The exchange is mandated to enhance its anti-money laundering safeguards and rectify lapses in its Know Your Customer (KYC) protocols, alongside its withdrawal from the U.S. market.

Binance, the world’s preeminent cryptocurrency exchange, has entered a plea of guilt in a substantial legal accord with the United States. Central to this agreement are violations of anti-money laundering and sanctions laws, culminating in a $4.3 billion penalty and the resignation of CEO Changpeng Zhao (CZ), who also incurred a $50 million fine.

This accord with U.S. authorities signifies Binance’s commitment to comprehensive compliance reform, underscored by a five-year monitoring period and hefty fines for anti-money laundering and sanctions breaches levied by FinCEN and OFAC. The exchange is mandated to enhance its anti-money laundering safeguards and rectify lapses in its Know Your Customer (KYC) protocols, alongside its withdrawal from the U.S. market.

Ultimately, the implications are as follows: Liquidity in the bitcoin market will continue to relatively migrate back onshore as U.S. investors and institutions increasingly enter the market, while the move simultaneously checks off one of the large boxes for the eventual approval of a spot ETF vehicle. Perhaps more importantly, the move eliminates a potential left-tail risk in the broader bitcoin market, as the world’s largest exchange which had a long history of run-ins with U.S. three letter agencies, is likely to be relatively neutered in terms of it’s market impact as time passes. While Binance continues its operations, this moment carries a mix of resolution and change, signaling a shift from the unbridled frontier of cryptocurrency to an era defined by greater institutionalization and regulatory oversight.

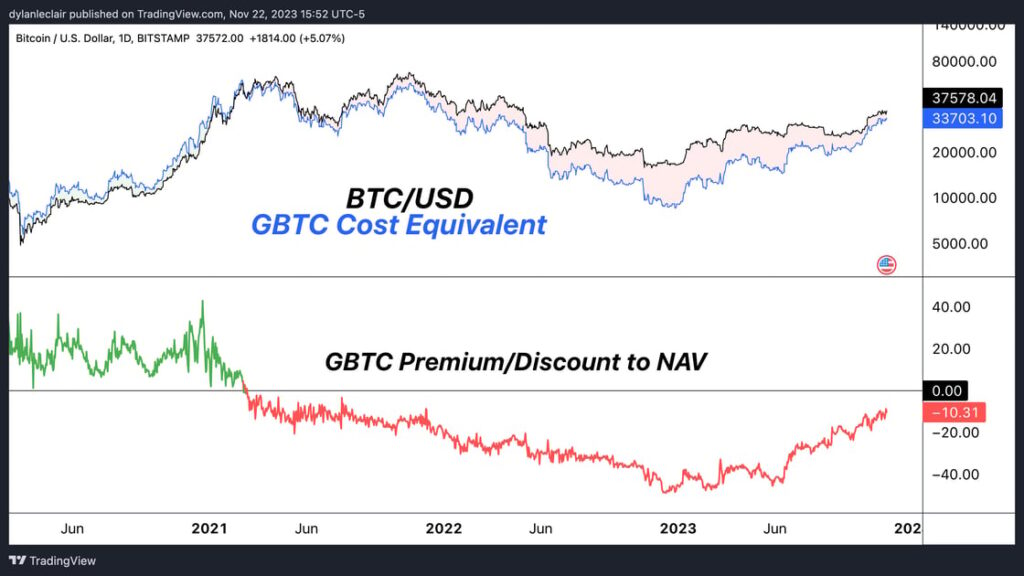

In the wake of Binance’s landmark legal settlement, the Grayscale Bitcoin Trust (GBTC) discount has moved to new highs, closing in at a 10% discount to NAV, as the Binance enforcement cleared up some of the SEC’s historical apprehensions leading to repeated ETF rejections. Additionally, Grayscale’s latest SEC filing and subsequent public commentary highlight the term “uplisting” in connection with GBTC’s conversion process. This term suggests a transition to a more favorable position within the market—potentially an ETF—and does not reflect any issues with the conversion itself.

While the discount to NAV currently present in the closed end trust obviously speaks to the poor structure of investment vehicle, the closing of the discount is viewed by many market participants as a derivative indicator of the likelihood of an ETF approval.

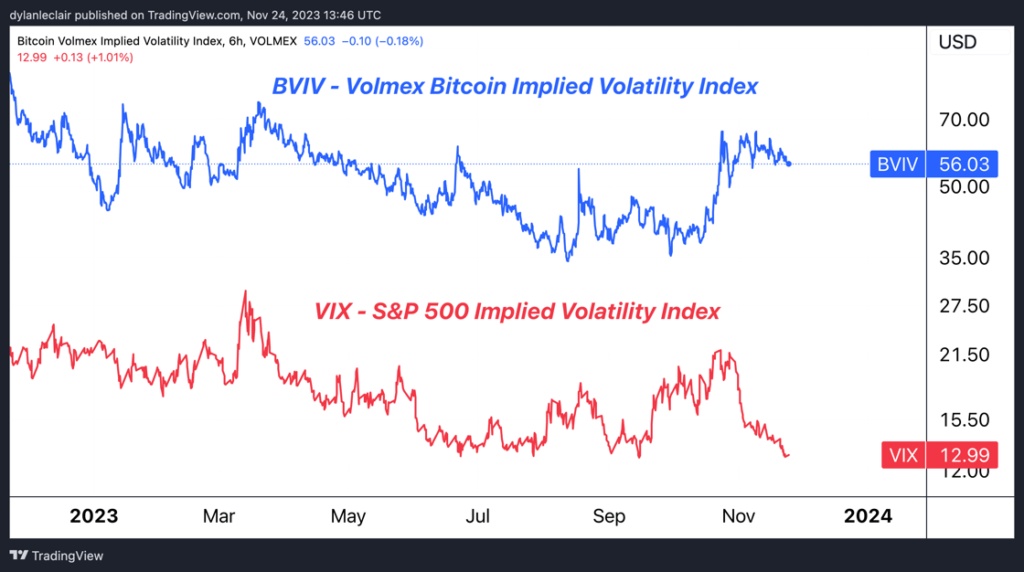

As the Volmex Bitcoin Implied Volatility Index illustrates, bitcoin’s implied volatility continues to stand out when compared to the VIX, the established measure of the S&P 500’s 30-day forward implied volatility. Both indices share a common goal of estimating 30-day implied volatility on an annualized basis, yet they are tailored to their unique markets—the BVIV for the round-the-clock bitcoin market, and the VIX for the traditional stock market which operates on set hours and days.

Currently, the BVIV indicates that the market expects bitcoin’s one-month forward volatility to be over four times higher than that of equities—a sharp increase from the doubling observed in October. This contrast is particularly striking as it occurs while the VIX is at its lowest since January 2020, suggesting a tranquil period in the stock market. It’s also noteworthy that the bitcoin market often exhibits a distinct pattern where its implied volatility tends to increase even as prices rise, a trend that is relatively rare in equity markets where the VIX frequently falls as indices gradually ascend over time.

E027: Bitcoin’s Role in Financial Advisory with Andy Edstrom

In the latest episode of The Last Trade, the newest member of the Onramp team Andy Edstrom lends his expertise from a decade on Wall Street and a decade as a registered investment adviser (RIA) at Wescap Group and a leading advocate for bitcoin adoption by the wealth management industry. The discussion touches on the implications of the Justice Department’s recent enforcement actions against Binance, and the task of navigating the complexities of OFAC compliance. Andy also touches on the importance of financial advisors in guiding clients through the maze of ‘crypto investments’, emphasizing the need for quality bitcoin focused education.

Don’t miss the full discussion — check out the entire episode here.

Wrapping up this week’s digest, Onramp Bitcoin invites you to explore our offerings on our website.

With an industry-leading multi-party custody solution, Onramp allows Bitcoin withdrawals without triggering a taxable event. Onramp stands as an optimal solution for HNWI and institutions seeking Bitcoin exposure prior to transitioning to self-custody.

If Onramp’s offerings align with your needs, or those of someone you know, feel free to schedule a chat with us here.

Onward and Upward,

Dylan LeClair

Originally published on Onramp