Michael Saylor and the team at Microstrategy are expanding the ways in which they access more capital to accumulate more bitcoin.

The mechanics of Bitcoin's supply are being fundamentally altered by sophisticated financial engineering. During our conversation, Jeff Walton highlighted how MicroStrategy's approach isn't just about accumulation – it's about permanent removal of Bitcoin from circulating supply. Through convertible notes and their new preferred stock offering, they're creating financial vehicles that effectively lock Bitcoin away for decades. This isn't just happening in isolation; we're seeing the development of a duration curve stretching from 10 to 30 years. As Jeff explained, this represents a paradigm shift in how institutional capital engages with Bitcoin, moving from speculative trading to multi-decade holding strategies.

"We're seeing the duration curve get built out... they're taking that off the market for 10 years, 30 years, whatever it may be." - Marty Bent

What's particularly fascinating is how this extends beyond just MicroStrategy. Other players are innovating with structured products, pairing Bitcoin with traditionally financeable assets like commercial real estate, further reducing the float of tradeable Bitcoin. As Jeff explained, this creates a compounding effect – as more Bitcoin gets locked away in these long-term vehicles, the remaining tradeable supply shrinks. The market hasn't fully grasped the implications of this permanent capital formation around Bitcoin, especially as more institutions develop similar strategies for long-term Bitcoin accumulation and storage. When you consider that MicroStrategy alone already holds 2.5% of all Bitcoin and aims to reach 5-6%, while other companies are beginning to follow their lead, we're witnessing the early stages of what could become a significant supply squeeze. The traditional dynamics of Bitcoin's market are being reshaped by these sophisticated financial vehicles designed for permanent capital deployment.

TLDR: Wall Street's financial engineering is permanently removing Bitcoin from circulation.

Check out the full podcast here for more on corporate Bitcoin treasury strategies, insurance market evolution, and the death of traditional debt markets.

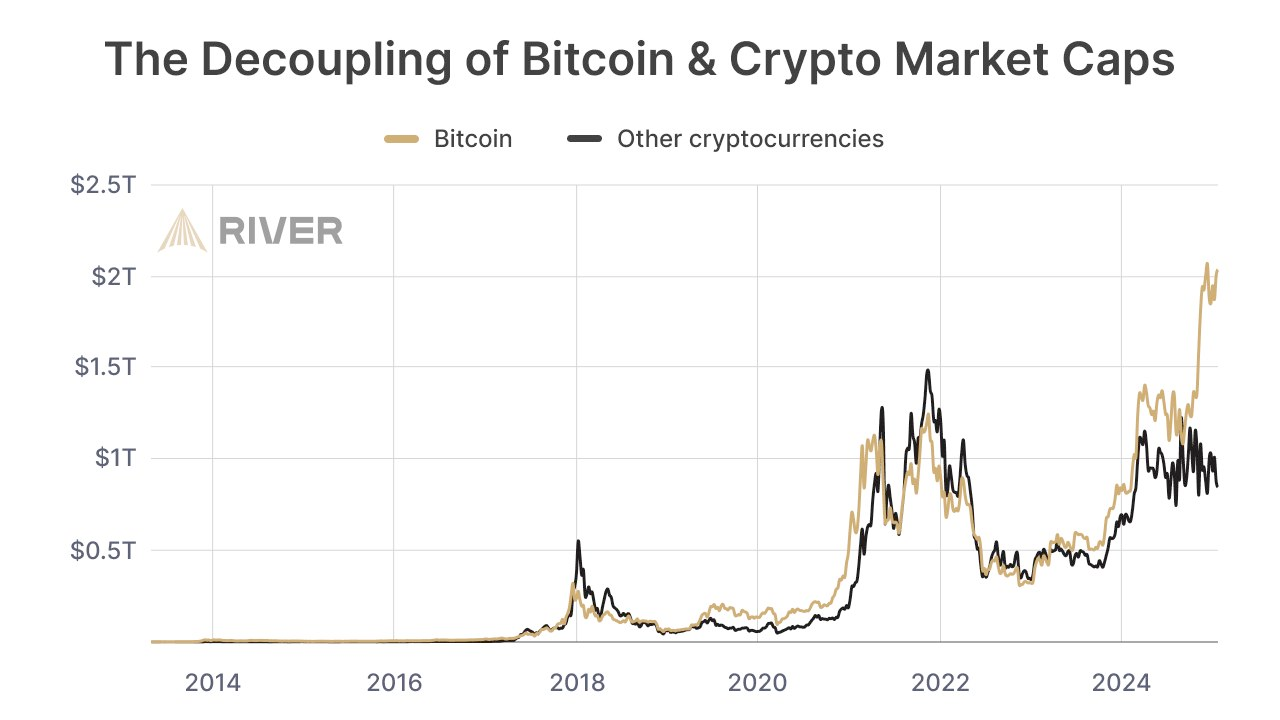

We may not want to get too far ahead of our skis, but we are currently witnessing a level of decoupling between bitcoin and the rest of the crypto market to a degree that has never been seen before. Bitcoin is 16 years old and it seems like the market has finally realized that bitcoin is it's own beast and broader crypto is a game of hot potato that creates exponentially increasing opportunity cost. With the establishment of bitcoin as a pristine collateral asset and savings vehicle in the eyes of individuals, companies, institutions, states and nation states the cost of playing around with crypto is simply too high. The divergence you see above is an expression of that recognition. Bitcoin is breaking away from the pack with authority.

It may be too early in this cycle to call, but we may be past the days of "alt seasons" that enable people to pile into altcoins in an attempt to achieve beta on bitcoin's success. This is a trend to watch as the year progresses.

Tether Plans USDT Integration with Lightning Network - via X

Kash Patel Pledges to Reveal Epstein Client List - via X

MicroStrategy's Saylor Lands Forbes Cover as "The Bitcoin Alchemist" - via X

Bitcoin Surges After Fed Meeting - via Financial Post

Bitcoin's difficulty is a dynamic measure that governs how challenging it is for miners to add new blocks to the blockchain. Currently at 108,105,433,845,147.20, this number automatically adjusts every 2,016 blocks (approximately every two weeks) to maintain a consistent 10-minute average block time. The adjustment mechanism is elegantly simple: if miners solve blocks faster than expected, the difficulty increases; if slower, it decreases.

The system works by setting a target value that miners' block hashes must fall below. The difficulty is calculated by dividing the maximum possible target (set in the first block) by the current target. This creates a self-regulating system where the network automatically adapts to changes in total mining power. To prevent extreme swings, adjustments are capped at 4x up or down.

This mechanism is crucial for Bitcoin's stability, ensuring that blocks are added at a steady pace regardless of how many miners join or leave the network, or how much more powerful mining hardware becomes.

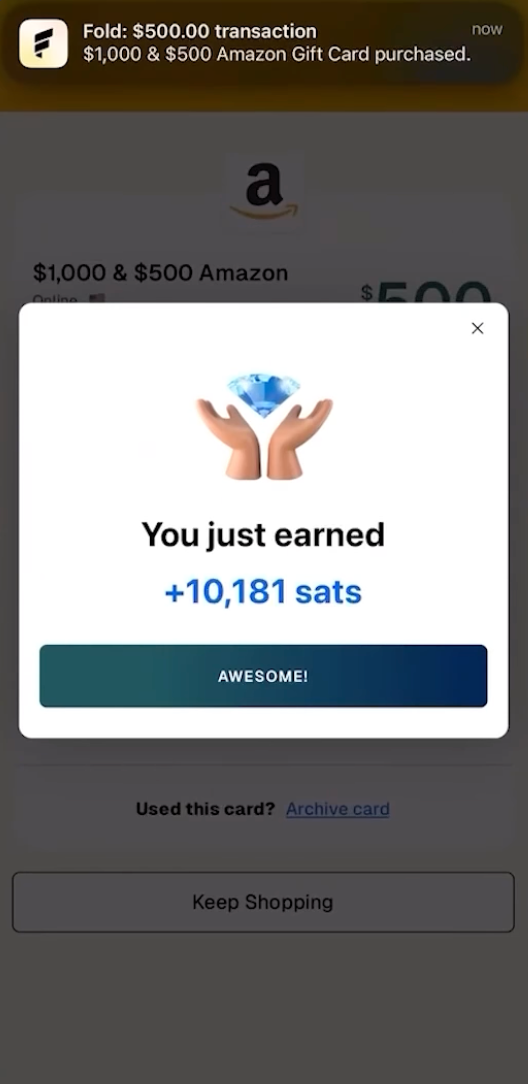

Turn your everyday purchases into a way to stack sats. With new gift card options, earn bitcoin rewards for everything from rides to groceries with Fold.

Ten31, the largest bitcoin-focused investor, has deployed $150M across 30+ companies through three funds. I am a Managing Partner at Ten31 and am very proud of the work we are doing. Learn more at ten31.vc/funds.

Subscribe to our YouTube channels and follow us on Nostr and X: