People don't need to sell assets for large amounts of capital to flow into bitcoin. Nik Bhatia explains why.

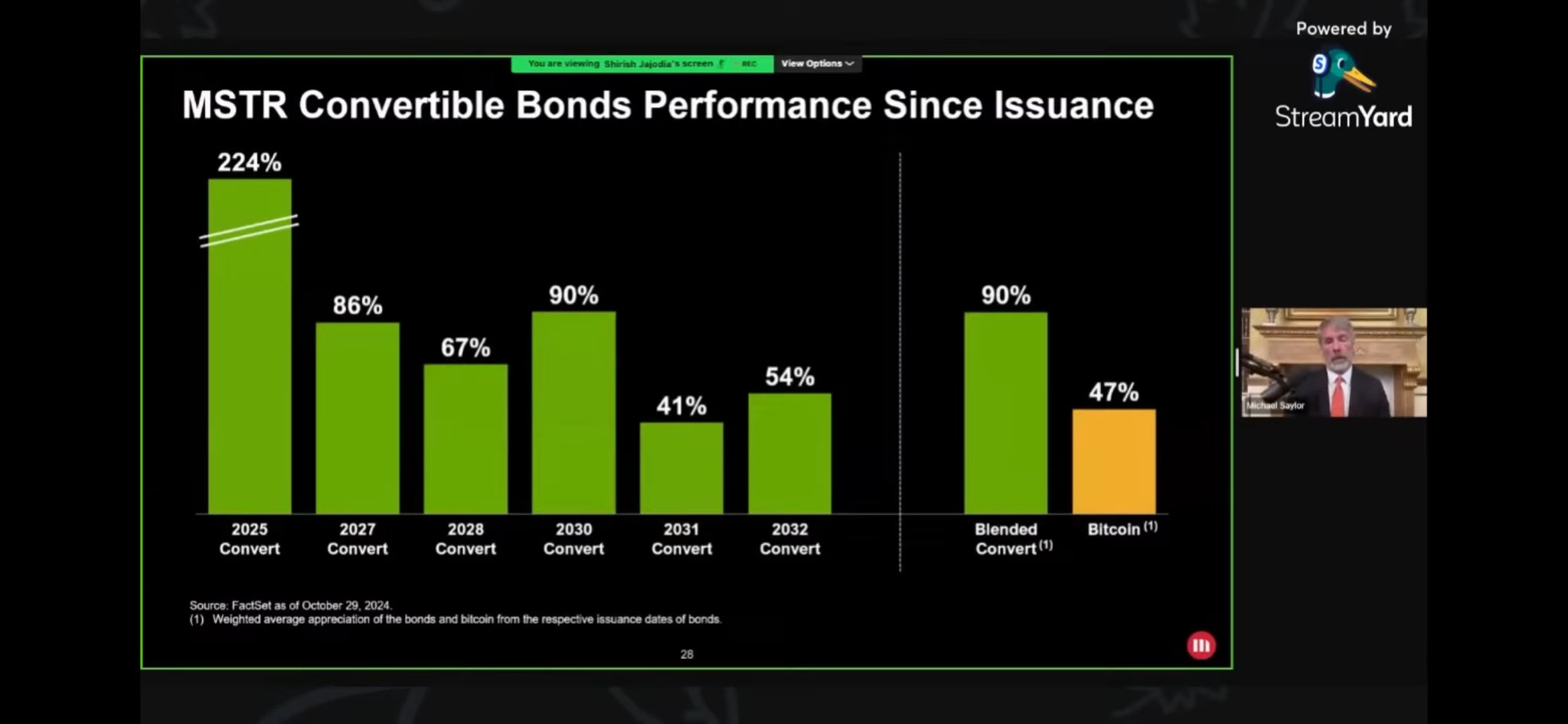

In a recent conversation I had with Nik Bhatia on the TFTC podcast he revealed a paradigm shift in how we should think about Bitcoin price appreciation. While many of us assumed Bitcoin's rise would come from investors selling traditional assets to buy BTC, Bhatia explains that bond investors are actually creating new money through repo market financing to purchase Bitcoin-related securities, particularly through vehicles like MicroStrategy's convertible notes.

"Flow is what matters and my whole thesis here is that Bitcoin getting to $20 trillion is not going to happen because there's several trillion of bonds being sold and then buying Bitcoin... It's going to be credit expansion." - Nik Bhatia

What makes this thesis particularly compelling is how the traditional financial system is essentially creating its own bridge to Bitcoin. As Bhatia detailed, bond funds can borrow against their existing holdings to finance new positions without selling assets. This means the flow into Bitcoin isn't constrained by the redistribution of existing wealth – it's being driven by credit expansion through established financial market mechanisms. MicroStrategy's convertible notes strategy has become the blueprint, demonstrating how this mechanism can work at scale. If performance of these convertible bonds continues you can expect demand to increase. Creating a flywheel for new credit creation flowing into bitcoin.

TLDR: Bond markets are creating new money for Bitcoin via repo financing & converts.

Check out the full podcast here for more on Trump & Bitcoin policy, sovereign reserves and MicroStrategy bonds.

Mobile Bitcoin wallets are convenient but less secure. Use them like a real wallet - only carry what you plan to spend. Learn more about them here:

2025-01-20, 23:59 UTC

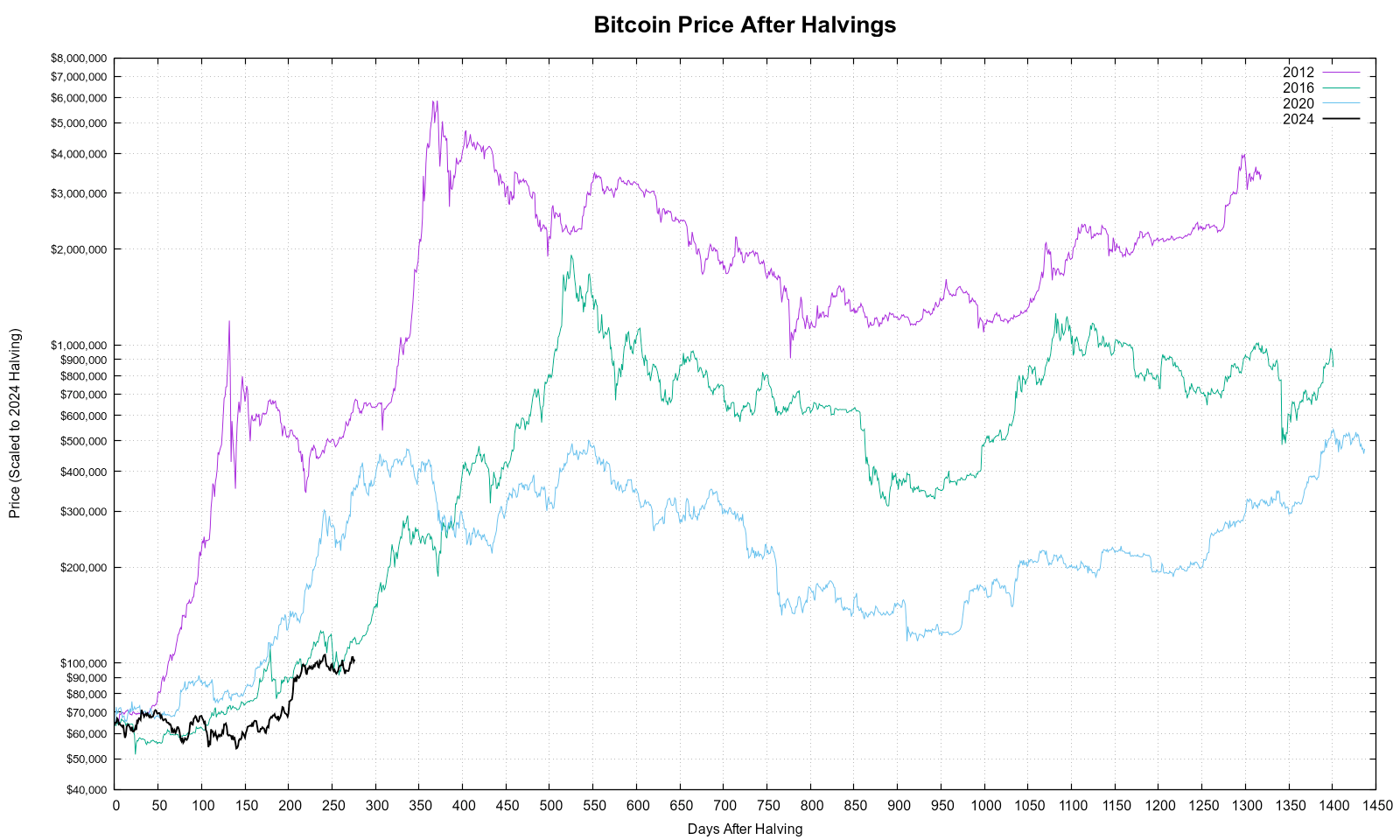

276 days after halving

Current: $102,589.00

2012 scaled: $663,796.91

2016 scaled: $120,278.08

2020 scaled: $352,706.56

As it stands today, bitcoin price performance is underperforming past halving cycles, despite being right below all time highs. Signalling a lot of room for upside potential from here.

OpenSats Grants Support for Three Bitcoin Core Contributors - via nobsbitcoin.com

Tornado Cash Sanctions Reversal Has No Effect on Developers' Trial, Says DOJ - nobsbitcoin.com

Ray Dalio confirms he owns bitcoin - via CNBC

KULR Expands Bitcoin Holdings to 510 BTC, Reports 127% BTC Yield - via KULR press release

President Trump issued a FULL and UNCONDITIONAL pardon to Ross Ulbricht - via X

If you’re not passively stacking sats as you spend cuck bucks you’re doing it wrong.

— Marty Bent (@MartyBent) January 20, 2025

Just stacked 10,181 sats buying an Amazon gift card. All made possible by @fold_app. pic.twitter.com/seqefkwSEX

Turn your everyday purchases into a way to stack sats. With new gift card options, earn bitcoin rewards for everything from rides to groceries with Fold.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Subscribe to our YouTube channels and follow us on Nostr and X: