Throughout the episode, the hosts reflect on the banking crisis of early 2023, which highlighted the risks associated with third-party custodians and the need for Bitcoin companies to hold a portion of their treasury in Bitcoin.

The year 2023 in Bitcoin has been a rollercoaster, marked by significant events that have shaped the community and the industry. The collapse of exchanges and banks alike highlighted the risks with centralized third parties.

In this post, we delve into the complexities and perspectives within the Bitcoin mining community, exploring the challenges and opportunities that lie ahead.

Bitcoin mining is a complex and evolving industry. The scarcity of block space is an issue that miners and users must navigate carefully to maintain network security and functionality.

Learn all about Hashrate and bitcoin, what hashrate means, how hashrate works, why it’s important, how it impacts bitcoin mining & more!

Even though a 27% increase in hashrate in less than three months may seem insane, you ain't seen nothing yet.

This is an episode filled with high signal industry knowledge.

Reggie Smith, lead FinTech analyst at JP Morgan, joins us to discuss his recent research into Bitcoin mining stocks including Riot, Marathon, Cleanspark and Cipher Mining.

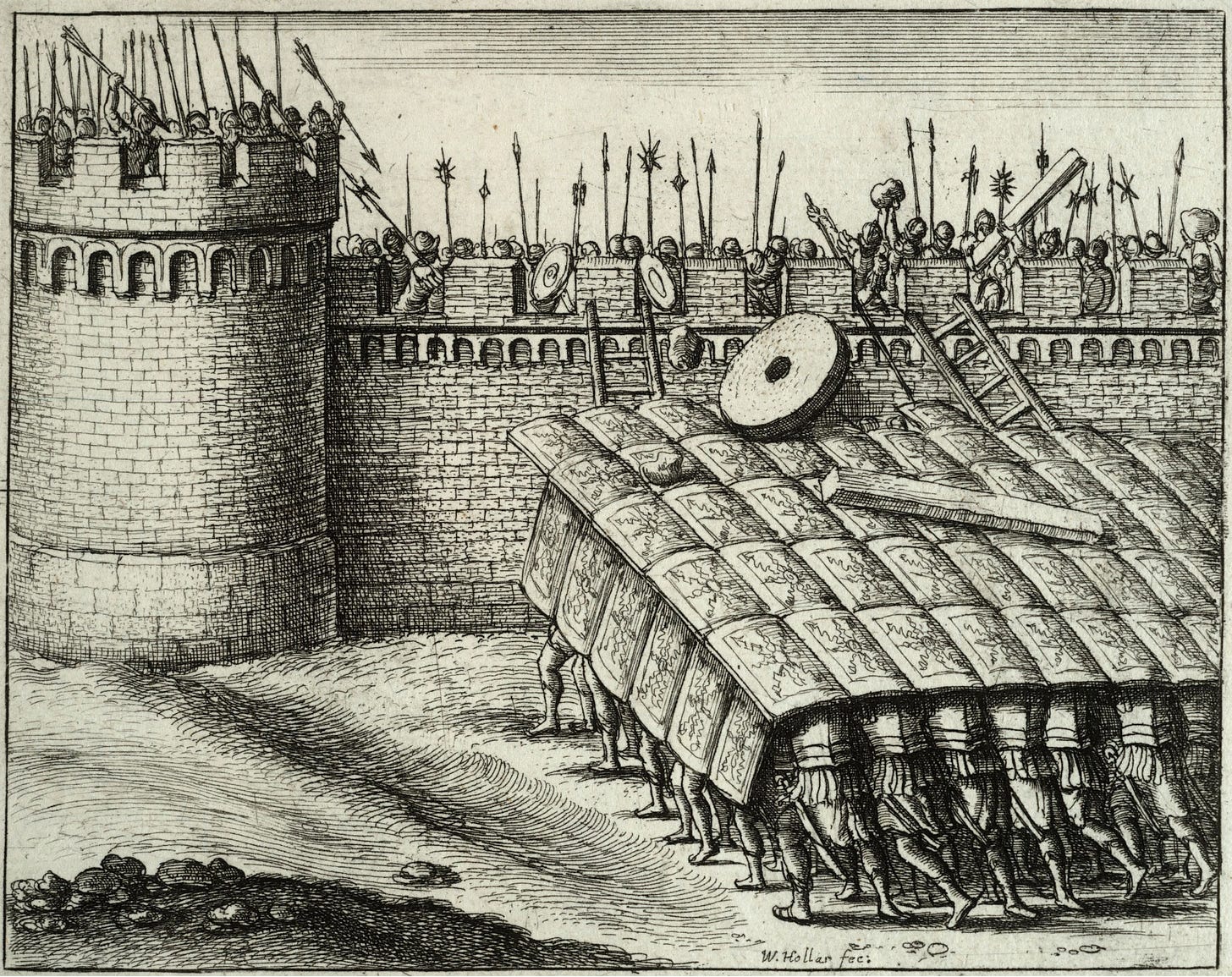

The ASIC testudo is fundamentally an infrastructure play, made possible through down-clocking.

Catch up with everything that happened this week in the bitcoin mining industry.

We discuss the pressing issue of crypto fees, how to think about L2 designs for Bitcoin, criticisms of BIP 300/301 and why Bitcoin miners arn’t more involved in Bitcoin governance.

Once we reach the point where AI companies are competing on electricity price instead of access to machines the fight for cheap power contracts will become viscous and AI companies will need to have a bitcoin mining strategy to compete.

Unfortunately, at the moment it is hard to build out more reliable energy infrastructure because the unreliable infrastructure is being heavily subsidized, which is artificially manipulating opportunity costs and pricing new reliable generation sources out of the market.

Bitcoin mining is the most ruthlessly competitive industry in the world and nothing makes this clearer than the current economics and landscape of the industry.