This is your life on central planning.

Academic Keynesian economists believe you can destroy demand for goods without destroying supply of goods. In reality, attempting to destroy demand for things people need to survive will more rapidly destroy the supply of said things than demand. https://t.co/lDcSonNeXb

— Parker Lewis (@parkeralewis) September 7, 2023

The Federal Reserve began its aggressive rate hike campaign in March of 2022. The explicit goal of this campaign is "demand destruction". The Fed is hoping to destroy demand by making the ability of companies to finance their operations so expensive that they are forced to cut their headcounts, which means there is an increased number of people who aren't making money that they can then go out and spend throughout the economy. With more people with less money to spend on goods and services, producers will readjust prices lower to move more inventory. At least, that is the theory behind demand destruction.

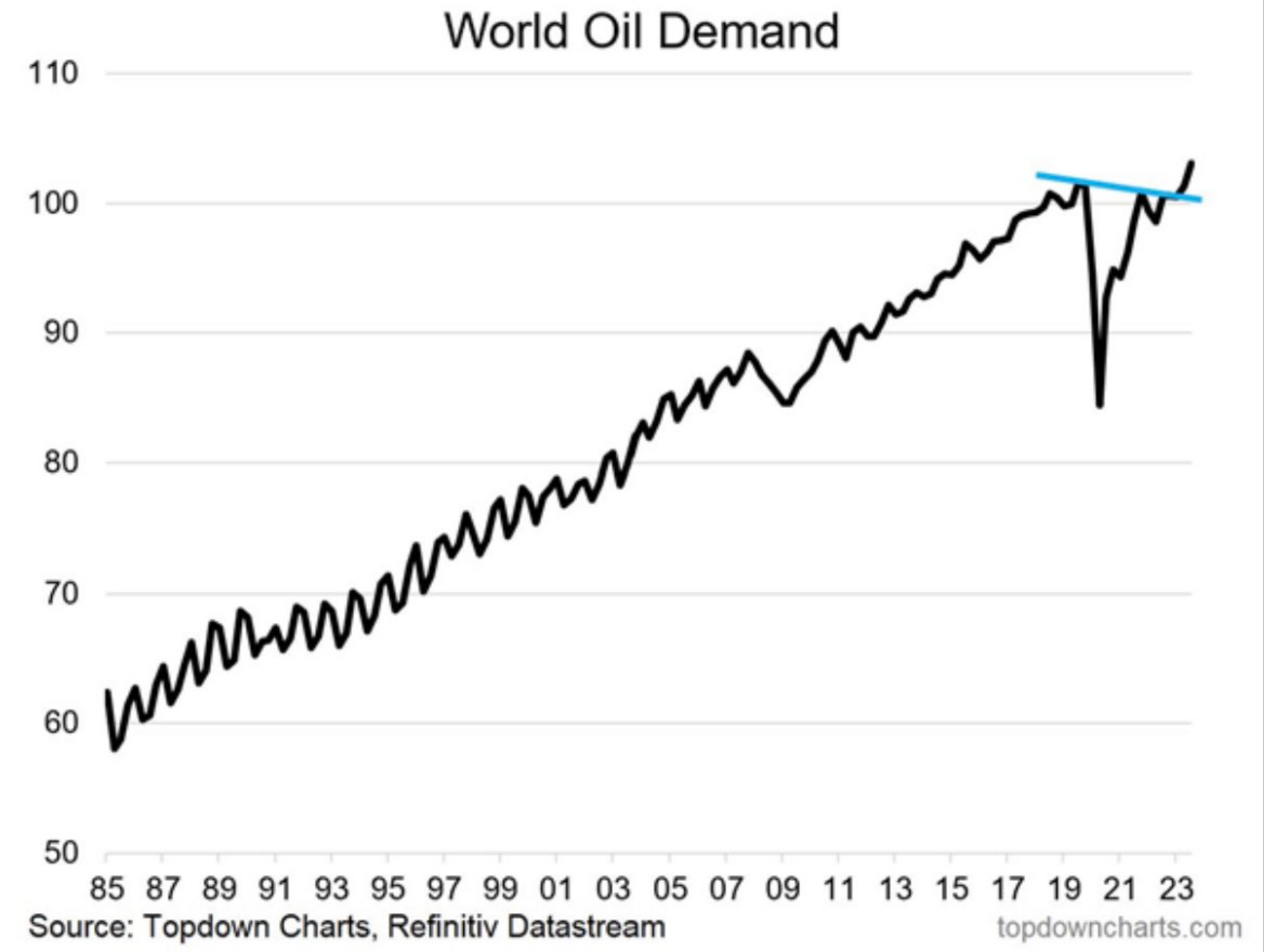

In practice, as our friend Parker Lewis points out, the demand destruction theory is structurally flawed because it fails to factor in the effect rapidly rising interest rates has on the supply side of things. And if we use the market for crude oil as a benchmark, it seems like the Fed's policy is backfiring. After a sharp demand decline in the wake of the COVID economic lockdowns, oil demand is back on the upwards trajectory that it was tracking before the lockdowns at a time when supplies are falling precipitously. By raising interest rates, the Fed has made it more expensive to drill new oil and gas wells. Making it much harder to bring more supply to market. For more supply to come to market the price of crude oil has to rise to a point that makes the economics work for producers to drill more wells. Producers need to be confident that they can move enough supply at a higher price to pay off the debt they took out to drill the wells and make some profit on top of that.

To be fair to the Fed, they haven't gotten any help from the Biden administration or OPEC+ on the supply side of things. Draining the Strategic Petroleum Reserve and OPEC+ extending production cuts longer than expected has helped to deplete supplies faster than anyone would have expected a couple of years ago. But I do think it's safe to say that higher interest rates have had a material effect on domestic supplies.

The supply side problems only get worse when you begin to consider the culling of the workforce that higher interest rates have induced. With less workers able to produce the goods and services that companies offer to their customers it becomes harder to produce those goods and services effectively. This leads to less supply.

The predicament the Fed finds itself in is that they expected demand to be disrupted much faster than the supply of goods and services. But unfortunately for them, even if people don't have jobs they still have to eat and fill their cars up with gas. And when you consider the US consumer's comfortability with credit, it is easy to see how demand can remain relatively elevated despite mass layoffs. This problem is made worse by the fact that Americans paid down a lot of their credit card debt en masse during lockdowns. They have some room to run their cards up despite the high interest rate environment. And even if they don't, they will plow themselves further into debt to ensure that they can eat.

The result of all of this is an economy filled with debt laden unemployed individuals who are going into the market to purchase a dwindling supply of goods, which pushes up the prices of those goods. The absolute worst outcome for the Fed and the current administration.

This is your life on central planning.

Final thought...

If not you, then who?