If you're not paying attention, you probably should be.

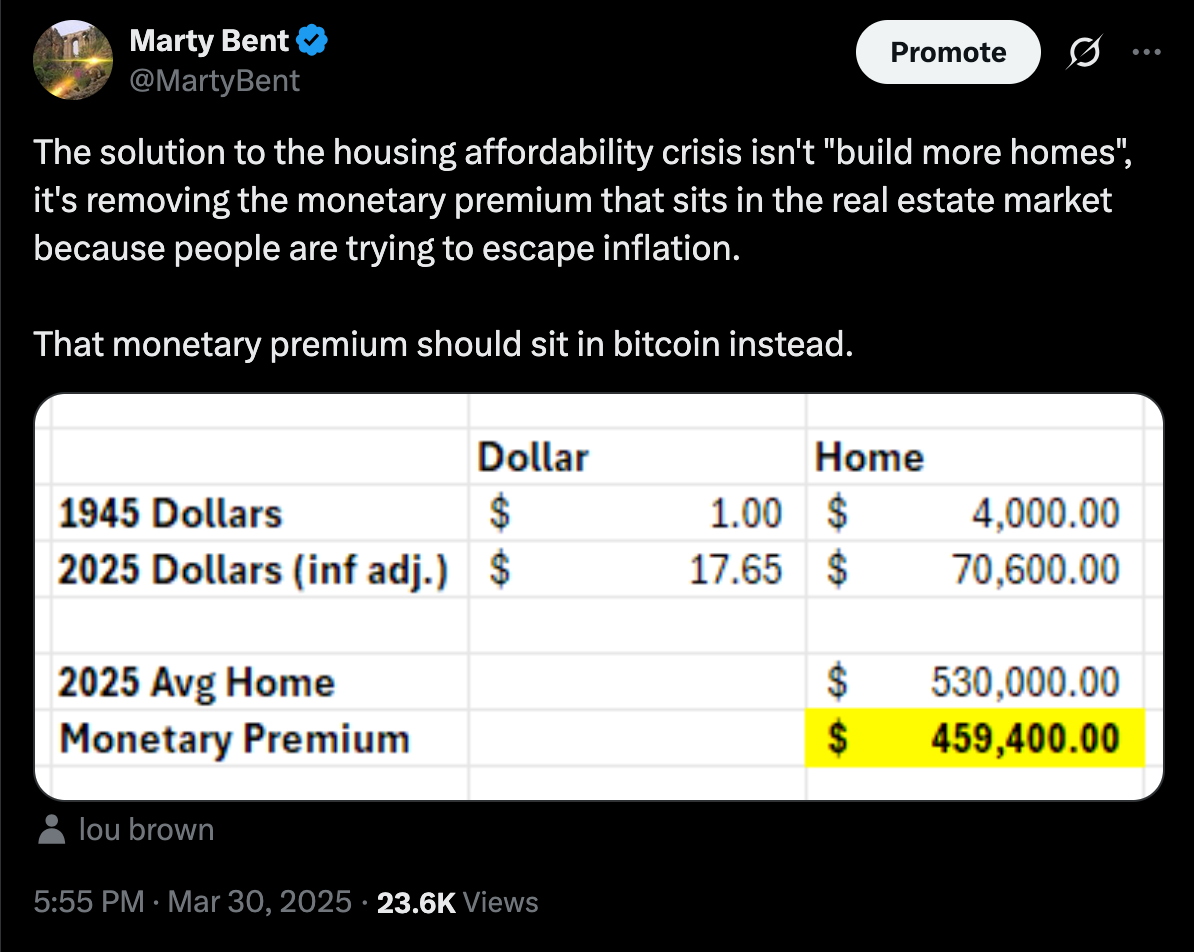

Over the weekend, Lou Brown responded to a tweet about housing affordability posted from the TFTC account with the above table, which roughly calculates the monetary premium that exists in the real estate market today using 1945 dollars and average home prices as a benchmark. When adjusted for inflation he found that if housing remained relatively stable and in line with official CPI prints, the average home for middle income earners should be around $70,600. Instead, the current price for these homes is ~$530,000, or $459,400 more than they would be if they tracked CPI. In the rough estimate, that represents a monetary premium of ~87% sitting in the US real estate market. Put another way, 87% of the value of homes is value that is leveraging real estate assets as a store of value.

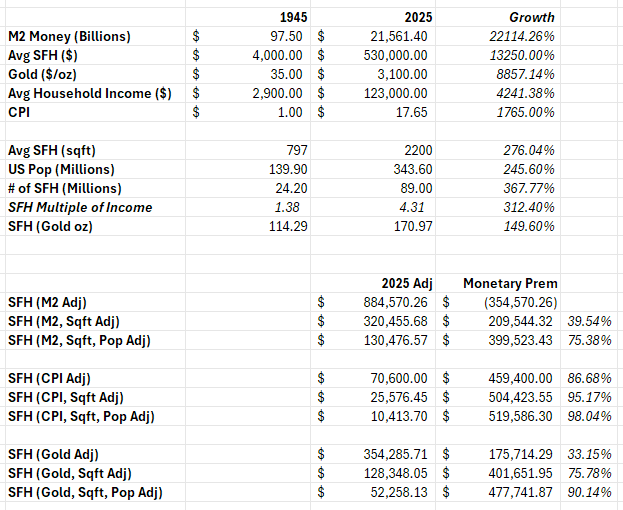

Now, that is a very crude metric that didn't factor in changes like population growth, the growth of the average square footage of houses that exist today, and other variables. Luckily for us, Lou took in some feed back and adjusted his table to include many of these metrics to paint a more well rounded picture for the potential range of monetary premium that exists in the housing market today. His updated table can be found here:

The range of monetary premium sitting in housing per Lou's number crunching is 33% (Single Family Home adjusted for gold appreciation since 1945) and 98% (Single Family Home adjusted for CPI growth, Square Footage Changes, and Population Adjustment). A pretty big range, but even so the bottom of the range is still very significant at 33%. According to Redfin, as of June 2024, the market for single family homes in the United States was $49.6 TRILLION. If we run with the low end of the range produced by Lou, that means that $16.3 TRILLION of wealth tied up in real estate represents a monetary premium. If we take the high end of the range, it represents $48.6 TRILLION that exists as a monetary premium. All of which would be better suited in an asset that is actually money; bitcoin.

It's probably safe to say that both ends of the spectrum are a bit extreme and that the true monetary premium that is sitting in real estate in the United States is somewhere in the middle. If we pick the exact middle we land on $32.45 TRILLION of excess value being stored in real estate because Americans are trying to use their homes as savings vehicles. To put that in perspective, that is 19.7x larger than the current market cap of bitcoin.

We are so early. It is only a matter of time before a critical mass of people wake up to the reality that bitcoin is objectively a better place to store their wealth in the long term. Bitcoin doesn't come with maintenance costs, taxes, or the volatility of location specific price premiums driven by demographics, quality schools, local economies and municipal services. It could take years or decades but the realization will be inevitable. Storing wealth in an asset that is perfectly scarce, cannot be debased, is fungible, divisible, portable and extremely liquid is simply rational. The only thing preventing the market from being completely rational today is the fact that 98% of the world has no idea what bitcoin actually is, how it works, and why it exists in the first place (to solve this exact problem and many others).

The monetary premium that exists in real estate highlights that you have an insane asymmetric advantage over most of the global population if you are accumulating bitcoin today. And in case you don't understand, real estate is only one market with an inflated market cap because people are using it as a store of value.

In our latest conversation with Pierre Rochard, we explored how Bitcoin is naturally separating from other cryptocurrencies through sheer network effects. Pierre articulated how other projects continue to fragment, highlighting Solana's emergence as proof that Ethereum never secured enough network dominance. Unlike these alternatives, Bitcoin represents a monetary revolution that requires consolidation around a single Schelling point. Alternative blockchains frequently attempt to tokenize solutions for problems that don't actually need blockchain infrastructure or tokens.

"We'll look in hindsight at the Ethereum phenomenon as kind of being an abnormality and the normal is fragmentation." - Pierre Rochard

As I've witnessed over the years, competing cryptocurrencies ultimately exhaust themselves through self-dilution. Pierre pointed out the crypto VC exhaustion that's setting in as they realize "there's not going to be a token for every use case." The crypto space's constant churn of technologies with each new programming language means projects like Ethereum and Solana will always be vulnerable to newer, shinier alternatives. Bitcoin, with its focus on monetary fundamentals rather than developer aesthetics, continues strengthening while others compete for diminishing attention.

Check out the full podcast here for more on BitBonds, strategic Bitcoin reserves, and the contrasts between DeFi and Bitcoin's approach to reforming the financial system.

Senator Tuberville to Reintroduce Bitcoin Retirement Bill - Via X

BlackRock Bitcoin ETP Hits $50B, Third-Largest Asset Gatherer - via X

BlackRock CEO Warns US Debt Could Boost Bitcoin Status - via X

US Bitcoin Institute Proposes $200B National BTC Purchase - via X

ICYMI Fold opened the waiting list for the new Bitcoin Rewards Credit Card. Fold cardholders will get unlimited 2% cash back in sats.

Get on the waiting list now before it fills up!

$200k worth of prizes are up for grabs.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Final thought...

Time to take out the trash.

Get this newsletter sent to your inbox daily: https://www.tftc.io/bitcoin-brief/

Subscribe to our YouTube channels and follow us on Nostr and X: