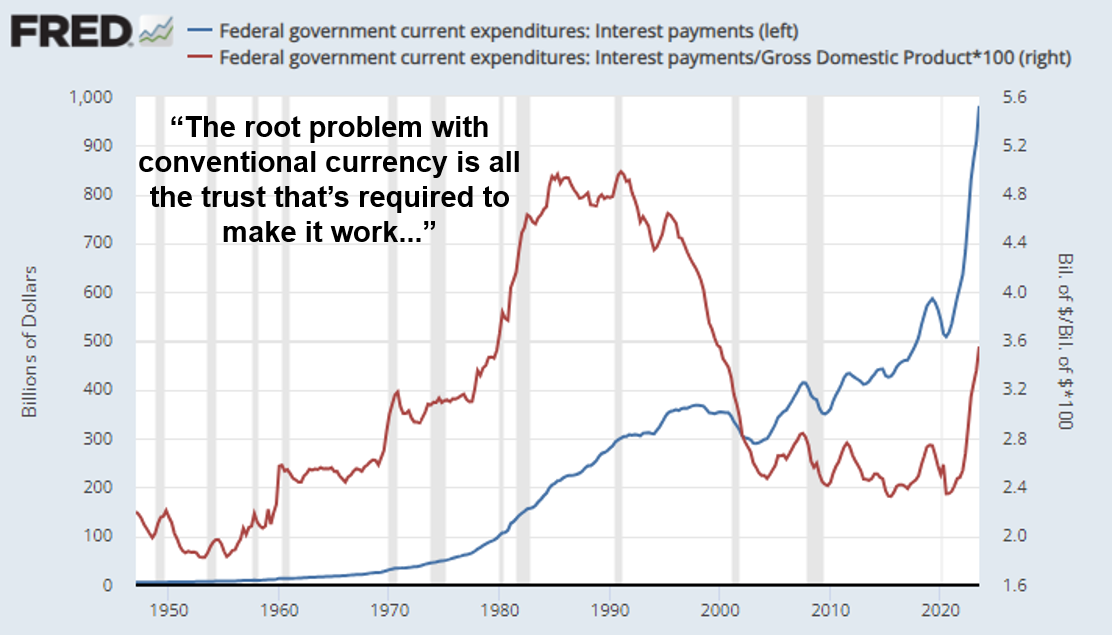

As uncertainty looms over the global economy, the Federal Reserve faces a daunting challenge with its $8 trillion balance sheet, a repository of assets that could potentially strangle credit, skyrocket mortgage rates, and hasten an economic recession.

Trying to simplify inflation is like trying to explain the entire plot of "Inception" in one sentence.

By bending over and asking for regulatory clarity you are failing to meet your obligation as a US citizen to disobey the unjust laws enacted by a vile class.

We fully expect the excesses and fragilities of late-stage fiat to compound further over the coming decade.

The market needs a monetary system whose cost of capital is determined by that market at any given point in time and not a small group of men in boardrooms at the member Federal Reserve banks.

Is the tail wagging the dog?

In short, the productive economy was whipsawed during the boom-bust, and now in the recession it's starved.

With runaway debt, massive amounts of unrealized losses on the balance sheets of banks, and sticky inflation it hasn't impossible to think that we are well on the way toward a hyperinflationary event in the US.

The inflation-is-prosperity fallacy has been internalized by the ruling class.

This is your life on central planning.

All of this should be a reminder that one of the Fed's mandates is "price stability" and that their idea of price stability is a perpetually low (soon to be not as low) level of price inflation.

Whether it's the Fed or Worldcoin, there are seriously demented people who are moving in haste to ensure that they have control over every aspect of your financial life.

History doesn't rhyme, it repeats. And what we're living through right now seems to be a repeat of the banking crises that led to the Great Depression and Weimar Republic hyperinflationary event.

The CPI has been coming in lower and lower month-on-month as the Fed has embarked on an aggressive rate hike campaign over the last one-and-a-half years.