Bitcoin mining is the most ruthlessly competitive industry in the world and nothing makes this clearer than the current economics and landscape of the industry.

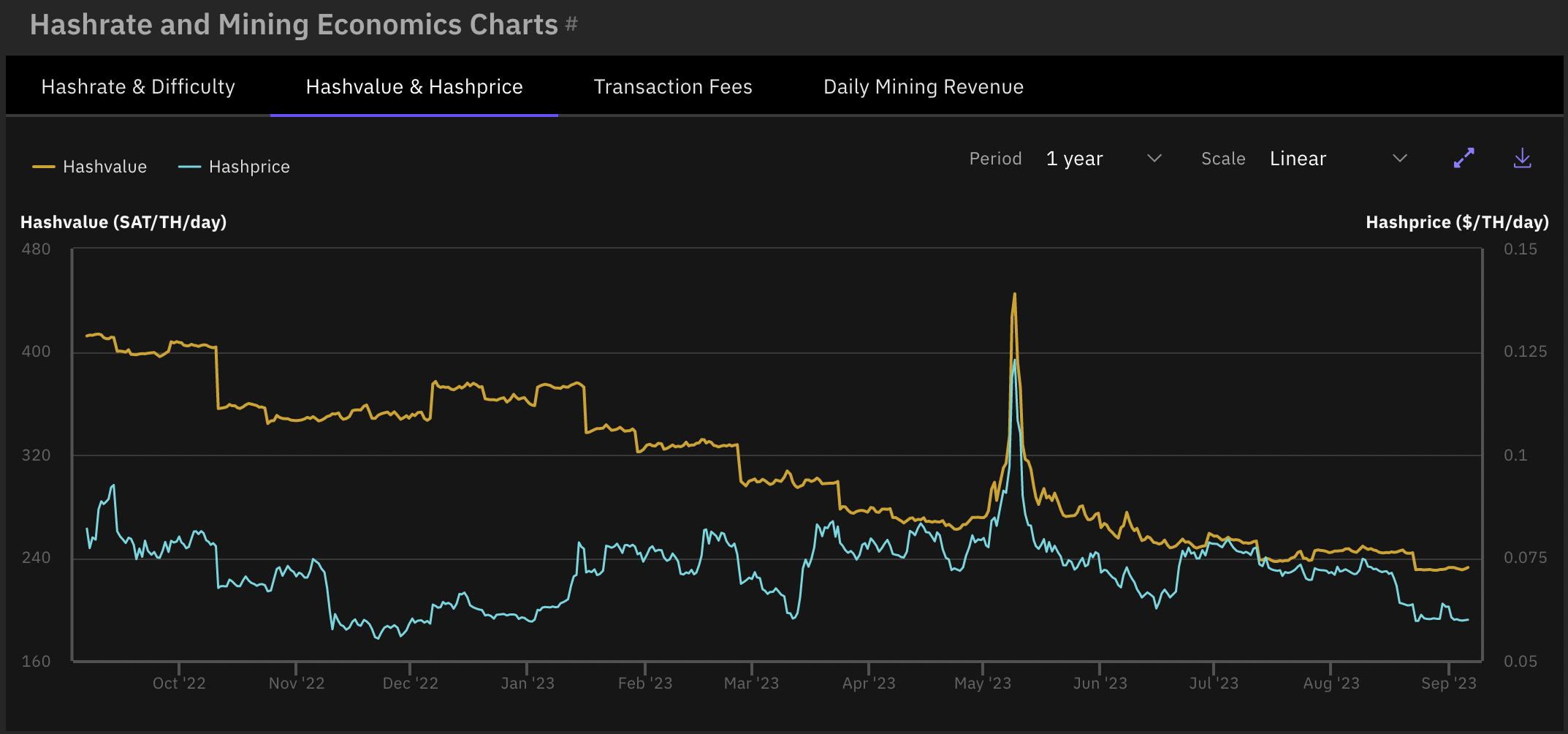

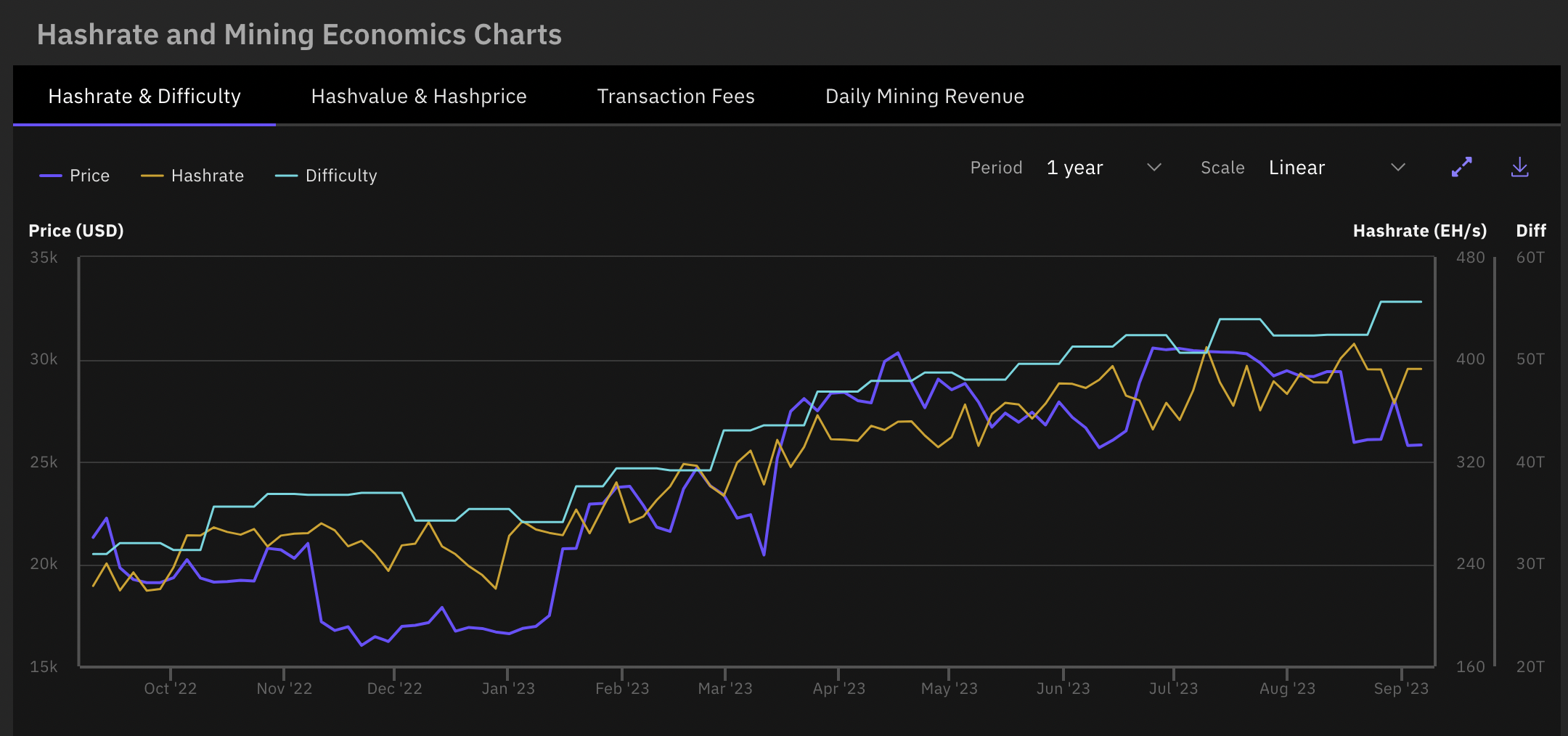

At the time of writing we are nine blocks away from the 401st difficulty adjustment since bitcoin launched in January 2009. The mining industry is about to receive some minor relief from the historically tough mining conditions as difficulty is set to adjust downward by 2.7%. As you can see from the first chart tracking hashprice and hashvalue over the last year, both metrics are sitting at or near all-time lows. This is because hashrate growth has surged by 43% over the last year, while the price has only increased by 17%, and bitcoin fee revenue per block is hovering at a measly 20,000,000 satoshis, or .2BTC. In other words, competition in the mining industry has grown by approximately 2.5 times compared to the price over the last year, placing significant pressure on profit margins.

Needless to say, miners worldwide are experiencing the challenges of this bear market, especially if they are operating older-generation hardware with relatively high electricity costs and not increasing their hashrate. Many people are puzzled by the rate of hashrate growth, considering that mining conditions have been quite unfavorable for the past year, except for a temporary increase in fee revenue in May of this year.

Here are a few factors that I'm paying attention to that may explain the growth of network hashrate despite suboptimal mining economics.

Historically, during times of low ASIC demand, ASIC manufactures have put their idle inventory to work to increase revenues. It would be naive for people to think this isn't happening in 2023. The manufactures have to put down hefty deposits to look down their real estate on the floors of the chip foundaries and they will do whatever it takes to ensure that they are able to keep that real estate. It's a very practical move when you think about it. Manufactures are sitting on top of the line machines that can mine more efficiently than any other on the market. There will be demand for those machines once the market turns. They might as well plug them in and make revenue with them while they wait to be sold.

This has a particularly pronounced effect on hashrate. By plugging in top of the line machines, the manufactures can mine profitably at relatively high electricity rates. The fact that these machines are top of the line also means they have a material effect on hash rate once they're plugged in. They can produce more hashrate with less electricity. The net effect is a less profitable landscape for everyone else.

Another factor contributing to hashrate growth despite terrible economics in the mining industry are the crop of miners who are throwing inhibitions to the wind and mining at a loss. There are probably a number of miners out there with material cash balances who are white knuckling it through the bear market by mining at a loss in hopes that they can make it to the other side of the bear market alive with their power contracts in tact. Some power contracts are written in a way that dictates that miners must take delivery of the electricity they have been alotted. If they don't they can suffer financial penalities and risk losing their contracts. This leads to miners keeping their machines on when they shouldn't be running. Raising the floor of overall hashrate. This archetype of miner is playing chicken with the price of bitcoin. If the price recovers and pushes them back into profitability they will live to die another day. If the price doesn't recover, or worse - falls further, they could meet a rather painful demise.

As we explained a couple of weeks ago, the Omani government joined Venezuela, Russia, the Kingdom of Bhutan, Iran, and El Salvador in the small group of nation states that have signaled their entry into the bitcoin mining game with their backing of Exahertz, a private miner in Oman. With access to cheap energy and sovereign wealth funds and/or sovereign debt markets, nation states are able pour capital and resources into mining operations during times when it isn't ideal for private companies to do the same.

This is likely having a less pronounced effect on overall hashrate at the moment, but is a trend that you should pay attention to moving forward. It is important that the bitcoin mining landscape remains sufficiently distributed geographically and from an ownership perspective. Nation states controlling a material amount of hashrate isn't ideal. If nation state hashrate ownership does increase it would be good if it is among nations who are adversarial and less likely to coordinate with each other. It is crucial to establish a Bitcoin standard as soon as possible to prevent nation states from printing more fiat currency and issuing debt to finance mining operations.

With all of this in mind, it will be increasingly important for miners who wish to survive this bear market to improve the efficiency of their operations. The best way to do this with the least amount of capital outlay is to underclock machines to increase energy efficiency, which increases a miner's margins. However, it should be made clear that a miner has to either own their energy infrastructure or construct their power contracts in a way that allows them to underclock when it is deemed necessary. Underclocking means that miners are consuming less electricity and power providers are incentivized to sell as much electricity as possible. It will be important for miners to work with their power providers and explain to them why it makes sense for them to push less electricity at times to increase the possibility of a long term relationship.

Bitcoin mining is the most ruthlessly competitive industry in the world and nothing makes this clearer than the current economics and landscape of the industry.

Final thought...

Feels good to be back in the saddle.