Sats per share is the new EPS.

Your $MSTR shares now have 17% more Bitcoin per share than they had at the end of 2023.

— The ₿itcoin Therapist (@TheBTCTherapist) September 13, 2024

Saylor is redefining capital management. pic.twitter.com/h3MreMJNYx

If you aren't paying attention, you probably should be. Michael Saylor and Microstrategy have willed a new metric into equities analysis into existence; sats per share. Whether you realize it or not at this moment, this will be the metric that defines whether or not a publicly traded company is delivering value to its shareholders in the long-run.

Bitcoin is in the process of monetizing as it marches its way to becoming the next reserve currency of the world and it is changing how companies measure their success. Last week Microstrategy brought this metric to life in public markets when it began including "BTC Yield" in their financials. This is a simple metric that looks at the change in the amount of bitcoin per share of the companies stock over time. Through the first half of 2024 Microstrategy realized a 17% yield on their bitcoin through strategic market moves that enabled them to increase their bitcoin stack in a way that is essentially non-dilutive despite the fact that they have ~14m more shares outstanding than they did at the end of 2023.

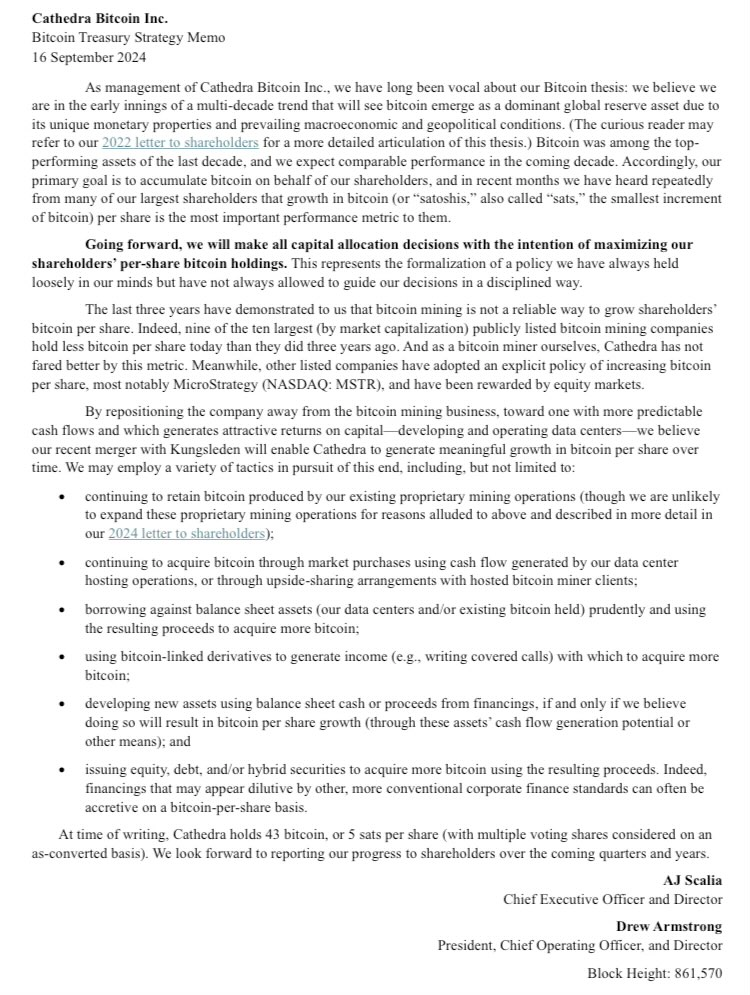

This is the beauty of Microstrategy's bitcoin accumulation play. They have figured out a way to add bitcoin to their balance sheet in a way that adds value to their shareholder base. This is a strategy that is going to work very well during bitcoin's monetization phase and you should expect to see other's explicitly citing sats per share as the metric they benchmark their performance off of. We've been thinking long and hard about this at Cathedra over the last year as we've been in the process of reorienting the business via a merger with Kungsleden Inc. Today AJ Scalia and Drew Armstrong sent out a memo that explains this reorientation with a laser focus on sats per share.

Every decision a business makes should be weighed against the opportunity cost of deploying dollars to purchase bitcoin outright. Particularly when bitcoin is going through its monetization phase. This will be incredibly beneficial for the broader economy in the long run because businesses will be forced to deliver actual value to the market in the form of goods and services when they use sats per share as their measuring stick.

If you are running a company it is in your best interest to internalize this as soon as possible. Not being prepared for this shift could be detrimental to the long-term viability of your business if you don't act. Saylor is going to continue to out stack you and his shareholders are going to be rewarded for his stewardship of their capital.

MicroStrategy announces a $700M private offering of convertible senior notes, with plans to use the proceeds to acquire more #Bitcoin and redeem Senior Secured Notes.

— TFTC (@TFTC21) September 16, 2024

The offering includes an option for an additional $105M. pic.twitter.com/Lp0P6TbOEL

Final thought...

Go birds.