Hope you have some bitcoin.

The number of banks on the FDIC’s “problem banks” list increased by 21% since Q4 2023 from 52 to 63 with total assets at risk rising by 5.2x from $15.8B to $82.1B.

— Marty Bent (@MartyBent) June 4, 2024

Not ideal! pic.twitter.com/kIB3jU9oZ9

The banking crisis seems to be rearing its head once again. No banks have failed in recent weeks, but the FDIC released its quarterly banking report for Q1 2024 on Monday and the data is not confidence inducing. The number of banks on the FDIC's "Problem Bank List" increased from 52 to 63. While this is "within the normal range for non-crisis periods of 1 to 2 percent of all banks", it is a bit alarming when you consider it represents a quarter on quarter growth rate of 21%. If that trend continues throughout the year the number of banks considered "Problem Banks" will be above what is deemed to be out of range for non-crisis periods. What's even more concerning is that while the number of banks considered to be problem banks only increased by 21% the total assets held by these problem banks increased by 5.2x. Moving from $15.8b to $82.1b.

This is coming at a time when the unrealized losses on banks' balance sheets are only continuing to worsen as E.J. Antoni points out.

Unrealized losses on banks' balance sheets are getting worse, and we're three months closer to when all of their emergency loans come due, and the consumer is in worse shape, and credit demand is falling, and loan nonperformance is up, and... pic.twitter.com/FBC8mtdIjQ

— E.J. Antoni, Ph.D. (@RealEJAntoni) June 5, 2024

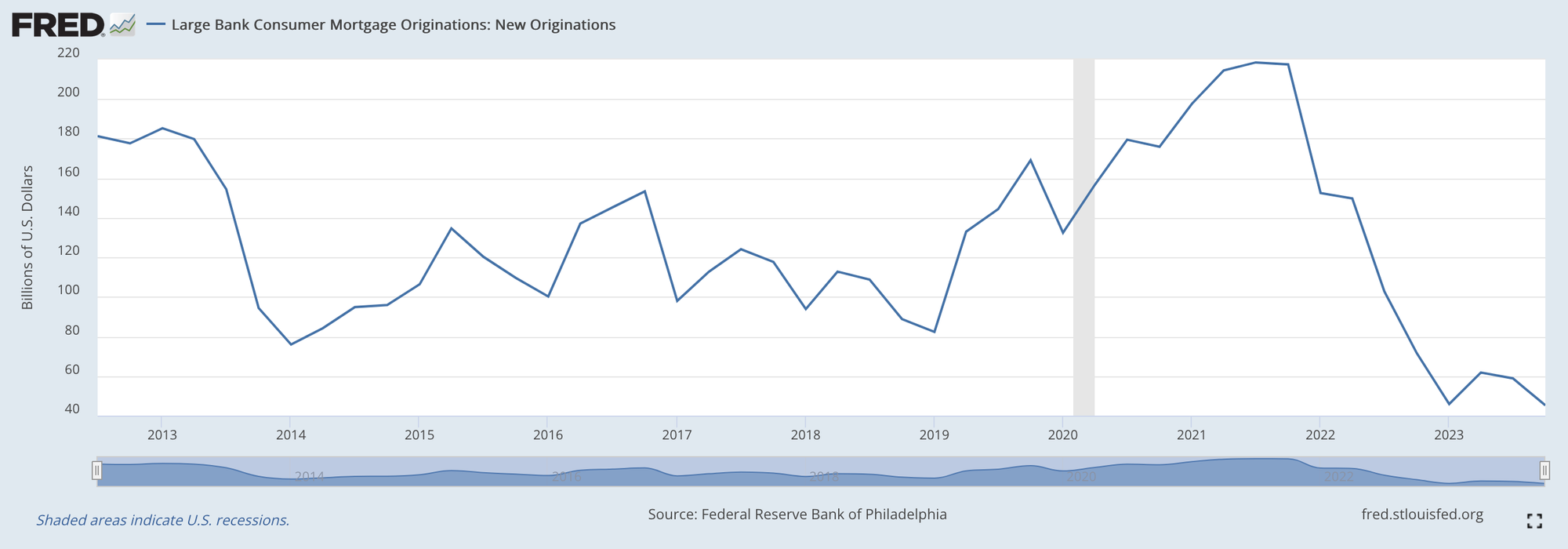

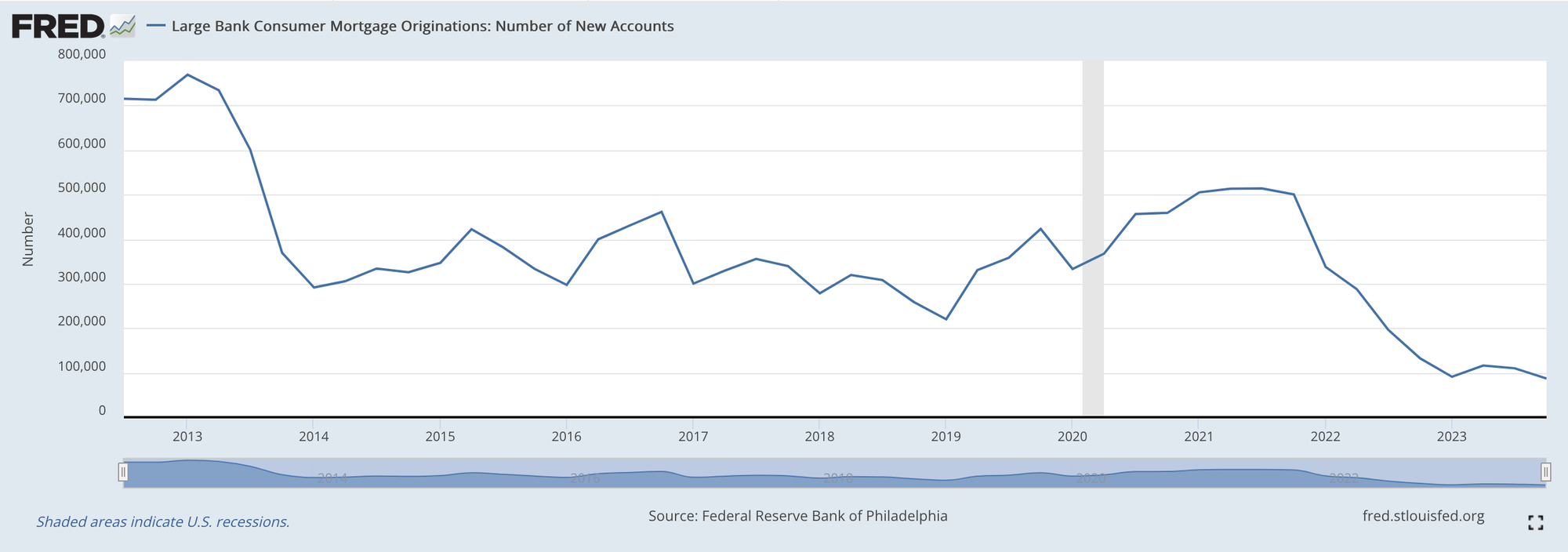

One can only imagine what these unrealized losses will look like when all of the BTFP loans that were taken out over the course of last year come due. Was the temporary lending facility enough to allow the banks to get in better capital positions to stomach sub-optimal business conditions? When you factor in inflation, cratering jobs numbers, rising credit card delinquency rates and mortgage origination being at its lowest point in over a decade...

it's hard to be confident that the banks have been able to put themselves in better capital positions. They're in the business of making money by issuing new money in the form of debt that enables them to produce revenue by collecting interest payments on the debt they've issued and people are running away from debt since interest rates are elevated. One has to imagine that push is about to come to shove and a lot of the unrealized losses sitting on these bank balance sheets are about to turn into realized losses as banks are forced to sell underwater assets to service other parts of their business.

In fact, signs of these unrealized losses started to materialize in commercial real estate markets over the course of the last year and they are starting to accelerate. As is evidenced by Deutsche Bank eating a $350m loss on a Manhattan office building.

This is absolutely insane...

— Triple Net Investor (@TripleNetInvest) June 5, 2024

Deutsche Bank takes a shocking $350M loss on a Manhattan office building

DB paid $500M for the tower at 222 Broadway in 2014

They just sold the building to a TPG JV for $150M

The office meltdown in Manhattan has gone from scary to disaster for… pic.twitter.com/j6YUb6GJxm

What's most interesting about this particular loss is that the building was sold to GFP Real Estate, which plans to convert the building from office space to residential units. This makes one wonder how many more office buildings that were purchased at inflated prices by banks and other capital allocators are sitting ducks waiting to suffer the same fate. And, furthermore, how many more nine figure realized losses will be taken by the banking sector?

The Great Repricing is underway. It is likely at the beginning stages but it is certainly underway and I don't think most people have internalized this yet.

Hope you have some bitcoin.

Final thought...

Salt air and the sea make life better.