There are many misconceptions about the pitfalls of spending bitcoin. If bitcoin is truly your savings technology of choice, spending bitcoin isn't only necessary, it's rational.

"It's more expensive to save in fiat and spend in fiat. The math is conclusive, so is the logic." - Parker Lewis

It looks like this is going to be a Parker Lewis-heavy newsletter. I didn't realize my producer chose the topic in the section below before hopping in the editor to write the Bent, but both topics from the podcast we released this week are very important for you to understand and internalize.

During our discussion about why bitcoin is money AND currency, we broached the topic of having to pay capital gains tax when spending bitcoin. Ever since I've been in bitcoin this has been something that always inevitably pops up when individuals express that it is alright to spend your bitcoin on goods and services that you may need at any given point in time. "That's stupid! You're going to pay capital gains taxes on that transaction? How are you going to track that?"

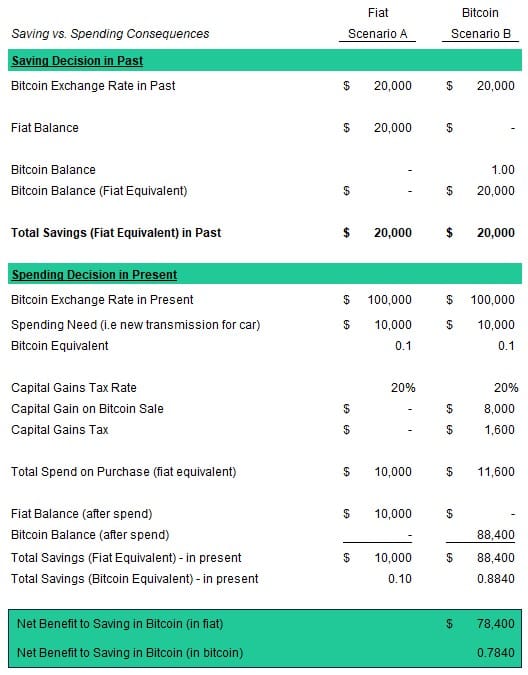

Hand up. I've been guilty of framing spending bitcoin in this way in the past. However, as time has goes on and you inevitably shift all of your savings into bitcoin you come to realize that spending bitcoin is not only inevitable, it is totally okay. Bitcoin is such an incredible savings vehicle compared to the dollar or other fiat currencies that it becomes illogical not to shift all of your long-term savings into the asset. Even if you have to spend some at some point in the future and stomach the capital gains costs. Parker illustrates this point in the table below, which walks people through the scenario of parking $20,000 in a fiat savings account v. $20,000 in bitcoin when bitcoin was trading at $20,000 (so getting 1btc at the time of savings) and then having to dig into that savings to pay for a $10,000 transmission repair when bitcoin was trading at $100,000.

As you can see, the end result of saving in bitcoin, selling some bitcoin to cover the cost of a new transmission and the associated capital gains taxes is significantly better than having saved in fiat and paying the same expense. The initial $20,000 savings in bitcoin at $20,000/btc would still be more than $78,000 in savings at $100,000/btc even after taxes while the fiat saving would have been cut in half to $10,000.

On top of this, those who screech about "tracking cost basis and transactions" are completely unaware of the advances that have been made to bitcoin wallets, invoicing software and exchange reporting that have been made in recent years. It is very easy to track and hand over to an accountant these days. I can tell you this with a straight face because bitcoin is our treasury asset at TFTC. We accumulate bitcoin with excess cash flows, save in it, and pay contractors in it every single week. I don't think twice about cost basis because tools like transaction labeling in cold storage wallets, monthly statements from exchanges like River and Strike and invoicing software like Zaprite make it very easy to simply download csv files and hand it over to an accountant.

Make sure you go read Parker's article, The Logic of Spending Bitcoin, and begin to seriously consider saving more in bitcoin because when you do it becomes much easier to spend because the logic is very straightforward.

In my recent conversation with Parker Lewis, he articulated why defining Bitcoin solely as a commodity while denying its currency status contradicts its fundamental economic nature. Parker emphasized that Bitcoin eliminates the need for an issuer entirely, functioning as both money and a means of exchange simultaneously. This capability is unprecedented in monetary history and allows Bitcoin to operate efficiently as a currency system without third-party validation.

"Let's just call it what it is. Call a spade a spade, and let's have a direct conversation about it and hopefully create good policy that does allow Bitcoin to flourish." - Parker Lewis

While Parker stressed that Bitcoin doesn't need regulatory advantages to succeed, he warned that misguided policy can create needless friction in the short term. We're witnessing crypto industry lobbying creating confusion by attempting to fit bitcoin into regulatory buckets that don't match its actual functions. The economic reality is that people are already using Bitcoin as currency, and any policy that tries to restrict this use would ultimately be fighting against economic gravity.

TLDR: Bitcoin policy must reflect its dual nature as money and currency

Check out the full podcast here for more on Bitcoin Takeover events, stablecoin limitations, and how Bitcoin payments are becoming more practical with tools like Lightning Network.

Billionaire Salinas Holds $4 Billion in Bitcoin, 70% of Portfolio - via X

Belarus Explores Crypto Mining with Excess Electricity - via X

Mt. Gox Moves Over $1B in Bitcoin - via X

Fed Abolition Bill Seeks End to Inflation Woes - via X

Block height indicates a block's position in the blockchain, counted from the genesis block (block 0). It serves several important purposes in Bitcoin's operation.

Target adjustment occurs every 2,016 blocks to maintain 10-minute intervals, while block subsidy halving happens every 210,000 blocks, creating Bitcoin's fixed supply. Locktime and relative locktime use height to control when transactions can be mined, and coinbase transactions must include the current block height.

Height isn't a guaranteed unique identifier since multiple blocks can temporarily compete for the same position during mining. These chain reorganizations make height references less reliable near the blockchain tip. Block hash provides the most reliable reference method, though height becomes more dependable when blocks are buried 3+ deep in the chain.

As of writing, the current height is 886,499, with the next target adjustment at 887,040 and the next halving at 1,050,000.

Bitcoin is the ultimate scarce asset. Join bitcoin macro expert Nik Bhatia at a live online event on March 17th for Death, Taxes, & 21 Million. Learn how to shield your wealth, leverage tax-advantaged accounts, and secure your bitcoin for future generations. Your financial advisor, accountant, or attorney might not be up to speed on bitcoin—don’t get caught off guard.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Subscribe to our YouTube channels and follow us on Nostr and X: